Patcharapong Sriwichai

In my ongoing endeavor to scrutinize all the major stocks linked to energy storage and solid or semi-solid state batteries, I recently turned my attention to FREYR Battery (NYSE:FREY). Intriguingly, on paper, FREY’s valuation is twice that of Solid Power (SLDP), even though both companies are still in their pre-revenue stages. Given this, I anticipated FREYR to introduce something groundbreaking to the market. However, I was greatly disillusioned by the lack of competitiveness in their business model and bleak outlook for the future.

Having weighed all the pros and cons of investing in FREYR, I am convinced that the appropriate rating is a strong sell. Given the competitive nature of the battery arena today, I believe most analysts or investors would arrive at the same conclusion after considering the details outlined in this analysis.

FREYR’s Business Model

Quoting directly from the company’s official website:

“Fuelled by low-cost hydro and wind energy, FREYR designs and manufactures high-density and cost competitive lithium-ion batteries with a reduced carbon footprint for the rapidly growing global markets for electric mobility, stationary energy storage, marine, and aviation applications.”

This, at least, was the initial vision when the company was founded. However, things have since taken a different turn:

While renewable energy might be affordable in Norway, it doesn’t match up to the incentives provided by the Inflation Reduction Act. To stay competitive, the company announced a new manufacturing plant in Georgia, which doesn’t rely on “low-cost” renewable energy sources, and began the process of re-domiciling to the U.S. Even though a sample battery production plant has been completed in Norway, with another gigafactory under construction, it’s evident that the competitive edge of low-cost renewable energy sources cannot compete with the tax credits available for battery production in the USA.

The claim that the company “designs” its batteries doesn’t reflect the complete truth. They license the technology from 24M Technologies without any exclusivity. Other tech has been licensed from Taiwanese company Aleees. Yet, there’s no significant innovation introduced by FREYR.

In essence, from my view, FREYR Battery is merely a battery manufacturer, a company that banks its entire business model on licensing technologies and scaling them up for mass production. And so far, given that their first major production plant with a capacity of 29 GWh has encountered regulatory barriers from the European Union, the prospects for manufacturing don’t seem bright either.

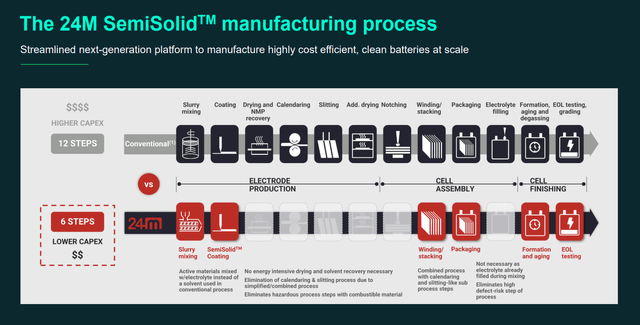

The 24M Technology claims to be capable of reducing capex up to 50% compared to traditional manufacturing technologies (FREYR Battery – Capital Markets Day Presentation)

FREYR’s Norwegian Gigafactory Faces Challenges

FREYR Battery’s flagship commercial-scale production venture was meant to be the Giga Arctic Factory in Norway. However, a trade agreement between the European Union and the United Kingdom imposes a 10% tax on vehicle imports that don’t include batteries manufactured within the EU or the UK, starting in 2027. In light of this development, FREYR Battery announced a shift away from producing EV batteries at its Giga Arctic Factory, opting to dedicate the entire production to BESS (Battery Energy Storage Systems) instead.

While this might appear as a feasible workaround, the larger problem is clear: the energy storage market is just a sliver compared to the vast EV segment, particularly in the European Union. According to Mordor Intelligence, the Battery Energy Storage market in the EU will have a meager CAGR of 1.67% over the next five years. The Union is primarily focusing on domestic energy storage-a domain where Tesla has been a leader for years-hydroelectric storage, and green hydrogen. Large-scale battery energy storage projects are few, and it remains uncertain if FREYR can withstand competition from Chinese lithium battery manufacturers.

The capital expenditure for the project was forecasted at $1.7 billion. In May, the company decided to halt construction, holding out for additional subsidies from the Norwegian government. They expect a financial aid package to be approved in the October 2023 national budget. In July, the EU Innovation Fund awarded the company €100 million, leading FREYR to announce during its latest earnings call that construction would resume, albeit “at a measured pace”.

The Competitive Edge Backfires

In their 2020-21 investor presentations, FREYR proudly highlighted how the Norwegian ecosystem provided a robust competitive edge for its production line. Norway boasts abundant resources essential for lithium battery production, offers vast quantities of low-cost renewable energy, and is geographically situated in Europe.

However, not being politically within the European Union has stifled its ambitions in the EV sector. Meanwhile, Volkswagen has adopted 24M’s technology and acquired a 25% stake in the company. The main market is now dominated by a colossal competitor with decades of large-scale industrial production experience, which not only utilizes the same technology but partly owns it.

Kyocera has started producing domestic energy storage systems based on 24M’s technology in 2020 (24M – Official Website)

In the U.S., the Inflation Reduction Act has been passed. Through section 45x, the act provides significant tax incentives for domestic battery production, essentially pushing the American market out of reach for non-U.S. producers.

FREYR has announced plans to construct a new massive plant in the U.S., dubbed Giga America. They aim to progress faster with this compared to the Giga Arctic. They hope to capture, as per management estimates, an additional $1.4 billion in annual free cash flow due to public incentives. However, this endeavor demands project equity financing of $1 billion. In the recent earnings call, it was revealed that plans for this financing round are still in the early stages, and many investors have expressed skepticism for various reasons. These include doubts about FREYR’s ability to operate efficiently on a large scale and whether 24M’s technology can prove economical when mass-produced.

A Looming Need for Cash

Here, I present the data on FREYR’s cash flow from operations and investment activities over the past six semesters (figures in $ million, sourced from Seeking Alpha):

Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | |

Cash from operations | -30.1 | -20.3 | -22.6 | -17 | -12.5 | -22.2 |

Cash from investing | -10.9 | -13.6 | -45.7 | -104.8 | -66.7 | -64.3 |

FREYR ended the last quarter with $334 million in liquidity, two massive factories yet to be built, and no indication about the gross margin they might generate once at least one of the giga factories commences production. While the company hopes to attract subsidies from the Norwegian government, as of now, no written agreement exists, and no figures have been disclosed.

Given their current cash burn rate, the company will undoubtedly need to raise new capital within the next 4-5 quarters. The project-level equity financing in the United States stands as a critical move in this regard. However, the company has yet to provide any specific details on how they plan to proceed.

Conclusion: An Unjustifiable Valuation

How can a company, which lacks significant proprietary technology, has no experience in large-scale production, is on the verge of diluting shareholder equity, and no longer provides any indication on margin and production cost estimates for its batteries per kWh, justify a valuation of over $800 million?

Currently, I see no plausible answer to this question. Hundreds of millions of dollars have been invested in a production plant near the Arctic Circle, which now risks turning into a massive liability due to European regulations on EV import taxes. A new facility is supposedly coming up in the United States, but without any distinct competitive edge over the plethora of other manufacturers crowding the North American market. There’s still uncertainty whether 24M’s technology is even a solid foundation for mass production. If it turns out to be viable, nothing’s stopping Volkswagen from fully acquiring the company.

I cannot find a single reason why, with so many established battery producers and a multitude of companies offering innovative technologies in the market, an investor should choose FREYR Battery. On the other hand, here are two stocks I’ve recently analyzed that offer significantly better opportunities:

- Solid Power: A company pioneering solid-state batteries with highly promising technology that’s close to mass production.

- Fluent Energy: Revolutionizing the battery storage world with its proprietary AI. This tech allows unique energy arbitrage management and storage system efficiency.

In conclusion, I believe that FREYR Battery makes for an excellent short to balance my exposure to other companies in the EV battery and energy storage sector, which have better valuations and prospects.

According to Fintel data, the volume of FREYR shares available for shorting fluctuates daily between 400,000 and 700,000. The borrow rates are currently in a range of 13.5-14.5%, high but not extremely high considering the stock’s volatility. Within 16-20 months, I expect the company to reach its target valuation, which is $410 million. This should be its tangible book value in 4-5 quarters, considering the cash burn rate and the effects of the project-level financing tied to Giga America.