da-kuk

Back in April, I wrote that SoundHound AI (NASDAQ:SOUN) was growing fast, but not fast enough to justify its valuation. With AI hype helping boost names in the space, let’s take a closer look.

Company Profile

As a reminder, SOUN has a voice AI platform that helps with human-computer interactions by allowing people to have more conversational, natural interactions when dealing with things like voice-enabled third-party assistants. Its speech-to-meaning technology combines automatic speech recognition with natural language understanding to convert speech into meaning in real-time. The platform’s deep meaning understanding technology also allows its platform to understand complex questions.

SOUN generates the bulk of its revenue from royalties when its Houndify platform is used in devices such as automobiles, smart speakers, and third-party assistants. Royalties are based on volume, usage, or duration. The company also earns revenue from subscriptions for service that don’t include a physical product, such as food ordering, and it has a music recognition app that it is looking to generate revenue with through advertising and lead generation.

Steady Riser

SOUN has been a steady riser, riding the recent hype in AI despite lackluster Q1 results.

SOUN saw its revenue jump 56% to $6.7 million in Q1. However, that’s off a very low base and was just in line with expectations.

Its cumulative bookings backlog, meanwhile, grew 46% year over year. While that is solid growth, it has also been meaningfully decelerating. Over the past year, bookings growth has gone from 207% in Q2 ($283 million), to 239% in Q3 ($302 million), to 59% in Q4 ($332 million), and now 46% in Q1 ($336 million). That’s a rapid deceleration of growth the past two quarters. In fact, its cumulative backlog was up only $4 million sequentially in Q1.

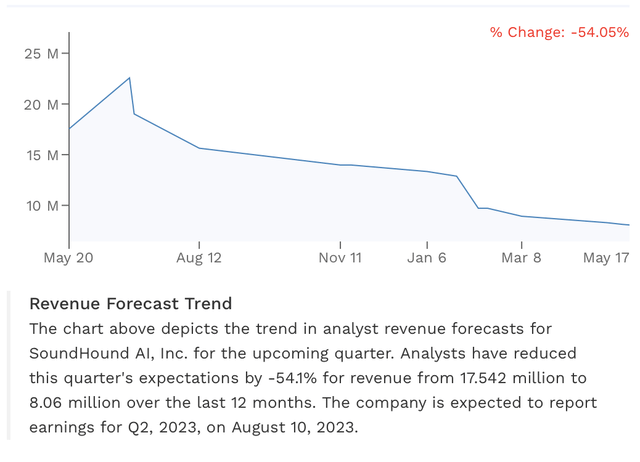

Now, undoubtedly there is some seasonality in those numbers, but for a company that should be at the early stages of growth, the 1% sequential bookings growth and decelerating trend is a bit concerning. In addition, its revenue forecasts continue to come down. For next quarter, analyst expectations are down over -50% since 12 months ago, showing a company that is now exactly living up to the hype.

SOUN Q2 Revenue Estimates (FinBox)

The automobile space was one area I noted in my original write-up where SOUN was making strong inroads. On that front, it said it saw over 2x growth in units while also being able to take price. It also said there was some exciting new brands in its pipeline, and that it added a Turkish EV maker as well as Stellantis Group (STLA), bringing its total up to 10 auto brands.

The other area that SOUN has really going after has been the restaurant space. On this end, the company made some strong gains in Q1 with restaurant POS providers.

On its Q1 earnings call, CEO Keyvan Mohajer said:

“One of the key to success in winning deals with a large number of businesses is the ability to integrate with a variety of point-of-sale systems that act as the brain center of the businesses. Along with our original point-of-sale integration with Square, this quarter, we went live with our Toast restaurant point-of-sale integration, and we have been working closely with our sales organization on our joint go-to-market. In addition, our voice AI is now available on Oracle MICROS Simphony POS that can seamlessly help any restaurant accept voice orders over the phone via menu kiosks or at the drive-thrus on their platform. Oracle has been a great partner, and we sincerely value their collaboration. We are also now live with Olo, a leading open SaaS platform for restaurants and are already working with several well-known brands in their customer base. These strategic channel partnerships expand our reach to hundreds of thousands of new locations.”

The company also thinks it can take its restaurant solution and expand it to other businesses. It said it’s been able to take its Smart Ordering Solution for restaurants and create a new service that allows “any business to field nearly any inbound queries or questions for opening hours, parking, location, typical wait times, products and services, appointments and reservations and more using an automated assistant over the phone.”

Expanding to use cases to other areas is a smart move in my view. The company obviously has a solid offering given the big-name partnerships and clients it does have. Auto and restaurants will still be key end markets in the near term, but it will need to branch out.

SOUN is expecting revenue growth to pick up as the year progresses, as restaurant deals ramp up and due to seasonality in the auto and consumer electronics business. It is projecting full-year revenue of between $43-50 million. Given the size of its business, I’d prefer to see the impact of seasonality be less noticeable at this point. Early-stage, hyper-growth businesses generally power past seasonality, and it doesn’t become noticeable until they become more mature.

Valuation

SOUN is projected to grow revenue 45% to $44.9 million. On that basis, SOUN stock trades at a price-to-sales multiple of over 16x.

Further out, however, analysts are expecting big growth from SOUN. For 2024, the revenue consensus is for sales growth of 82% to $81.8 million. Then in 2025, one analyst is projecting revenue to grow 40% to $115.1 million.

Notably, the growth projections have come down a lot for next year, while SOUN stock has moved much higher.

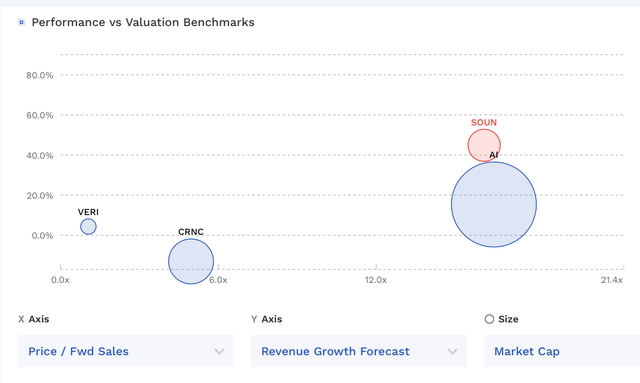

SOUN trades at one of the higher valuations among early-stage AI companies.

SOUN Valuation Vs Peers (FinBox)

Conclusion

Right now, it’s good to have AI in your name for a stock, as the AI craze is in full throttle. Given that SOUN is a small but legit company with strong growth, it wouldn’t surprise me if it doubled or tripled from here. That’s just the current fervor AI names are seeing right now.

From a valuation perspective, the stock shouldn’t make that type of move, and there are certainly flags around its decelerating growth and how later-year expectations continually drift lower. In the near term, though, it may not matter.

At this point, SOUN is a stock that is trading more on hype than fundamentals. Bulls and bears will both have enough to justify their view points in the short to medium term. I’m not a momentum investor, and I’ve also learned not to short momentum names based on valuation. As such, I prefer to stay on the sidelines on this one.