PM Images/DigitalVision via Getty Images

The collapse of Silicon Valley Bank (SIVB) last week sent markets into a bit of a tailspin with the S&P 500 dropping 5% in a week, the Financial Select Sector SPDR ETF (NYSEARCA:XLF) dropping 8%, and the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) dropping over 14%. Regulators then closed Signature Bank (SBNY) over the weekend, citing “systemic risk.”

If we count Silvergate’s (SI) shutdown on March 8, it looks like three banks have just collapsed in the span of a week. The narrative now seems to be that the financial economy is actually crumbling underneath a façade of “soft landing” recovery efforts and that it behooves the investor to get out of bank stocks while he can.

What isn’t immediately obvious is that each banks’ issues are rather idiosyncratic. While it is true that the individual issues can likely be traced back to rising interest rates, which itself is a macroeconomic phenomenon, the banks themselves each have their own mishaps which caused their collapse. American banking as a whole remains healthy and even has certain tailwinds behind it.

Silvergate and Signature Bank were both involved with crypto. Because rising rates hurt risk assets, crypto has seen a substantial bear market over the last year. A simple result of this is increased stress felt by institutions that deal with crypto. We saw a few crypto firms collapse in 2022 due to leveraged positions rapidly unwinding as the bear market deepened. We can think of these two (Silvergate especially) as victims to the overall effect of rising rates on high-risk assets. In this case, the asset is crypto and the banks did not effectively manage risk.

SVB’s balance sheet indicates that it was overly long duration in a period of rising rates. Moreover, it did not bother with proper interest rate hedging for such a portfolio of loans. This is like the crypto case, except here the risk assets were unhedged long-term bonds. Signature Bank also had the misfortune of having a chunk of its assets in SVB deposits.

So although the three collapses happened very close together, these are very case-specific events. We can safely assume that most of banking industry practices some form of interest rate hedging. And, we can be sure that most of them do not touch crypto.

This is why the recent selloff in bank stocks is probably a big overreaction and possibly a bigger opportunity for astute investors. For one, banks in general tend to benefit from rising rates so there is a strong macroeconomic tailwind. The Fed has signaled that rate hikes will continue so this tailwind should persist.

We can see that banks will be mostly okay using a simple “Main Street perspective.” Most banks have not raised their interest on deposits from the 2020 zero-interest rate levels. Depositors still earn about 0.15% annualized. The banks can then take the money and get a risk-free return of over 4% annualized on any of the short-term T-bills. We’ve seen some CD rates go up, but most are still under 4% and given the illiquidity of the CDs, it is truly free money for the bank to then lock in a 1% via the spread with the 1-year treasury that yields nearly 5%.

As long as banks are not dealing with stuff too far removed from treasuries, interbank lending, and collateralized loans (mortgages, cars loans), they should be making good profits and dividends should be safe.

Everyone Panics but the Insiders

The most informed banking investors, banking insiders, are signaling their belief that the current downturn in banking stocks is a huge mispricing by the market.

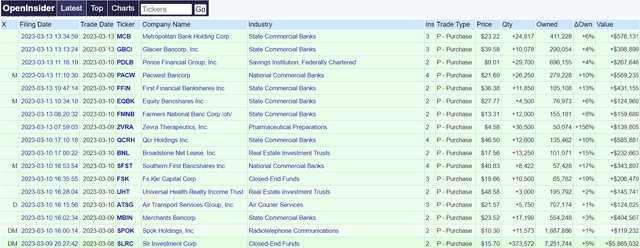

Cluster Buys as of 13 March 2023 (OpenInsider)

In this table of “latest-cluster-buys” (cluster buy means many insiders of the same company are buying) from OpenInsider, nearly every cluster of insiders buying in the last week has been by banking insiders. These buys are also not insubstantial. The ΔOwn column tells us the percent increase of shares from the total shares already owned. Many added over 5% on average to their positions. The situation is still very recent, and insider filings often lag their purchase times by a few days or weeks. The fact that it’s only been a few days and there are already so many cluster buys is extremely bullish for the banking sector. I expect that in two more weeks many more filings from bank insiders will appear on this list.

If there were serious concerns about the sector from its most informed members, we might expect to see insider selling. Instead, at the time of writing, there is not a single obvious banking insider selling at the same time a lot of banking insiders have been buying.

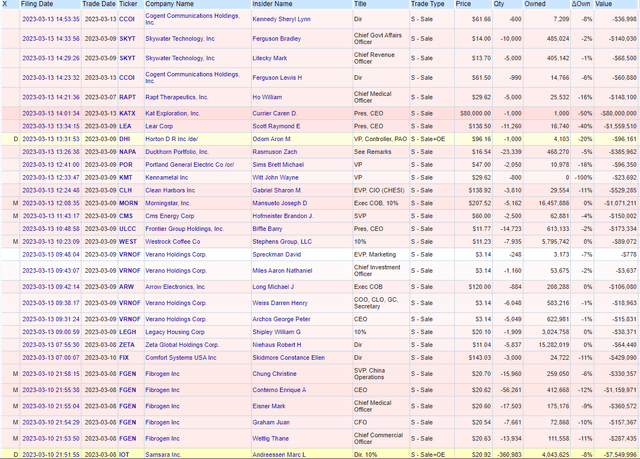

Insider Sells as of 13 March 2023 (OpenInsider) Insider Sells as of 13 March 2023 (OpenInsider)

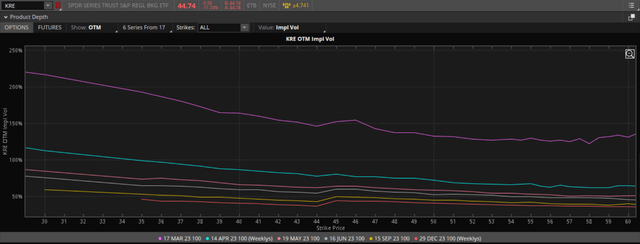

Options Market Panic

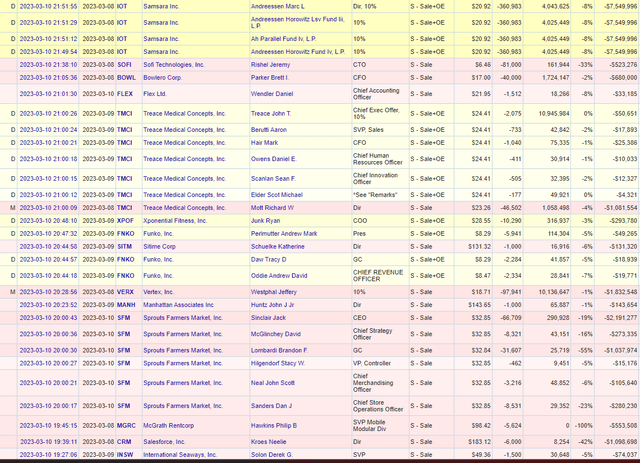

We can also see evidence of panic in the options markets. Specifically, KRE and XLF implied volatilities are at a year-long highs. In the case of KRE, IV is nearly 50% higher than the previous height less than a year ago. Furthermore, the IV term structures for both ETFs are in extreme backwardation. Generally, these are signs of capitulation and a bottoming in equity indices (note that equity indices generally refer to broader indices like the SPX, but seeing that these are equity ETFs within a sector, the comparison and implications are somewhat applicable).

KRE Price and IV Time Series (TD Ameritrade) KRE IV Skews at Different Expiries (TD Ameritrade)

In the above chart, each curve is the IV skew from the OTM KRE options of a specific expiration. The spot price is $44.74 per share. The curves are stacked neatly above one another, with the closer expiries exhibiting higher IV. We can see that in the near dated options, the IV is significantly higher, and there is also a more prominent skew.

All this points to panic-like behavior. Combined with the fact that IV has not been close to this high in a while, the short volatility trade, and specifically short downside volatility, appears promising.

The Federal Government Put: “Too Weak to Fail”

The other piece is that the US government will almost certainly step in to bail out the financial sector even if it did collapse. This serves as the final backstop against a worst-case scenario. In truth, there are a lot of issues going on in the global economy and America is doing okay only because the US Dollar and US debt is still viewed as safe-haven assets. This will remain true for a while, and it is in America’s best interest to maintain economic and financial stability so the world can continue to trust in American assets.

America is stuck in an awkward position because it has been exporting its inflation to the rest of the world by raising rates. Higher rates lead to a stronger dollar, which is better for the American consumers who get most of their goods via imports. The rest of the world experiences higher inflation as a result because their currencies are weakened. If US rates were to fall, the reverse of this process causes domestic inflation to increase. There is, at this point, effectively a floor on domestic interest rates due to this. The ceiling for rates comes from the US government needing to keep its debt serviceable without relying exclusively on printing money.

This lack of options for monetary policy means that the government, not the Fed, will step in to ensure economic stability. To some extent, it has already started doing so. By citing “systemic risks” as the reason for shutting down Signature Bank, it has signaled a proactive approach to monitoring the situation as it unfolds.

This hands-on, almost micromanaged, approach is because the stakes are so high. A collapse of a large chunk of the US banking sector would be a repeat of 2008 but at a time when the world is increasingly multipolar and the criticism of and challenge to US dominance is growing. The position is one of vulnerability. The US economy is too vulnerable, too weak to fail— because failing would mean the unacceptable loss of trust in the US-led system. The government will ensure this does not happen.

Valuations, Roughly

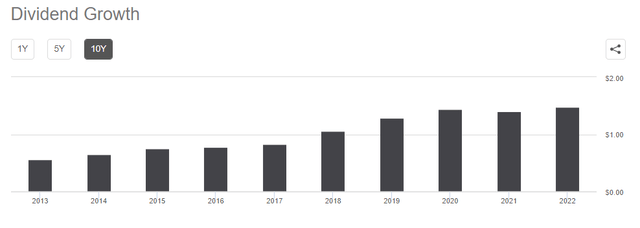

Bank earnings are mostly safe because of the rising rates tailwind. Overall, economic reports are coming in better than expected (which is prompting the Fed to persist with rate hikes) so financial activity is also persisting. Higher rates mean more saving, which also gives banks more capital to work with and earn a spread from. KRE dividends have steadily increased over the last 10 years. Along with the confidence of insiders and the incentives of the US government, I don’t see dividends being seriously threatened.

KRE Dividend Growth History (Seeking Alpha)

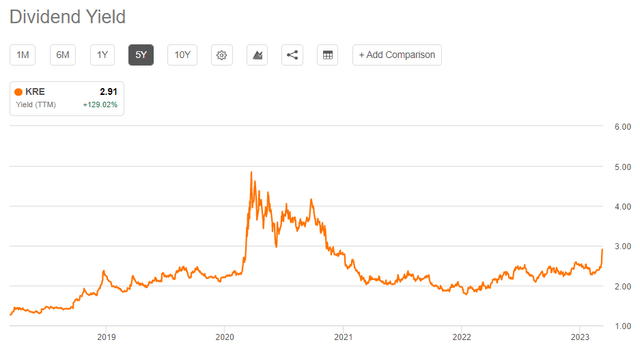

Furthermore, KRE’s yield is approaching a high point. In the last week, the shares have depreciated 14% due to largely panic behavior. This has pushed the yield into an attractive entry point.

KRE Dividend Yield History (Seeking Alpha)

The Trade

Today I sold some near-dated OTM puts on KRE. Given the incredibly high IV and the substantial skew in the near-dated options, I view this as an extremely high-probability trade. I plan to hold the options until expiration and even take assignment if KRE continues to fall. My strike prices are over 15% below the spot price, so the entry price if assigned would lead to a yield around 4%.

Because of the backwardation in IV, it also makes sense to use calendar or diagonal spreads to bet on a mean reversion of volatility, while expressing some directional preference. For instance, one can buy an ITM call option expiring in a year and sell an OTM call expiring in a month.

The point is the current setup seems to favor selling near-dated options and taking an upward bias on price (positive delta).

XLF also lends itself to a similar setup but it’s IV profile did not seem as egregiously overpriced as KRE.

Finally, given how many insiders have started to buy shares, those who do not want to deal with options could consider buying KRE or XLF or even the specific shares that insiders are buying. Use some kind of dollar cost average—spend about N dollars every other day on these positions for the next month. The risk reward is there.