This is the second part from EVM vs SmartWeave: A comprehensive guide for consenting developers.

Lazy Execution: An Alternative Perspective

The modular thesis has been one of the most prominent narratives in the blockchain space over the past few years. Pretty much all of the leading L1s, Solana could be the only exception here, settled on scaling decentralized networks by modular approach instead of relying on a monolithic layer responsible for delivering all the blockchain’s properties. SmartWeave is a unique approach to the modular thesis, solely focused on scaling distributed ledger compute capabilities via separating the data storage from the execution layer.

SmartWeave’s “lazy evaluation” approach transfers the responsibility of executing smart contract code from network nodes to the smart contract users.

In essence, this means that the computation of transaction validation is deferred until required, reducing the workload on network nodes and allowing for more efficient processing of transactions. This approach enables users to execute as much computation as needed without incurring additional fees, offering functionalities that are not feasible with other smart contract systems. As a result, builders no longer have to worry about gas optimization when evaluation is offloaded to users.

Assessing the suitability of EVM and SmartWeave

Financial primitives are one of the most significant applications of blockchain technology, and the EVM is particularly suited for this purpose due to its strict and deterministic execution of smart contract code on every network node. Additionally, the massive amounts of money that underlie EVM platforms, such as Ethereum Mainnet and consonantly L2s, provide a high level of security, making EVM-based smart-contract networks better positioned to capture the DeFi market.

Another crucial factor to consider is the need to scale SmartWeave applications that require heavy computation. This can only be achieved by delegating the execution layer to specialized entities, as relying on the user’s device alone would be impractical. Attempting to evaluate contracts with thousands of user CPU interactions would be futile.

An abstraction layer like Warp’s DRE has been developed to overcome this challenge. It comprises a distributed validator network that handles contract computations, significantly improving response time and user experience.

However, ensuring this abstraction layer remains fully decentralized at the end stage is important to avoid third-party dependencies and censorship issues. Nonetheless, it’s worth noting that the overlying execution layer, which could be susceptible to hypothetical malicious activity, cannot compromise the decentralization and immutability of the SmartWeave data stored on Arweave. Any entity can retrieve the data directly from Arweave and execute the contract’s state independently, thus preventing fraudulent activities.

While many applications already provide added value for Permaweb users, the Arweave ecosystem is still in its early stages. Currently, the exploration and definition of standards are ongoing, similar to the early days of Ethereum with the creation of the prime ERC standards.

Compared to EVM systems, developer activity and available tooling remain niche. While this can disadvantage newcomers due to the steep learning curve, it also presents an exciting opportunity for true innovation, which is the backbone of the crypto industry.

SmartWeave Market Fit

While it’s interesting to talk about architecture design advantages and constraints in theory, let’s focus on the practical side and explore specific use cases where EVM might not be the best fit. That’s where SmartWeave could potentially fill a niche. DeSoc (Decentralized Social) has recently emerged as a major trend in the crypto space, generating excitement, community involvement, and developer engagement akin to the legendary DeFi summer.

DeSoc aims to solve the challenges of traditional social media, such as disjointed creator monetization and disproportionate platform value, through an open architecture that unlocks social graph data. However, social graph protocols such as Lens Protocol, Farcaster, and CyberConnect are still in their early stages of development, with various standards and tradeoffs to consider.

One of the setbacks for the social graph protocols to consider is the limitations of the EVM. This includes high gas fees and a long finality window. Nobody wants to wait for two minutes to process a “like” action. A possible solution is to store less critical data, such as likes and mirrors, off-chain, while posting more important actions on-chain. However, this approach may require sacrificing on-chain programmability and decentralization.

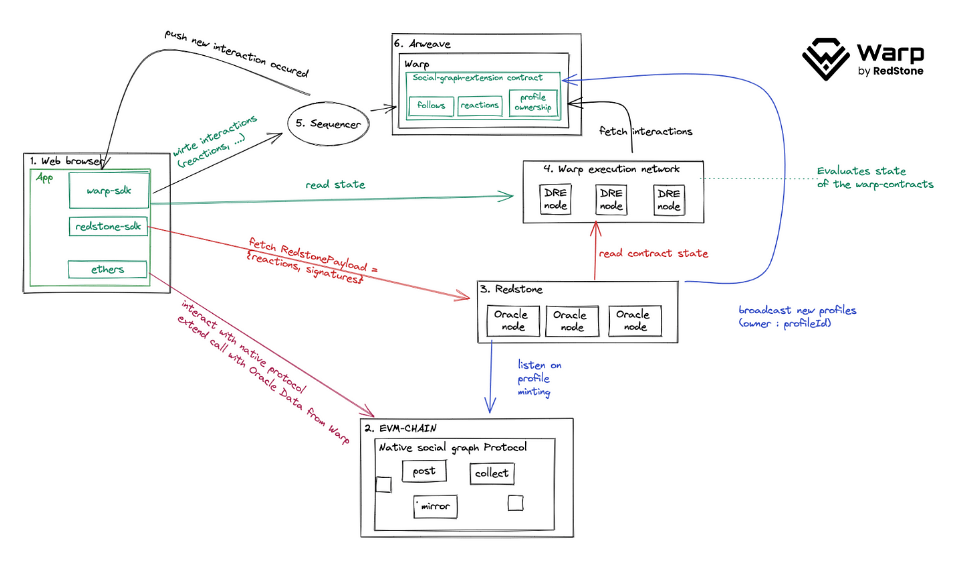

Warp, however, excels in these EVM’s restraints thanks to its unusual architecture and ability to keep user interactions on the permaweb (Arweave ledger) without sacrificing user experience. By delegating certain high-cost or high-throughput actions to Warp, existing social graph protocols built on EVM chains can be enhanced with seamless SmartWeave integration, leveraging both technologies’ strengths. An example of such a mutual symbiosis can be found in the graphic below:

SmartWeave’s adoption can be augmented by exploring AI and financial modeling, thanks to the benefits of transparent underlying data stored on-chain and the ability to combine it with other Arweave network modules. Due to high storage costs, such integration is economically infeasible on an EVM system.

While still nascent, experimentation with machine learning models utilizing Warp software is already happening today here. One of the most common use cases widely adopted now is a variety of database implementation systems built using the Warp SDK, capable of processing production-ready volumes of interactions on a large set of data that would be unmanageable on the EVM network. Several projects lead the permissionless DB cohort, including WeaveDB, FirstBatch, Glacier, and Kwil.

There are still many interesting and unexplored possibilities for the Warp protocol, such as bringing business logic on-chain for document management or deal signing. The early stage of the tech stack and web3 gaming also present opportunities for specific engine modules to live on-chain, like scoreboards and ledgers of items. These areas can provide significant traction for Warp’s growth, even if just one sizable enterprise or game studio decides to offload some of their workflow on-chain.

Final thoughts

Ultimately, the decision to use either EVM or SmartWeave will depend on a project’s specific needs and the developers’ preferences. While the Ethereum Virtual Machine (EVM) has been widely accepted as the go-to solution for blockchain applications, it may not always be the best choice.

At Warp, we believe that SmartWeave, a permanent and immutable execution environment without the limitations of network-wide consensus for state validation, could serve as a complementary network or viable alternative for specific modules in the Web3 ecosystem.

Guest post by: Jakub Wojciechowski, CEO and Founder of Warp Contracts and RedStone