We don’t know how good we had it.

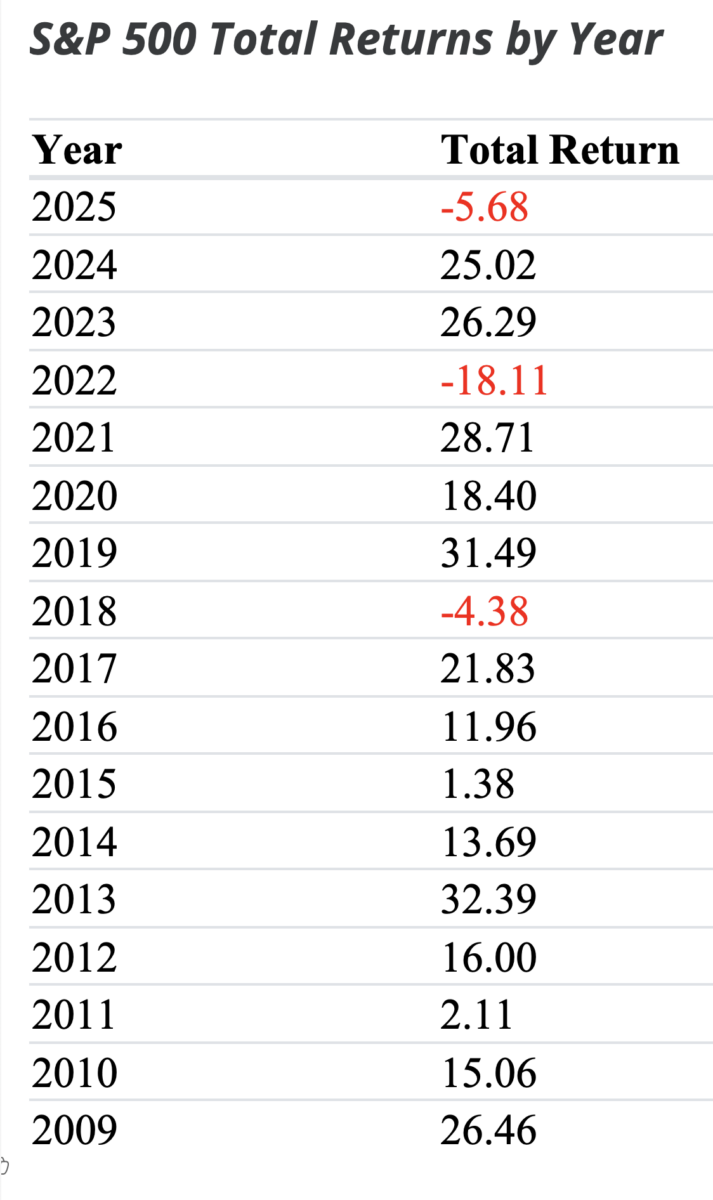

Let’s take into account the returns knowledge from the interval post-Nice Monetary Disaster (GFC), after which unpack what it would imply.

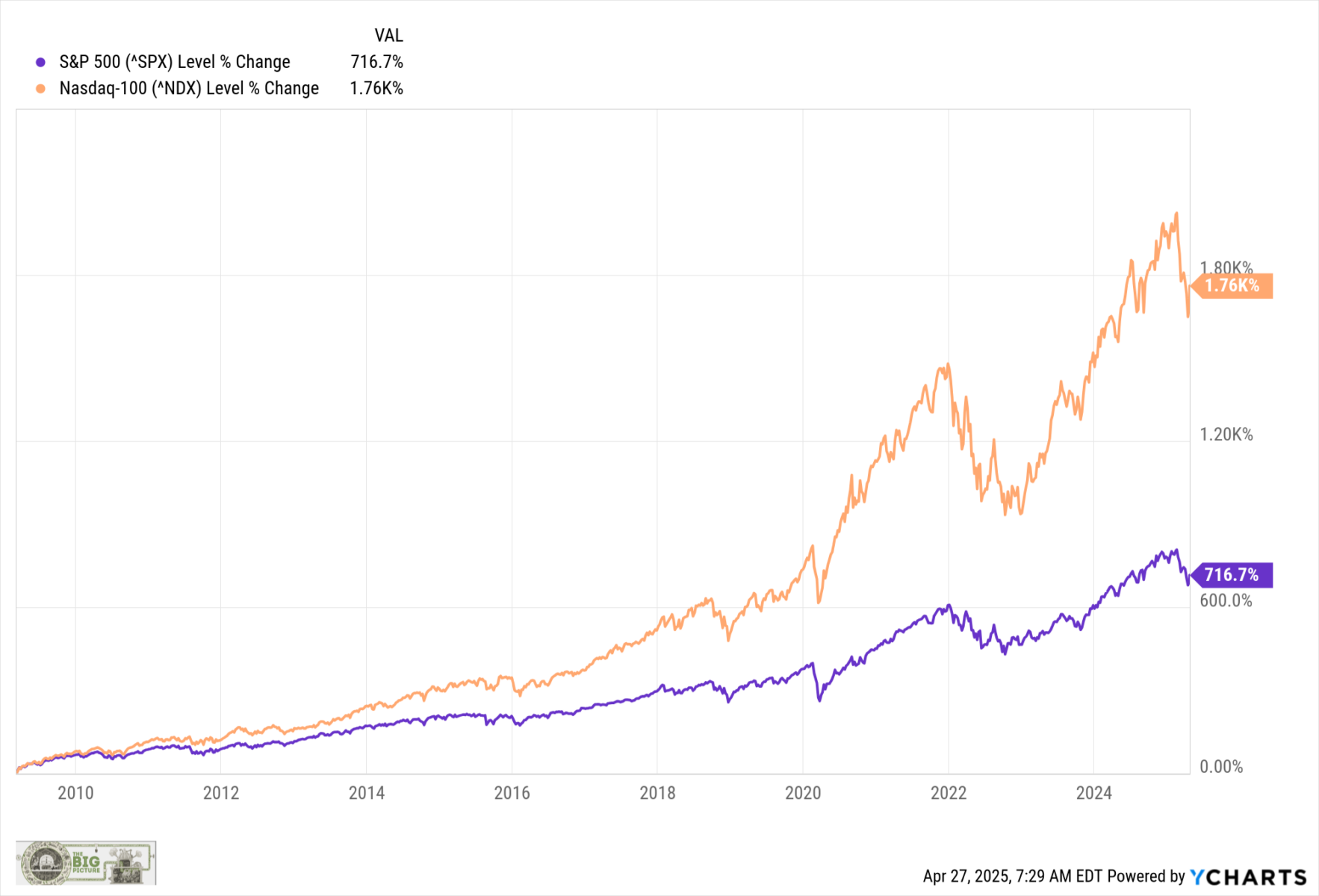

Beginning January 1, 2010, the S&P 500 generated a complete return (with dividends reinvested) of 566.8%, or 13.3% per 12 months from the beginning of 2010 by means of the tip of Q1 2025. The Nasdaq 100 has practically doubled that. (Chart above is from March 2009, however that’s dishonest)

Examine this to the typical 15-year return intervals over the previous century, which generated ~8.7%. Common annual returns over the previous century have been about 10.4%.

Utilizing rolling 15-year interval returns, we see how atypical this period has been. The one two higher eras have been the speedy aftermath of World Warfare II by means of Might 1957 (about 18% annualized) and the tech increase within the Nineteen Eighties and 90s, 15 years peaking in April 1999 (round 17% annualized). This present 15-year peak was by means of February 2024 at ~16%.

Over the whole thing of the post-GFC period, we’ve got been averaging a 3rd greater than the standard annual returns since 1925, and practically double the typical 15-year stretch.

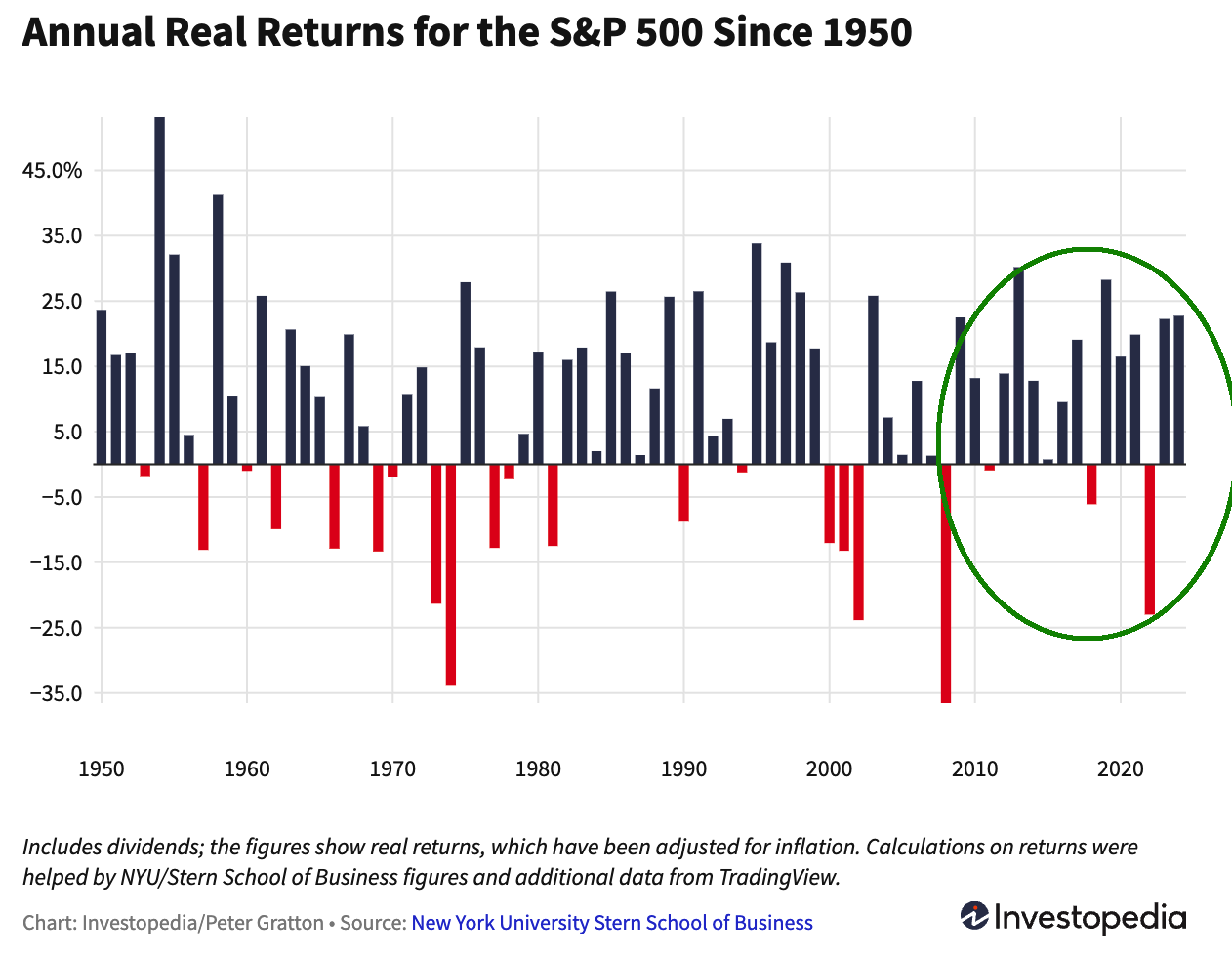

And that spectacular run of post-financial disaster returns have include just a few minor setbacks:

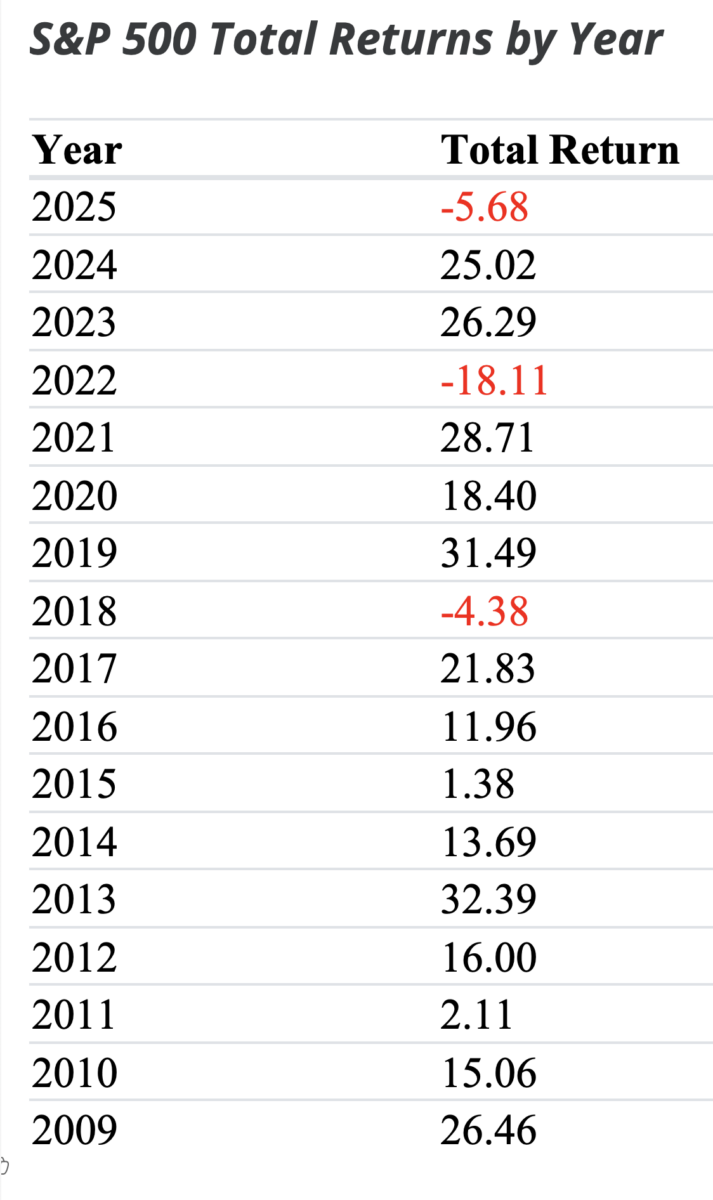

-Flash Crash in 2010.

-2015 achieve of “solely” 1.4%

-2018 drop of 4.4%, together with a This fall drop of practically 20%.

-Q1 2020 down 34% within the pandemic.

-2022 down 18% for the 12 months.4

The total desk of positive aspects for the reason that GFC appears like this:

Desk by way of Slickcharts

~~~

Fundamental Avenue has now turn into an everyday “BTFD” participant. It is a direct results of muscle reminiscence – a Recency Impact affect pushed by 15 years of market positive aspects. What has developed over the whole thing of the post-financial disaster period of rising fairness markets and till 2022, falling or zero rates of interest. The excellent news is that that is the way you construct wealth over the lengthy haul. Nick Maggiulli’s e book “Simply Hold Shopping for” makes this case very persuasively.

After we speak about muscle reminiscence, what we’re actually discussing are habits for which we’ve got been repeatedly rewarded. What breaks that prior behavior relies upon upon how we alter our behaviors in response to that punishment and reward.

Recall what occurred throughout prior adjustments in market regimes.5 Within the Nineteen Eighties and 90s, dip consumers had been rewarded, regardless of the 1987 crash (the final word 22% dip!), the 1990 near-recession, a presidential impeachment, the Thai Baht disaster, the Russian Ruble default, Lengthy-Time period Capital Administration collapse, and extra.

For 20 years, each dip buy was quickly rewarded.

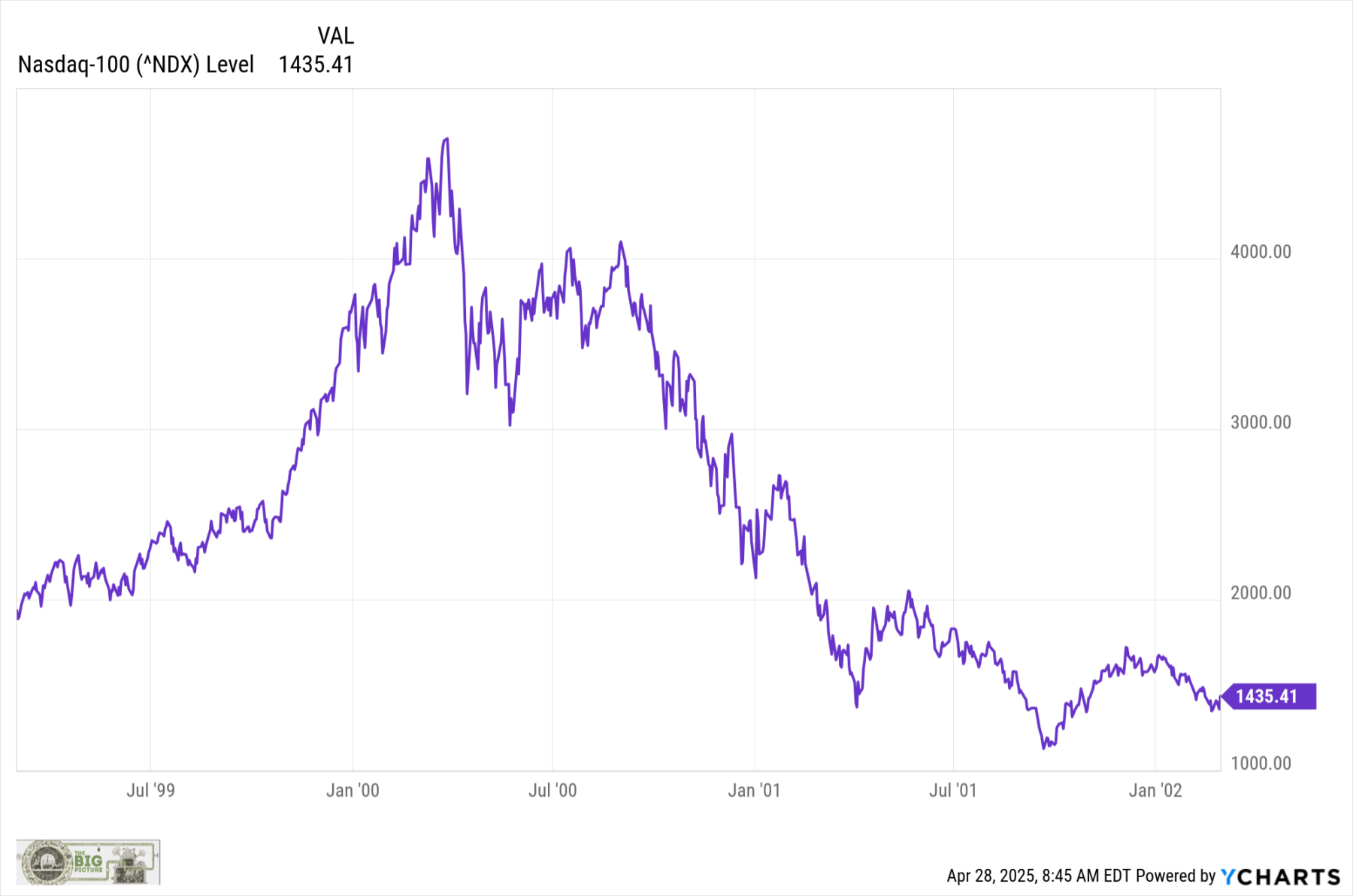

It takes some time to vary conduct. Have a look at the dotcom implosion (and the September 11 terrorist assaults). From March 2000 to the double lows October 2002 and March 2003, the Nasdaq 100 fell 82.9% (peak to trough). That was not a straight line down…

~~~

We could have had it too good for too lengthy – regardless that it didn’t really feel that means. In October 2009, I known as the transfer off the lows “The Most Hated Rally in Wall Avenue Historical past.” In seven months, the S&P 500 had moved 57.5% from the underside, and the Nasdaq 100 had gained 64.6%.

Historical past informs us that when US markets get slashed by 56%, it creates a really advantageous entry level into equities for contemporary capital. The recency impact challenges us to beat the psychological stresses brought on by a contemporary, memorable crash. Folks fought the rally the complete means up, and continued so for years. “Monetary Repression” was the rallying cry for underperforming managers.

Over the following 16 years, the gang could have forgotten that ache. Any single day the place markets rally 12.5% just isn’t what danger managers name a rational buying and selling day.

What has developed over the previous decade and a half is solely that BTFD has labored like a appeal. Maybe, it has labored too properly. The chance is that if and when the pattern adjustments, some merchants shall be gradual to adapt; traders could get discouraged once they study that investing for the “long run” isn’t measured in months or quarters, however in many years.

Folks hated the rising inventory market within the early 2010s. The current concern is that, due to the Recency Impact, they now not hate it sufficient…

Beforehand:

The Most Hated Rally in Wall Avenue Historical past (October 8, 2009)

___________

1. Knowledge from Nick Magiulli’s return calculator.

2. If we needed to cherry decide the information, we might begin with the March 2009 finish of the GFC, and the returns can be a lot larger, or date it from the pre-GFC peak in October 2007, and make the returns decrease.

3. See additionally Lazy Portfolios rolling returns.

4. Plus bonds down 15% – the primary double-digit drop for each asset courses in 4 many years.

5. I’m not essentially claiming a regime change is upon us; relatively, it’s a reminder of what occurs when secular traits in markets reverse.