halbergman

HCTPF logo (Hutchison Port Holdings Trust Ltd)

Investment thesis

From time to time, some of our followers comment on losses in value they have in some of their positions. People dislike losses, even if it is just a paper loss, twice as much as the exact same amount would be a profit.

That was the conclusion Kahneman & Tversky came to, which they called the Prospect theory.

In January of each year, we share our portfolio performance with our readers. The assessment for the performance in 2019 dealt with our two counters which had the largest book loss.

We called those companies our two “ugly ducklings”.

Hutchison Port Holdings Trust (OTCPK:HCTPF) (OTCPK:HUPHY) was one of them. We still own these shares through the main listing in Singapore.

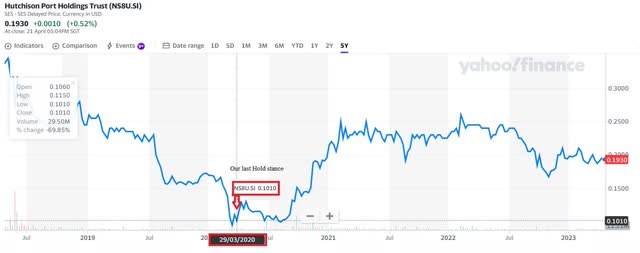

The last time we covered HCTPF was in March 2020 when we had a Hold stance. That was pretty much the bottom of the market. Not just for this company, but for many others as well.

HCTPF’s share price has doubled (Yahoo Finance)

In our defense, we need to clarify something. We meant that the reason for it being an ugly duckling was purely on the basis of the book’s loss, and not on its future prospects.

It has doubled since then. More importantly, is it time to revise our stance now?

Introduction

HCTPF and HUPHY are trading over the counter in the U.S. but they have too low trading volumes.

The company’s main listing is on the Singapore Stock Exchange with two different counters. One is denominated in USD and has a ticker code of NS8U.SI with an average daily trading volume of 6.2 million shares per day. The market capitalization is USD 1.67 billion. The other counter is denominated in SGD with a ticker code of P7VU.SI which has a lower average trading volume of 559,000 shares per day.

It is useful to read the fund manager Third Avenue Value Find shareholders letter from 2018, as it gives some color as to what the company do and how they saw their value proposition then.

When Hutchison Holdings (OTCPK:CKHUY), which is listed in Hong Kong and is its main shareholder and sponsor, decided to list this business trust why did they choose Singapore and not Hong Kong and why did they decide on an IPO price per share of just below 1 USD?

We do not know for sure why they chose Singapore, as opposed to Hong Kong, but we believe it was partly because Singapore’s SWF Temasek, through its wholly owned subsidiary PSA, is the second largest shareholder with 15% of the company. Lately, there has been talk of Temasek wanting to sell this stake.

The reason they chose to price the shares as “penny shares” is simply because that is very common in Singapore. Some information on penny shares in Singapore can be found in one of our earlier articles here.

2022 FY financial results

Net profit attributable to shareholders in 2022 was HKD 1,099 million, which equates to USD 140 million (exchange rate: 1 HKD = 0.1274 USD).

The EPS was HK cents 12.62. That was 37% lower than in 2021.

To stay competitive, HCTPF is investing and implementing several technological solutions, such as remotely operated cranes, video analytics, and gate processing of trucks to be fully paperless.

In order to weather the increased interest rates, we are pleased that HCTPF embarked on a debt repayment program in 2017 where they would repay a minimum of HK$1 billion annually.

This has resulted in the company lowering its total borrowings from HK$33.6 billion by the end of 2016 to HK$27.1 billion as of 31st December 2022.

Yearly finance cost has come down from HK$701.2 million to HK$673.3 million in that period and their portion of fixed rate borrowings is over 70%.

In terms of valuation, we are interested in the NAV per unit in USD since our shares are denominated in USD. As of the end of December 2022, it was USD 0.31 which gives us a P/NAV of just 0.62

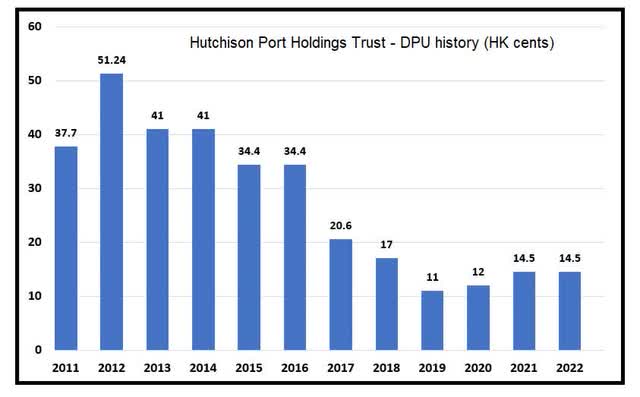

Despite the much lower earnings in 2022 YoY, they maintained their DPU at HK cents 14.5 which was paid out the year before.

As one should expect, the DPU has been lower over the last three years, but the slide in distribution started way earlier than the pandemic started in 2019.

Hutchison Port Holdings Trust – dividend history (Data from HCTPF. Graph by TIH)

Based on the present share price of USD 0.193 and their TTM dividend, we get an attractive yield of 9.4%.

How sustainable is the dividend? HCTPF is a business trust, much like a REIT. Its policy is to distribute 100% of its distributable income. See here on page 87 of the IPO prospectus

It is not too far-fetched to imagine that the distributable income will increase with China opening up after the pandemic. Therefore, we could see increased DPU to the same level as what it was in 2017. That would give investors a yield of 13.7%

Business prospects

Their business should grow, as HCTPF formed a J/V with Shenzhen Port Group in 2021 to construct, develop and operate a new container terminal in Yantian, Shenzhen where they already have a large presence. It covers 120 hectares of land. HCTPF holds 79.45% of the J/V.

Yantian Terminal in Shenzhen, China (Hutchison Port Holdings Trust 2022 Annual Report)

The estimated cost of the development is approximately RMB 10.9 billion with about RMB 2.7 billion injected as a capital contribution. HCTPF’s share is RMB 1.1 billion which has already been paid into the J/V in October last year, financed through their internal cash.

The first berth is expected to operate in 2025 and should certainly contribute to a higher net income.

It is hard to predict what the volumes will be going forward, and what kind of profit margins they can achieve.

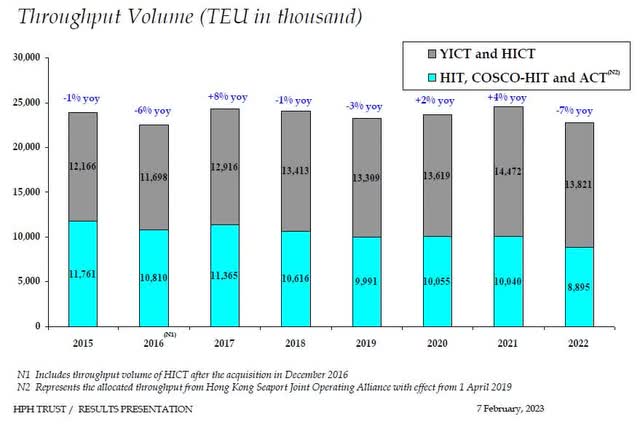

Volumes over the last eight years have been quite stable, despite the challenging times.

Throughput volumes (Hutchison Holdings Port Trust 2022 Financial Results presentation)

Risks to thesis and conclusion

When we invest, there are good reasons why we ensure that we have a diversified portfolio.

If some of our positions incur heavy losses, others make sure we survive to go on and hopefully learn from our mistakes or misfortune.

All of HCTPF,’s business is located in the Greater Bay Area of Hong Kong and Shenzhen. If some negative event takes place in China that curtails trade, their business could be severely impacted.

We would be more comfortable if they had terminals in ports spread across the globe, something which could easily be done since Hutchison Holdings has interests in 51 ports comprising 295 operational berths in 25 countries as of the end of 2022.

Geopolitical risks may lead to lower export from China.

Nevertheless, analysts at Singapore’s largest bank DBS Group (OTCPK:DBSDY) are optimistic about better days ahead for HCTPF. Their thesis is based on the reopening and recovery in China.

We have also observed China’s strong PMI recovery, and do share the analyst’s view that it is quite plausible that HCTPF can deliver steady earnings growth and a higher dividend yield from FY2023 onwards.

If the DPU can get back to the HK cents 40 to 50, which we saw roughly 10 years ago, remains to be seen.

All in all, we like the efforts HCTPF made in reducing debt and growing its business, especially in view of it being a business trust that basically distributes close to 90% of its earnings.

We do not see the share price doubling again in a shorter period of time, but a gradual improvement should take place on higher distribution if it does materialize.

As such, our stance is now upgraded to a Buy.

If you look at a list of the 12 largest port operators in the world, Asian companies including Hutchison Holdings which is the second largest, dominate that list. If you are reluctant to invest in Hong Kong companies, you can look at A.P. Møller Maersk (OTCPK:AMKBY), (OTCPK:AMKBF), which has a secondary listing in the U.S. We recently covered that company here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

![Biden, Xi seek to ‘manage our differences’ in meeting [Video] Biden, Xi seek to ‘manage our differences’ in meeting [Video]](https://s.yimg.com/ny/api/res/1.2/HywoN9LPP8QmREVic1WKBw--/YXBwaWQ9aGlnaGxhbmRlcjt3PTEyMDA7aD04MDA-/https://media.zenfs.com/en/ap.org/f182014a18f3a7af090f2d19605818ec)