Up to date on April 18th, 2022 by Bob Ciura

Traders seeking to generate increased ranges of earnings from their funding portfolios ought to check out Actual Property Funding Trusts, or REITs. These are corporations that personal actual property properties and lease them to tenants or put money into actual property backed loans, each of which generate a gentle stream of earnings.

The majority of their earnings is then handed on to shareholders, by means of dividends. You’ll be able to see all 208 REITs right here.

You’ll be able to obtain our full checklist of REITs, together with essential metrics corresponding to dividend yields and market capitalizations, by clicking on the hyperlink under:

The great thing about REITs, for earnings buyers, is that they’re required to distribute 90% of their taxable earnings to shareholders yearly, within the type of dividends. In return, REITs sometimes don’t pay company taxes.

Because of this, lots of the 200+ REITs we observe supply excessive dividend yields of 5%+.

Bonus: Hearken to our interview with Brad Thomas on The Certain Investing Podcast about clever REIT investing within the under video.

However not all high-yielding shares are computerized buys. Traders ought to rigorously assess the basics to make sure the excessive yields are sustainable. This text will talk about 10 of the highest-yielding REITs round with market capitalizations above $1 billion.

Be aware that whereas the securities on this article have very excessive yields, a excessive yield alone doesn’t make for a strong funding. Dividend security, valuation, administration, steadiness sheet well being, and development are all crucial components as properly.

We urge buyers to make use of the under evaluation as informative, however to do vital due diligence earlier than shopping for into any safety – and particularly excessive yield securities. Many (however not all) excessive yield securities have vital danger of a dividend discount and/or deteriorating enterprise outcomes.

Desk of Contents

You’ll be able to immediately bounce to any particular part of the article through the use of the hyperlinks under:

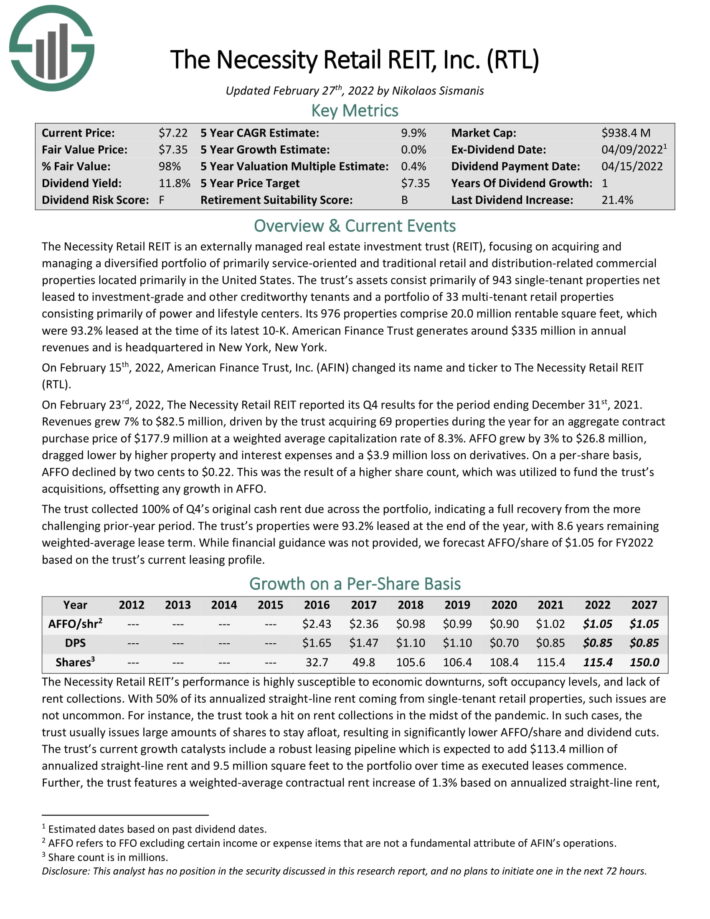

Excessive-Yield REIT No. 10: The Necessity Retail REIT (RTL)

The Necessity Retail REIT (previously generally known as American Finance Belief) is an externally managed actual property funding belief (REIT), specializing in buying and managing a diversified portfolio of primarily service-oriented and conventional retail and distribution-related business properties positioned primarily in the US.

Supply: Investor Presentation

The belief’s property consist primarily of 943 single-tenant properties web leased to investment-grade and different creditworthy tenants and a portfolio of 33 multi-tenant retail properties consisting primarily of energy and way of life facilities. Its 976 properties comprise 20.0 million rentable sq. toes, which had been 93.2% leased on the time of its newest 10-Ok.

Click on right here to obtain our most up-to-date Certain Evaluation report on RTL (preview of web page 1 of three proven under):

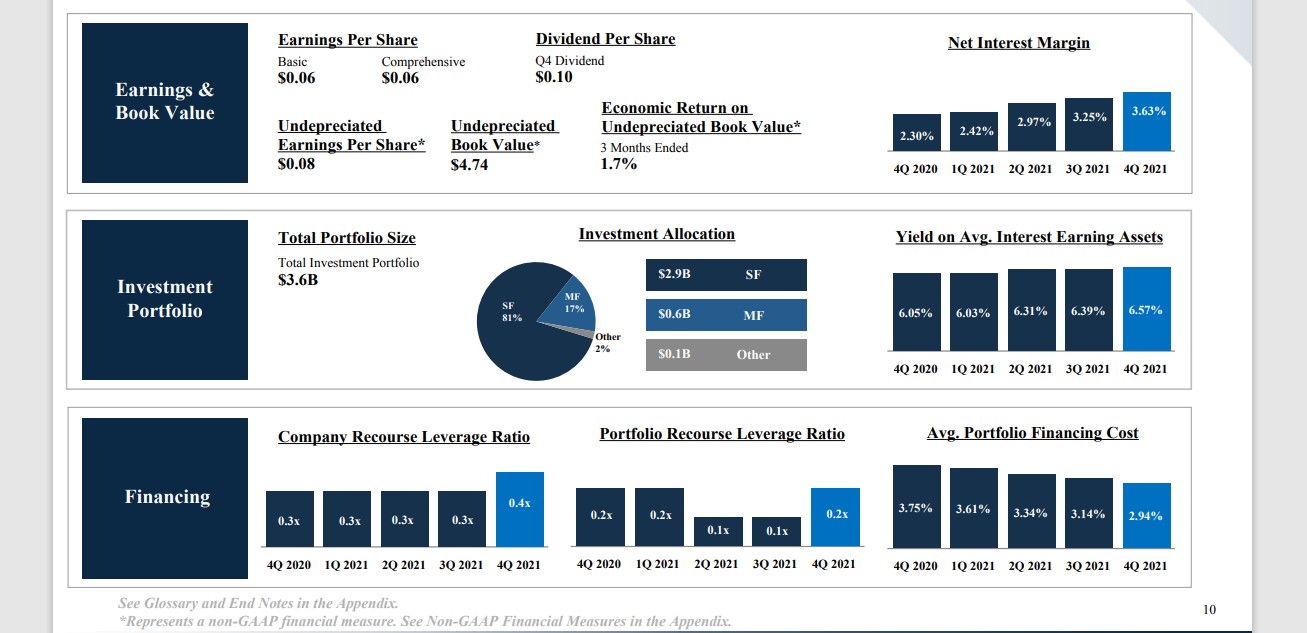

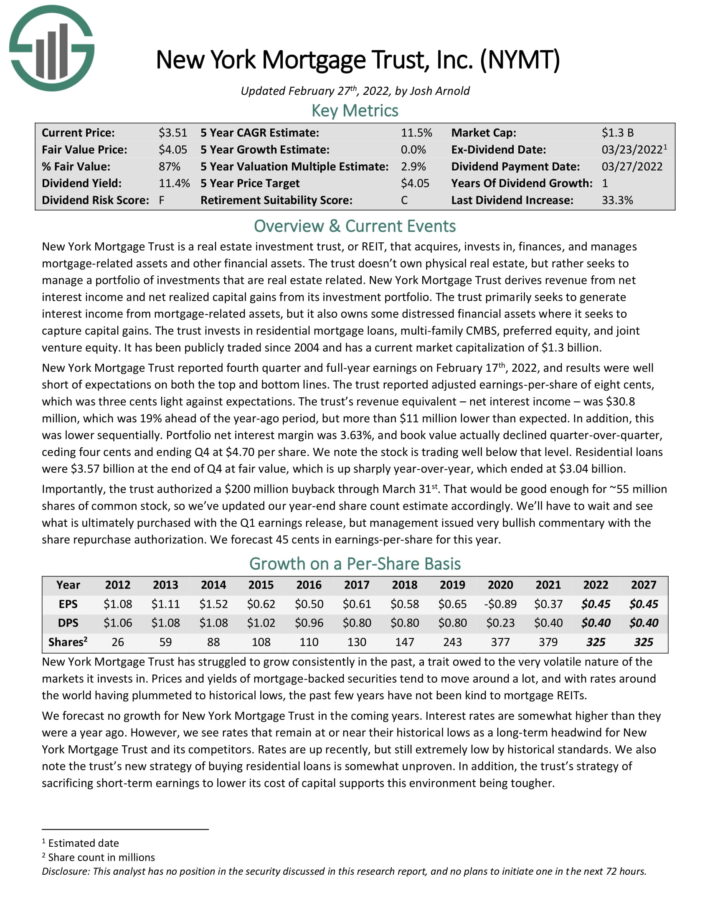

Excessive-Yield REIT No. 9: New York Mortgage Belief (NYMT)

New York Mortgage Belief is an actual property funding belief, or REIT, that acquires, invests in, funds, and manages mortgage-related property and different monetary property. The belief doesn’t personal bodily actual property, however quite seeks to handle a portfolio of investments which are actual property associated. New York Mortgage Belief derives income from web curiosity earnings and web realized capital beneficial properties from its funding portfolio.

Supply: Investor Presentation

The belief primarily seeks to generate curiosity earnings from mortgage-related property, but it surely additionally owns some distressed monetary property the place it seeks to seize capital beneficial properties. The belief invests in residential mortgage loans, multi-family CMBS, most popular fairness, and three way partnership fairness.

Click on right here to obtain our most up-to-date Certain Evaluation report on NYMT (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 8: AGNC Funding Company (AGNC)

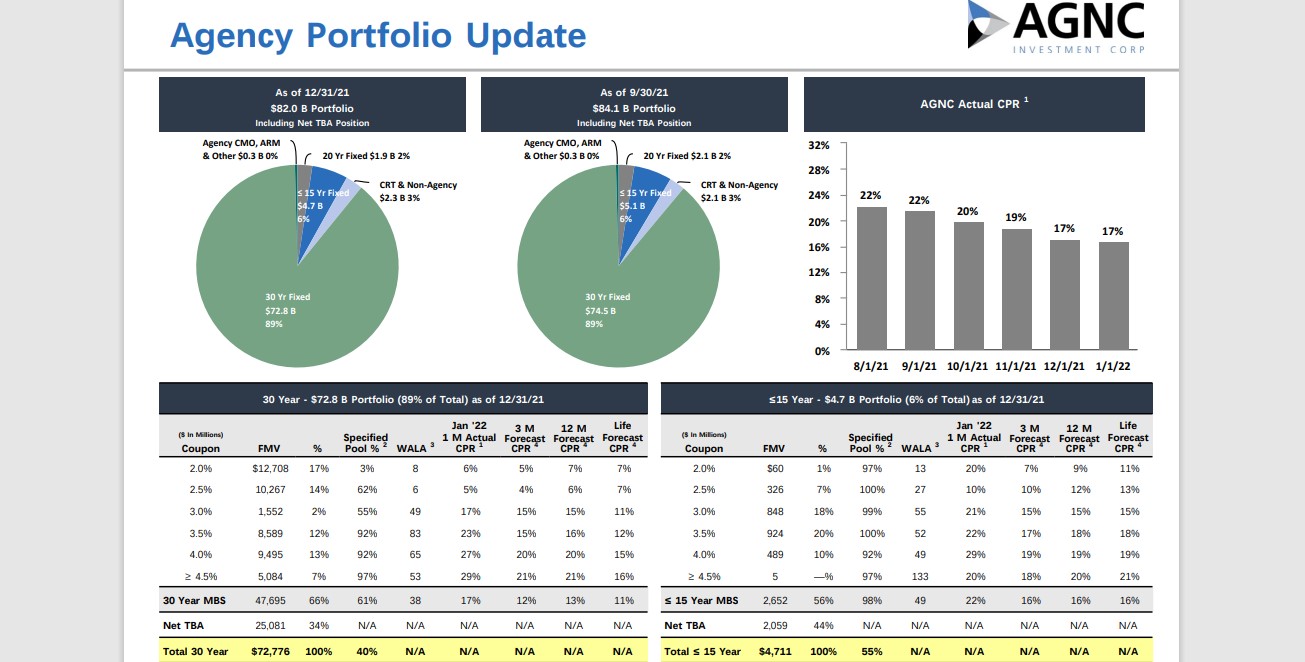

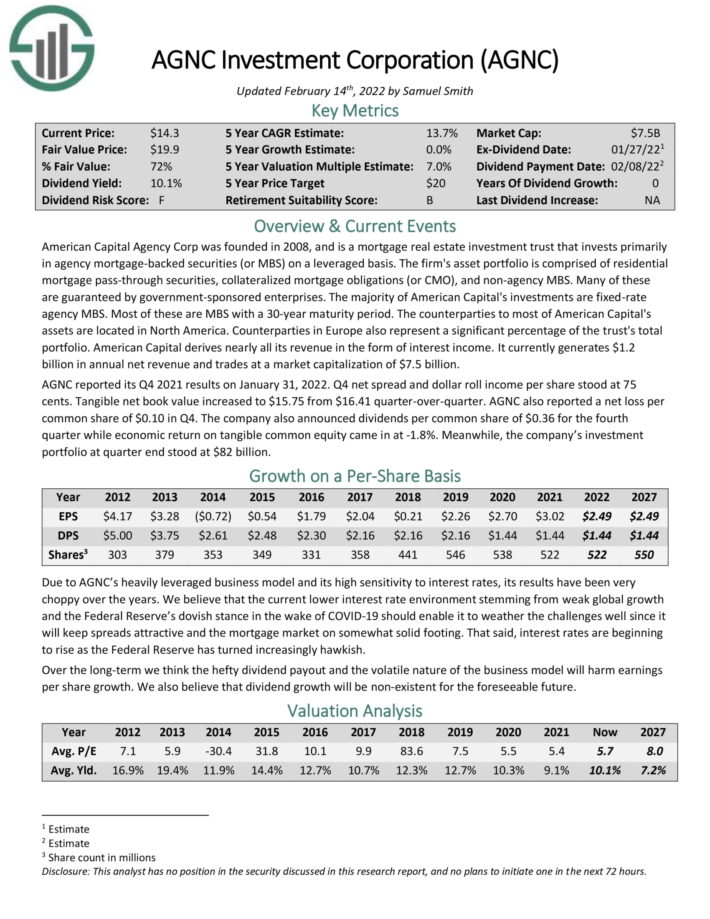

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage move–by means of securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

The vast majority of American Capital’s investments are fastened–charge company MBS. Most of those are MBS with a 30–12 months maturity interval. American Capital derives practically all its income within the type of curiosity earnings.

Supply: Investor Presentation

AGNC reported its Q4 2021 outcomes on January 31, 2022. Q4 web unfold and greenback roll earnings per share stood at 75 cents. Tangible web e book worth elevated to $15.75 from $16.41 quarter-over-quarter.

The corporate additionally introduced dividends per widespread share of $0.36 for the fourth quarter whereas economic return on tangible widespread fairness got here in at –1.8%. In the meantime, the corporate’s funding portfolio at quarter finish stood at $82 billion.

Click on right here to obtain our most up-to-date Certain Evaluation report on AGNC (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 7: Chimera Funding Company (CIM)

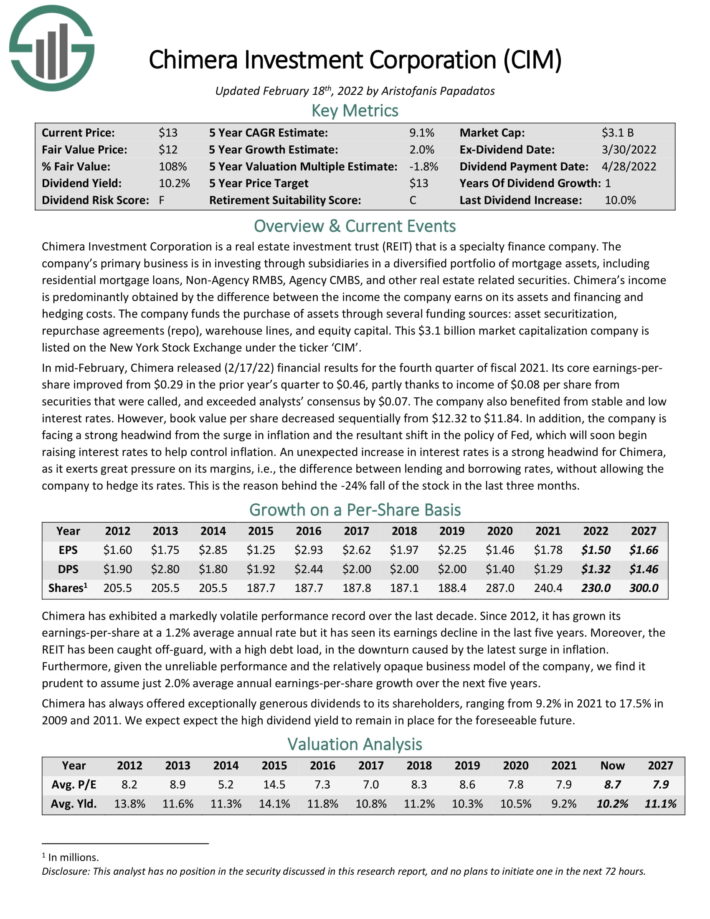

Chimera Funding Company is an actual property funding belief (REIT) that could be a specialty finance firm. The corporate’s major enterprise is in investing by means of subsidiaries in a diversified portfolio of mortgage property, together with residential mortgage loans, Non-Company RMBS, Company CMBS, and different actual property associated securities.

Chimera’s earnings is predominantly obtained by the distinction between the earnings the corporate earns on its property and financing and hedging prices. The corporate funds the acquisition of property by means of a number of funding sources: asset securitization, repurchase agreements (repo), warehouse traces, and fairness capital.

Click on right here to obtain our most up-to-date Certain Evaluation report on CIM (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 6: PennyMac Mortgage Funding Belief (PMT)

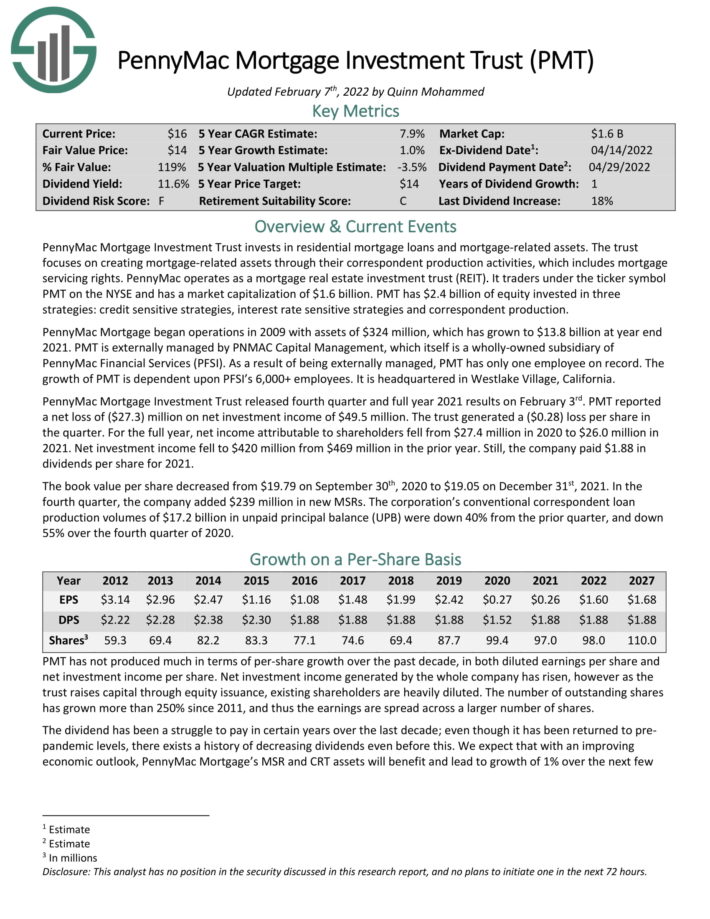

PennyMac Mortgage Funding Belief is a specialty REIT that invests in residential mortgage loans and mortgage-related property. PMT is managed by PNMAC Capital Administration, LLC, a subsidiary of PennyMac Monetary Companies, Inc. (PFSI).

PMT believes it’ll generate long-term development alongside a big (and rising) addressable market in its core trade.

Click on right here to obtain our most up-to-date Certain Evaluation report on PMT (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 5: Ellington Residential Mortgage REIT (EARN)

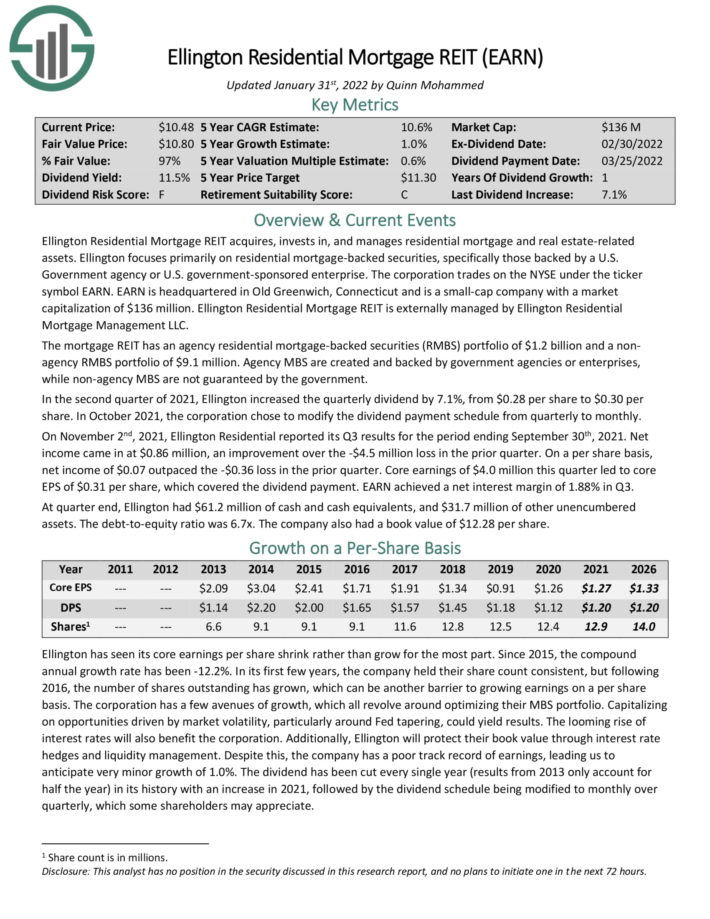

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Ellington Residential Mortgage REIT is externally managed by Ellington Residential Mortgage Administration LLC. The mortgage REIT has an company residential mortgage–backed securities (RMBS) portfolio of $1.2 billion and a non–company RMBS portfolio of $9.1 million. Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

Click on right here to obtain our most up-to-date Certain Evaluation report on EARN (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 4: Annally Capital Administration (NLY)

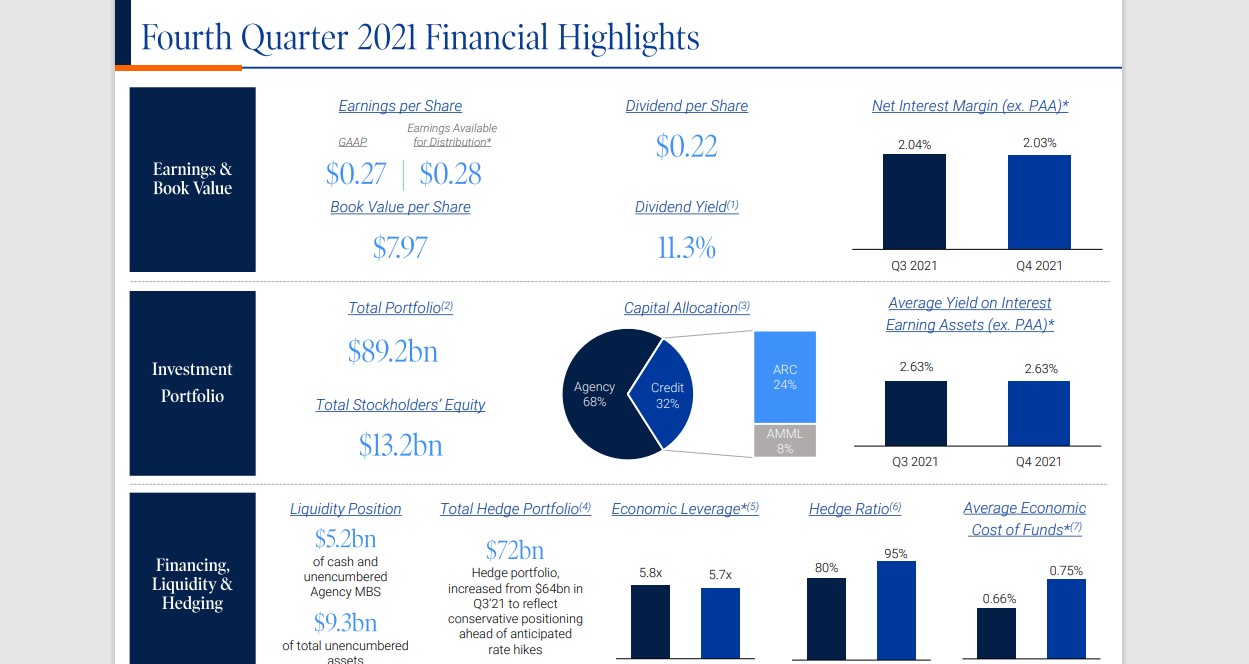

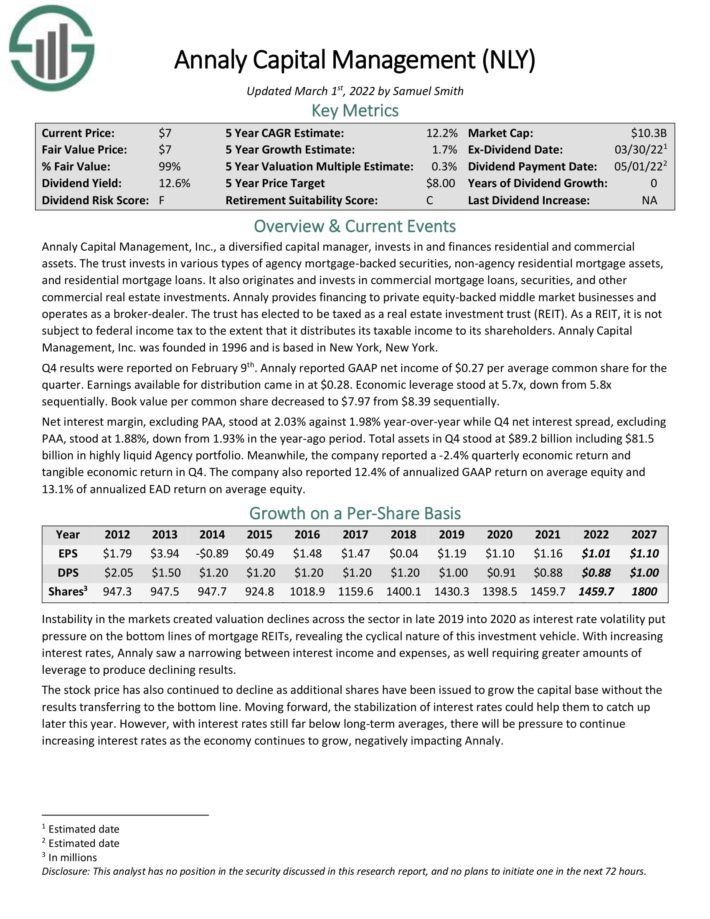

Annaly Capital Administration, Inc., a diversified capital supervisor, invests in and funds residential and business property. The belief invests in varied forms of company mortgage–backed securities, non–company residential mortgage property, and residential mortgage loans.

It additionally originates and invests in business mortgage loans, securities, and different business actual property investments. Annaly provides financing to non-public fairness–backed center market businesses and operates as a dealer–vendor.

This fall outcomes had been reported on February ninth.

Supply: Investor Presentation

Annaly reported GAAP web earnings of $0.27 per common widespread share for the quarter. Earnings obtainable for distribution got here in at $0.28. Financial leverage stood at 5.7x, down from 5.8x sequentially. Ebook worth per widespread share decreased to $7.97 from $8.39 sequentially.

Click on right here to obtain our most up-to-date Certain Evaluation report on NLY (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 3: Two Harbors Funding Corp. (TWO)

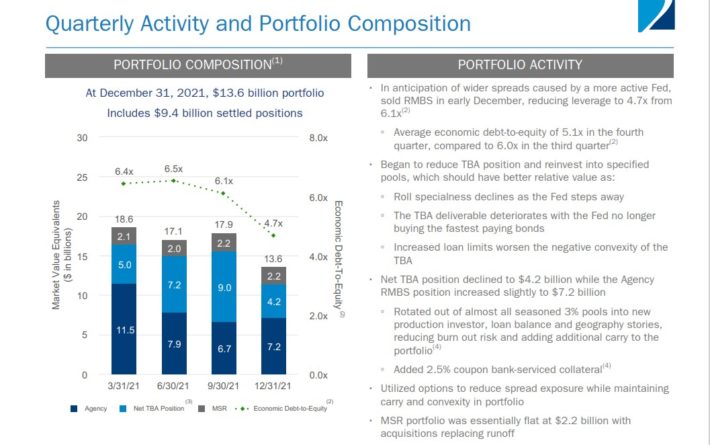

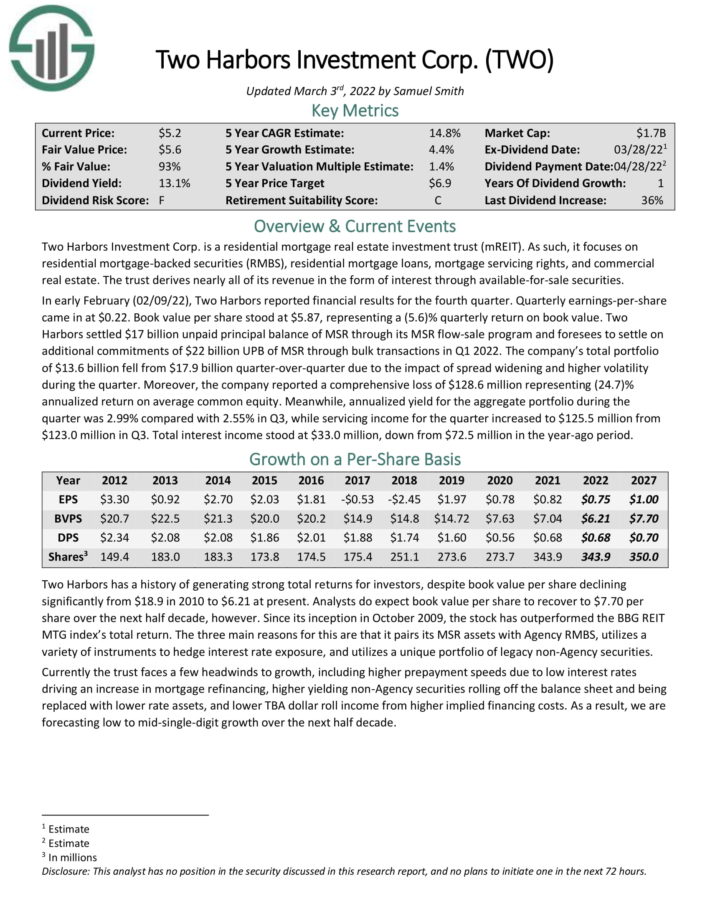

Two Harbors Funding Corp. is a residential mortgage actual property funding belief (mREIT). As such, it focuses on residential mortgage–backed securities (RMBS), residential mortgage loans, mortgage servicing rights, and business actual property.

The belief derives practically all of its income within the type of curiosity by means of obtainable–for–sale securities.

Supply: Investor Presentation

In early February (02/09/22), Two Harbors reported monetary outcomes for the fourth quarter. Quarterly earnings-per-share got here in at $0.22. Ebook worth per share stood at $5.87, representing a (5.6)% quarterly return on e book worth.

Two Harbors settled $17 billion unpaid principal steadiness of MSR by means of its MSR flow-sale program and foresees to choose extra commitments of $22 billion UPB of MSR by means of bulk transactions in Q1 2022.

The corporate’s complete portfolio of $13.6 billion fell from $17.9 billion quarter-over-quarter because of the affect of unfold widening and better volatility throughout the quarter. Furthermore, the corporate reported a complete lack of $128.6 million representing (24.7)% annualized return on common widespread fairness.

In the meantime, annualized yield for the mixture portfolio throughout the quarter was 2.99% in contrast with 2.55% in Q3, whereas servicing earnings for the quarter elevated to $125.5 million from $123.0 million in Q3. Complete curiosity earnings stood at $33.0 million, down from $72.5 million within the year-ago interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on Two Harbors (TWO) (preview of web page 1 of three proven under).

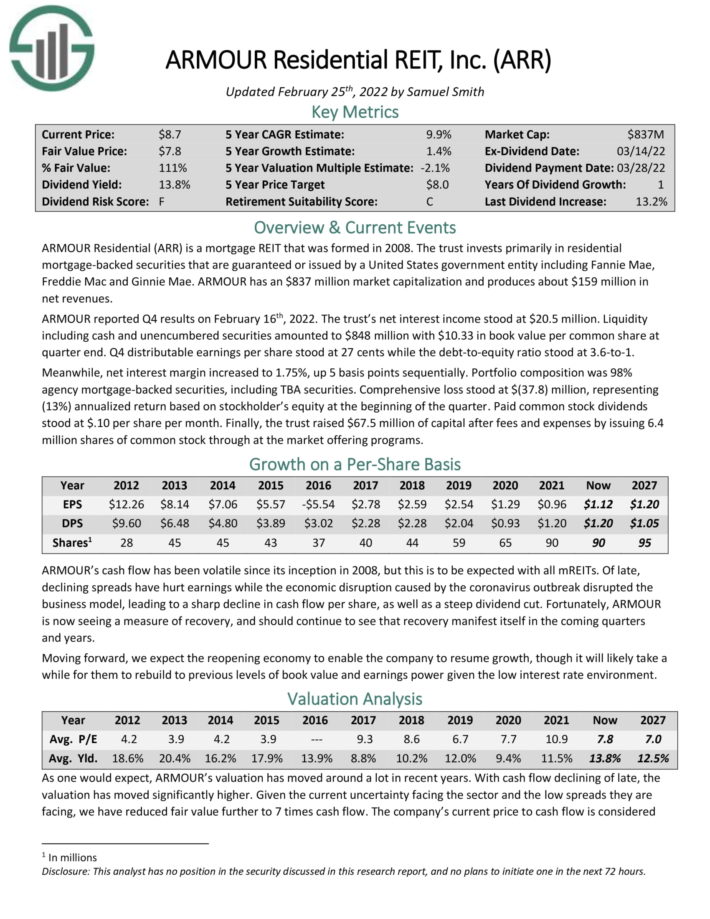

Excessive-Yield REIT No. 2: ARMOUR Residential REIT (ARR)

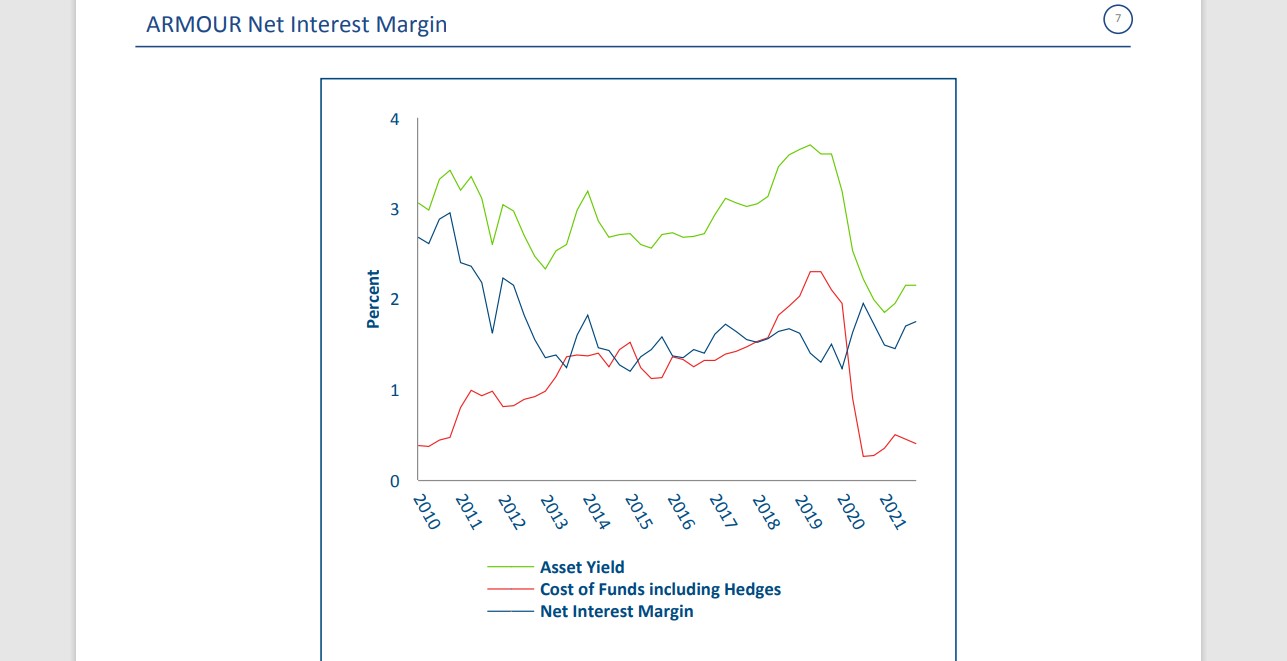

ARMOUR is a mortgage REIT that invests primarily in residential mortgage–backed securities that are assured or issued by a United States authorities entity together with Fannie Mae, Freddie Mac and Ginnie Mae.

ARMOUR reported Q4 outcomes on February 16th, 2022. The belief’s web curiosity earnings stood at $20.5 million. Liquidity together with money and unencumbered securities amounted to $848 million with $10.33 in e book worth per widespread share at quarter finish. Q4 distributable earnings per share stood at 27 cents whereas the debt-to-equity ratio stood at 3.6 to 1.

Supply: Investor Presentation

In the meantime, web curiosity margin elevated to 1.75%, up 5 foundation factors sequentially. Portfolio composition was 98% company mortgage–backed securities, together with TBA securities.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARR (preview of web page 1 of three proven under):

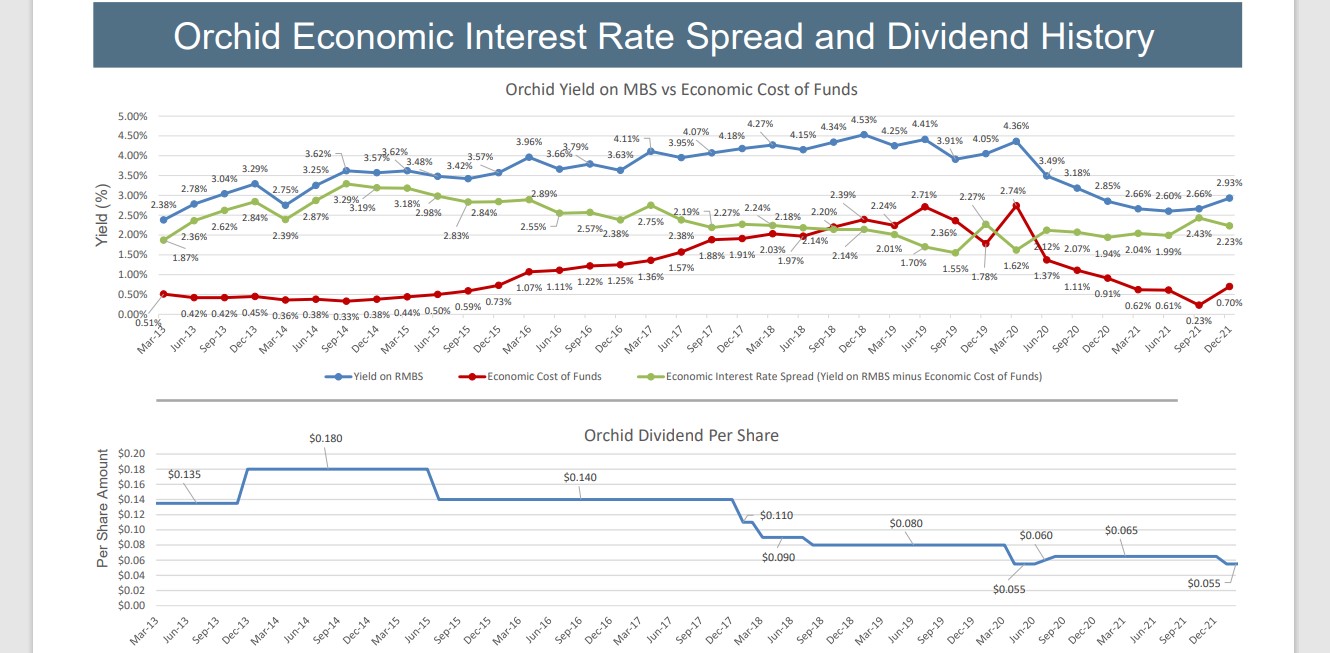

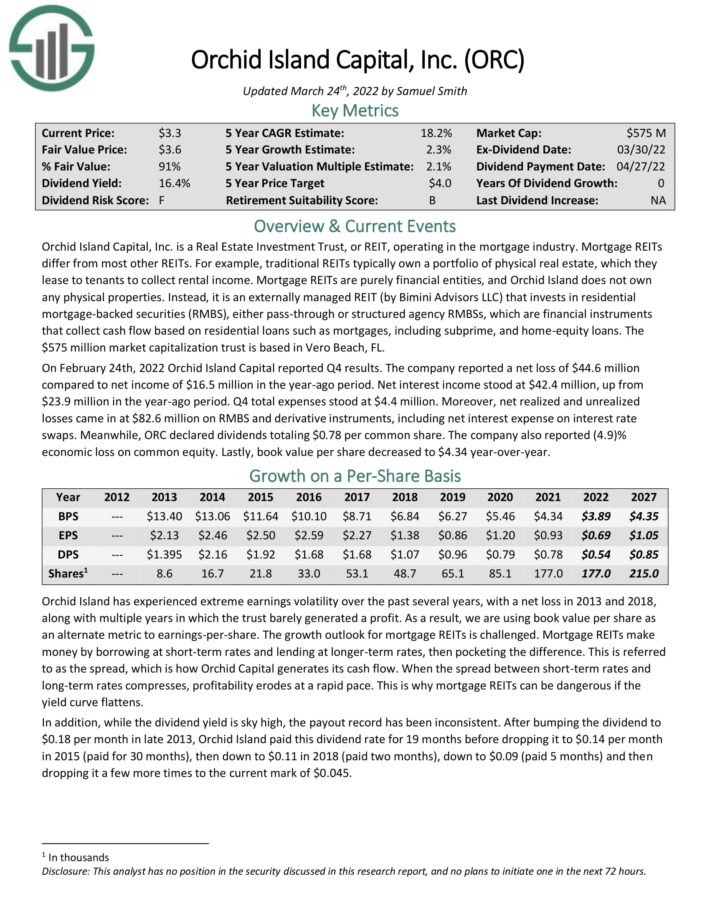

Excessive-Yield REIT No. 1: Orchid Island Capital (ORC)

Orchid Island Capital, Inc. is a mortgage REIT. As such, Orchid Island does not personal any bodily properties.

As an alternative, it’s an externally managed REIT (by Bimini Advisors LLC) that invests in residential mortgage–backed securities (RMBS), both move–by means of or structured company RMBSs. These are monetary devices that gather cash circulation based mostly on residential loans corresponding to mortgages, together with subprime, and residential–fairness loans.

Supply: Investor Presentation

On October 28th, 2021 Orchid Island Capital reported Q3 outcomes. Web earnings got here in at $26.0 million and features a net curiosity earnings of $32.6 million. Ebook worth per share stood at $4.77, up by $0.6 sequentially from $4.71.

ORC lately lower its dividend by 18%, though the inventory nonetheless yields 17.6%.

Click on right here to obtain our most up-to-date Certain Evaluation report on ORC (preview of web page 1 of three proven under):

Closing Ideas

REITs have vital attraction for earnings buyers, because of their excessive yields. These 10 excessive high-yielding REITs are particularly engaging on the floor, though buyers must be conscious that abnormally excessive yields are sometimes accompanied by elevated dangers.

At Certain Dividend, we frequently advocate for investing in corporations with a excessive likelihood of accelerating their dividends each 12 months.

If that technique appeals to you, it might be helpful to flick through the next databases of dividend development shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].