Put this phrase in your vocabulary for the second half of the yr as a result of you’re going to be listening to it in every single place: “a gentle recession.”

That is the place the puck goes. All of Wall Road’s chief strategists and chief economists are going to be pivoting to this case in the event that they haven’t already. The “gentle touchdown” thought goes to fade away. Now will probably be a gentle, silky, attractive delicate recession. It’s about to change into consensus.

There isn’t any cause to stay in worry of this, ought to it really occur. We now have already been dwelling with recessionary circumstances within the inventory marketplace for 7 or 8 months now.

Final evening on What Are Your Ideas we used the under chart from JC:

That’s 33 consecutive weeks of extra shares making new lows than making new highs. As you may see, that is traditionally as unhealthy because it will get with the lone exception of the Nice Monetary Disaster in 2008-2009. Once more, this isn’t the longer term, that is the current. We now have already been dwelling via it.

This morning’s June CPI report got here in at 9.1%, one other recent 40-year excessive and above Wall Road’s consensus expectations. Core CPI (which removes the all the time unstable meals and vitality parts) additionally got here in hotter than anticipated. PCE – Private Consumption and Expenditures, an alternate inflation measure stated to be extra carefully watched by the Federal Reserve – would possibly are available in milder however that is solely as a result of it has a decrease weighting to housing and hire costs. The housing part for inflation is now the largest upside contributor.

The excellent news is that falling gasoline costs during the last month will assist the scenario on the bottom. As well as, journey costs have been cooling off, each airline fares and inns are off the highs. However that’s about it.

What this report means is that one other 75 foundation level transfer is a lock for July’s FOMC assembly. That might put the in a single day Fed Funds price at 2.25%. One other massive hike is sort of assured for September. This morning the Financial institution of Canada introduced a 100 foundation level rate of interest hike. The market was anticipating 50 foundation factors. Central bankers all over the world are completed enjoying video games, apart from the ECB and BoJ. They’re checkmated for varied causes and won’t act till everybody else has.

And this week we’re going to begin listening to from Company America, which is able to solely enhance the case for “a gentle recession” as CEOs and CFOs journey over one another to ratchet down 2nd half expectations. That is what ought to occur. It units up future upside surprises ought to the recession really show to be delicate.

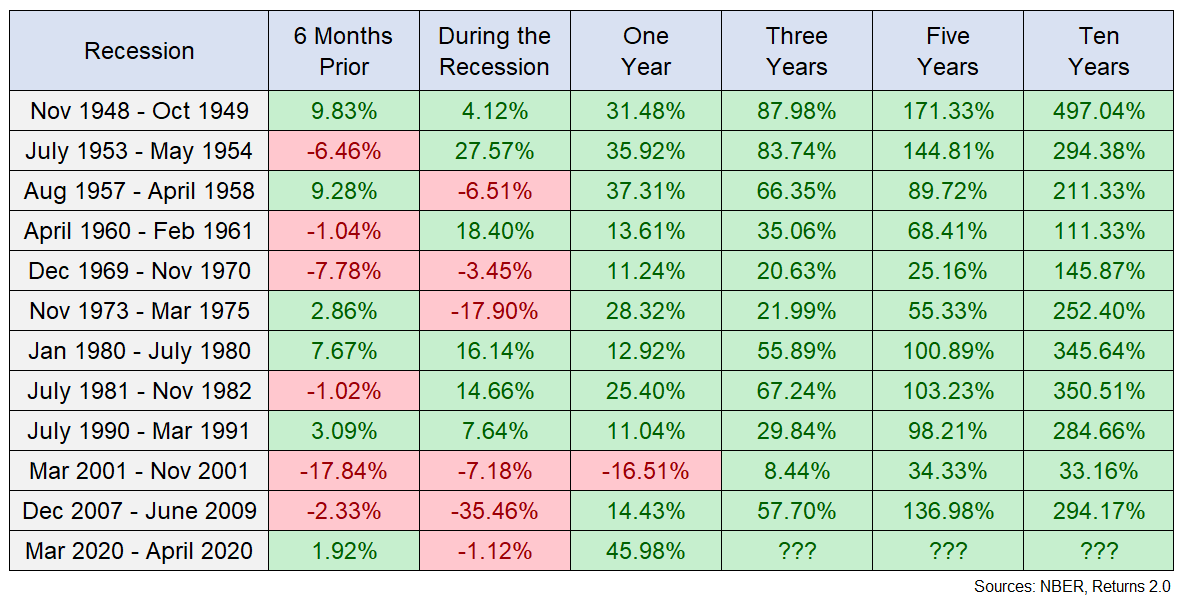

Again to shares – the chart under ought to give you some hope about why the longer term isn’t fairly as dour as you would possibly assume. Historical past tells us that shares do a whole lot of the repricing work AHEAD of recessions. Right here’s what occurred for the inventory market earlier than, throughout and after each recession since World Warfare II through my colleague Ben Carlson. You may learn his publish right here.

Most recessions don’t require catastrophic losses, as you may see. In some excessive circumstances issues get actually unhealthy. I might argue that they have already got gotten fairly unhealthy. Nothing is sneaking up on us – individuals have been speaking about recession all yr and inventory costs have already been adjusting for this risk because the first day of January.

It’s going to be okay. Put your head down, maintain saving and investing, maintain your value of dwelling in test, keep away from leverage, keep in mind that all bear markets have one factor in frequent: They finish.