Felipe Gustavo S Borges/iStock Editorial via Getty Images

The Industrial Select Sector (XLI) fell for the third week in a row, ending -1.04%, while the SPDR S&P 500 Trust ETF (SPY) sunk (-0.25%) for the second week straight. XLI was among the nine, out of the 11 S&P 500 sectors, which closed the week in red. On Thursday, the Producer Price Index came in cooler than expected in April on a Y/Y and M/M basis.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +6% each this week. YTD, 4 out of these 5 stocks are in the green.

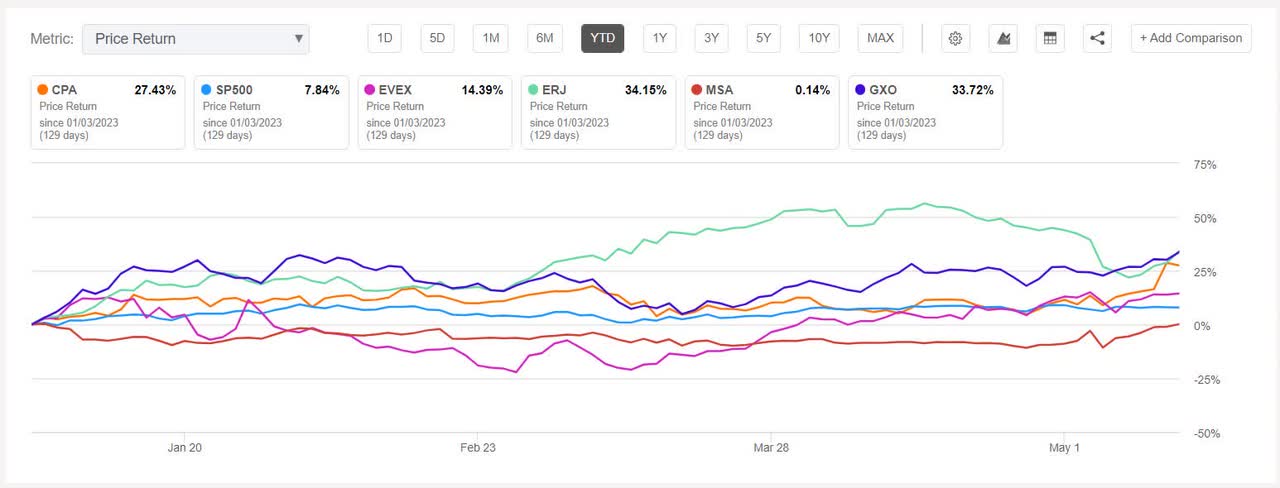

Copa Holdings (NYSE:CPA) +13.10%. The Panama-based airline saw its stock soar on Thursday (+10.56%) after Q1 results beat estimates.

CPA has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Strong Buy. The stock has a factor grade of A+ for Growth and B for Profitability. The average Wall Street Analysts’ Rating is Buy, wherein 9 out of 15 analysts see the stock as Strong Buy. YTD, +25.90%.

Eve Holding (EVEX) +8.37%. The shares shot up the most this week on Monday (+4.99%). The electric air taxi developer also reported its quarterly result on Tuesday but the stock closed only +0.77% higher that day.

The SA Quant Rating on EVEX is Hold with score of B for Momentum and D for Valuation. The average Wall Street Analysts’ Rating differs with a Buy rating, wherein 2 out of 7 analysts tag the stock as Strong Buy, 1 as Buy and 4 as Hold. YTD, +11.53%.

The chart below shows YTD price-return performance of the top five gainers and SP500:

Embraer (ERJ) +7.68%. The Brazilian aircraft maker’s shares rose +4.23% on Friday after NetJets said in a post-market release on Thursday that it signed a deal worth over $5B for up to 250 Praetor 500 jets with Embraer.

ERJ has a SA Quant Rating of Hold with factor grade of A for Momentum and D+ for Growth. Meanwhile, the average Wall Street Analysts’ Rating is Buy, wherein 7 out of 14 analysts view the stock as Strong Buy. YTD, +30.83%.

MSA Safety (MSA) +6.92%. The safety equipment maker’s stock rose throughout the week. The SA Quant Rating on MSA is Hold, which is in contrast to the average Wall Street Analysts’ Rating of Buy. YTD, -0.50%.

GXO Logistics (GXO) +6.88%. Q1 earnings and revenue exceeding expectations helped boost the stock on Wednesday (+2.90%). YTD, the shares have risen +31.44%, the most among this week’s top five gainers. The SA Quant Rating on GXO is Hold, which differs with the average Wall Street Analysts’ Rating of Buy.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -8% each. YTD, 3 out of these 5 stocks are in the red.

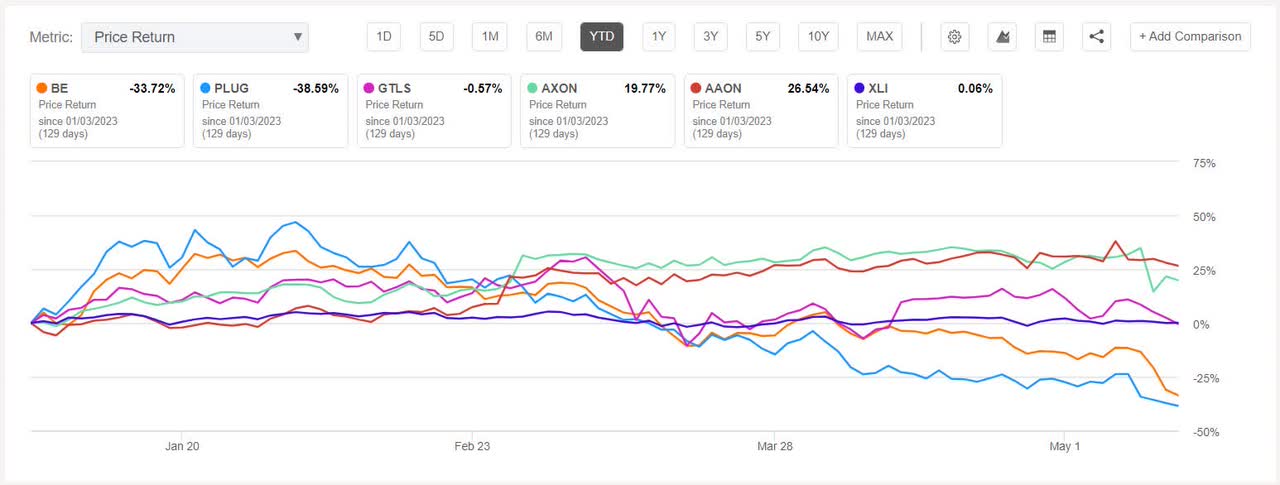

Bloom Energy (NYSE:BE) -25.18%. The company’s stock fell throughout the week, the most on Wednesday (-8.49%) following mixed Q1 results post-market Tuesday, and on Thursday (-12.96%) after unveiling plans to offer $500M in senior notes convertible to cash and common stock. YTD, -33.47%.

The SA Quant Rating on BE is Hold with a factor grade of A+ for Growth and D- for Profitability. The average Wall Street Analysts’ Rating differs with a Buy, wherein 7 out of 21 analysts see the stock as Strong Buy.

Plug Power (PLUG) -19.48%. Shares of the Latham, N.Y.-based company declined -13.83% on Tuesday after posting a larger than expected Q1 loss and issuing a FY23 revenue forecast that lagged analyst expectations. YTD, -39.53%, the most among this week’s worst five performers.

The SA Quant Rating on PLUG is Sell with a factor grade of F for both Profitability and Momentum. The rating is in stark contrast to the average Wall Street Analysts’ Rating of Buy, wherein 14 out of 29 analysts tag the stock as Strong Buy.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Chart Industries (GTLS) -9.68%. The Ball Ground, Ga.-based cryogenic solutions provider’s stock declined throughout the week, barring Monday. YTD, -0.82%. GTLS has a SA Quant Rating of Hold, with a score of A+ for Growth but C for Profitability. The average Wall Street Analysts’ differs with a Strong Buy rating, wherein 12 out of 17 analysts view the stock as Strong Buy.

Axon Enterprise (AXON) -8.37%. The maker of Tasers saw its stock plunge on Wednesday (-15.05%) despite Q1 results beating estimates. The SA Quant Rating on AXON is Hold, but the average Wall Street Analysts’ differs with a Buy rating. YTD, +21.44%.

AAON (AAON) -8.30%. The cooling and heating equipment manufacturer’s stock fell the most on Monday (-6.11%). The SA Quant Rating on AAON is Hold, which is in contrast to the average Wall Street Analysts’ rating of Buy. YTD, +25.72%, gaining the most among this week’s worst decliners.