Technology industry insiders have warned that the UK’s hopes of securing a quick deal to deepen digital trade ties with the US have run into growing resistance in Washington, as Prime Minister Rishi Sunak visits to discuss stronger economic relations with President Joe Biden.

In April last year, the two countries had agreed to set out an “ambitious road map” to deepen trade ties, including “harnessing the benefits of digital trade”. Tech groups have been hoping for the two countries to forge a deal to boost digital transactions, even if they have ruled out talks on a more comprehensive free trade agreement for now.

But critics say the Biden administration is now soft-pedalling the prospects of a digital deal with the UK, as some lawmakers on the left side of the Democratic party increasingly balk at provisions that would benefit big technology companies.

“The reality is that nothing has happened since the joint statement in Aberdeen because the US has been unwilling to engage substantively in digital trade negotiations for domestic political reasons,” said Sabina Ciofu, head of the international policy and trade programme at the lobby group TechUK.

Here’s what else I’m keeping tabs on today:

-

Economic data: The OECD releases its Economic Outlook, Germany issues industrial production figures for April and Halifax publishes its UK House Price Index.

-

Bank of Canada: The central bank announces its interest rate decision.

-

Results: Brown-Forman, Campbell’s and Inditex report.

Five more top stories

1. The EU is considering a mandatory ban on member states using Huawei and other companies deemed to present a security risk in their 5G networks, after only a third of the bloc’s countries had blocked the Chinese company from critical parts of their communications despite Brussels’ recommendations. Read the full story.

2. A $1tn US government borrowing spree is set to further strain the country’s banking system, as the Treasury department seeks to rebuild its cash balance in the aftermath of the debt ceiling fight. Here’s why traders and analysts are concerned.

3. Revised data is set to show the eurozone economy has shrunk over the past two quarters, removing some of the shine from its recent resilience in the face of an energy and cost of living crisis. Here are economists’ expectations for the figures to be published tomorrow.

4. One of Canada’s largest asset managers plans to more than double its headcount in London and invest billions in Britain, including on green projects, defying the prevailing gloom over the country’s attractiveness after Brexit. More on the Alberta Investment Management Company’s vote of confidence in the UK.

5. The UK’s Advertising Standards Authority has banned recent ads from Shell, Repsol and Petronas for misleading the public on the climate and environmental benefits of the groups’ products overall by omitting “material information” on their larger polluting operations. Read more on the landmark rulings.

The Big Read

When he won the Labour leadership in 2020, Sir Keir Starmer insisted he would bring together the UK opposition party’s disparate factions after it had suffered four election defeats in a row, two of them under Jeremy Corbyn. Instead, three years on, Starmer has carried out a radical realignment, sidelining the left and driving the machinery of the party on to the political ground he thinks can win an election.

We’re also reading . . .

Chart of the day

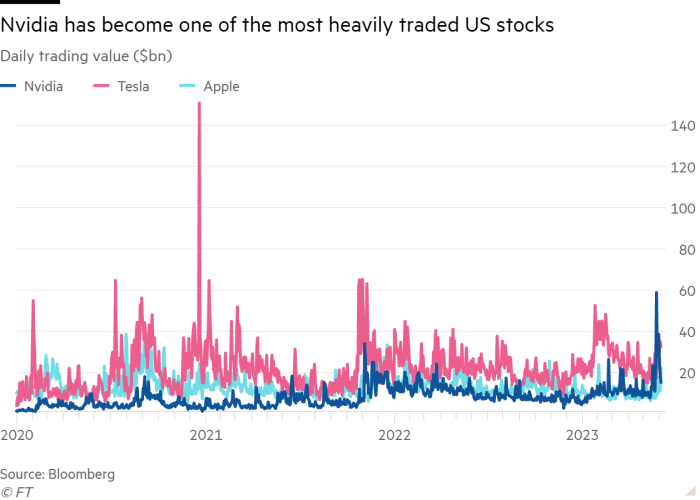

Big money managers including State Street, Fidelity, Amundi and mutual funds had all cut positions in Nvidia earlier this year, missing out on the eye-watering rally that recently pushed its valuation to $1tn. They’ve spent the past two weeks catching up, racing to amass shares of the US company that has become a go-to bet on artificial intelligence.

Take a break from the news

Does anyone really need Apple’s impressive new “mixed reality” headset, the $3,500 Vision Pro? Technology correspondent Patrick McGee sets out to answer this question.

Additional contributions by Benjamin Wilhelm and Gordon Smith

Recommended newsletters for you

Asset Management — Find out the inside story of the movers and shakers behind a multitrillion-dollar industry. Sign up here

The Week Ahead — Start every week with a preview of what’s on the agenda. Sign up here