Chip Somodevilla

TJX Companies (NYSE:TJX) ticks all the boxes for me when looking at long-term compounders set to increase shareholder value over time. The company has a working business model insulated from disruption, its brand is evergreen as clothing brands will always be looking to offload inventory, and management has maintained a strong capital position over time. I think prudent investors should wait for an inevitable downswing to buy the shares, but TJX deserves a spot in long-term portfolios.

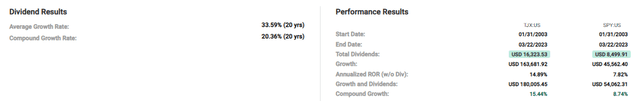

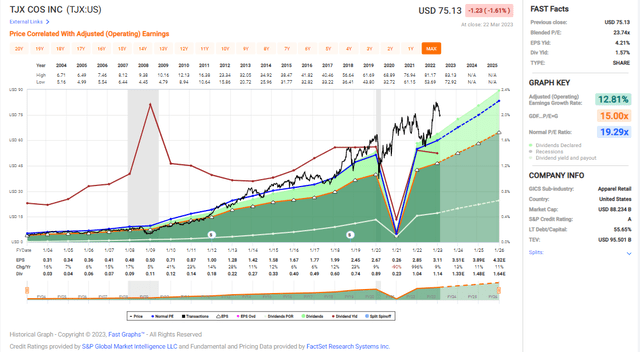

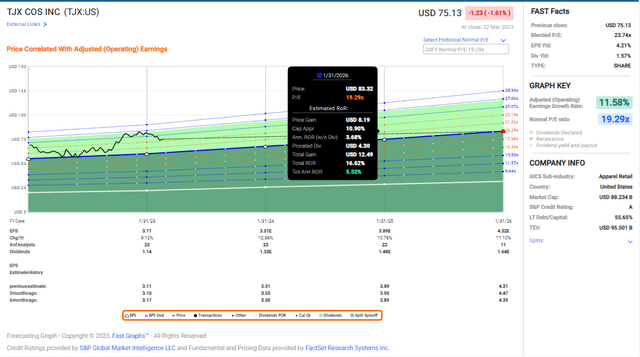

FAST Graphs

Retailers are notoriously fickle, but I’ve written about several on Seeking Alpha that have beaten the market over time. TJX would have turned a $10,000 investment in 2003 into $180,000 today versus $54,000 invested in SPY. With that, you’re looking at a company with relatively little drama. They remind me of companies like Dollar General (DG), where the company has a long-term growth strategy and they successfully execute year after year. Up until the pandemic, there was only one year TJX had failed to drive positive comparable store sales growth in its 40-year history.

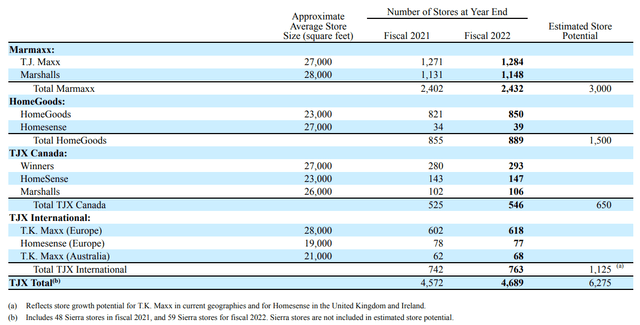

Company filing

Adding to that, TJX is among the very few retailers successful in international expansion. Margins in Canada are actually better than their American operations, while International (Europe and Australia) margins lag. However, all segments are growing strongly, profitably, and have become entrenched in their geographies. Several years ago, TJX had even purchased part of a company in Russia to attempt further expansion, which was sold off due to the Ukraine war.

The off-price model is evergreen and has translated well globally. Although I highly doubt TJX will ever drive any meaningful success in its e-commerce operations (and they don’t seem to put that much effort behind it), I don’t think they need to. The treasure-hunt experience I’ve described in past articles is real, and the rapid inventory turnover drives repeat customer visits as well as the company’s rewards program.

Given the inventory challenges from the pandemic, part of which I outlined in my recent article on embattled V.F. Corporation (VFC), I anticipate TJX won’t have to put even the normal amount of effort in to source product. In general, the company utilizes its 1,200 buying associates to source from 21,000 vendors in 100 countries, and then flexes its 53 distribution centers to get products to its ~4,700 stores. There were some fears in the past of the company’s ability to source, but if those were to crop up it likely would have occurred by now. Without its own product lines, the company faces little risk in customer taste changes, as inventories turn over frequently and will always carry recent products.

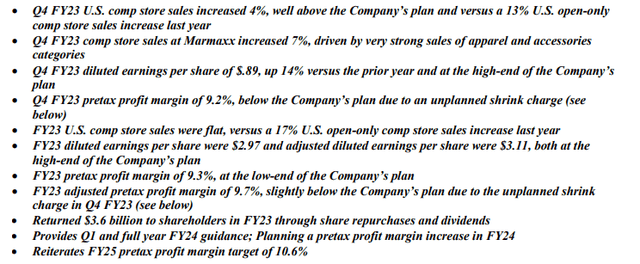

Company press release

The pandemic was rough for TJX, however. The company has a minimal e-commerce footprint (although they do maintain websites across all of their brands) to fall back on and store closures and lockdowns crushed sales. Earnings dipped significantly for the first time in the past two decades. However, the company has bounced back meaningfully. In the most recent quarter, comp sales grew 4% in the US on strength at MarMaxx (Marshall’s and TJ Maxx), while HomeGoods declined 7% coming off 22% comp’s last year. HomeGoods operates at lower margins than MarMaxx (7.3% versus 11.6% in the most recent quarter) but represents a meaningful growth vector for the company and reduces the concerns of market saturation. Margins remained crimped on outsized shrink with an effect of 60 bps and continued higher freight costs, coming in at 9.2% for a rise of 20 bps yoy.

In other business segments, Canada grew 10% on a 12.5% margin and International grew 11% on a 7.2% margin, both FX neutral. The company now operates 550 stores in Canada and future store growth will likely be outsized in the International segment, which accounts for around 10% of sales today. I’d like to see margin expansion in the company’s international segment.

HomeGoods will be an area for improvement from here. The full year saw 11% comp sales decline on the back of a 32% comp increase in 2022. However, margins remained low at 6.3% for the full year, but did show improvement into the fourth quarter. The company opened 50 new stores, and plans for around 500 new stores over the long-term.

Despite the scale of TJX, management projects an opportunity for 1,400 additional stores in operating geographies adding to an existing store count of 4,700. With the proven ability of operating internationally, I’d imagine we see more markets open to prevent overall saturation even over the long-term. My only concern at that point would be margin dilution.

2024 projections are for 2-3% comparable store sales growth, 5-7% sales growth, and 6-10% earnings growth with a continuously improving margin profile to 10-10.2% in 2024 and 10.6% in 2025 on the back of improving freight costs. This growth won’t blow the doors off, but I see it as somewhat conservative and factoring in some unknowns regarding shrink and customer traffic, specifically in the HomeGoods segment.

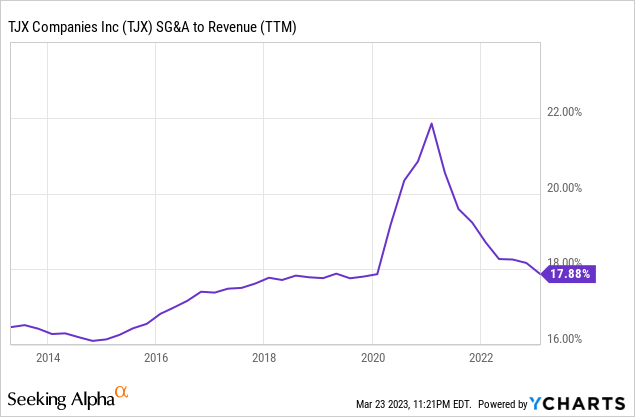

SG&A to revenue has long been a strong point for TJX, and has returned to pre-pandemic levels. This is a key metric to monitor for retailers to ensure expenses don’t rise significantly in new markets diluting profitability on a rise in revenues.

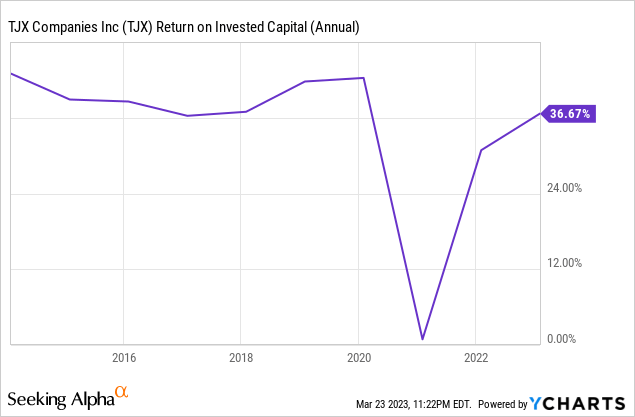

Another area the retailer shines in is returns on invested capital. All the retailers I cover that continuously increase store count profitably share similarly stellar returns on invested capital. As a shareholder, this should give confidence management is shrewdly investing shareholder capital to drive value creation.

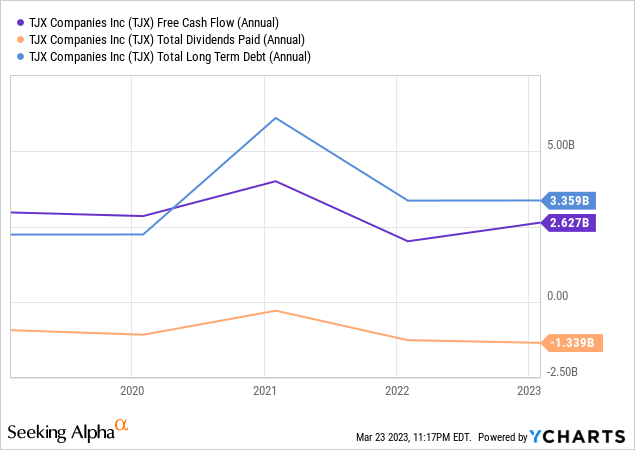

As far as the capital position, I have no concerns. The dividend is well covered, and was recently hiked 13%. TJX is carrying $5.5B in cash on the balance sheet, or a cushion greater than the overall debt load, and returned $3.3B to shareholders in the past fiscal year. Buybacks have averaged below the current share price, which I assess to be slightly overvalued. However, the dilution isn’t significant, and TJX is maintaining a strong trajectory such that buybacks will tend to be worthwhile.

Management projects an additional $2-2.5B in buybacks into this year, and capex of $1.7-1.9B. The company expects to open 150 new stores, remodel 400, and move 55. TJX maintains an open store format that allows for shifts in size and layout based on inventory. Remodels help keep the existing store count fresh, something I think Ross (ROST) could improve on based on my personal experience.

In all, the balance sheet is in a good spot, and I’d anticipate TJX continues to hike the dividend well into the future.

FAST Graphs

The pandemic is easy to spot here, but besides that the company has an incredible compounder earnings trajectory, averaging a 12.8% growth rate over the long-term. Looking at the blue average multiple line, the company is a little richly valued today. It’s not infrequent to get the opportunity to buy when it touches fair value, and I’d wait for the next time it breaks under 20X earnings per share, or the mid-$60’s range.

FAST Graphs

Based on the current price and a return to the average long-term multiple, an investor today would get around 5.5% annualized total returns based on low double-digit earnings growth to 2026. It pays to wait.

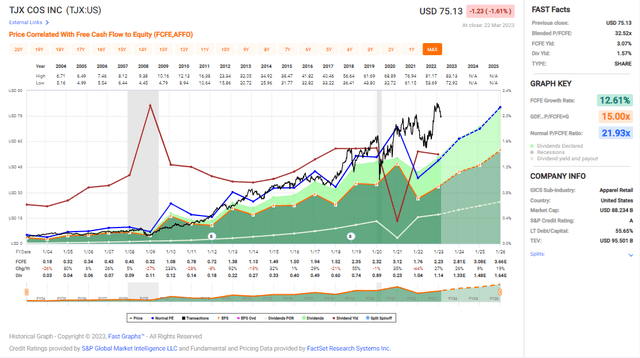

FAST Graphs

Free cash flow is a little choppier, but the trajectory is in the right direction and the growth rate is in-line with earnings. Again, the company is trading above its long-term P/FCF multiple.

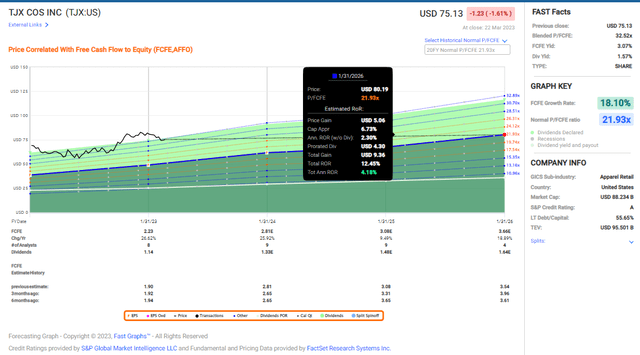

FAST Graphs

Based on FCF growth estimates and a multiple around 22X FCF, an investment today would yield only around 4% annualized.

In all, TJX remains one of the best long-term retail performers in the market. I have very few concerns about the business model or the growth prospects over the long-term. I’m rating it as a hold, with a buy target of $65 or so to give some margin of safety.