It’s no secret that there’s an reasonably priced housing disaster for a lot of Individuals. This assertion is to not level fingers or assign blame (I’ve robust opinions about this, however I’ll save them for an additional day).

Election season is in full swing, and the financial system, inflation, and reasonably priced housing are main speaking factors for each events. I’m not attempting to show this right into a political dialogue, so I’ll keep away from diving into the proposed insurance policies and my opinions of each candidates, however you may learn extra about them right here.

Nonetheless, I’ll focus on one of many extra distinctive concepts I’ve learn just lately. In an op-ed revealed final month in CNBC, the CEO of Operation Hope and a former advisor to Barack Obama, John Hope Bryant, argued a 40-year mortgage is a short-term answer to housing affordability points in America.

Once I first learn this proposal, I disagreed with it. In reality, the unique title of this text was “A 40-Yr Mortgage Would Be Horrible for Homebuyers.” However once I dove into the info and performed round with an amortization schedule, I spotted there are literally some monetary advantages right here that is likely to be price exploring.

John Hope Bryant’s Case for a 40-Yr Mortgage

In a nutshell, Bryant’s proposal facilities across the following tenets:

- Subsidizing the speed between 3.5% and 4.5% for first-time homebuyers after they full monetary literacy coaching.

- Subsidies could be capped at $350,000 for rural areas and $1 million for city.

- There could be no cap on age.

An extended mortgage answer isn’t a brand new idea. In reality, earlier this 12 months, Grant Cardone predicted that we may even see 50- and even 100-year mortgages in our lifetime.

Spreading out funds over time means a decrease month-to-month fee for homebuyers, which, in concept, will permit them to afford a property that will in any other case be out of attain.

Let’s Do the Math

On the floor, the numbers appear nice. It could permit these patrons a extra practical entry level to homeownership and permit them to construct fairness over time.

I wish to name out this quote from Bryant’s proposal within the CNBC article:

“Critics might argue {that a} longer mortgage time period will increase the entire curiosity paid, however the advantages of affordability and entry outweigh this downside. For a lot of, the choice is indefinite renting, which builds no fairness and leaves households weak to rising rents and financial displacement. A 40-year mortgage permits extra folks to start constructing fairness sooner, providing a pathway to long-term monetary stability and sustained human dignity.”

Right here’s the place I used to be going to make my argument that the numbers don’t help the idea. However after spending a day in Excel, I found three explanation why this plan has benefit.

1. Decrease month-to-month funds

Bryant’s foremost argument was that this proposal would decrease the month-to-month fee for properties by providing a decrease rate of interest long run.

I checked that assertion utilizing the BiggerPockets mortgage calculator to provide you with a month-to-month principal, curiosity, taxes, and insurance coverage (PITI) fee. For simplicity’s sake, we’re going to make use of the nationwide median dwelling worth from Redfin, property taxes from TaxFoundation.org, and insurance coverage prices from Insurance coverage.com. I’m together with tax and insurance coverage right here to attempt to paint an image of the complete month-to-month price for which these owners could be accountable.

We may make the argument that a few of these homebuyers would look to place down much less upfront or obtain down fee help from the assorted packages on the market. Nonetheless, to maintain these comparisons as apples-to-apples as attainable, I’m sticking with 20% down to start out with the identical mortgage quantity and keep away from PMI—the numbers right here would clearly look very totally different with a smaller down fee and mortgage insurance coverage.

| Instance A | Instance B | |

| Mortgage Time period | 360 months | 480 months |

| Curiosity Charge | 6% | 4% (break up between 3.5% and 4.5%) |

| Buy Value | $439,000 | $439,000 |

| Down Cost | 20% | 20% |

| Annual Property Taxes | 0.91% | 0.91% |

| Annual Insurance coverage | $2,881 | $2,881 |

| Month-to-month PITI Cost | $2,329.00 | $1,743.66 |

This one is pretty easy and shouldn’t come as a shock—an extended mortgage time period with decrease charges will imply decrease month-to-month funds. In these two eventualities, the distinction is about $585.

Over the course of the 12 months, that’s greater than $7,000 saved in month-to-month funds with a 40-year mortgage. Not too shabby.

2. Decrease general funds

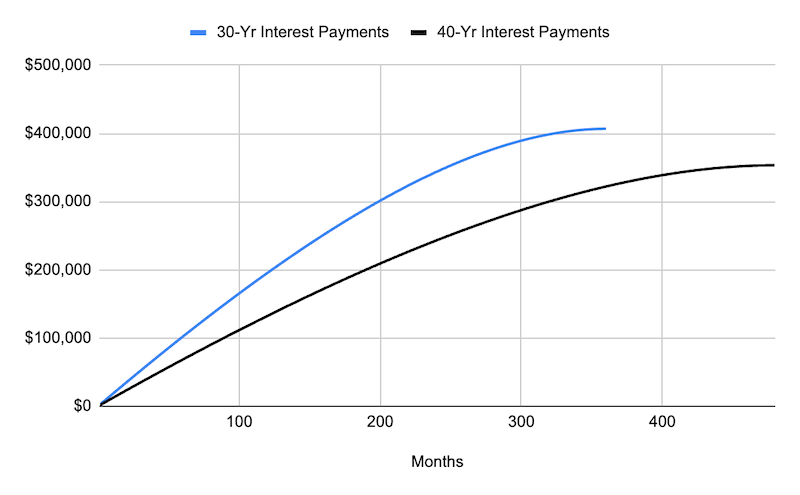

My assumption was going to be that even with a decrease fee, the general curiosity funds could be increased with a 40-year mortgage. Bryant even made point out of that in his proposal.

Nonetheless, we’re each incorrect. When trying on the lifetime of every mortgage in my state of affairs, the entire curiosity funds stack up like this:

- 30-year mortgage: $406,823.67

- 40-year mortgage: $353,343.76

The principal stays the identical at $351,200, however the 40-year mortgage homebuyer really pays $53,479.91 much less in curiosity funds when all is alleged and completed.

This comparability reveals that, opposite to my preliminary assumptions, the 40-year mortgage really ends in decrease general curiosity funds regardless of the prolonged mortgage time period. Once more, this calculation will change based mostly on totally different down fee quantities (e.g., solely placing 5% down means $419,595.95 in curiosity for the 40-year mortgage), however there are conditions the place an extended mortgage means the house comes at a less expensive price.

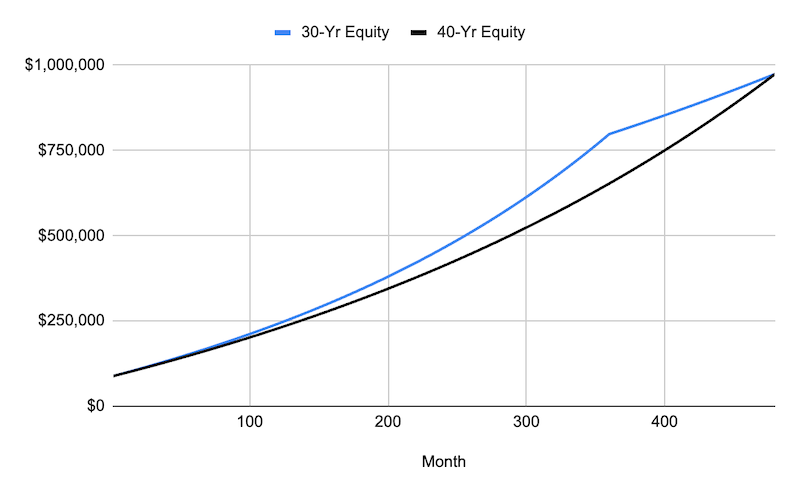

3. Fairness is a blended bag

Bryant’s different foremost argument centered round fairness progress for a 40-year mortgage. That is the place he’s proper and flawed, relying on the way you analyze the numbers. It’s sort of a grey space.

What number of first-time patrons discover their “endlessly dwelling” with their first buy? Based on GOBankingRates, the common American will transfer greater than 11 instances of their life. I could also be a uncommon case as a result of an early profession that compelled me to relocate about each 18 months, a divorce, and a remarriage, however I’ve moved about 10 instances already, and I’m 41 years previous.

For the sake of argument, let’s be conservative and assume a homebuyer stays of their home for 10 years earlier than deciding it’s time to maneuver. I’m going to make use of the identical nationwide median dwelling worth and 20% down fee, however I’m not going to contemplate property taxes and insurance coverage on this calculation.

Our BiggerPockets information analyst Austin Wolff manually derived one-year appreciation from Zillow MSA worth information, however at 4.28%, I discovered it to be unrealistic over the long run. The housing market is a bit of distinctive proper now. Subsequently, I’m going to imagine appreciation at 2% yearly, which I consider shall be extra correct over the long run.

Once you take a look at the 120-month mark, a 30-year mortgage has $13,543 extra fairness when contemplating dwelling worth with 2% annual appreciation and remaining mortgage stability. That hole continues to widen over time till the 40-year mortgage lastly catches up on the finish of its time period.

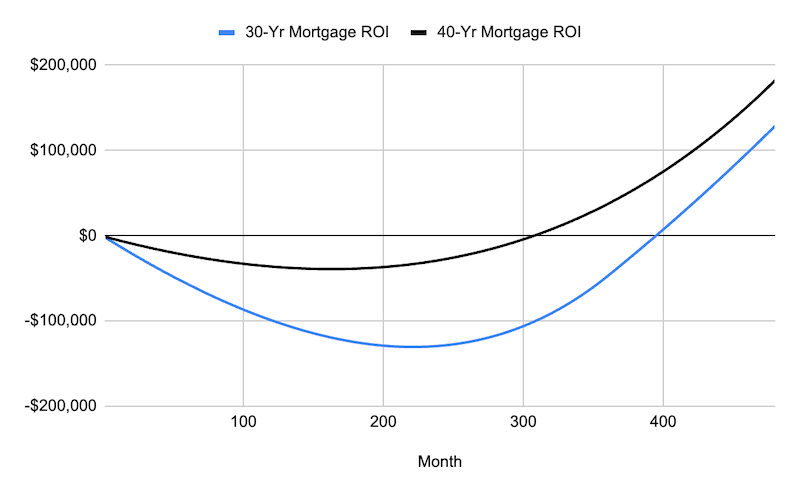

Now, let’s take a look at this as a buy-and-hold funding. Except this house owner is home hacking and residing without spending a dime, the down fee and month-to-month mortgage funds over time will take a significant dent out of that fairness. In reality, at 120 months, a 30-year mortgage house owner has spent practically $100,000 extra in down fee and month-to-month mortgage funds in comparison with the fairness gained by appreciation and amortization. The 40-year mortgage house owner is simply underwater by $36,000.

The 40-year mortgage proprietor has constructive ROI beginning at month 308, whereas it takes an additional seven years for the 30-year mortgage proprietor to achieve the identical level—effectively after their mortgage funds finish.

Based on my calculations, a 40-year mortgage could be advantageous to owners, particularly those that plan on staying within the property long run or home hacking to start out. Rental property traders might discover some deserves of the long term, because it may generate further month-to-month money circulate by reducing the mortgage obligation, but it surely reduces the general fairness potential when it comes time to exit the property.

The Provide-and-Demand Counterargument

There are two fixed, undefeated issues on this world:

- The 1959 Syracuse Orangemen (the one undefeated crew price mentioning)

- The precept of provide and demand

Regardless of the monetary numbers trying favorable for a 40-year mortgage, I do consider this proposal may create an unfavorable shift to provide and demand. Including extra potential homebuyers to a market with restricted provide will create extra competitors for that provide, and that can trigger costs to extend.

Bear in mind again in 2020 and 2021, when properties obtained dozens of affords, and patrons had been waiving contingencies and due diligence? Whereas we might not attain that degree of loopy available in the market, elevated competitors will drive some homebuyers to spend greater than they wish to for his or her properties and/or skip inspections. As traders, it’s simple to stroll away from a deal that doesn’t make sense, however when coping with first-time homebuyers who’re emotionally hooked up to a property, that FOMO is difficult to withstand.

We additionally want to contemplate how lenders would possibly react to this proposal. If they’re amassing much less curiosity, would they really attempt to cap the down fee to five% or 10%? Doing that can barely negate the cheaper month-to-month fee by including PMI and trigger extra curiosity funds over time.

Subsequently, I do fear this proposal to assist homebuyers might have the unintended consequence of harming a few of them.

Closing Ideas

I should be clear and admit my arguments are largely based mostly on assumptions and really primary math. All offers will look totally different, and relying on the patrons, one of these mortgage will or received’t work.

As I discussed, there may be an reasonably priced housing drawback on this nation, and I believe one thing must be completed to offer first-time patrons a possibility to buy a house.

Whereas a 40-year mortgage might initially appear counterintuitive, it may present vital monetary benefits for some homebuyers, particularly these in search of decrease month-to-month funds and long-term affordability. Nonetheless, it’s necessary to stay conscious of potential market impacts, akin to elevated demand and competitors, which may inadvertently drive up dwelling costs and create new challenges.

Finally, the 40-year mortgage is a instrument that would profit particular patrons, but it surely all comes right down to methods and objectives for homeowners and traders.

Prepared to reach actual property investing? Create a free BiggerPockets account to study funding methods; ask questions and get solutions from our neighborhood of +2 million members; join with investor-friendly brokers; and a lot extra.

Be aware By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.