BING-JHEN HONG

The investment thesis

When Warren Buffett first disclosed his Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) position back in Q3 2022, I felt puzzled and wrote an article about it. As seen from the following chart, he added about 60M shares of TSM during Q3 2022. The position was worth about $4.1, and was the 10th largest position in the Berkshire portfolio at that time.

I felt puzzled for several reasons. Obviously, the first one is that Buffett is well known for his allergic reactions to tech businesses. Secondly, I felt the geopolitical risks are a bit high with the ongoing trade tension. And finally, I felt the stock’s total return potential, when adjusted for its profitability and valuation, is not competitive compared to others of his signature picks such as Apple Inc. (AAPL) or Visa Inc. (V).

Source: stockcircle.com

Indeed, shortly afterward, he had exited the TSM position completely as shown in the chart. To wit, he sold 52M shares in Q4 of 2022 (about 86% of his initial stake). And then sold the remainder of the position in Q1 2023.

The goal of this article is to reengineer the thought process behind these transactions. And the thesis is that I am still seeing too many risks associated with TSM. I will analyze a few of the key risks in the remainder of this article, including geopolitics, profitability, and also the limited return potential.

Geopolitical risks

TSM certainly is a scale leader in a sector with a bright growth curve. However, I was concerned by the ongoing trade tension among the major powers (such as China, the U.S., and the EU), especially regarding high-end chips. After the termination of his TSM stake, Buffett indeed commented that geopolitics played a role in this decision.

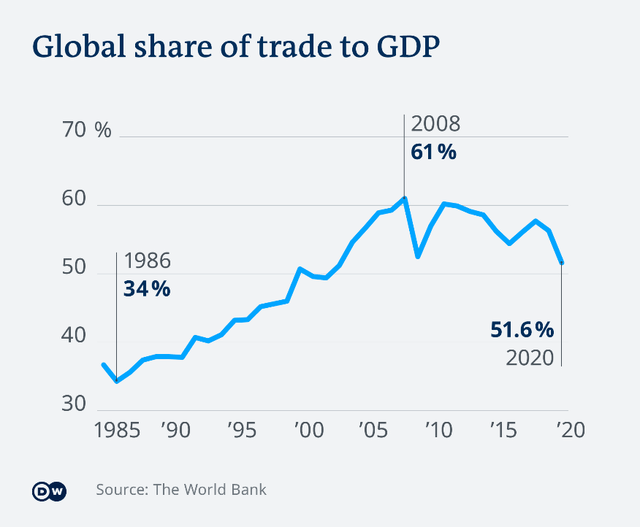

Looking forward, I am still seeing too many uncertainties with TSM’s role in the intricate network of global chip industry. I view many recent events as a signal for accelerated deglobalization. The deglobalization process has been a megatrend that has been developing for over a decade, as seen in the chart below. To wit, globalization, as measured by the percentage of total exports as a share of global GDP, has been declining since its peak in 2008. The percentage has declined from 61% in 2008 to 51.6% in 2020. Recent events, such as Apple’s rejection of TSM’s price increase demand, the passage of the CHIPS Act in the U.S., and the Russian-Ukraine war, are very likely to further accelerate this process in my mind.

Source: The World Bank

TSM’s valuation changes

At the time Buffett bought the TSM stake, there were definitely good considerations, including both attractive valuation and healthy profitability. Here I will detail the valuation to consider first and leave the profitability consideration in the next section. When Buffett built his position in Q3, 2022, the stock price varied in a range of $68.5 to $91.5, with an average closing price of $82.5. Its EPS for 2022 was about $6.6. As a result, the average P/E during that time was about 12.5x only, a quite attractive level.

Then in the next few quarters, its valuation multiples changed quickly and also drastically, both due to price movements and the deterioration of fundamentals. To wit, consensus estimates now expect an EPS of $5.1 for 2023. And at the same time, its prices have rallied to the current level of $98, translating into a P/E ratio of 19.4x, more than 55% more expensive than the time Buffett first established his position.

And next, we will that see such an elevated valuation has compounded the risks and limited the return potential.

Source: stockcircle.com and Author

TSM’s profitability

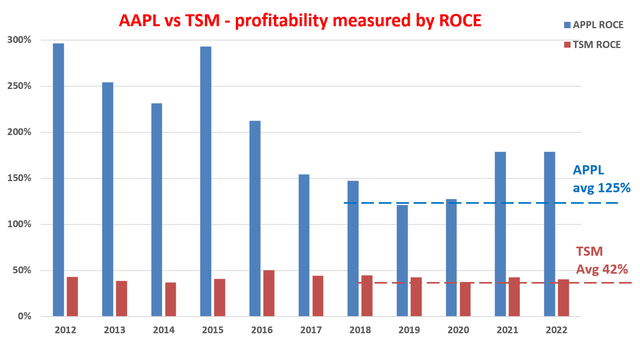

As aforementioned, TSM is undoubtedly a scale leader in an upward sector. And it has enjoyed robust and consistent profitability over the long term, as shown in the chart below. Here I am using the return on capital employed (“ROCE”) as the key profitability metric. To wit, TSM’s average ROCE has been rock solid, around an average of 42% over the past decade. The consistency is simply remarkable.

Source: Author based on Seeking Alpha data

Despite such stable and healthy profitability, I don’t feel the stock to be as competitive as other of Buffett’s signature picks such as AAPL or V. Take both AAPL and V feature ROCE on the level of 100% as seen in the chart below. As detailed in this blog article, this metric is of fundamental importance for two key reasons. Firstly, and obviously, it measures how profitably a company can use its capital to generate earnings. And secondly, it also provides insights into how quickly a company’s revenue and earnings are expected to grow over time, as the long-term growth rate is governed by the product of ROCE and the reinvestment rate (“RR”).

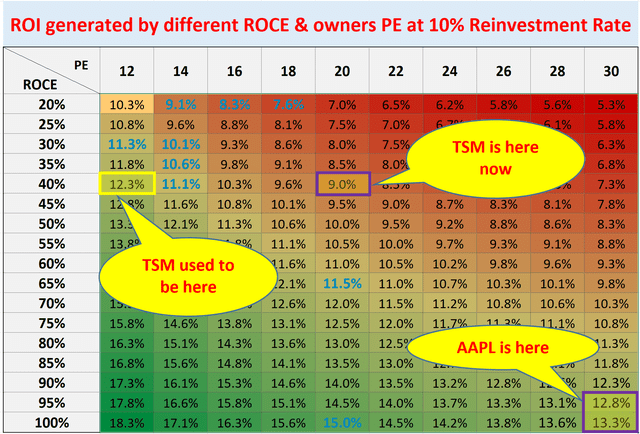

Hence, even when the P/E of AAPL (or Visa) is higher than TSM by a good margin, these companies can grow faster under the same RR and thus provide better total return potential. To be more specific, the chart below shows my projected return potentials for TSM at a P/E of ~12x (when Buffett built his positions) and ~20x (its current P/E).

I project TSM’s long-term growth rate to be about 4% assuming 10% RR (10% RR * 42% ROCE = 4% long-term growth rate). At a P/E of 12x, TSM would provide an earnings yield of about 8%, leading to a total return potential of about 12% per annum. Currently at ~20x P/E, the earnings yield has diminished to about 5% and the total return potential to about 9% in tandem. In contrast, AAPL, despite its higher P/E of around 30x, still provides a much higher long-term return potential thanks to its much higher ROCE.

Source: Author based on Seeking Alpha data

Other risks and final thought

There are certainly some upside risks. Taiwan Semiconductor Manufacturing Company Limited, being located in Taiwan, benefited from favorable foreign-exchange translations recently and such benefits could continue. The company also has a leading position in 5 nanometer (“nm”) technologies. Moreover, it has been aggressively ramping up its 5 nm manufacturing capacity. It reported that 5 nm products accounted for nearly 1/3 of its total sales during the December 2022 quarter already. Advanced technologies (such as the 5 nm products) tend to enjoy higher-than-average margins.

To conclude, I am seeing the downside risks as the dominating forces in the near future. And to recap, these risks for Taiwan Semiconductor Manufacturing Company Limited include geopolitical risks, the deglobalization process, and its current valuation risks. All these factors lead to a limited total return potential in my view, especially when adjusted for risks. As such, it made sense to me that Warren Buffett exited his position shortly after he bought the shares. And my overall rating for Taiwan Semiconductor Manufacturing Company Limited stock is a “hold” based on these considerations.