onurdongel/E+ via Getty Images

For the week ending June 16, the Industrial Select Sector (XLI) gained +2.98%. XLI was among the 10, out of the 11 S&P 500 sectors, which closed the week in green. YTD, XLI has risen +7.37%.

Meanwhile, the SPDR S&P 500 Trust ETF (SPY) rose +2.22% (YTD +14.91%), helped by the Federal Reserve keeping its policy rate unchanged, which broke a streak of 10 straight rate hikes. The SP500 index has now been on a five-week winning streak.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +12% each this week. YTD, 2 out of these 5 stocks are in the green.

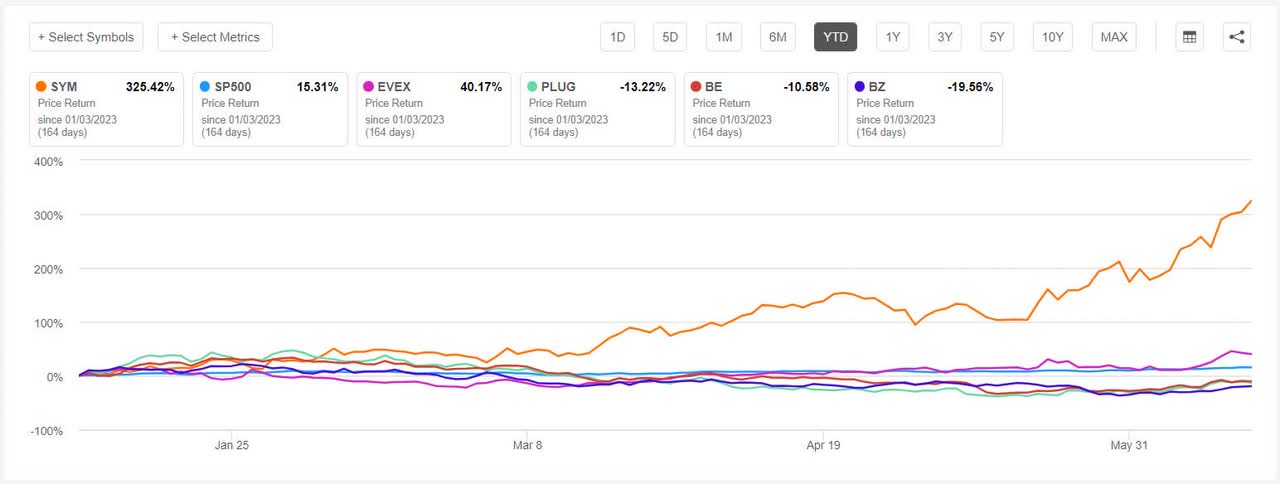

Symbotic (NASDAQ:SYM) +18.87%. The Wilmington, Mass.-based company took the top spot for the second week in a row after seeing gains of ~30% last week. Shares of the robotics warehouse automation company soared the most on Tuesday (+15.25%). YTD, the stock has risen +328.98%, the most among this week’s top five gainers.

SYM has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of B+ for Profitability but D for Growth. The rating is in contrast to the average Wall Street Analysts’ Rating of Strong Buy, wherein 10 out of 13 analysts see the stock as Strong Buy.

Eve (EVEX) +18.41%. Shares of the electric air taxi developer shot up the most on Tuesday (+8.78%). The SA Quant Rating on EVEX is Hold with score of A for Momentum and D for Valuation. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 3 out of 8 analysts tag the stock as Strong Buy. YTD, +36.67%.

The chart below shows YTD price-return performance of the top five gainers and SP500:

Plug Power (PLUG) +15.27%. On Monday, the shares soared +13.09% after the company detailed plans for its investor day on Wednesday, which included above-consensus guidance for 2023 sales.

However, YTD, the shares have fallen -14.55%. PLUG has a SA Quant Rating of Sell with factor grade of F for Profitability and D- for Momentum. The average Wall Street Analysts’ disagrees with a Buy rating, wherein 14 out of 29 analysts view the stock as Strong Buy.

Bloom Energy (BE) +13.34%. Similar to its peer Plug, Bloom’s stock also rose the most on Monday (+11.29%). YTD, the shares have declined -10.25%. The SA Quant Rating on BE is Sell, which is in contrast to the average Wall Street Analysts’ Rating of Buy.

Kanzhun (BZ) +13.34%. The Beijing-based online recruitment company rounded off the top five but its shares have seen some volatility. YTD, the stock has declined -15.41%. The SA Quant Rating on BZ is Hold but the average Wall Street Analysts’ Rating is Strong Buy.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -5% each. YTD, 2 out of these 5 stocks are in the red.

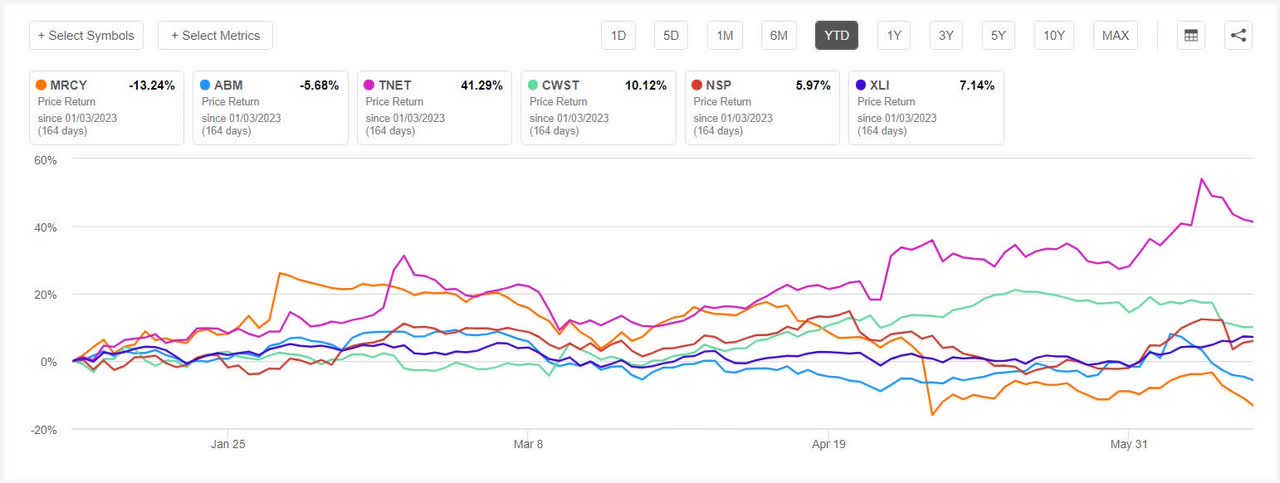

Mercury Systems (NASDAQ:MRCY) -9.74%. The aerospace and defense products maker carries a Sector Perform rating at RBC Capital Markets. YTD, the shares have declined -13.59%, the most among this week’s worst five performers.

The SA Quant Rating on MRCY is Sell with a factor grade of D+ for Profitability and D- for Momentum. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 3 out of 8 analysts tag the stock as Strong Buy.

ABM Industries (ABM) -8.69%. The New York-based company’s stock fell throughout the week. YTD, the shares have dipped -4.66%. The SA Quant Rating on ABM is Hold with a score of A+ for Growth and C+ for Valuation. The average Wall Street Analysts’ Rating differs with a Buy, wherein 4 out of 8 analysts see the stock as Strong Buy.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

TriNet (TNET) -8.25%. The Dublin, Calif.-based payroll services provider landed among the losers this week after being among the top five gainers the previous week on a report that it was exploring a potential sale.

The SA Quant Rating on TNET is Hold with factor grade of B+ for Profitability and D for Growth. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 2 out of 6 analysts tag the stock as Strong Buy. YTD, the shares have gained +44.59%, the most among this week’s top five decliners.

Casella Waste Systems (CWST) -6.14%. The stock fell -4.96% on Tuesday after the company on Monday post market announced that it will buy the assets of Consolidated Waste Services for $219M, and launched a $400M stock offering according to a separate release. The SA Quant Rating on CWST is Hold, which differs with the average Wall Street Analysts’ Rating of Buy. YTD, +9.47%.

Insperity (NSP) -5.72%. The staffing solutions provider’s stock fell the most on Wednesday (-7.71%). However, YTD, the shares have risen +5.43%. The SA Quant Rating and the average Wall Street Analysts’ rating, both, on NSP is Buy.