Is a few alleviation from inflated residence costs headed our manner? Over the previous two years, sellers have taken the housing marketplace for a trip, getting dozens of presents on each listed home. Regardless of the situation, space, or age of the property, patrons had been filling open homes each weekend simply to make an over-asking supply on what must be a fairly priced home. Now, the tables are beginning to flip, and consequently, sellers are getting determined.

Rates of interest are rising and patrons are backing out of the market by the dozen. As an alternative of twenty presents in a weekend, sellers are taking a look at two, and none of them are over asking worth. That is excellent news for residence patrons and nice information for buyers, as offers have gotten simpler to return by whereas the housing market hysteria takes a breather.

We introduced your complete On The Market panel on this week to see the place they’re discovering offers, how their very own markets are fairing, and what buyers ought to search for on the horizon as demand steadily begins to gradual. We additionally go into the way forward for housing stock and the way one other stock disaster may very well be coming quickly.

Dave:

Hey, everybody, and welcome to On The Market. In the present day, we have now an excellent episode in retailer for you the place I’m joined by the complete forged of On The Market. We’ve obtained Henry, James, Jamil and Kathy to speak concerning the state of the market. Mainly, when you’ve got been paying consideration, the market is beginning to shift and we thought that it could be an excellent thought to have everybody from the forged be a part of us to only discuss what they’re seeing out there, what knowledge are they monitoring and the way they’re discovering offers. And only a fast spoiler, they’re discovering offers. They’re discovering extra offers. So in case you are inquisitive about find out how to get into this market, you undoubtedly need to hearken to this episode, and we have now an additional good knowledge drop so undoubtedly stick round to the tip. Hey, everybody. Welcome to On The Market. In the present day, it’s like a household reunion. We have now everybody right here. We’ve obtained Kathy, Jamil, Henry and James. The whole crew. It’s been some time since all of us had been collectively. I missed you guys.

Kathy:

It’s a podcast occasion.

Henry:

Yeah.

Jamil:

The pajama jam-a-jam.

Dave:

Pajama jam.

Henry:

We might have worn pajamas.

Dave:

Wait, we obtained to do an episode the place we’re all in our jamies.

Kathy:

Nicely, I’ve my pajama bottoms on, in fact.

Dave:

Sure.

Henry:

I don’t have any bottoms on.

Dave:

All proper. Henry, would you want so as to add to that?

Henry:

No, I believe I’m good.

Dave:

Okay.

Henry:

Appropriately clothed for this podcast.

Jamil:

Simply attempting to wade previous all of the psychological photographs proper now, in all probability simply transfer on.

Dave:

Superior. Nicely, as a lot enjoyable as it’s to only get you all collectively for enjoyable, we determined that as a result of perhaps you assume otherwise, however to me it looks like the market has actually began to shift. We had the primary half of the 12 months, all of us knew or form of had been pondering that the market was beginning to shift, and lots of the information, lots of the anecdotal tales we’re all listening to is that the market is altering. And so I needed to get your complete crew collectively, the complete pressure of On The Market to speak about how the market is shifting and the way buyers, people who find themselves listening to this, can adapt.

So what we’re going to do is I’m going to first learn via some market knowledge and we’ll hear from everybody about what knowledge you all really feel is a very powerful. Then we’ll go into just a few tales. I’d love to listen to from you all about what’s taking place in your particular person companies. After which we’ll discuss completely different methods and the way they’re impacted by the market shifts. Y’all prepared?

Jamil:

Let’s do it.

Kathy:

Yeah.

Henry:

I’m prepared.

Kathy:

Let’s go.

Dave:

All proper. Candy. So June knowledge got here again. That is going to air on the finish of July, however as everybody is aware of, knowledge comes a couple of month in arrears. And so we had been speaking about June knowledge and the headline numbers haven’t modified all that a lot. Media and gross sales worth nonetheless up an infinite quantity, nevertheless it did drop. It’s all the way down to 11.2% year-over-year. It was at 15% in Could, in order that represents a slowdown. And for anybody who’s listening to this, should you noticed 11% year-over-year development in any pre pandemic time, you’d be flipping out and intensely excited or involved. I don’t even know, however it could be very anomalous. So simply seeing it go all the way down to 11% does characterize that issues are cooling, nevertheless it’s definitely not any form of time to panic. In order that’s what’s occurring with gross sales worth.

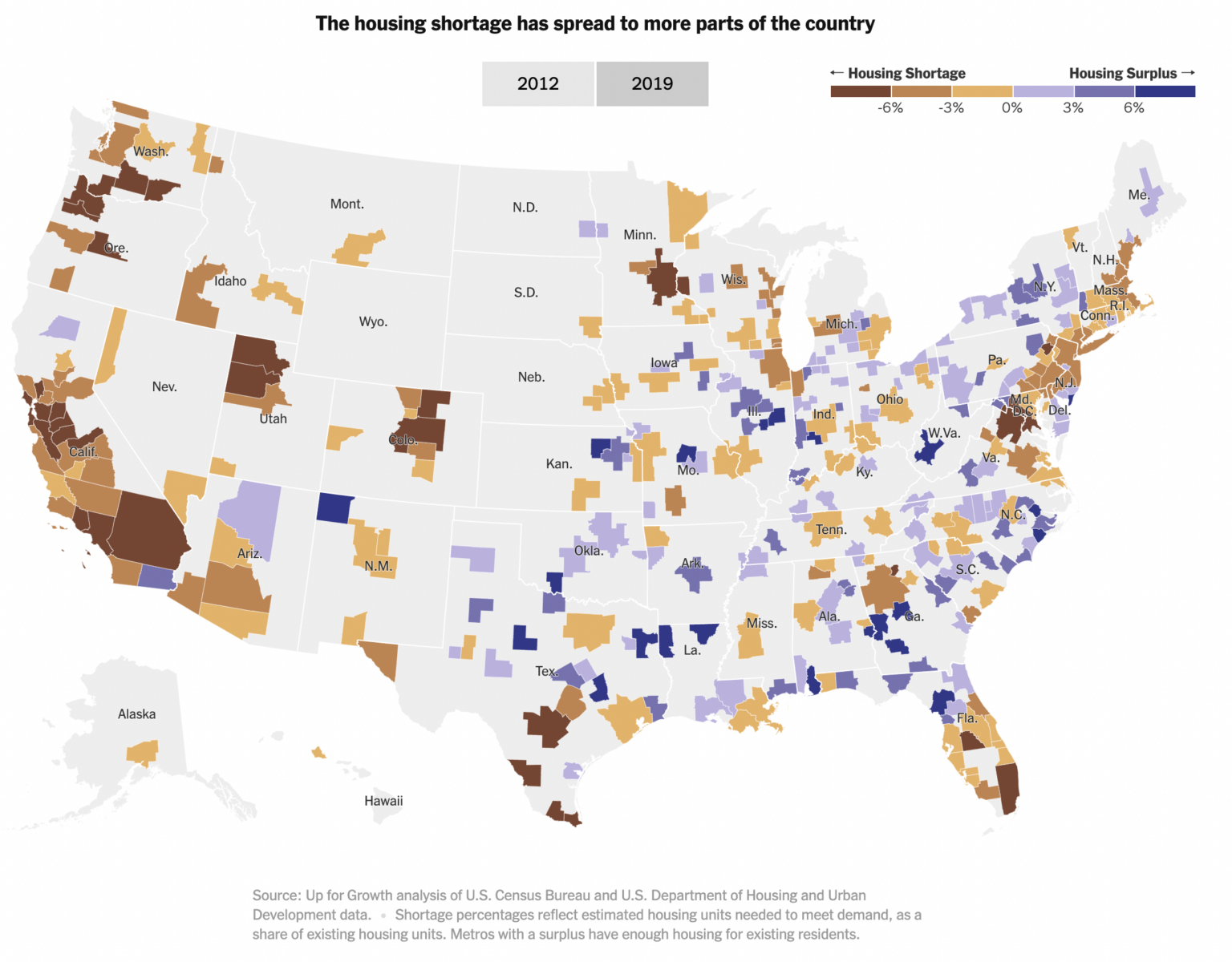

We’re additionally seeing that stock, which I imagine is likely one of the most necessary metrics, are beginning to change. So stock, for anybody who isn’t conscious, dropped dramatically during the last couple of years and when stock is low and demand is excessive, prefer it’s been, that may push up costs. So we see that stock is beginning to recuperate and it’s going up and up and up. In Could, we began to see the development of year-over-year development. It was at 9%, now it’s at 15%. In order that sounds nice, however stock, simply should you have a look at it in absolute ranges, is only a full joke. It’s at 913,000 homes available on the market in June. Only for the document, in June of 2019, pre pandemic, it was 1.6 million. So we’re nonetheless down 44% over pre pandemic stage. So altering, however nonetheless actually loopy.

Two of my different favourite issues are month’s provide at 1.7 months. Up from a low of 1.3, however lower than half of the place we had been in June of 2019. Days on market, solely at 23 days. Regular is taken into account about 45, 50, relying on who you imagine. So all of this knowledge means that we’re nonetheless tremendous low. We haven’t gotten anyplace close to to what’s regular, however issues are beginning to change. So Henry, let’s begin with you. What do you consider all this knowledge that’s coming in? What are the issues that you just assume are a very powerful and that you just’re going to be taking note of via the remainder of this 12 months?

Henry:

So the factor that I’m watching probably the most is absolutely, one of many issues I’m watching probably the most is days on market. So we have now lots of property proper now in our enterprise that we’re placing available on the market, actually actively as we converse. And to take the numbers that you just mentioned and produce them all the way down to a micro stage in my market, we’re including a couple of hundred houses every week. And so every week our competitors for different houses available on the market is rising. And so getting houses available on the market sooner is of extra of a profit as a result of there’s rather less competitors every week that it’s on the market. And so we’re sort of in a push to get every thing listed as shortly as doable. And we even have the expectation that these properties are going to take a seat available on the market somewhat longer than they had been than even six months in the past.

However that’s not likely doom and gloom, as a result of issues are nonetheless promoting due to precisely what you mentioned. The numbers have come down, however they’ve come down for these such excessive highs that even the numbers they’ve come all the way down to, if these had been only a blip and not one of the different issues that occurred earlier than that, and we noticed that, such as you mentioned, 11%, we’d be like, oh man, issues are loopy, 11%, that’s nuts. And so homes are nonetheless promoting. They’re taking somewhat longer to promote, nevertheless it’s the final couple of houses I bought, I’d say we obtained… I believe the final residence I bought, we obtained two presents and it took us about three weeks to get each these presents. After which one in all them was at asking worth.

And so what does that imply? We nonetheless priced that home at what we thought we might get pre pandemic. So I in all probability priced it larger than what it sometimes ought to go for in a traditional market, as a result of I used to be betting on issues we’re nonetheless promoting at premiums. And I didn’t get pre pandemic… I imply, I didn’t get presents like within the final six months the place we might’ve obtained seven presents within the first hour it was available on the market. It took two weeks to get two presents and I nonetheless obtained an asking worth supply, which is larger than what I anticipated promoting the home for. And so the market continues to be sturdy for somebody like me, who’s an investor who’s shopping for, rehabbing, after which promoting. However sure, issues are shifting and to me, all that’s equated to is it’s simply slowing down somewhat bit.

Dave:

You’re promoting flips, proper, or stuff you had been already planning to promote or are you promoting now due to market circumstances issues that you just had been initially intending to purchase and maintain?

Henry:

No, we’re solely promoting issues we had been planning to promote whatever the market circumstances. I imply, that’s simply, that’s how we function anyway. Even within the peak months the place issues had been going for high greenback, we had been nonetheless solely promoting issues we had been planning to promote. I’m at all times going to be a purchase and maintain investor. Now I did trim somewhat little bit of the fats on my portfolio throughout that point. Which means, there have been some properties that had been somewhat extra upkeep intensive than I anticipated, and we had been capable of promote these at a premium after which take that cash and redeploy it into different purchase and holds.

However proper now all of the market is telling me is that there’s two issues, I simply have to plan for somewhat bit longer time and I didn’t actually modify my plan when issues had been loopy. It was simply tremendous cool to promote a home in a day. However issues are going to take somewhat longer and I simply need to regulate that offer. That how a lot competitors is there going to be for me? However the profit to me now could be as a result of market circumstances are altering, extra offers are coming my manner that I didn’t need to go marketplace for and so I’m really capable of purchase properties cheaper.

Dave:

All proper. Nice. I do need to hear extra about the way you’re getting properties cheaper in just a bit bit. However Kathy, what do you make of this knowledge? What are you monitoring proper now?

Kathy:

Provide and demand in fact is a very necessary factor to take a look at, however it may well change. It may well change fairly shortly. And it surprises me when persons are stunned on the adjustments or when these headlines performing as if this was some sort of shock. It jogs my memory of that scene in Austin Powers the place the curler’s like 100 toes away and he’s freaking out, all the opposite. The Fed had gave us warning and gave us warning a very long time in the past that there have been going to be seven fee hikes this 12 months, about, and that meant that their intent was to decelerate the economic system and which means the economic system’s going to decelerate. So the economic system’s doing what the Fed desires it to do, which is to decelerate. And truthfully, it’s what most individuals need the housing market to decelerate as a result of it was getting uncontrolled.

So that is what we’re getting, a slower market, and folks had time to arrange for it. I’d hope. I’d hope folks paid consideration to that. So we all know that there’s going to be two extra fee hikes, one perhaps, effectively, we expect anyway, we don’t know, however they’re saying, and so it’s going to proceed to gradual in fact, as a result of inflation was excessive. So we do want to arrange for extra, extra of a decelerate. And on the similar time we have now all the weather are nonetheless in place that had been there final 12 months, which is that this large group of people that need to purchase and never sufficient stock, as you mentioned. With all these fee hikes, it nonetheless hasn’t actually made that a lot of a distinction in stock. I simply regarded up the place my daughter purchased as a result of I actually inspired her to purchase a property simply close to me as a result of she had a child and I wanted to be close to that child.

So she’s about half-hour away and he or she paid loads. She paid in all probability an excessive amount of for that home, however with the low fee she’s capable of keep there. So I used to be somewhat frightened and I checked out comps simply to see, oh boy, is her home beneath water now? In no way. It’s nonetheless up $75,000 from when she purchased it six months in the past. And that is within the LA space the place they’re saying that issues are slowing down, however there have been solely three properties in her worth vary available on the market they usually had been an terrible situation. In order that’s simply sort of an instance of there’s simply not homes obtainable and if you need a spot to reside, you’re both going to pay excessive hire otherwise you’re going to pay excessive mortgage, which one are you going to decide on?

And should you’re capable of purchase, folks would possibly select that as a result of at the least the hire, at the least the month-to-month fee goes in the direction of paying down that mortgage and never paying any person else. So what do I seem like? Appear to be? That is what I seem like. What do I have a look at is certainly provide and demand. And we all know it’s altering, however presently there’s nonetheless simply not sufficient provide and nonetheless large demand. With that mentioned, we’re within the rental enterprise. So we’re seeing a number of presents on rental properties as a result of the identical downside exists in rental properties. That’s why I’m so glad although my daughter paid a lot, she’s locked in and her mortgage is decrease than the rents. And that’s taking place lots of locations. Folks aren’t going to go away their houses as a result of their present fee is far decrease than the rents on the market, except they’re in a very distressed state of affairs.

So provide, demand, that’s what we’re targeted on. We’re having a tough time discovering money circulation, though it’s beginning to ease up and we’re beginning to have the ability to purchase properties at auctions once more, and discover properties we will renovate, and we’re beginning to see worth cuts. So from my vantage level, it’s an exquisite factor. We’re seeing extra alternative. I’m extraordinarily enthusiastic about this market and the subsequent six months, as a result of there’s a lot concern that people who find themselves on the lookout for one thing apart from not simply targeted on pricing or worth cuts, however are actually taking a look at a long run funding, for money circulation in a market that’s rental starved that is an unimaginable alternative.

Dave:

That’s an excellent level. And I really, I learn it. I don’t know should you noticed this text as effectively. I believe it was within the Wall Road Journal that bidding wars are actually taking place for leases.

Kathy:

Sure.

Dave:

It’s shifted from the housing market the place you place a home available on the market, they had been seeing a number of presents. Now landlords and property managers who’re simply placing a traditional rental, persons are bidding up the worth of hire the place, I imply, you guys do that greater than me, however I’ve been a landlord for 12 years, I’ve by no means had that occur in my life.

James:

It’s undoubtedly been a development the final 24 although. The final 12, 24 months, we’ve undoubtedly been getting much more aggressive rental functions. You simply need to be careful for town you’re in as a result of some cities don’t allow you to do it.

Kathy:

Yeah. For the final two years, we even have been seeing that within the sure markets that we’ve been in, as a result of they only couldn’t convey on provide quick sufficient in elements of Florida and these areas which might be rising so quick and it’s been so laborious to construct. Now, we even have a enterprise of syndications the place we’re constructing single household houses and that’s affected. That’s been laborious for us as a result of we’ve gone via a time the place costs have gone up a lot, simply the fee to construct a house has elevated a lot that in lots of circumstances builders are simply hoping to interrupt even, and in the event that they need to decrease costs now, it’s going to harm lots of builders. I do know we’re beginning to really feel it. Most of our initiatives are already bought, so we’re getting out of them, however there can be alternative with new houses. It’s simply unlucky for the builders. A few of our initiatives the place we thought initiatives like that had been hitting a 16% to twenty% IRR, hit 8%. So nonetheless not horrible, however undoubtedly not near what we anticipated due to how costly every thing obtained and now with costs softening.

Dave:

James, I needed to show to you as a result of I do know you’ve been comparatively, I don’t need to say bearish, however you’ve been warning and pondering that costs had been going to say no for a couple of months now, do you see this latest knowledge as a mirrored image of that, and do you assume costs are happening, I assume you would say nationally, but additionally in your market within the Seattle space?

James:

Yeah, I believe we’re undoubtedly seeing a development the place issues are coming off peak. I imply the information that you just simply talked about is sort of similar for what’s occurring in our market or nationally that’s about 35% much less on the median residence worth down. What I’ve been monitoring is I’m monitoring median sale costs in particular neighborhoods from March. I need to see what was taking place in February, March. After which what I’m seeing in all these markets that had been leaping, the purple scorching markets, Boise, Scottsdale, Seattle, Austin, they skyrocketed about 20% to 25% in a single single month in February. And what we’re seeing is true now pricing’s down about 10% to 11% on median residence pricing on those that hockey sticked up, in order that’s somewhat bit extra aggressive.

Those that over accelerated are literally down extra like 50%. And so these are knowledge developments that we’re actually watching proper now as a result of we write about 30 to 40 presents a month or every week after which we’re additionally itemizing about 5 to seven properties every week as effectively. And so we have now fixed stock coming available on the market and so these are issues that we’re attempting to trace. What’s going on in every particular neighborhood on that median residence worth after which additionally what’s the stock ranges? For me, I can’t simply use one stat, one truth. I obtained to take all of it and put it into this, I obtained to combine all of it up after which sort of provide you with my very own evaluation, as a result of what we’re seeing right here is we’re seeing a development coming down and it’s a slower development, which is a good signal for actual property.

They jacked up the price of cash by 35% to 40% and we’ve solely seen like a ten% pullback off peak, not even off of actually what the median residence worth is. And so these charges have slowed every thing down, however we’re seeing houses take longer to promote. We bought 5 houses this weekend. 5 went pending. One went pending within the first week, the opposite 4 took anyplace between 20 and 35 days and we bought these houses for about 2% to three% off checklist simply because we’re giving some concessions. The most important key stat that I watch and it’s laborious as a result of the one method to do it’s to make cellphone calls is definitely site visitors on listings proper now. As we’re going to inclinations for repair and flip, as we’re going for improvement initiatives in new building, we’re spending a ton of time calling each dealer to see what number of our bodies are coming via as a result of what among the stats aren’t telling folks, in addition to the mortgage app request stat, is there’s a only a few quantity of individuals wanting proper now.

It’s not simply that the transactions are down. The our bodies are down by about 90% at the least in our native market and so it’s very key for something that you just’re promoting that you must worth effectively. You’ll be able to’t worth off what your proforma is, you must worth off the now. And what we’re doing to maneuver properties is we’re calling via all of the brokers, we’re seeing the place the site visitors is, we need to know the place probably the most quantity of our bodies are as a result of that may click on that sale, after which we’re pricing within the cluster of all of the comps. And you are able to do that by checking median residence worth, you need to verify stock ranges, days on market after which making that proper cellphone name. And you may sort of get all these magical numbers in, however as you place it collectively that’s how we’re writing these presents out is predicated on every metropolis, no matter that development is, we’re baking into our proforma.

So if Seattle got here down, a selected neighborhood in Seattle got here down 10% and we have now a pair listings out there that the brokers are saying that the showings are nonetheless one to 2 every week, we’re going to truly proforma in somewhat bit extra depreciation as a result of that’s simply naturally what’s taking place with the price of cash growing so quickly. And the great factor is we’ve seen the Fed, the banks have already sort of baked in lots of these charges into the present price, and so these subsequent couple hikes shouldn’t increase charges an excessive amount of extra so you may sort of get these little candy spots out there across the median residence worth the place the motion is after which worth accordingly. However we’re nonetheless promoting lots of property on market proper now. Issues are undoubtedly gradual, however you simply need to put the precise plan on it and issues promote. They at all times promote.

Dave:

That’s nice recommendation. That’s an information level that’s not simply attainable simply by Googling round, attempting to determine what the foot site visitors is in a door. I’ve by no means heard of somebody actually calling round and attempting to get that. That’s a very good tip. Simply in absolute phrases, what numbers are they providing you with? Is it like 100 folks every week had been touring and now it’s 10 or what are the numbers you’re seeing?

James:

We’re seeing a couple of 95% drop off. So if we had been seeing 25 to 30 showings in a weekend, which is fairly widespread particularly these markets that jumped 10% to twenty% in a single month, it was about 25 to 30 showings on common via these properties. We’re seeing about two to 3 showings now on these properties and it’s regular. And the one stuff that we’re seeing excessive site visitors on is what was referenced is these bidding wars on rental low-cost product. Individuals are attempting to put cash, they need to beat inflation, a budget stuff you may nonetheless money circulation with the excessive rates of interest proper now. That stuff’s nonetheless loopy on that aspect. We’re writing lots of presents on the opposite aspect and it’s virtually like we’re seeing the margins simply get increasingly compressed or folks don’t need to have a look at the information downstream as a result of on the purchase aspect, if it’s low-cost, it’s getting bid up.

Now the costly alternatives there’s no one enjoying. A minimum of in our market nobody is enjoying in that zone as a result of what the most important concern is a ten% drop, let’s say the mark comes down one other 10% and decompresses one other 10%. On 300 grand that’s 30 grand. That’s not good, however that’s doable. On a $3 million property that’s $300,000. And so I believe we’re seeing the a number of presents on the rental properties as a result of it’s protected. You’ll be able to play with a flip, you may play with a rental and you may sort of put collectively a very bulletproof technique for that property. So persons are chasing safeness they usually’re simply being cautious. These 10%, 15% swings are detrimental and that’s why these markets simply aren’t transferring proper now.

Dave:

Yeah, that’s actually good perception. Jamil, are you seeing the identical form of factor? As a result of Phoenix can also be a fairly excessive worth market like Seattle and I assume, one, should you had been simply taking a look at it on the face worth of how quickly it elevated may very well be in danger for some form of correction. What are you seeing?

Jamil:

So I’m listening to all people discuss and it appears like they’ve been simply staring on the market that I reside in and reporting it precisely because it’s been going. So tremendous correct representations of what they’re seeing. I’m really dwelling in that as effectively. For us, I’ve two companies, it’s wholesale and repair and flip. For my wholesale enterprise what we discovered has occurred is there was an absolute pause. So simply as you noticed, folks had been sort of like wanting, oh, what’s going to occur out there, are my flips going to promote, are they going to go beneath contract, how lengthy am I going to have to carry this? Nicely, these buyers they paused for about two weeks. They weren’t actually bullish on pulling the set off on getting another stock as a result of they needed to see what was taking place.

Nicely, all of these, in the event that they had been priced effectively, went beneath contract and people patrons have all come again to the wholesale enterprise they usually’re able to deploy and able to go once more. So simply as James has mentioned, simply as Henry mentioned, simply as Kathy mentioned, in case you are in that median residence worth vary, should you’re within the affordability space, you might be completely tremendous. The luxurious. So we do some luxurious flips and the posh flips have completely, simply as James has mentioned, the site visitors has gone down considerably. We might get a number of calls a day. Proper now we’re getting perhaps one or two every week. And I believe it has loads to do with the psychology of the kind of purchaser. So that you guys know I’m on a tv present, I’ve a manufacturing crew that’s following us round, and lots of the folks within the manufacturing crew it’s like common jobs.

In order that they go they usually needed to take part within the housing market as a result of they had been seeing what we’re doing. Nicely, all that point when stock was simply flying off the cabinets, they couldn’t even compete. They couldn’t write presents, they only couldn’t make it work. All the pieces was money and these guys are financed. And so what we noticed occur is as costs or as charges went up, the actually, actually subtle purchaser or the rich individual, they sort of stepped again and mentioned, I’m going to attend a second. I’m simply going to attend a second and I’m not going to make my transfer proper now. I’m going to attend for issues to form of calm down. But it surely left an enormous alternative for different individuals who had been annoyed as a result of they couldn’t take part out there to step in. And so now they’re profiting from their flip at property that’s within the median residence worth.

Now with respect to pricing, what we discovered is what you and I mentioned with Rick, the place I had categorized this spike in worth, which I known as emotional fairness, that’s the cash that folks overpaid for property that wasn’t backed by a lender appraisal. So that is stuff the place if the appraisal got here in at one worth and folks bid up one other $100,000, I name that emotional fairness as a result of it’s not lender backed. It’s not appraised. That stuff has disappeared. No matter that run up was, so that you might need a few excessive comps in a neighborhood, no matter that additional 150,000, 25,000 that bought above checklist, that pricing is gone. So persons are simply coming again to normality. They’re simply coming again to, and it’s nonetheless excessive, however they’re coming again and now the flippers are pricing in at the place that quantity ought to really be. They’re not overpricing the way in which that they may have been a few months in the past.

And in order you simply heard Henry say, we’re speeding, speeding, speeding to get every thing available on the market proper now. My prediction is we’re going to see one thing actually attention-grabbing occur as a result of that mentality, that sentiment is what many buyers are doing, they’re speeding. And even owners that have to promote, that want to maneuver, they’re speeding, speeding, speeding. However guys, have a look at stock. Proper now, even with that rush stock at a month and a half. It’s nonetheless a vendor’s market as much as three months of provide. So we’re seeing this enormous rush of all these subtle folks attempting to get the highest greenback for his or her property. That’s like squeezing the tip of a toothpaste tube.

Guys, we’re simply getting the final bits of it proper now and I believe that the consequence that we’re going to see right here goes to be one thing we actually gained’t perceive till we’re in it. As a result of we’re actually pushing out all of those houses, all of this stock proper now, and this rush to capitalize on the excessive worth and no matter purchaser exercise continues to be there, and also you’re going to search out that stock, simply because what Kathy mentioned, the builders are being killed proper now due to price going up and charges going up, they’re slowing down. I really feel one other good storm coming. That’s my opinion. I believe that I’m monitoring proper now to see if this storm is definitely going to hit. Days on market, months provide, and I’m watching it like a hawk.

Dave:

Are you saying an ideal storm for costs to go up once more?

Jamil:

To extend once more, once more, once more. I do know this sounds nutty and perhaps I’m contrarian right here, however I believe what you’re going to see popping out the opposite aspect of that, and sure, it’s going to have a momentary dip, similar to when the pandemic occurred homes pricing began to go down, however from the place? We had been at ridiculously excessive costs, in fact, it’s going to return down from the psychosis. However there’s nonetheless no stock. It’s a joke. And also you’ve obtained all these folks speeding to place stock available on the market proper now. I believe the results of that, we’re going to really feel it.

James:

One factor concerning the stock that I believe there’s little or no provide proper now, however folks do have to comply with this development. It’s growing each month and the our bodies are low. And as you’re doing improvement, as you’re doing repair and flip, you might be performing out your offers 6 to 12 months down the street, by the point you get there and that’s the place you need to hedge somewhat bit. The brief time period investments are riskier. Wholesaling is a good factor to be in proper now. You get out and in of a deal.

Pace is essential in a market that’s somewhat bit transitioning. However I do hear loads from folks, it’s like, oh, effectively, there’s no stock. There’s no stock, however you must monitor the development as a result of by the point you get into the… You’re going to be drowning by the point you understand what’s occurring. And we’re seeing that regular enhance, we’re seeing a restricted quantity of our bodies, and we all know that the Fed is saying that charges are going to extend. I believe the stock ranges are going to be as much as three to 4 months within the subsequent three. It’s simply, that’s what the development is.

Jamil:

It will get there, James, and I’m in an settlement that we’re going to see that bump, we’re going to see that bump in stock, however I don’t know that the stock’s really there to help that bump. That’s my fear. My fear is that we nonetheless haven’t constructed sufficient homes to fulfill demand in a traditional market. And I believe what’s taking place is as you’re saying proper now we have now fewer our bodies, however these our bodies are solely going to take a seat on the sideline for therefore lengthy. There’s going to be some extent the place they’re simply going to say, I obtained to get again into it. Take a look at hire. They’re bidding up. Lease goes up and up and up and up. And simply to hire a home in Phoenix proper now to have a good residence, you’re speaking $4,000 to $5,000 a month.

I imply, that’s some huge cash, proper? So persons are going to say that, they’re going to take a look at that, they’re going to be like, I’m not renting. That is trash. I’m going to go purchase a home, although the speed’s 6.5% proper now makes far more sense for me to go purchase a home. And I do know I’m going to sound loopy to lots of people, this man simply mentioned, housing costs are going to go up once more. I don’t assume it’s going to occur proper now, however I believe that coming across the bend, that’s a particular danger. The way in which that we’re seeing exercise proper now, it’s a particular danger.

Kathy:

It makes a lot sense whenever you describe it that manner, as a result of as folks see that perhaps these headlines aren’t appropriate and perhaps there’s not going to be a housing crash, after which they understand that 5% is perhaps a traditional mortgage fee. It was there simply a few years in the past. So folks will modify. It’s scary to purchase a home should you assume the costs are going to go down, however when folks begin to see that’s not taking place, you’re proper, they may come flooding in once more.

Dave:

So then what’s taking place? Are you seeing the identical factor within the luxurious market, Kathy and Jamil, that James is seeing? And do you assume what you’re saying about costs persevering with to extend goes to occur throughout the spectrum of asset courses or housing courses?

Kathy:

I can simply converse from what I see in Park Metropolis the place stock has elevated dramatically. So there’s alternative in Park Metropolis proper now, in actual fact, in our personal improvement we’ve decreased costs. So it’s an excellent alternative as a result of areas like that at all times come again. There’s only a few locations which have the sort of snow that Park Metropolis has. It’s like gold. It’s so fluffy. In order that doesn’t exit of favor and so this can be a nice alternative to get into luxurious as a result of there’s an elevated stock, whereas actually a couple of months in the past there was nothing to purchase. There was nothing. Now there’s one thing to purchase.

Dave:

Nicely, I’m going to do my finest Kathy imitation and say that there is no such thing as a nationwide housing market and it is dependent upon the place you might be. And as such, we even have one other knowledge drop for you this week. This one is absolutely good. I’m very enthusiastic about this. We put collectively lead indicator knowledge for just about each market within the US, and it exhibits two issues or it exhibits a bunch of issues. So I put a bunch of metrics on there. It has median gross sales worth, days on market, new listings, lively listings, and worth drops. All tremendous necessary. After which what we did was examine it year-over-year, which usually in regular market circumstances, I don’t learn about you guys, year-over-year is form of the dependable factor that you just have a look at as a result of there’s lots of seasonality within the housing market and also you need to see how, for instance, June 2022 in comparison with June 2021.

There’s this factor known as base impact in knowledge evaluation the place if final years knowledge was actually loopy for some motive, you may’t actually have a look at year-over-year knowledge. And in order that’s one other issue that’s occurring right here and why you see this stuff in some markets worth drops went up 400% this final 12 months. It’s as a result of they had been at nothing and so proportionally it appears to be like actually excessive. And so on this knowledge drop, not solely will we offer you year-over-year knowledge, however we offer you pre pandemic comparability. So you may have a look at knowledge from 2019 to 2022. And naturally, no evaluation is ideal, however this could aid you taking a look at these two issues mixed, for my part, aid you perceive, okay, what’s the latest development and what’s it in comparison with regular instances? How does this monitor?

And so that you’ll see it’s actually completely different. It’s actually completely different relying on the place you might be out there. So you may obtain that. I ought to in all probability provide the URL. It’s biggerpockets.com/datadrop5. So you may verify that out. I’m going to go on document and say, I believe Boise is the riskiest housing market in your complete nation proper now, as a result of not solely are lively listings up like 200%, they’re larger than they had been pre pandemic, and in order that to me is a big shift in what’s occurring. However in the meantime, locations in Florida and North Carolina look nice. They give the impression of being utterly nice. In order an investor, as we at all times say right here, you must be a market knowledgeable and this knowledge drop ought to aid you grow to be a neighborhood knowledgeable.

All proper. Let’s change gears somewhat bit as a result of I do need to discuss offers. It sounds such as you guys are discovering offers and I need to understand how you’re discovering these offers and what sort of offers are working for you. Henry, you talked about you’re discovering cheaper offers. Are you able to inform us somewhat bit extra about what you’re into proper now?

Henry:

Yeah, that’s an excellent query. So deal circulation for us has at all times been about discovering off market offers. And off market offers primarily signifies that we’re shopping for issues that aren’t listed from individuals who have to promote greater than they need to promote. So there’s normally some sort of misery concerned and that misery is main them to need to, or to need to, or have to money out of their residence to both go deal with some state of affairs or regardless of the case could also be. And so when you’ve gotten this good storm of the financial setting is unsure, inflation is tremendous excessive, persons are beginning to perhaps lose jobs, or get laid off, or can’t discover work that they need, after which you’ve gotten additionally rates of interest rising within the housing market and also you’ve obtained some volatility there, or from the retail purchaser might not absolutely perceive what’s taking place in the true property market and that creates some uncertainty.

You’ve obtained this good storm of individuals simply saying, you understand what? I obtained to get out of this home. I obtained to get out of it fast. I had considered promoting it six months in the past, however I didn’t need to do it and now I’ve obtained to eliminate it. And what’s taking place now could be sometimes I’m within the enterprise of selling or sending out info to folks after which they’ll attain out to me in the event that they’re taken with a suggestion I might need. And I’m seeing a complete lot extra of individuals simply reaching out to me primarily based on phrase of mouth. One of many final offers I purchased was my title firm actually known as me and mentioned, Hey, I obtained a woman who simply desires to promote her home, she wants it gone proper now, are you able to name her? And that’s occurred twice prior to now six months the place folks have simply reached out to me and mentioned, Hey, I heard you purchase homes, are you able to come by my home?

And I’ve ended up shopping for these properties and so I’m getting a complete lot extra folks on the lookout for me than me on the lookout for folks, and I believe that’s on account of each the true property market uncertainty and the economic system uncertainty. And so the final one I purchased, it was in nice form. I informed the woman to promote it with the true property agent and he or she’d in all probability be okay. She didn’t need to take that danger. She wanted it gone now. And she or he felt like she would get more cash from me than if she listed it. And so we went forward and we purchased that property. However I attempt to educate all people that I come into contact with and allow them to know, Hey, these are your choices. And these two choices listed below are in all probability going to web you more cash, they only gained’t be with me, however I’m completely happy to attach you with them. And folks nonetheless even understanding which might be like, effectively, simply inform me what you are able to do. And to me that claims that there’s uncertainty for them they usually need to go together with one thing that’s sure and fast.

Dave:

Jamil, are you seeing the identical factor? As a result of I do know within the wholesaling enterprise you’re sometimes on the lookout for a majority of these misery promoting conditions.

Jamil:

Yeah. So attention-grabbing, one in all our main lead era strategies is definitely direct to vendor via agent. So we actually leverage agent relationships to get lots of alternatives. What we’ve seen is realtors six months in the past had been principally all on ecstasy. They had been out of their thoughts. They’re like, oh my God, it feels so good. Wow, the housing market is loopy I don’t even need to work and provides some water. That’s what was taking place they usually had been out of their thoughts and completely simply off their rockers with pricing. They had been like, oh, worth? A billion {dollars}. Let’s strive it. And in order that’s sort of what occurred. And in order that has completely shifted. The factor that we discover is that the common residence proprietor isn’t as updated on market developments and stats and knowledge as we’re and we would like them to be. As a result of they’re not likely paying consideration. They’re in their very own bubbles, they’re in their very own worlds, and till it impacts them, they’re not going to examine a headline about this and that with the market.

Brokers, nonetheless, completely have their finger on it. And so they’re proper now struggling the hangover from their actually, actually attention-grabbing occasion nights that they’d for the final six months. And so proper now, they’re in a depressed state. After we discuss to them, they’re like, oh my God, every thing is so unhealthy. I can’t. I’m like, what are we going to do? In order that they’re so open to listening to from us what quantity we need to pay they usually’re going and promoting that worth to their sellers, as a result of they’re fearful. They’re like, look, I do not know what’s taking place proper now. The charges are excessive, there’s no patrons, my cellphone’s not ringing, it’s best to take their supply. And so we’ve been really cleansing up as a result of there’s so many alternatives.

I really feel like we actually can title our worth and it’s taking place. I had an agent who we have now an excellent relationship with, however she had a property listed available on the market, it was an authentic situation and occurs typically, as a result of the market was so scorching, she listed it at what must be ARV, which didn’t make any sense to us since you’re taking a look at it and also you’re like, how would you do this? This home wants a full renovation to justify that worth. And she or he’s like, effectively, that is what the vendor desires. And so it sat for 30 days after which she reached out to us and mentioned, Hey, the place would you guys be? And it was legitimately $250,000 beneath what her checklist worth was. Finished. She would’ve not had that dialog with us 60 days in the past. So guys, when you’ve got not taken benefit of the agent finder program right here at BiggerPockets achieve this, as a result of they may aid you join the dots on some unimaginable offers, work with the realtors. I’m telling you proper now, they know higher than anyone and they’re probably the most fearful pack that exists proper now.

Dave:

And if you wish to take a look at what Jamil’s speaking about, we have now this device on biggerpockets.com. You’ll be able to go to biggerpockets.com/af and you will get matched with a investor pleasant agent. It’s utterly free. There’s tons of nice brokers on there. So it’s best to undoubtedly go verify that out. Kathy, so that you mentioned earlier that your shopping for patterns are altering somewhat bit, proper? You even talked about that some issues had been developing on public sale. Is that the way you’re pursuing offers proper now?

Kathy:

Yeah. We weren’t capable of actually discover money circulation properties during the last six months in among the markets we had been in and within the money flowing markets there simply wasn’t the stock. So it was somewhat bit laborious to search out that and now it’s coming again once more. So we’re again in form of these Midwest markets, which I believe you talked about these are sort of scorching proper now as a result of it’s the one place that’s reasonably priced nonetheless. So we’re taking a look at that. We’re additionally about to start out… I’ve been taking a look at multifamily, I’ve been taking a look at industrial properties, and single household and it’s sort of attention-grabbing after I’ve regarded that multifamily hasn’t fairly come down but. I don’t assume the way in which it’d and I may very well be fallacious. I used to be fallacious two years in the past. I ought to have purchased each single multifamily I might get my arms on, however in 2020 I actually wasn’t too positive how that was going to go, however some folks actually made out effectively.

Now we’re taking a look at a few of these properties and persons are nonetheless actually, lots of proformas are nonetheless betting on rents going up fairly dramatically they usually would possibly, however in addition they won’t and it simply makes me somewhat bit nervous. And even so, even with these actually excessive rents which might be being projected, the returns are simply okay. However once we had been taking a look at one other single household fund, we had a single household rental fund for the final 5 years, the numbers had been really fairly good and higher than the multifamily that we had been taking a look at. So we’re taking a look at elements of Texas for that fund after which elements of the Central Florida space for single household. And it’s simply thrilling to have the ability to negotiate once more. That was simply not one thing you would do earlier than for some time. Perhaps Jamil and James and Henry might, however we didn’t know find out how to do it during the last six months.

Dave:

It’s attention-grabbing that you just mentioned concerning the Midwest. I used to be wanting one thing this morning on realtor.com. They’ve this factor known as the hotness rating, which sounds prefer it must be on a courting app and never on actual property.

Jamil:

It’s so good. I really like that. They name it hotness. Oh my gosh. Take a look at Wisconsin, it has a duck face.

Dave:

Nicely, sadly it’s simply really housing market knowledge, however I believe your app would possibly take off, Jamil. And what it’s exhibiting is that the most popular markets, and once more, each one in all these web sites that does this has their very own methodologies so it’s best to go have a look at what they’re really doing to rank these markets, however the hottest markets proper now are within the Midwest and within the Northeast. It’s been years since I’ve seen scorching markets in Massachusetts, in Connecticut, New Hampshire, Vermont, Maine. Central Florida continues to be highly regarded, Kathy, don’t fear. So we’re nonetheless seeing lots of that, nevertheless it’s simply, I believe it’s the impression of the migration over the previous couple of years. Folks have been transferring out of these locations or the markets have gone up, however not 40% or 50% within the final two years. And so comparatively talking, the Midwest and the Northeast have gotten extra reasonably priced and possibly at the least have much less competitors than in Florida and Texas and also you would possibly have the ability as a purchaser to go searching and really decide a home you want, which sounds loopy given what’s occurred during the last two years.

Kathy:

It’s sort of regular. It’s cyclical the place the tremendous scorching markets which might be the place folks actually need to reside, they’ll go up and up and up in worth till they hit a peak, after which that’s as excessive as they’ll go. They hit an affordability ceiling after which we begin to see the extra linear markets take off. So it appears to be sort of the identical as once we had been shopping for in Texas in 2005 the place that was the place to be. That’s the place it was about to take off once more. However should you’re beginning a household and perhaps you do have the flexibility to make money working from home or you would get a job, there’s so many job openings, and also you’re wanting round and simply getting actually depressed at hire and residential costs, you would possibly simply begin wanting in markets that you just hadn’t considered earlier than, in order that may very well be what the developments are.

Henry:

So the tremendous scorching states are dying off and the dad bod states are beginning to win, huh? There’s an opportunity for me but.

Dave:

Is {that a} dad bod state? I’ve ever heard of that. Is that actual?

James:

There’s at all times a trickle down impact. In 2008, the new markets, those that respect the quickest, the hockey stick up, are the primary ones that hit the brakes. The opposite ones preserve limping alongside after which ultimately they comply with the identical developments, to be sincere. In 2008, each market trended with the costly markets after about six months. And so it’s simply, the costly markets are the leaders, they sort of present you what’s going to occur. They forecast the remainder of the markets six months down the street.

Dave:

I believe what you’re saying too is true, Kathy, and is attention-grabbing that sadly for lots of people housing of their metropolis, whether or not you hire or purchase, is changing into unaffordable. And if these developments proceed at the least there’s doubtless going to see some reversal in migration patterns, or perhaps just a few migration to a few of these cheaper locations just like the Midwest. You have a look at cities like Chicago, it’s the third largest metropolis in the US, it’s manner, manner beneath common by way of housing market appreciation during the last couple years, however nonetheless has a very nice economic system. So you would think about locations like that beginning to see a revival once more or at the least I can.

Kathy:

Yeah. And it’s humorous, I’ll simply say that we principally did our occasions in California and I’d ask the room with a whole lot of individuals, Hey, what number of of you’ve gotten been to say Indianapolis, or Birmingham, or Cincinnati or Cleveland? And perhaps a pair arms would go up. So it was actually humorous so many Californians don’t actually go east of I don’t know, Nevada. And so I’d take simply busloads of individuals from California to go see these areas they usually nonetheless had this concept that it was like wheat fields or one thing in these cities.

James:

I simply have this imaginative and prescient of all these Californian vacationers carrying Hawaiian shirts with cameras wanting like, wow, have a look at how they reside the place there’s corn.

Henry:

What’s the Piggly Wiggly?

Kathy:

I swear if we blindfolded them, they wouldn’t know they weren’t in San Francisco. And actually, among the areas like Cleveland their downtown has been revitalized, it’s lovely, it’s a medical chief with the Cleveland Clinic, and it’s nicer in some methods than among the areas that they’re dwelling in California that haven’t been up to date or upgraded. So lots of people had been shocked and we noticed lots of people really transfer. So I’m sorry for being a part of the California migration situation.

Dave:

Oh my gosh.

Kathy:

It was like-

Dave:

Apologize on behalf of all Californians who moved, Kathy. It’s your duty.

Kathy:

… nevertheless it’s like they actually didn’t know that there was very nice locations to reside outdoors of California that it’s simply sort of humorous. Now, perhaps after dwelling a winter they may change their thoughts.

Dave:

That’s a Rick and Morty episode. I obtained to name Dan Harmon. James, I did need to ask you concerning the flipping market as a result of I believe that’s the one one we haven’t actually touched on right here. And simply curious the way you’re discovering offers in flip? Sounds such as you’re in all probability staying away from the posh market or what are you concentrating on proper now?

James:

No, we don’t keep away from any market. We simply purchase otherwise and modify the proformas. So with our luxurious stuff, we’re undoubtedly going for a lot larger returns, 25% or to 30%. Or with leverage we’re concentrating on 50% to 60%, as a result of we want that additional padding if the market does appropriate extra. And likewise we’re simply not utilizing peak comps. We solely use comps inside 30 days or pendings and we’re speaking to each dealer. And if the comps are larger 30 days in the past, than we’re utilizing the pendings. However the easiest way that we’re getting offers achieved, we’re undoubtedly seeing sellers are adjusting their numbers, there’s a slight panic occurring I can inform with brokers and sellers, and so what we’re doing is we’re making mass contacts, getting in entrance of individuals, speaking to as many individuals as doable.

As you develop your community, you’re going to get extra deal circulation. However the greatest factor to do is as we’re attempting to get extra offers achieved is as a result of we have now to placed on a brand new pair of glasses. How we had been flipping houses or growing or shopping for rental properties for the final 24 months is an previous technique. It’s important to change your technique up. We simply purchased a house and we closed on it about 60 days in the past. It was an costly property. We’re going to be concentrating on 1.9 million because the exit. We had a $250,000 price range on it to go much more larger finish. I simply re snapped my price range and we are actually at $65,000 as a result of we’re going for a unique factor. We noticed what’s buying and selling, what just isn’t buying and selling.

As flippers, folks obtained somewhat bit spoiled. They’re like, we will have as a lot enjoyable with this, spend as a lot cash as we would like on this, and we’re going to crush it and I’m going to seem like a genius. These days are over. Traders duties or my duty is that if there’s a good market, I’ve to invent that return. I’ve to provide you with the precise plan that’s going to make me cash or rack me a return. And in order that’s all we’re doing is we’re getting extra offers achieved as a result of everybody else continues to be taking a look at these offers the identical manner like, oh, effectively it prices 200 grand to do it that manner. Sure, should you’re going to go for peak pricing, however in a market that’s not reasonably priced, I’m not going for peak pricing anymore. We’re getting again down and soiled, procuring at clearance shops, protecting what we will preserve, not altering out ground plans, protecting issues transferring faster and we’re simply making them much less good, as a result of that’s what the market is asking for.

They need extra affordability however livable product. And so once more, we’re simply placing on a brand new pair of glasses, we’re hitting mass quantities of contacts and we’re simply taking a look at offers otherwise. And should you don’t have a look at them otherwise and you purchase on the previous, it’s going to be laborious to get a deal achieved as a result of your rehab prices are going to be excessive, you’re going to be cautious in your exit worth since you had been utilizing peak comps earlier than, and also you simply have to vary issues up. So every thing that we’re doing, purchase and maintain, we’re shopping for cheaper or otherwise, doing much less work on them. Our rental properties, we’re concentrating on ones that we have now that if the margins are nonetheless tight, we’re going for ones which have upside, improvement upside.

One factor we have now seen is builders… Multi-family we’ve elevated our purchasing as a result of builders have pulled again loads. And so the multi-family with improvement upside is that this no man’s land to the place we will purchase and nonetheless get a good money circulation, nevertheless it has a serious kicker on it. After which with our syndication and improvement stuff, we’re simply closing on allow solely. And syndicating, we’re not waving feasibility or giant multi-family if we’re shopping for ourself, except we have now that secondary mortgage locked in. We do lots of worth add the place we’re organising a two step mortgage. If it isn’t one hundred percent dedication, we’re strolling from the deal. We gained’t even ask for a haircut. We want that dedication on the financing, as a result of that may be detrimental. So we’re simply altering how we have a look at issues, how we construction our offers, and we’re doing simply as many properties, if no more, than we had been doing the 90 days in the past.

Dave:

That’s nice. I believe I simply need to summarize for people who find themselves listening to this every thing we’ve talked about at present. The market is shifting, however none of you appear scared. None of you appear to be you’re stopping or are involved actually about your individual companies efficiency.

Jamil:

No.

James:

I imply, there’s at all times the painful transition time the place everybody’s like, what’s occurring? And so long as you put together for that, however on the finish of the day we’re shopping for off math. The mathematics’s going to work in some way. You simply need to put the precise math on it and submit accordingly. Simply create your purchase field, put your math on it and also you’ll preserve shopping for. You’ll nonetheless become profitable. We’ve made cash 2008, or 2005 to now we’ve at all times made cash.

Kathy:

Yeah. And I’d say, I’m involved about among the initiatives that we’ve been in for the previous couple of years. It’s been troublesome with the brand new residence builds, nevertheless it’s forcing me to take a look at different choices like what can we do with these excessive finish houses in Park Metropolis? And I sort of put a put up on Fb and mentioned, Hey, is there anybody on the market that may need to share a trip residence in Park Metropolis and sort of do a Picasso sort factor the place there’s 4 or 5 – 6 homeowners and all people sort of picks their weeks and then you definitely brief time period rental it in any other case. And if we had three or 4 of these, then folks within the trade who’re doing masterminds they usually need a spot the place there’s a bunch of houses subsequent to one another, it’s simply completely different sorts of the way to cope with wrestle. When issues don’t end up the way in which you assume then sort of there’s different methods to take a look at it and different alternatives. In order that’s what we’re doing now and we had an enormous response. We had like 250 folks reply that they needed that. So now I’m going to discover ways to do this, find out how to do shared trip leases.

Dave:

Yeah. It’s nearly being inventive in any market. Over the previous couple of years it was simply really easy. You could possibly simply form of throw a dart on the dart board and that, like James mentioned, it’s over. However that doesn’t imply that there should not alternatives. You simply need to be somewhat extra cautious or somewhat bit extra inventive. And thanks all for giving such good enter onto among the methods that you’re adjusting your methods and serious about find out how to profit and nonetheless develop your companies throughout this transitionary time.

All proper, guys, this was very enjoyable. It’s at all times enjoyable having all of you right here. So for Jamil, Henry, Kathy, and James, I’m Dave Meyer, and we’ll see you all subsequent week. On The Market is created by me, Dave Meyer, and Kaylin Bennett, produced by Kaylin Bennett, enhancing by Joel [inaudible 00:54:23] and Onyx Media, copywriting by Nate Weintraub. And a really particular due to your complete BiggerPockets crew. The content material on the present On The Market are opinions solely. All listeners ought to independently confirm knowledge factors, opinions, and funding methods.

Be aware By BiggerPockets: These are opinions written by the writer and don’t essentially characterize the opinions of BiggerPockets.