shaunl

Investment Rundown

Operating in the transportation and logistics industry Werner Enterprises Inc (NASDAQ:WERN) has grown steadily over the last decade but seems to have hit a roadblock right now as macroeconomic conditions are unfavorable. This hurt the latest earnings report from the company and EPS dropped 32%. With a fleet of around 8.600 trucks WERN still has the opportunity to remain a significant player in its industry and grow exceptionally well in times of economic prosperity, but in downturns like this, margin preservation will be a key focus.

In terms of the valuation of WERN, it stands at an FWD P/E of around 16 which is very close to the sectors of 17. I don’t think this necessarily means that WERN should be viewed as a buy, and neither do I think it’s a sell. The company has a proven track record of success but seeing how the next few quarters pan out in terms of demand and margin retention will paint a more clear picture of whether or not now is the time to buy WERN. I would prefer to wait until I recommend them a buy, as a result, WERN will be a hold rating from me right now.

Company Segments

As a company operating in the transportation and logistics industry, there is a certain cyclicality to the earnings of the business. Nonetheless, the company has grown into one of the largest truck carriers in the US with a fleet of around 8.600. Of that fleet around 8.305 are operated by the company itself and the remaining ones are operated by smaller individual companies and some dealerships as well.

In WERN there are two different segments, the TTS segment and the Werner Logistics segment. Within TTS they divide the focus between direct transport and one-way transport. The logistics segment offers aid to companies who quite frequently need to move assets or products between various places. Here WERN helps with distribution lines and scheduling of transportation.

WERN Overview (Investors Presentation)

One of the largest disruptions that the industry has seen is the rise of E-commerce. This trend put enormous pressure and demand on transportation companies as people wanted to get their products the fastest possible way. This grew demand for truckload carriers as the routes they take are more flexible but require significant logistic infrastructure. WERN has battled this by ensuring they have strong relationships with its partners

Earnings Highlights

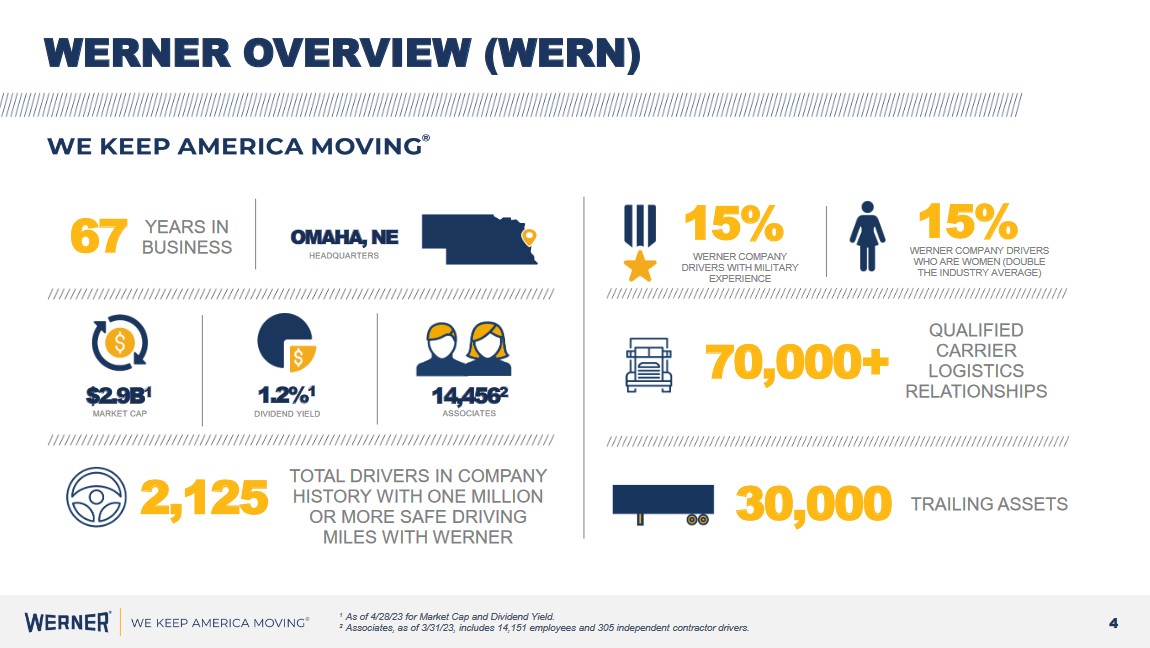

Looking at the latest earnings report from the company, there was a significant drop in the EPS, 32% to be exact. This was despite the revenues increasing by 8% YoY. Lower margin retention shows to me that WERN is struggling with making the most of the softening economic environment they have found themselves. The impact that inflation has had on the business seems quite severe and passing down costs doesn’t seem possible which has caused these constrained margins.

Q1 Results (Earnings Presentation)

Where there were some good signs however in the last earnings report was a continued upward trend for the operating ratio, which now sits at 89.3%, climbing from 85.8% in Q1 FY2021. This has resulted in stronger revenues per truck per week. During the last 2 years, the average yearly growth has been 6% for it. I think these revenues are rather sticky as rates have steadily been climbing this year so far, even whilst fuel prices have declined.

The FCF generated by the company continues to be a key focus, and in 2022 they generated $144 million of it. However, seeing as the Net CapEx in 2023 is expected to rise to between $350 – $400 million, I can see a scenario where the FCF takes a hit and we go lower. The share price would most likely reflect this by diving deeper.

Risks

The most prominent risk for companies in transportation is the fluctuations of economic activity which creates various demands between fiscal years. When compared on a year-over basis it could discourage some from investing, but over the long term, these are often smaller short-term challenges. I usually view investing in transposition in the North American market as a bet that economic prosperity will continue and eventually resume if in a decline.

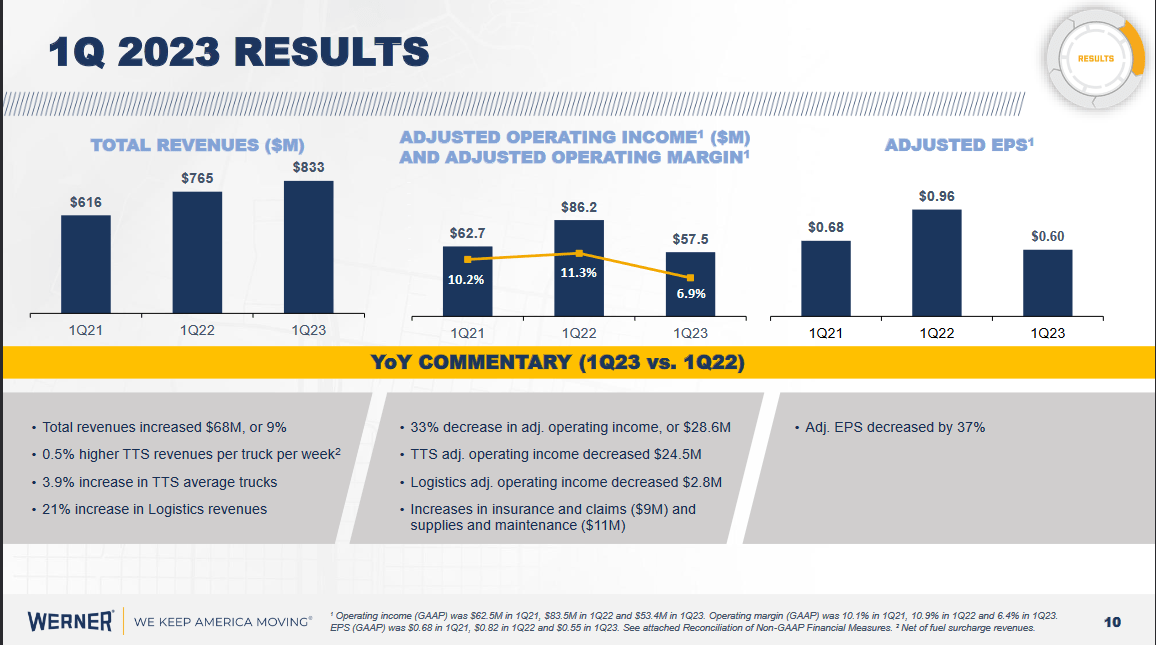

Apart from lower demand, the volatility of fuel prices does create challenges for transportation as quarterly results can be hard to predict.

Gas Price (eia.gov)

Looking at the chart for historical gas prices we can see it’s been on a steady uptrend and with some spikes in prices sprinkled on top. I don’t worry about this too much, however, as the margins for WERN have been steadily trending upwards as they become more and more efficient with their operations.

Financials

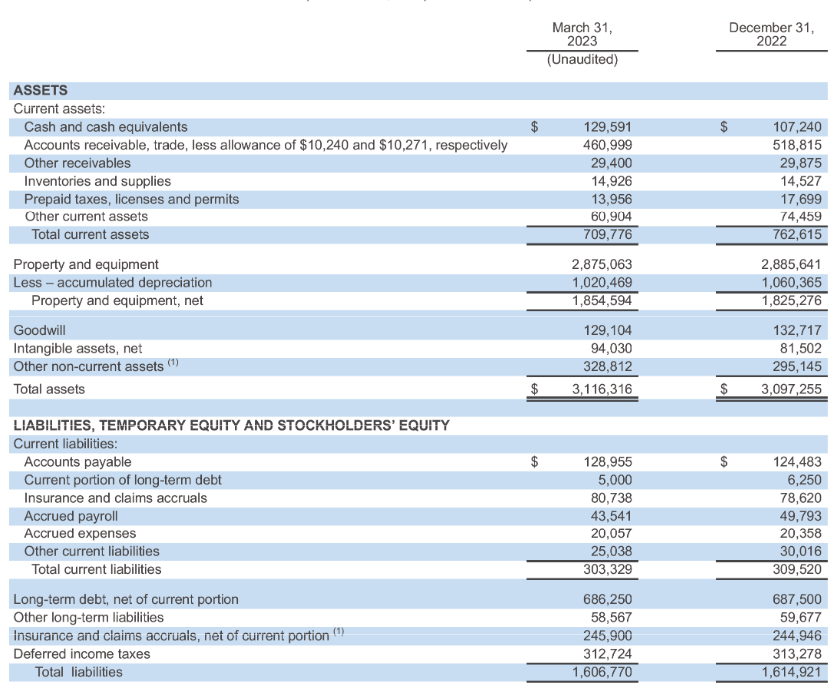

Looking at the balance sheet for WERN it has made some solid improvements on a QoQ basis. The cash position has increased by 20% and now sits at $129 million. This means that WERN is still able to acquire companies and build out its fleet and take market share.

Balance Sheet (Earnings Report)

In terms of debt for WERN it doesn’t sit alarmingly high I think, just shy of $700 million. The company does mention previously generates decent cash flow, over $100 million in 2022. This is more than sufficient to pay down any current debt the company might have. Right now, the current debt is only $5 million which presents no danger in my opinion. As for the coming quarters, I wish to see the cash position either continue to increase or be used for acquisitions. I think it’s in times like these that the best times are presented to acquire new companies when economic activity is slowing and valuations are lower.

Final Words

To have some exposure to the transposition industry, I think is important for a diversified portfolio, be that with rail companies or truck companies like WERN. The appeal of WERN seems to be the steady track record of growth the company has had, which has translated into buying back shares and distributing a dividend.

But I think the last quarter showed some cracks in the business. The revenues might have been up but margins took a hit and the EPS fell by 32%. The valuation is quite similar to the rest of the sector and doesn’t necessarily scream a buy as a result. I will be viewing the company’s ability to retain margins in the coming quarters, and if there are positive signs I can see WERN being rated a buy rather than a hold which I have right now.