2022 was like a reset for the decade. 2023 is the opposite, even if a lot of investors haven’t seen it that way yet.

But you will…

Because today, we’re talking about the “stock of the year” — and the technology that’s disrupting virtually every sector.

Yes, this year is all about artificial intelligence. And you can’t have AI without microchips (or semiconductors). I dive into that in my new presentation here.

However, not all chips are created equal.

There are three major kinds: logic chips, analog chips and memory chips. The most sophisticated of these is logic.

These are also the types of chips that companies like Nvidia and AMD make, and are able to support the highest levels of AI.

But which company is closest to creating the “God chip”?

Or in other words, the holy grail of chips, which would have the most bang for its buck (and companies chomping at the bit to get).

Find out in today’s video…

(Or read the transcript here.)

Hot Topics in Today’s Video:

- Market News: Based on May’s U.S. jobs report, here’s what I think will happen with the next Federal Reserve rate hike. [0:50]

- Investing Opportunity: The company we’re lauding as the “stock of the year.” [3:50]

- Reader Question: Angelo would like to know where chipmaker Analog Devices (Nasdaq: ADI) fits with regard to artificial intelligence. Is it the new “God chip”? [5:30]

- Mega Trend: Pet telehealth care — the next Amazon? The rising adoption of the Internet of Things and AI for pet parents are some of the major drivers for this market. [10:40]

- Do you use telehealth for your pet? Let us know how you use it at [email protected]. (And if you want to include a picture, we’d love to see your pet! 😉)

See you soon,

Ian KingEditor, Strategic Fortunes

(From Apple: “Introducing the new era of special computing with Apple Vision Pro.”)

In case you missed it, Apple made a splash this week by announcing the arrival of their long-awaited virtual reality headset, the Vision Pro.

In typical Apple fashion, it’s an impressive piece of hardware with five sensors, six microphones and 12 cameras. The company’s also redefining, and even changing the vocabulary of, what its products do.

It’s not a “virtual reality headset.” It’s a spatial computer with a 3D camera!

I have a house full of assorted Apple products, and I’ve always admired the company’s craftsmanship and focus on quality. Apple makes legitimately great products.

And it has an almost flawless track record of making things that might have normally been “geeky” into the very definition of cool.

But I don’t see myself shelling out $3,500 for a computer I wear on my face. And apparently, Wall Street feels the same way.

Apple’s (Nasdaq: AAPL) shares dipped following the announcement.

Now, not to beat up on Apple. This is one of the finest companies in the history of global capitalism. It’s a true moneymaking machine, with profit margins so high, it’s almost obscene.

And the Vision Pro may ultimately be a major success for Apple. Let’s face it, the company hasn’t whiffed in over two decades now.

But I’m more interested in the macro picture: America’s productivity problem.

Due to the aging of the baby boomers and the relatively smaller size of subsequent generations, our labor force isn’t growing at the rate it used to.

So in order to keep the economy humming along, we need more output per worker. And that’s simply not happening at the speed we need it to, which is why inflation has been so hard to kill for the past year.

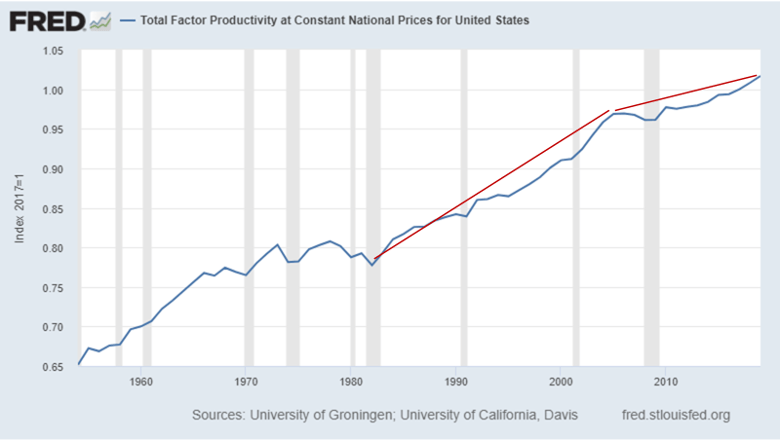

Looking at the numbers, total factor productivity exploded higher throughout the 1980s, 1990s and early 2000s — as personal computers (and later the internet) revolutionized work.

But starting around 2005, productivity really started to slow. Newer technologies like social media and the smartphone weren’t really productivity boosters.

Or whatever productivity-boosting powers they might have had, have since been negated by the endless hours the average person spends just playing and scrolling.

Now, could Apple’s “spatial computer” boost productivity?

A few models from now, it’s possible that something like this could enable a surgeon to perform surgery remotely, for example. And several other applications we just haven’t even thought of yet.

But I’d rather follow true labor-saving technology like artificial intelligence and robotics automation.

This is the technology we desperately need, and the companies that bring it to market stand to make an absolute fortune.

Today, Ian mentioned the “stock of the year.” I won’t give away what that is (you’ll just have to watch the video).

But if you want to learn more about microchips — or the tech behind producing AI software — check out Ian’s free webinar here.

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge