© Reuters. FILE PHOTO: A logo of Taiwanese chip giant TSMC can be seen in Tainan, Taiwan, Dec. 29, 2022. REUTERS/Ann Wang/File Photo

TAIPEI (Reuters) – Shares of Taiwanese chipmaker TSMC slumped more than 3% on Friday after the world’s largest contract chipmaker flagged a 10% drop in 2023 sales and said production due to start next year at its first plant in Arizona would be delayed.

In early trade, Taiwan Semiconductor Manufacturing Co Ltd’s shares underperformed a 1.65% fall in the broader index.

On Thursday, TSMC reported a 23.3% fall in second-quarter net profit, reflecting sluggish demand as global economic woes take a toll on demand for chips used in everything from cars to cellphones.

As TSMC steps up its global expansion, the company said production at its first plant in Arizona will be delayed until 2025 due to a shortage of specialist workers.

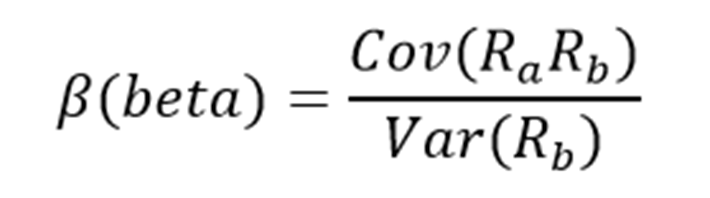

The company’s earnings of T$181.8 billion ($5.85 billion) for the quarter ended June still beat forecasts and analysts said the downward revision for full-year revenues was expected by investors.

“The revenue guidance downward revision could be the last cut for TSMC as the inventory correction cycle is likely coming to an end in 4Q23, in our view, and we see TSMC well positioned for a strong growth outlook in 2024,” Goldman Sachs (NYSE:) said in a research note.

“We believe the U.S. expansion delay is also well expected by investors.”

Other analysts were also upbeat on TSMC, thanks in part to strong demand for artificial intelligence (AI), which currently contributes around 6% of revenue.

“We expect a solid 2024 onward outlook on the back of its leading position in AI chip manufacturing,” Citi Research analysts said in a note.