kokkai

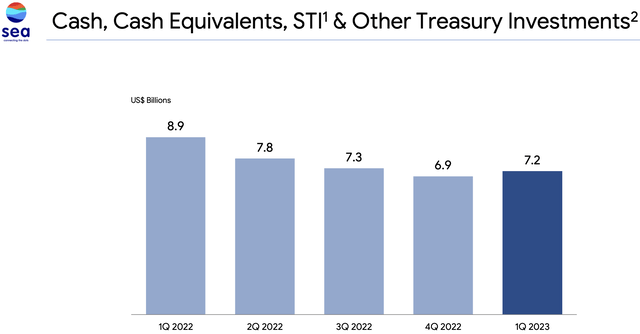

Sea’s Cash & Equivalents Begin Rising Due To Robust Free Cash Flow Generation

Sea Ltd. Q1 2023 Earnings Presentation

Two Decisive Vantage Points

In the interest of optimally serving you, I believe there are two decisive vantage points for the Sea Limited (NYSE:SE) (henceforth, just Sea) thesis. We will discuss them below; after which, we will address the last lingering Garena-related issue that the business presently faces, for which there appears to be light at the end of the tunnel. We will get to that later.

- Sea now generates free cash flow.

- Sea is arguably the strongest it’s ever been as an enterprise, while also trading near its cheapest valuation ever as a public company (it was cheaper in late 2022). We explored this reality using the TGI framework (which is a framework I’ve shared with you in past notes. In short, it’s ironic that Sea would operate from virtually its greatest position of strength ever, while trading at one of its lowest valuations in its corporate history. That is “The Greatest Irony.”) We will touch on this today in this note.

As an aside, I’ve been thinking about “lingering business issues” generally speaking, and I would say that, like a partnership with a spouse, one will invariably find “lingering issues” in whatever route or business they choose.

Of course, this harkens to the timeless adage:

The grass isn’t always greener on the other side.

Oftentimes, patience, tenacity, and mental fortitude are the solution, as opposed to bailing to perceived greener pastures (where one will often experience the same hurdles they experienced in their former situation). There’s nuance here to be sure, but it is a philosophy by which I personally live.

With this in mind, let’s begin!

Sea Ltd. Now Generates Free Cash Flow

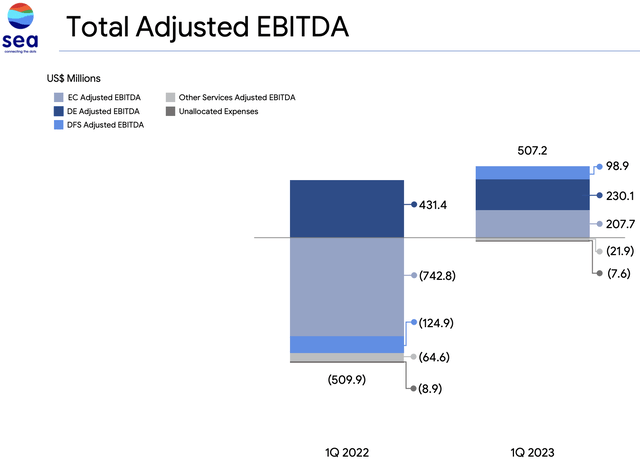

As of today, Sea has achieved profitability. It now both generates free cash flow, as further evidenced by the aforementioned growing cash balance (which did not occur via financing activities, to be sure), and GAAP net income.

We can see these realities in the charts below:

Rough Approximation Of Free Cash Flow (Need To Subtract CAPEX To Account For Omitted “D&A”)

Sea Ltd. Q1 2023 Earnings Presentation

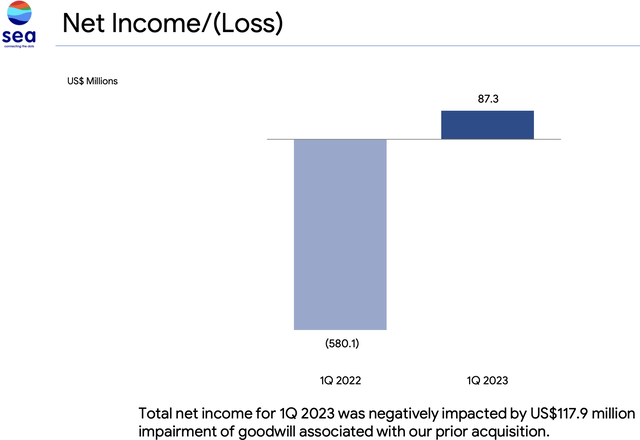

And, below, we can see that Sea now generates GAAP profits. These GAAP profits would have been larger were it not for a one time write-down expense, in which Sea wrote down goodwill value on the asset side of its balance sheet to account for the reduction in value of an acquisition it previously made.

Sea Ltd. Q1 2023 Earnings Presentation

So, in short, Sea now generates robust free cash flow, which it can use for a variety of purposes, e.g., the creation of its cloud business, which it recently noted it might pursue.

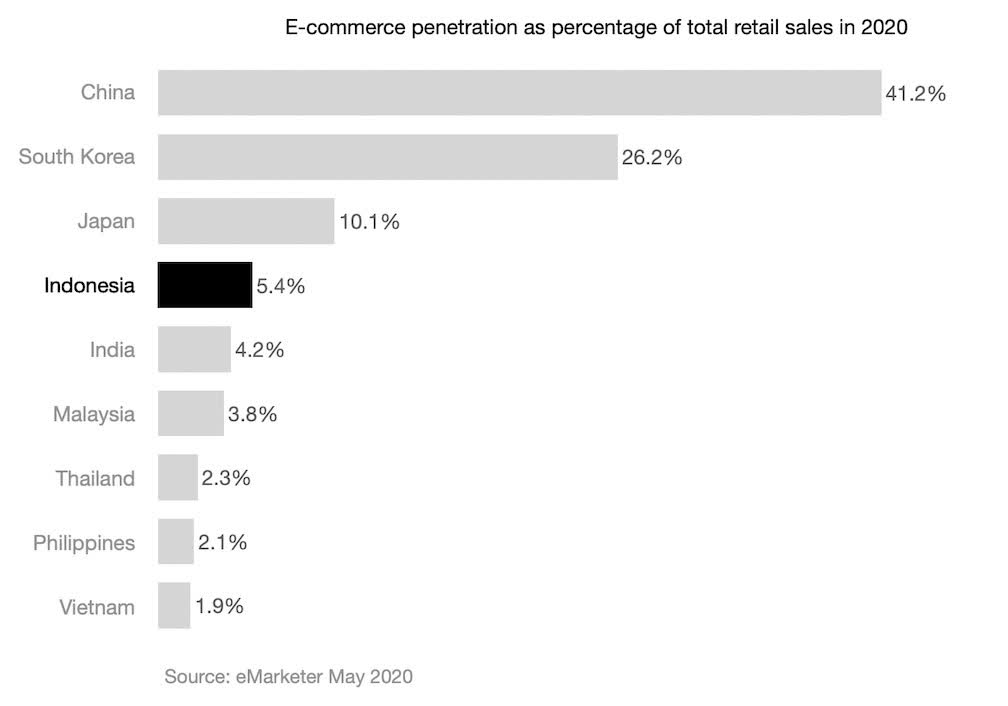

Brief Aside As To The Future Of Sea

Candidly, while the cloud business would be nice, and, with the advent of our latest AI technology, it’s almost “very necessary” for humanity, I would much prefer CEO Forrest Li to focus on building out Shopee Express (basically fulfillment by Amazon but in SE Asia) whereby Shopee captures the majority of the 1P market in SE Asia (to the extent possible! Essayons!).

I do think Mr. Li understands this and is making good progress in this regard.

In the past, I adamantly voiced my displeasure with Sea’s entrance into LatAm, as I believed it was a frivolous waste of shareholder capital that was abutting the territories of two of the most “customer-centric” businesses on earth, i.e., MercadoLibre (MELI) and Amazon (AMZN), both of which I’ve owned and studied closely.

Sea has since discerned as much as well, ultimately withdrawing from the majority of its LatAm markets and the EU, much to the relief of shareholders, I’ll add.

Today, my hope is that Mr. Li recognizes the moat that he could create by building out a massive autonomous logistics network: the goal should be to create “totally autonomous warehouses,” whereby he maximize the ability to create consumer surplus in SE Asia.

I believe Sea’s logistics network should resemble a lifelike “superintelligence.”

Of course, this is just my 2c, but I believe it would be the most judicious use of shareholder capital as of today, by which to optimize the consumer surplus for those served.

I do hope that Sea begins building computing centers as well, as that would afford the business cheap compute, with which its autonomous factories would operate, and it would support the creation of the AI/global data community that I have hoped would materialize since I began sharing my ideas publicly.

Let’s now turn to the second vantage point.

Considering Sea Through The TGI Framework

- TGI Framework = The Greatest Irony framework, which I employed in late 2022 to assess a number of businesses. It effectively stated that many businesses, including Sea, were operating from their greatest positions of strength, while simultaneously trading at their most depressed valuations in their corporate histories. I deemed it greatly ironic that these businesses traded at such lofty valuations in the late 2010s and early 2020s when they operated from weaker positions.

With Sea now generating robust free cash flow, we could add another pillar to the fairly immense irony that has been the market’s trading of the business over the last 60 months or so.

As I’ve shared recently, I speak of Mr. Market with only perfect deference.

I do not mean to disparage Mr. Market in any sense. We all get things wrong at times, and I am no stranger to this reality.

But, in my estimation, which I believe to be objective reality, Mr. Market’s pricing of Sea has been fairly ironic. And, as we know, the great irony we’ve witnessed has been roughly synonymous with “the great opportunity.”

With these ideas as of our platform, I will not belabor Sea’s great irony; instead, I will share Beating The Market’s work in detailing it:

- The Greatest Irony 10 (SE) (S)

- Note that you needn’t read that note to fully grasp the thrust of this note to you today.

To briefly summarize the ideas presented in that note, as you consider it, you will find that Sea has achieved almost unbelievable feats of growth.

I believe that, if you shared the metrics presented in the above note in a vacuum: sans share price data, sans controversy of LatAm, sans The Everything Bubble of 2021, sans the recent bank failures precipitated by the fastest repricing of credit in the history of America, the observer would conclude that Sea is positively in its greatest position of strength ever, after having achieved simply breathtaking feats of entrepreneurial success and growth.

It is my belief that the observer would remark, “Simply incredible… How did they do it?! Is there a way I could buy into this business almost unbelievable business? Who are the entrepreneurs who created this?”

Of course, this is simply my perspective, though one in which I vehemently believe. And, of course, there is share price data, 24/7 news, etc., and all of the biases that attach to it.

Now, with all of that being said, it’s not all sunshine and roses. Let’s now explore some issues that Sea has faced and could face further.

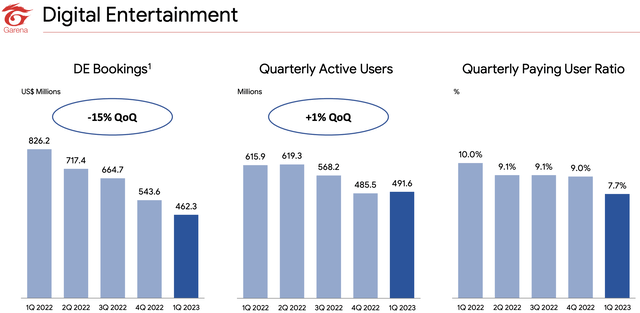

Garena’s Sales Collapse

Sea Ltd. Q1 2023 Earnings Presentation

On the subject of Garena’s slow motion sales collapse, I shared the following:

In my eyes, it was a great quarter, excepting the continued financial bleed in DE (illustrated above). That said, we’re still generating ~$1B in cash flow from that segment each year. That’s fantastic. We’re demonstrating operating leverage in our ecommerce business and FinTech business. That’s fantastic.

Cash balance continues to grow as the business generates free cash flow. Lots to like, though I will report back on management’s commentary on DE bookings.

[I believe management has the right plan, which entails optimizing for user experience first; then, monetizing in the years and decades ahead. Game franchises, when properly stewarded, last much longer than most realize!]

So net income in the Q was about $200M ex the write-down. So SE is trading at about 50X? or thereabouts EV/fcf.

[If we annualize Sea’s GAAP net income, it currently trades at about 45X EV/net income. Note that Sea is still very much a “growth business” that is aggressively reinvesting into its business, as we briefly explored above. I do not believe paying about a 2% fcf/EV yield is egregious in light of this reality, and this reality, i.e., Sea is reinvesting in its business, will likely produce growth reacceleration in the years and decades ahead.]

On the subject of Garena’s collapsing sales, I mean it’s bad… no doubt.

But it’s not the end of the world.

BTM’s subscription count has been declining for [nearly] years!

I’m not whining! I’m not quitting! I’m still [giving it my all]!

(as I believe SE and its team are doing!)

[And I have 100% faith that Beating The Market’s subscription count, like Garena’s sales, will begin trending in the right direction in due course. Business is non-linear; sometimes fairly viciously so. We explored these ideas together and more in this note.]

Beating The Market Chats: Core Economic Infrastructure Channel.

In summary, I believe Sea has the right strategy to preserve the integrity and fanbase of Free Fire, and, as such, Free Fire’s bookings will return to growth and/or stability at some point in the years ahead.

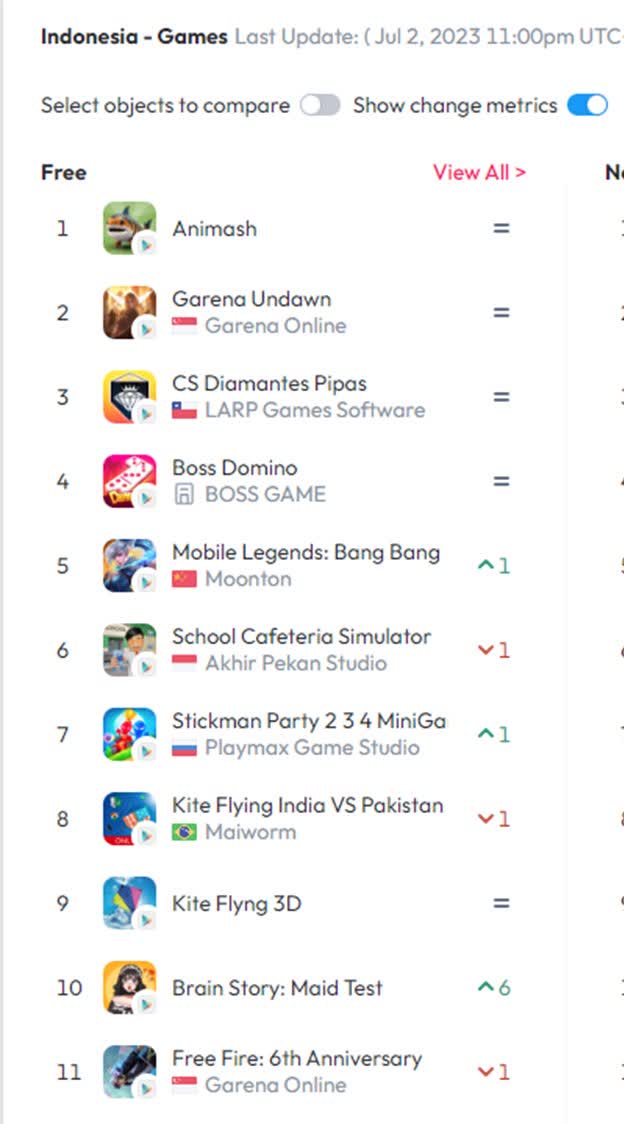

Furthermore, Garena’s latest hit game title, Undawn, appears to be performing well according to recent data:

Google Play Store

Google Play Store

Roughly speaking, Sea trades at about 29x EV/Garena’s cash from ops today.

There’s Shopee and Sea Money and Sea ads and Shopee Express, and future businesses that Sea will layer on as well. However, in my estimation, we’re only paying for Sea’s, quite notably, very successful game studio that’s presently experiencing some non-linearity.

Let’s now briefly consider Sea Ads and Sea Money, both of which are vital to the investment thesis for Sea.

Sea Ads And Sea Money

Our original note on Sea explored its digital ad ambitions (among other topics), which Beating The Market continues to highlight to this day. For instance, I’ve been recently sharing ideas such as,

Still the best time in 15 years to be considering this channel and (GOOG).

MACS’ digital ad growth will likely be breathtaking, and I very rarely see anybody talk about it.

Which is odd… because between Roku (ROKU)/The Trade Desk (TTD)/Connected TV and MACS, I don’t know that there are more exciting areas in the digital ad market.

Learn More About Beating The Market’s MACS Acronym Here.

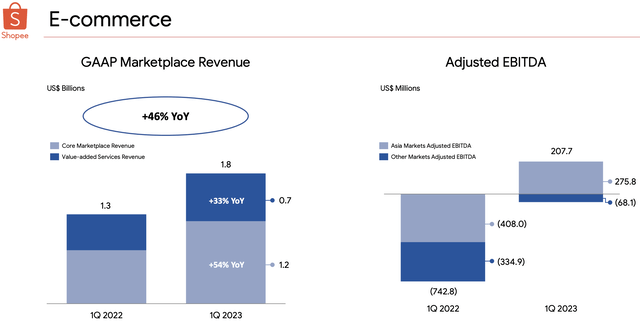

And I believe we can discern Sea pulling on this digital ad lever via data points such as (emphasis added):

“Core marketplace revenue, mainly consisting of transaction-based fees and advertising revenues, was up 54.3% year-on-year to US$1.2 billion.”

Forrest Li, CEO, Sea Ltd.’s Q1 2023 Earnings Call.

Turning to Sea Money, our second work on Sea centered around its FinTech ambitions.

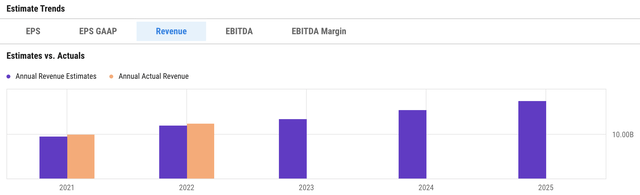

In TGI 10, we more granularly illustrated the “almost unbelievable” growth Sea’s FinTech business had experienced over the last 5 or so years (keep in mind Sea’s businesses are 5-10 years old, and they already generated well over $10B in profitable revenue. I am excited for what the future will bring for Sea).

Sea’s Sales Estimates, Fwd. 3 Years

YCharts

And that work was predicated on our original examination of Sea’s FinTech business.

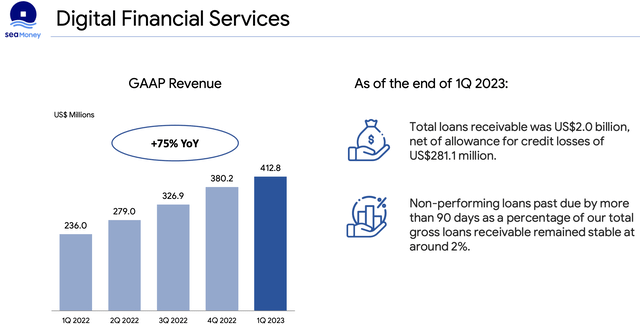

Today, Sea Money is vastly larger than where it stood when we originally began coverage of this line of business.

Sea’s Recent Business Performance

Sea Ltd. Q1 2023 Earnings Presentation

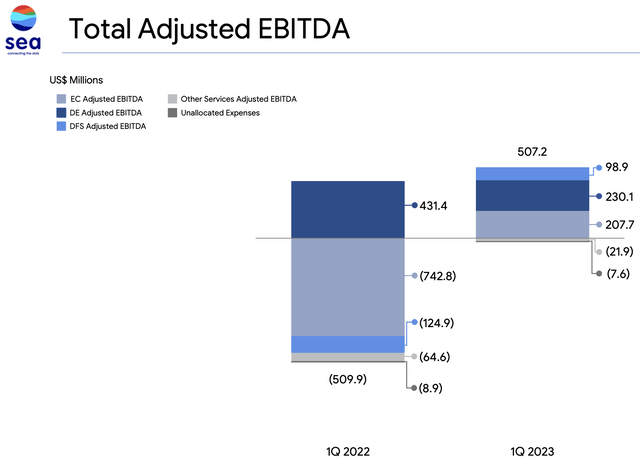

As of May 20th, 2023, it’s likely that Sea operates at an annualized run rate of very roughly $2B in profitable financial services sales.

Sea Money produces about $100M in adjusted EBITDA (roughly free cash flow, as there is no capex and Sea has little interest expense)

Sea Ltd. Q1 2023 Earnings Presentation

Now, this is great, but I do not believe the market is fully pricing this reality in.

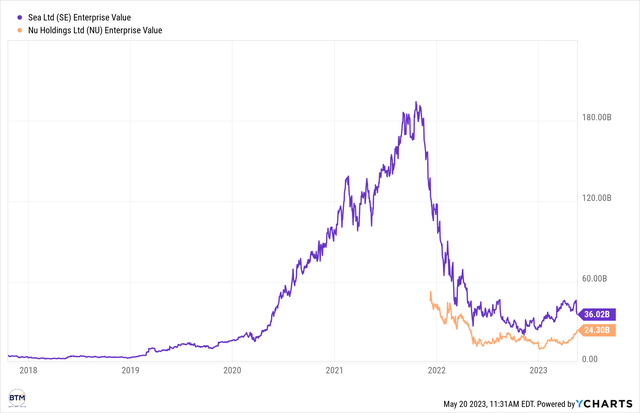

To illustrate this idea via some objectively rough data, in LatAm, Nu Holdings Ltd. (NU) trades at about $24B in enterprise value. Nu operates at about $3.5B in annualized revenue run rate, and it has about the same number of users as Sea Money (very roughly, 60M to 70M).

Sea & Nu’s Enterprise Values

YCharts

Using this as a point of reference, Sea Money should trade at about $15B to $20B in enterprise value.

Today, the entirety of Sea trades at about $36B in enterprise value (keeping in mind its large net cash position, which grew in Q1 2023).

In light of how well Sea’s ecommerce division has been performing, I believe that this represents pricing that might be a bit too pessimistic; especially in light of how rapidly Sea could grow once we emerge from this very rapid interest rate hiking cycle.

The Incredible Performance Of Sea’s Ecommerce Business, Q1 2023

Sea Ltd. Q1 2023 Earnings Presentation

Shopee’s Long Road Ahead, Graphically Depicted

eMarketer

In short, I believe Sea should roughly trade at over $50B in enterprise value today, were the market truly pricing in the net present value of what I believe will be robust cash flows for decades to come.

Concluding Thoughts

With monday.com Ltd. (MNDY) and Sea now producing robust free cash flow sustainably, we can continue to accumulate these businesses with greater confidence.

We’ve always believed these to be some of the best businesses on earth.

Now, with robust, sustained free cash flow, alongside incredible growth (especially once we get on the other side of all the bank failures and the fastest repricing of credit in U.S. history); alongside dynamic cultures, there’s certainly much more of an element of “letting these names ride on autopilot” into the future.

There’s also the very exciting element of these companies now having robust cash flow whereby they could even further reinvest and even further accelerate growth in the future.

In short, I am very happy with the performance of Sea; Garena’s collapsing sales notwithstanding.

Should you want more work from me on the business of Sea, I would encourage you to read the following notes:

Thank you for reading and have a great day.