Published on May 18th, 2023 by Aristofanis Papadatos

Due to the surge of inflation to a 40-year high last year, the Fed has been raising interest rates at an unprecedented pace since early last year to cool the economy. As a result, the economy has slowed down lately and the risk of an upcoming recession has significantly increased. Apartment REITs have proved resilient to recessions thanks to the essential nature of their business. Hence, they are interesting candidates for the portfolios of income-oriented investors in the current investing environment. This article will discuss the prospects of the top 10 apartment REITs.

You can download our full list of REITs, along with important metrics such as dividend yields and market capitalizations, by clicking on the link below:

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Apartment REITs #10: Mid-America Apartment Communities (MAA)

Mid-America Apartment Communities is a REIT that owns, operates and acquires apartment communities in the Southeast, Southwest and mid-Atlantic regions of the U.S. Founded in 1977, it currently has ownership interest in 101,986 apartment units across 16 states and the District of Columbia and has a market capitalization of $18 billion.

MAA is focused on the Sunbelt Region of the U.S., which has exhibited superior population growth and economic growth in the long run. Thanks to this competitive advantage, the REIT has offered exceptional returns to its shareholders.

Source: Investor Presentation

As shown in the above chart, MAA has outperformed its peers by a wide margins in almost any time frame over the last two decades. It has also managed to avoid cutting its dividend over the last 30 years. This is a testament to the resilience of this REIT to recessions.

MAA is currently offering a 3.7% dividend yield, which may seem lackluster to income-oriented investors. However, the stock has a healthy payout ratio of 61% and has grown its dividend by 11% per year on average over the last three years.

Moreover, MAA has grown its funds from operations (FFO) per share at a 7.7% average annual rate over the last decade. Growth stumbled in 2020 due to the pandemic, but the pandemic has subsided and thus the trust has returned to growth mode.

MAA has ample room to expand its asset portfolio while it will also grow its bottom line by enhancing the value to its customers via the rollout of smart home technology in its units. MAA has already installed smart home technology in more than 50,000 units. Overall, the REIT can be reasonably expected to grow its FFO per share and its dividend by at least 5% per year on average over the next five years.

Click here to download our most recent Sure Analysis report on Mid-America Apartment Communities (MAA) (preview of page 1 of 3 shown below):

Apartment REITs #9: Camden Property Trust (CPT)

Founded in 1993 and headquartered in Houston, Texas, Camden Property Trust is one of the largest publicly traded multifamily real estate companies in the U.S. The REIT owns, manages and develops multifamily apartment communities. It currently owns 178 properties that contain 60,652 apartments.

Camden Property Trust has grown its FFO per share by 5.4% per year on average over the last decade. More importantly, it has exhibited a consistent performance record, with minimum volatility, and proved remarkably resilient to the fierce recession caused by the pandemic in 2020. To be sure, the REIT posted just a 3% decrease in its FFO per share in that year and kept raising its dividend. It has raised its dividend for 12 consecutive years and is currently offering a 3.5% dividend yield, with a solid payout ratio of 58%.

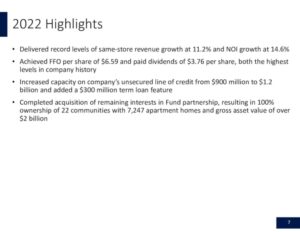

Moreover, Camden Property Trust enjoys strong business momentum. In 2022, the REIT posted record same-store revenue growth of 11.2% and growth of net operating income of 14.6%.

Source: Investor Presentation

It also grew its FFO per share by 22%, from $5.39 in 2021 to a new all-time high of $6.59, and invested heavily in the acquisition of new properties. Overall, Camden Property Trust enjoys positive business momentum and has ample room for future growth in the long run.

Click here to download our most recent Sure Analysis report on Camden Property Trust (CPT) (preview of page 1 of 3 shown below):

Apartment REITs #8: American Homes 4 Rent (AMH)

Based in Maryland, American Homes 4 Rent is an internally managed REIT that focuses on acquiring, developing, renovating, operating and leasing single-family homes as rental properties. AMH was formed in 2013 and has a market capitalization of $14 billion.

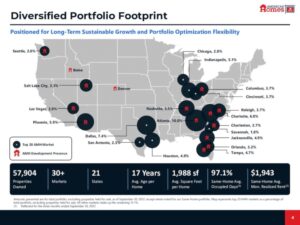

The REIT holds nearly 58,000 single-family properties in more than 30 sub-markets of metropolitan statistical areas in 21 states.

Source: Investor Presentation

Its properties have an average age of 17 years and a strong occupancy rate of 97.1%. As shown in the above chart, AMH has broad geographic diversification and is focused primarily on areas with high economic growth.

Thanks to the superior growth of its markets, AMH has exhibited an exceptional performance record. It has grown its FFO per share every single year since its formation, at a 13.2% average annual rate. Growth has somewhat decelerated in recent years but the 5-year growth rate is still a solid 7.8%.

AMH is offering a 2.5% dividend yield, which is lackluster for a REIT. However, it is important to note that the REIT has more than doubled its dividend in the last two years. Thanks to its healthy payout ratio of 55% and its promising growth prospects, AMH is likely to grow its dividend at a fast pace in the upcoming years.

Click here to download our most recent Sure Analysis report on American Homes 4 Rent (AMH) (preview of page 1 of 3 shown below):

Apartment REITs #7: UMH Properties (UMH)

UMH Properties is a REIT that is one of the largest manufactured housing landlords in the U.S. It was founded in 1968 and currently owns tens of thousands of developed sites and 135 communities located across the midwestern and northeastern U.S.

As manufactured homes are cheaper than conventional homes, UMH Properties has proved resilient to recessions. This was evident in the severe recession caused by the coronavirus crisis in 2020, as the REIT grew its FFO per share by 11% in that year. UMH Properties has grown its FFO per share by 3.8% per year on average over the last decade.

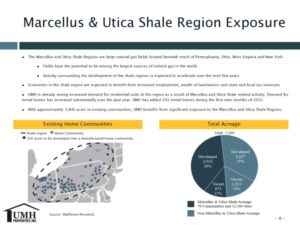

Moreover, UMH Properties has promising growth prospects ahead. The REIT has great exposure to the Marcellus & Utica Shale regions, which have the potential to be among the largest sources of natural gas in the world.

Source: Investor Presentation

The development activity in these promising areas is likely to accelerate in the upcoming years. As a result, UMH Properties is likely to enjoy a strong tailwind in its business.

UMH Properties is currently offering a 5.2% dividend yield. This yield is much higher than the yields of the aforementioned REITs but UMH Properties has an elevated payout ratio of 90%. It is also important to note that the REIT has a material debt load, with interest expense consuming 70% of operating income and net debt of $743 million, which is equal to 79% of the market cap of the stock. Overall, it is prudent to expect modest dividend growth going forward.

Click here to download our most recent Sure Analysis report on UMH Properties (UMH) (preview of page 1 of 3 shown below):

Apartment REITs #6: Equity Residential (EQR)

Equity Residential is one of the largest U.S. publicly-traded owners and operators of high-quality rental apartment properties with a portfolio primarily located in urban and dense suburban communities. The properties of the trust are located in affluent areas around Boston, New York, Washington, D.C., Southern California, San Francisco, Seattle, and Denver.

Equity Residential greatly benefits from the favorable characteristics of its target group. Affluent renters are highly educated, well employed and earn high incomes. As a result, they pay approximately 20% of their incomes on rent and hence they are not burdened by their rent. Thanks to their strong earnings potential, the REIT can easily grow its rent rates year after year.

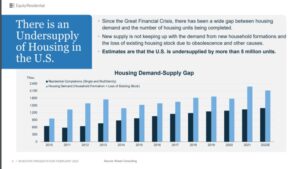

Moreover, Equity Residential greatly benefits from a wide deficit between the supply and demand for housing in the U.S.

Source: Investor Presentation

Since the Great Recession, there has been a wide gap between housing demand and supply. The gap has been estimated to be more than 5 million apartment units. This gap provides strong pricing power to Equity Residential.

Click here to download our most recent Sure Analysis report on Equity Residential (EQR) (preview of page 1 of 3 shown below):

Apartment REITs #5: American Assets Trust (AAT)

American Assets Trust is a REIT that was formed in 2011 as a successor of American Assets, a privately held company founded in 1967. AAT is headquartered in San Diego, California, and has great experience in acquiring, improving and developing office, retail and residential properties throughout the U.S., primarily in Southern California, Northern California, Oregon, Washington and Hawaii. Its office portfolio and its retail portfolio comprise of approximately 4.0 million and 3.1 million square feet, respectively. AAT also owns more than 2,000 multifamily units.

AAT pursues growth by acquiring properties in submarkets with favorable supply and demand characteristics, including high barriers to entry. It also redevelops several of its newly-acquired properties in order to enhance their value. In addition, it has a capital recycling strategy, which involves selling properties whose returns seem to have been maximized and buying high-return properties.

Thanks to all these growth drivers, AAT has grown its FFO per share at a 7.0% average annual rate over the last eleven years.

Source: Investor Presentation

Its FFO per share decreased for the first time in a decade in 2020 due to the pandemic but AAT has recovered from this crisis.

Moreover, AAT is currently offering a nearly 10-year high dividend yield of 7.0%. The abnormally high yield has resulted primarily from the impact of high interest rates on the interest expense of the REIT as well as fears that the work-from-home trend may continue hurting the office properties of the REIT. We view these headwinds as temporary and expect AAT to endure the ongoing downturn. Thanks to its healthy payout ratio of 59% and its decent growth prospects, AAT is likely to defend its generous dividend for the foreseeable future.

Click here to download our most recent Sure Analysis report on American Assets Trust (AAT) (preview of page 1 of 3 shown below):

Apartment REITs #4: Essex Property Trust (ESS)

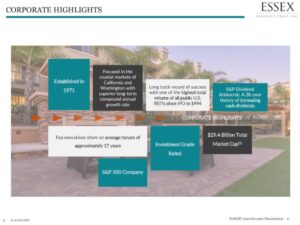

Essex Property Trust was founded in 1971 and became a publicly traded REIT in 1994. The trust invests in west coast multifamily residential proprieties, where it engages in development, redevelopment, management and acquisition of apartment communities and a few other select properties. Essex Property Trust has ownership interests in several hundred apartment communities, which consist of over 60,000 apartment homes.

Essex Property Trust has many attractive characteristics. First of all, it has a long track record of success, with one of the highest total returns in the REIT sector since its IPO in 1994. The REIT has offered outsized returns thanks to the superior economic growth of the coastal markets of California and Washington.

Source: Investor Presentation

In addition, Essex Property Trust is a Dividend Aristocrat, with 28 consecutive years of dividend growth. As this period includes the Great Recession and the pandemic, the dividend growth streak of the REIT is a testament to the resilience of the trust even under the most adverse economic conditions. It is also worth noting that Essex Property Trust has earned investment credit ratings and hence it has a lower risk level than many other REITs, which operate with a highly leveraged balance sheet.

Essex Property Trust is currently offering a nearly 10-year high dividend yield of 4.3%. Thanks to its solid payout ratio of 58%, its healthy balance sheet and its resilient business model, the REIT is likely to continue raising its dividend for many more years. The trust has grown its dividend by 4.6% per year on average over the last five years. As this growth rate is nearly equal to the growth rate of FFO per share, investors should expect a similar dividend growth rate in the upcoming years.

Click here to download our most recent Sure Analysis report on Essex Property Trust (ESS) (preview of page 1 of 3 shown below):

Apartment REITs #3: Equity LifeStyle Properties (ELS)

Equity LifeStyle Properties is a REIT that engages in the ownership and operation of lifestyle-oriented properties, which consist primarily of manufactured home and recreational vehicle communities. The Trust was founded by James M. Hankins in 1992 and is headquartered in Chicago, IL.

Equity LifeStyle Properties has 450 properties in 35 states and one Canadian province and has outperformed the S&P 500 and the REIT sector by a wide margin over the last decade. During this period, the REIT has offered a total return of 344%, whereas the index and the REIT sector have offered a total return of 217% and 88%, respectively.

Moreover, Equity Lifestyle Properties has many attractive characteristics. First of all, it has grown its FFO per share and its dividend by 9.0% and 21% per year on average, over the last 16 years.

Source: Investor Presentation

Furthermore, the REIT is somewhat protected from the impact of high interest rates on interest expense, as only 7.5% of its debt is floating rate debt. This is an important feature, as most REITs are suffering from a steep increase in their interest expense due to multi-year high interest rates. It is also worth noting that Equity Lifestyle Properties has a strong interest coverage ratio of 5.5 and hence it can endure the ongoing economic slowdown without any problem.

Equity Lifestyle Properties is offering an uninspiring dividend yield of only 2.6% but investors should not dismiss the stock for its modest yield. The REIT has grown its dividend by 14% per year on average over the last decade. As it has ample room to grow its FFO per share and has a solid payout ratio of 63%, it can keep raising its dividend at a fast clip for years.

Click here to download our most recent Sure Analysis report on Equity LifeStyle Properties (ELS) (preview of page 1 of 3 shown below):

Apartment REITs #2: UDR (UDR)

UDR, also known as United Dominion Realty Trust, is a luxury apartment REIT. The trust owns, operates, acquires, renovates, and develops multifamily apartment communities in high barrier-to-entry markets in the U.S.

A high barrier-to-entry market consists of limited land for new construction, complicated entitlement processes, low single-family home affordability and strong employment growth potential. The majority of UDR’s real estate property value is established in Washington D.C., New York City, Orange County, California, and San Francisco. UDR owns or has an ownership interest in 58,411 apartment homes, 415 of which are homes under development.

UDR has exhibited a consistent performance record. During the last decade, the REIT has grown its FFO per share almost every year, at a 6.2% average annual rate. Thanks to its reliable growth trajectory, the REIT has paid a dividend for 201 consecutive quarters and has grown its dividend for 13 consecutive years, at a 6.7% average annual rate.

Source: Investor Presentation

UDR is now offering a nearly decade-high dividend yield of 4.1%. Thanks to its reasonable payout ratio of 74% and its rock-solid business model, the stock is likely to continue raising its dividend for many more years.

Click here to download our most recent Sure Analysis report on UDR (UDR) (preview of page 1 of 3 shown below):

Apartment REITs #1: AvalonBay Communities (AVB)

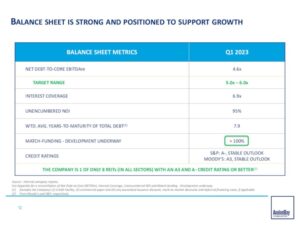

AvalonBay Communities is a $25 billion multifamily REIT that owns a portfolio of several hundred apartment communities and is also an active developer of apartment communities. The strategy of the REIT involves owning top-tier properties in the major metropolitan areas of New England, New York/New Jersey, Washington D.C., California, and the Pacific Northwest.

AvalonBay Communities has exhibited a consistent performance record. During the last decade, the REIT has grown its FFO per share almost every year, at a 5.1% average annual rate. The REIT also proved resilient to the pandemic, as it posted just a 7% decrease in its bottom line in 2020 and has fully recovered from that downturn, with record FFO per share in 2022. Even better, the REIT is on track to grow its FFO per share by another 7% this year, to a new all-time high.

Moreover, AvalonBay Communities is offering a nearly 10-year high dividend yield of 3.7%. The REIT has a decent balance sheet, with a reasonable leverage ratio (Net Debt to EBITDA) of 4.6 and a strong interest coverage ratio of 6.9.

Source: Investor Presentation

Given also the healthy payout ratio of 63% of the REIT, the dividend is likely to remain safe for the foreseeable future.

Click here to download our most recent Sure Analysis report on AvalonBay Communities (AVB) (preview of page 1 of 3 shown below):

Final Thoughts

Most apartment REITs pass under the radar of the majority of investors due to their mundane business model. However, some of these REITs have offered exceptionally high returns to their shareholders. In addition, apartment REITs have proved resilient to recessions, as the demand for housing remains strong even during rough economic periods. Given the underperformance of REITs over the last 12 months and their defensive business model, the above stocks are interesting candidates for the portfolios of income-oriented investors, especially given the increasing risk of an upcoming recession.

If you are interested in finding high-quality dividend growth stocks and/or other high-yield securities and income securities, the following Sure Dividend resources will be useful:

High-Yield Individual Security Research

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].