Leonid Ikan

(Note: This article appeared in the newsletter on March 10, 2023.)

(Note: This is a Canadian company reporting in Canadian dollars unless otherwise noted.)

Headwater Exploration (OTCPK:CDDRF) has long been guiding that the current year will be a great year; but the next year is always going to be slower. That is until the next year gets there. It is a conservative way of stating that management only knows about a year ahead of time where the discoveries allow for rapid growth. Of course, commodity prices need to be such that the rapid growth can occur. So far, they appear to be accommodating. However, it is not unusual for a cyclical downturn to come out of nowhere. Hence management is not projecting rapid growth every year into the hereafter as is very common on the technology side.

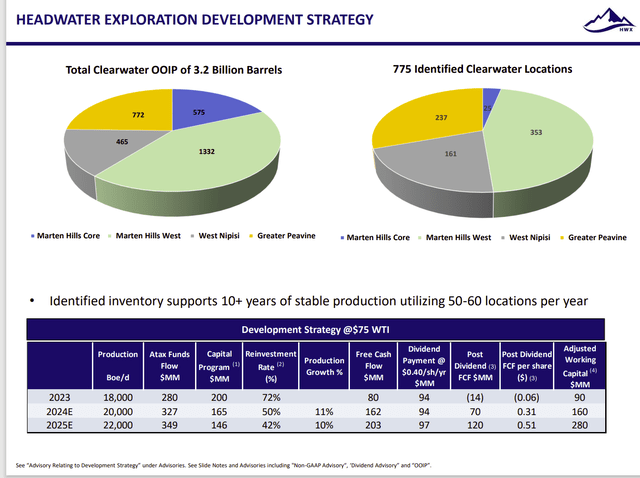

Headwater Exploration Cash Flow Expenditure Guidance (Headwater Exploration March 2023, Corporate Presentation)

The result is that management will predict (or guide) solely based upon what is known and for how long they can see current commodity prices. This is important because a lot of investors are always wondering about commodity price visibility. What is clear is that we are already in March of this fiscal year and management is not guiding to a lot of growth past this fiscal year until the next fiscal year comes into view a lot better.

Usually, that means the time to consider get in is when most investors are down on the industry (which they are currently). A debt-free company like this one with a large cash balance is ideal because a company like this one can easily handle a commodity downturn when there is no debt to service. All management needs to do is just “cash checks” as the production rolls in or shut-in the production if prices get too low and live off the cash balance. There are going to be a lot of competitors with debt suffering far more before you have to worry about the future of this company.

People often ask “what if the stock goes down?”. Yet whenever an investor like John Templeton or Peter Lynch gave an interview, the one thing they always note is to buy bargains and be sure enough of your due diligence that you can hang on without worrying if the stock goes lower. I have yet to hear a single one of them ever talk about pin-pointing the stock price bottom. In fact, through the years, many of the great investors noted about one-third of their ideas worked out and even then, there was often a significant decline before the stock appreciated to a good profit.

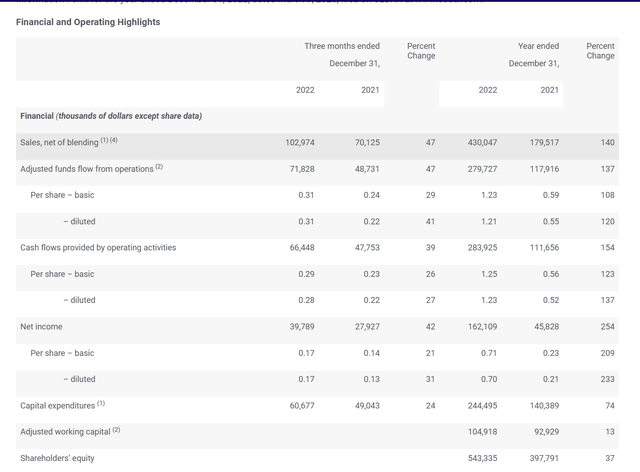

Headwater Exploration Summary Of Operating Results (Headwater Exploration March 2023, Earnings Press Release)

Note that growth is rapid enough for earnings to overcome a considerable price decline when compared to commodity prices in the second quarter. Since the production base is still relatively small, that rapid growth is likely to continue.

Management has begun to issue a dividend to shareholders. However, despite the guidance shown in the first slide, this management can make a very good return with fast paybacks in the Clearwater area. Therefore, dividends are likely to be a lower consideration than building the company.

This management sold their last company to Baytex Energy (BTE) before the pandemic. Therefore, it is significant that they got back into the industry to participate in the Clearwater basin emergence as a major producing basin. My own inclination is to wait until they sell this company because there could be considerable growth ahead as this basin develops.

Management has steadily been adding acreage to its initial position. The record of the exploration wells appears to be far more successes than dry holes. That record appears to be set to continue well into the future.

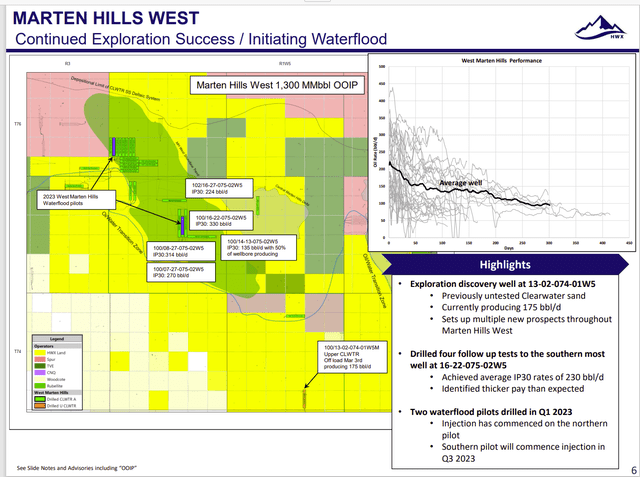

Headwater Exploration Marten Hills Guidance And Exploration Success (Headwater Exploration March 2023, Corporate Presentation)

One of the things to note is that management thinks they have recovered a small fraction of the oil in place. That can vary considerably from the reserve report because the reserve report only notes what can be commercially recovered from the project undertaken. If a new technique becomes available, then more oil in place can be recovered. Sometimes it is as simple as moving to secondary recovery techniques.

But the key is that as long as technology advances, this field is likely to be producing for a very long time. It is also possible to extend the life of the location by bringing on more intervals at commercial cost levels. That is also likely to happen as technology progresses.

Many of the areas that the industry is now developing have been producing for a very long time. Those areas are likely to be producing oil long after we are gone as well. But many managements will tell you that recent technology advances have revolutionized the play or revitalized an interval. I am a firm believer in the continuing advancement of technology to keep a lot of these basins producing for a long time to come.

Headwater Exploration Additional Development Acreage Possibilities (Headwater Exploration Corporate Presentation March 2023)

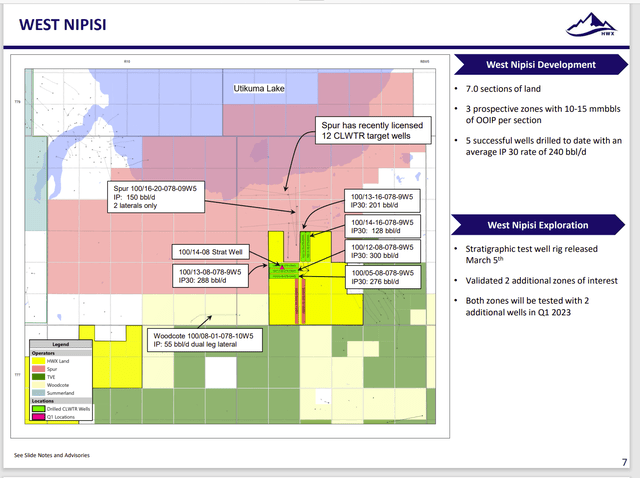

Management has been exploring the new acreage. In due time this progress will be added to the future guidance that was shown initially. Evidently, management has the same plan for the whole area. That would be to drill the wells and then head to waterflooding within a year or so to ensure a steady reservoir pressure that would enable greater recovery of the oil in place.

The only time management has not had success with exploration wells recently was the Shadow lease holdings. Even there, management is likely to try again in the future. The early-stage development of the Clearwater basin suggests there is still a lot of oil in place that management has yet to “discover”. So, there is likely to be quite a bit of growth available in the future.

The Future

Whether or not management guides to rapid growth after the current fiscal year, it does appear that rapid growth for the foreseeable future is likely as long as commodity prices are at levels to support that strategy.

Similarly, a debt-free balance sheet is a priority because heavy oil is a relatively discounted product. That discount can widen during times of commodity price downturns because of weak demand. Therefore, it is important for the company to have a cushion “just in case” the worst happens.

More importantly is that the company has found heavy oil near the top of the heavy oil grade range. That opens the possibility of finding some medium grade oil in the future which would sell at a better price.

So, there is a lot of upside potential to this rapidly growing company. The protection against long-term downside losses is in the rapid growth and the debt-free balance sheet. Sometimes small upstream companies are safer investments than their larger peers. That appears to be the case here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.