It was like a scene right out of the movie It’s a Wonderful Life…

In the movie, George Bailey took over the family business of the Bailey Bros. Building & Loan. The Building & Loan took in deposits and lent out the money in the form of mortgages.

The difference between the interest they pay to depositors, and the interest they receive from mortgages, is the Building & Loans gross profit.

At one point in the movie, there is a run on the bank…

(Click here to watch the clip.)

Panicked depositors want their money — all at the same time. George tells them that he doesn’t physically have their money … it’s in mortgages.

And those mortgages helped their neighbors buy homes in the community.

After calming the mob, George persuades them to withdraw just the money they immediately need, which fortunately he has on hand.

The townsfolk take George’s advice and a run on the bank is averted.

Well, on March 8, Silicon Valley Bank (SVB) wasn’t so lucky. It witnessed a 21st-century bank run.

With a few taps on their bank app, depositors transferred $42 billion out of SVB in one day.

Signature Bank was right behind it. Customers were spooked by the collapse of SVB and withdrew more than $10 billion in deposits.

Now there’s panic in the market.

When Mr. Market freaked out about SVB closing, bank stocks sold off sharply. Several regional banks were down as much as 60% the Monday following the failure!

And last week, Moody’s placed six regional banks under review for potential credit rating downgrades.

First Republic Bank was one of the banks on the list and is down close to 80% since the beginning of March.

We’ve never owned any banks in our portfolio and have avoided the carnage that bank stocks are going through.

But Mr. Market’s panic spread through to the whole market — not just bank stocks. So if you see red in your portfolio and other investors panic selling their stocks, I want you to keep one thing in mind…

The path to higher gains will always test investors — to see how much conviction you have in your position in the face of downturns.

So when that happens, simply ask yourself two questions on the companies in your portfolio…

Don’t Forget

Mr. Market measures a company’s performance in quarters, but we measure it in years.

To determine if we want to continue owning the stocks, we ask ourselves…

No. 1: Did anything fundamentally change about the business?

Show me the money!

I would read the latest earnings report and quarterly transcript.

Is the company still growing for the long term? Is it booking real-world revenues? Does it still have a rock-star CEO focused on driving shareholder value?

If yes, why would you sell? Nothing has changed. And eventually, the stock price will follow the business, not the other way around.

No. 2: At the current share price, is the business priced at a bargain?

When investors panic, stock prices drop. That’s the nature of the beast when it comes to investing.

And if you don’t have the right temperament, it will keep you awake at night.

But if you’ve checked question No. 1, low stock prices can be like manna from heaven!

Because quality businesses that we want to own for five years or more are trading at an even better bargain than when we recommended it.

I recommend using these periods to BUY.

⬆️ 140%+ in ONE Year

Over time, stock prices will eventually follow the business’s success.

Or … its failure.

I’ve shared with you all year that we’re in a whole new era for the stock market — one where investing success is all about picking the right business.

This is especially true when it comes to microcaps.

They provide some of the best opportunities in today’s market — but you have to know where to look! (Don’t worry, that’s what you’ve got me for.)

In the words of legendary investor Peter Lynch: “The very best way to make money is in a small growth company that has been profitable for a couple of years and simply goes on growing.”

Which is exactly what we’ve been doing with my research service Microcap Fortunes all along.

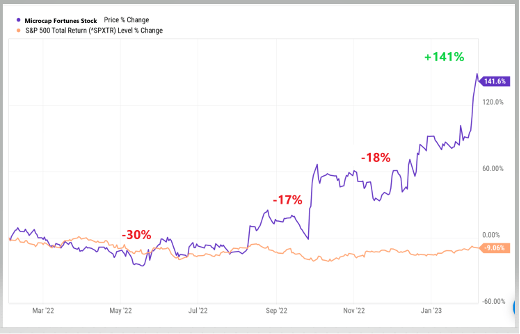

Here’s a real-time example of why it pays to hold your stocks through volatility and market panic.

One of our health tech companies has already grown revenue from 0 to over $51 million…

The founder and CEO is a rock star. After launching a new drug just approved by the FDA, he’s confident that within two years, the company’s revenue will more than double.

At the start of the year, the stock hit more than 140% while the stock market was down -9%…

(Click here to view larger image.)

However, 141% wasn’t a straight shot up … it never is.

Look at the chart again.

My readers had to endure three double-digit drawdowns to get to 140%.

And we’re still holding the stock in the portfolio for bigger gains ahead. And just a few days ago, ANOTHER stock hit 102% since adding it in September.

It won’t always feel easy, but volatility is the price we pay for big gains.

Have you held your stocks during this drawdown? Or did you panic and sell? Let me know at [email protected].

There is ALWAYS a reason to sell… But if you did, you’d be kicking yourself today.

Big drawdowns would test the patience of most investors.

If you had no idea what the company did, its prospects or who the CEO was … you might’ve sold.

But not us.

Because we had a very good idea of the underlying worth of the business. So when prices fell, I told my readers to buy more shares at a better bargain price!

Your Turn

Microcaps continue to be one of the biggest bargains in the stock market right now.

They’re like small hidden gems in the market.

And here’s why…

Big institutions can’t invest in them because they are too small. That gives us a big edge.

On average, there are five times as many analysts covering large-cap companies compared to the average microcap.

Since there are few to no institutional investors following these companies, they become very efficiently priced. And that’s because most of the trading is done by individual retail investors that look at them as lottery tickets.

When stock prices rise, they jump aboard. And when prices fall, they join in the selling … regardless of price.

That’s music to my ears because it creates opportunities for us. Because the stock price tells you nothing about the business.

Attached to every stock is a business. So while retail investors buy and sell stocks based on price, I spend my time researching the business.

We make our money when the stock price trades at a huge discount to the worth of the business.

And that’s the time to buy them.

Are you ready to stop trading in and out of stocks based on wiggles and jiggles on a chart or big headlines in the news?

And ready to invest by focusing on the business? (And sleep better at night!)

If so, then click here to get started before the next 140%-plus gain passes you by.

Regards,

Charles Mizrahi

Founder, Alpha Investor