LordHenriVoton

The CPI report for November is due out on Tuesday, December 13, just one day before next week’s FOMC meeting. Expectations show the y/y rate dropping to 7.3% from last month’s surprise reading of 7.7%. Meanwhile, Core CPI is forecast to remain sticky, rising by 6.1% year-over-year versus last month’s reading of 6.3%. It would be the fourth month in a row that core CPI was above 6%.

Should CPI come in hotter than expected, it would likely result in an unwinding process of the CPI missed last month. Causing the S&P 500 (SP500) to fill the gap and drop back to 3,750.

CPI Could Come In Hotter

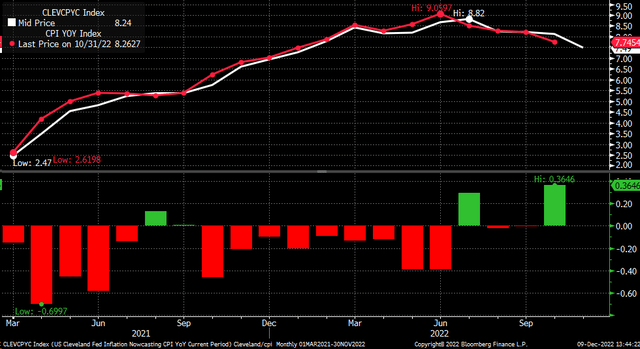

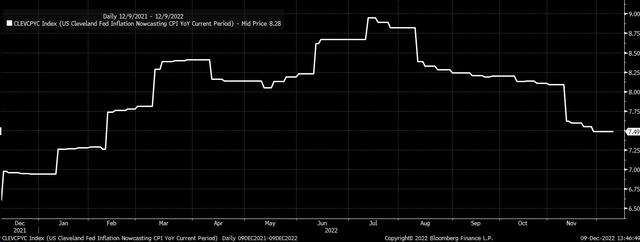

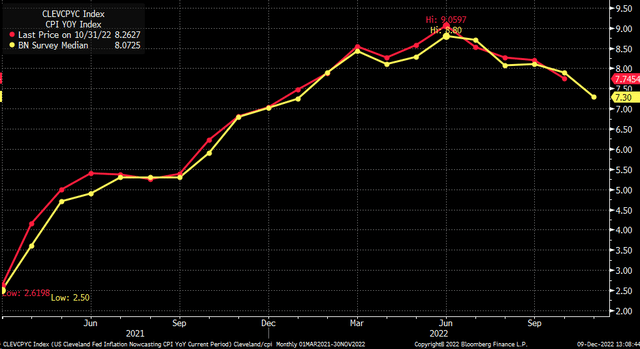

The Cleveland Fed isn’t as optimistic and sees inflation for November being hotter than the survey. Currently, the Cleveland Fed sees y/y CPI rising by 7.5% and Core CPI rising by 6.3%.

The Cleveland Fed’s data had been incredibly reliable for a long time, with the actual CPI report coming in hotter than the Fed’s estimates 16 of 19 times. Then it all went wrong with the October data when the Cleveland Fed overestimated the headline CPI by almost 0.4%. It was the biggest miss in nearly two years for the Cleveland Fed.

Bloomberg

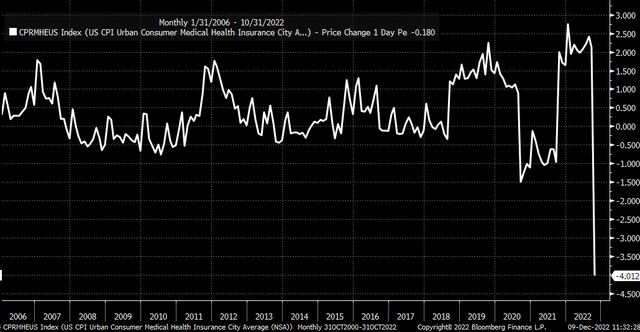

The significant change and miss by the Cleveland Fed appeared to be due to changes in the way the BLS calculated health insurance premiums inflation. This led to a massive 4% m/m drop in the measures, the most significant adjustment in the subcomponent’s history.

Bloomberg

There was a big adjustment in the Cleveland Fed’s CPI year-over-year data following the release of the October CPI data. So if the Cleveland Feds data is back on track, it would again suggest that CPI comes in hotter than expected.

Bloomberg

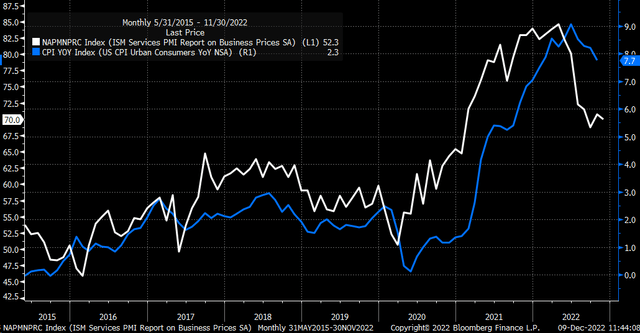

Additionally, the ISM Services prices paid index tends to lead the CPI by around one month since 2016. The prices paid index for November shows that inflation remains very high, with an index value of 70, suggesting that the pace of inflation may have only slowed minimally in November, if at all. Therefore, the CPI should not see a significant decline compared to October, suggesting analysts’ expectations may be too low.

Bloomberg

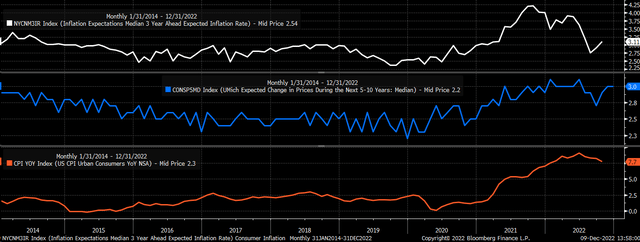

Additionally, there was a meaningful uptick in consumer-based inflation expectations in October and November. The NY Fed and the University of Michigan saw medium-term inflation expectations rise. At least in the past, these have been good leading indicators for overall changes in the CPI. Consumer-based inflation expectations could be a leading indicator as consumers see prices increase in real-time; therefore, those price changes may be reflected later on the CPI report.

Bloomberg

The PPI report for November showed the final demand for Food rose 15.5% year-over-year, up from 13.2% in October, a massive move higher. Food prices have a significant weighting in the CPI report, with a 13.7% weighting, and are moving counter to the expectations of an overall falling CPI.

Bloomberg

Stocks Have Much To Lose

A hotter-than-expected CPI report could result in the S&P 500 unwinding much of the recent gains and filling the gap at 3,750, especially heading into the Fed meeting. The index has recently broken two key uptrends. One of those uptrends was formed following the CPI report on November 10, becoming a point of technical resistance.

Additionally, the S&P 500 has fallen out of a rising wedge pattern, and that is a bearish reversal pattern. It leaves the possibility of the entire rally off the October lows vanishing, with a second gap to fill at 3,585.

TradingView

Long-Term Inflation May Prove Sticky

So while the pace of inflation may be falling, it seems to be coming down slower than expected. This is key as the Fed tightens rates because the slower the inflation rate falls, the longer the Fed will need to keep rates elevated, and the higher those rates may need to go.

Bloomberg

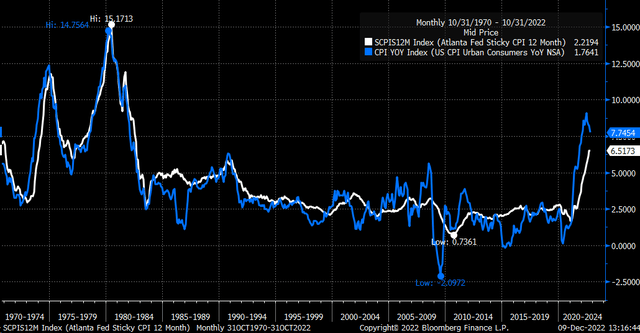

Additionally, there may be a point when inflation gets stuck, and that level may be quickly approaching. The Atlanta Fed Sticky 12-Month CPI gauge shows a 6.51% inflation rate. This metric was well anchored around 2.5% for the past decade and recently moved significantly higher. The real question is how quickly it will come down because it has lagged by approximately six months in the previous years, which presents a threat that inflation stays higher than most people expected.

Bloomberg

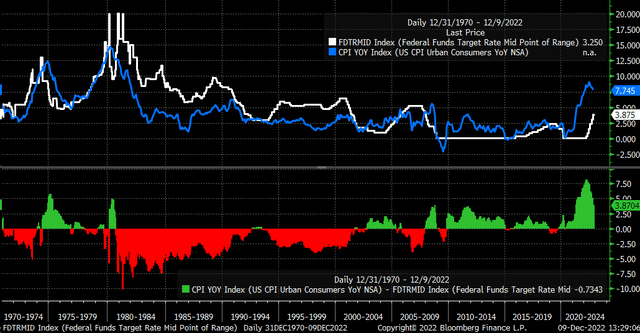

If inflation does become sticky, then it will become apparent that rates are too low. During the persistent times of high inflation in the 1970s, 80s, and 90s, inflation rates didn’t start to fall until the Fed Funds rate went above the inflation rate.

Currently, the CPI rate is 3.87% higher than the Fed Funds rates. Even factoring in another 50 bps rate hike next week and the estimated 7.3% CPI forecast, the Fed Funds Rate will be 2.9% too low. Therefore the longer it takes for the CPI to come down, the more likely it is that Fed’s terminal rate will end up going higher.

Bloomberg

Given the adjustments to the CPI report in October, we have probably seen a peak in the inflation rate. But it is no longer about the peak. The focus is likely to shift to persistence; at this point, there is little data to suggest inflation will disappear quickly.