Text size

Changing rates of inflation could make negotiations between Ford and the UAW more complicated.

Eric Thayer/Getty Images

Add labor relations to the challenges

Ford Motor

faces in terms of electric-vehicle pricing, production, and market share, not to mention the difficulty of selling cars when rising interest rates and inflation are leaving consumers with less spending power.

Wednesday, Wells Fargo analyst Colin Langan added the auto maker to the broker’s list of tactical ideas for the third quarter—a selection of stocks that the bank believes could be moved up or down by significant events expected in the coming three months.

Langan said Ford stock (ticker: F) could be dragged down as uncertainty mounts about approaching negotiations between auto makers and the United Auto Workers. “We expect a contentious negotiation given new UAW leadership and high wage expectation,” wrote Langan. “A 10% wage increase is our base case, which implies about $850M in [incremental] costs.”

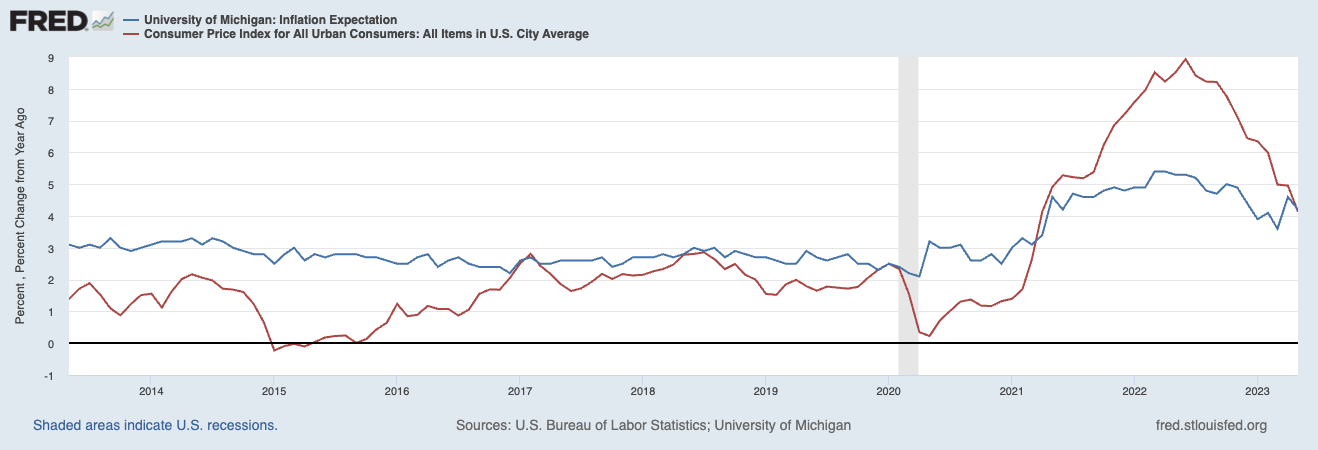

Wages are expected to go up because inflation is much higher now than it was in 2019, when the industry and the UAW last negotiated a contract. Back then, inflation was running at around 2% a year, but it has averaged roughly 4.6% since the contract was signed. The average over the past 12 months is about 6.8%.

Those changing rates will make it more difficult for both sides to know what is a good deal.

“UAW contracts expire September 14 and one of the most important variables will likely be COLA,” or the cost-of-living adjustment, wrote Benchmark analyst Mike Ward in a Wednesday email.

Workers at

Spirit AeroSystems

(SPR) just signed a labor deal that raises pay at roughly 6% a year on average for the coming four years. The first-year increase in wages will be almost 10%.

Increased costs can eat into profit margins and result in lower earnings for auto makers, including Ford.

At the same time, Langan said, pricing for all cars, including EVs, is likely to fall in response to high interest rates and tighter lending standards. They would take an additional hit if “if broader macroeconomic weakness materializes,” he said.

All of that points to a lower stock price for Ford. Langan rates the stock at Sell and has a target of $10 for the price, which is the lowest among analysts tracked by

FactSet

.

Ward is at the other end of the spectrum. He rates shares Buy and has a $20 price target, the highest among the analysts FactSet follows. The Benchmark analyst says Ford is a good bet because he expects profits to be more stable than usual, and because the stock sell for less than nine times per-share earnings.

Overall, 43% of analysts covering Ford rate that shares at Buy. The average Buy-rating ratio for stocks in the

S&P 500

is about 55%. The average target for the price is about $14 a share.

Ford stock was down 0.7% in early trading following the call. The

S&P 500

and

Dow Jones Industrial Average

were both off about 0.5%.

Write to Al Root at [email protected]