kazuma seki

The Cohen & Steers REIT and Preferred and Income Fund (NYSE:RNP) is a lightly leveraged, well-managed closed end fund (“CEF”) focused on publicly traded real estate companies and fixed-income securities. RNP is split roughly 50/50 between REITs and fixed-income securities and uses debt of about 30% of asset value to push the leveraged yield up to about 8% as of this writing.

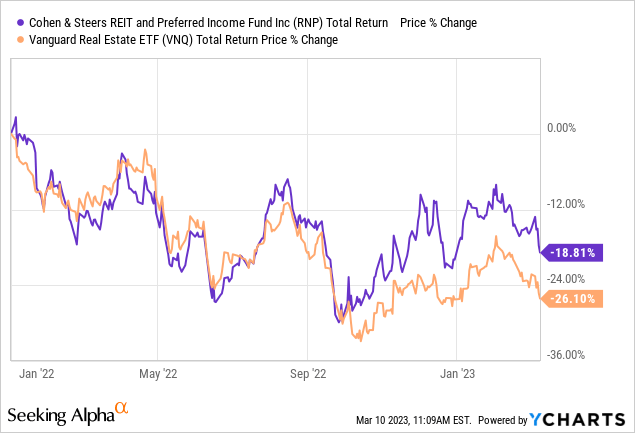

As far as CEFs go, RNP appears to me to be one of the safest and best managed available. It’s striking to me that, amid rapidly rising interest rates since the beginning of 2022, RNP has outperformed the unleveraged Vanguard Real Estate ETF (VNQ):

I suspect this is due to three factors:

- The lower volatility of preferred and other fixed-income securities in the portfolio.

- Management’s active stock-picking of only the best REITs.

- The leveraged high yielding distribution.

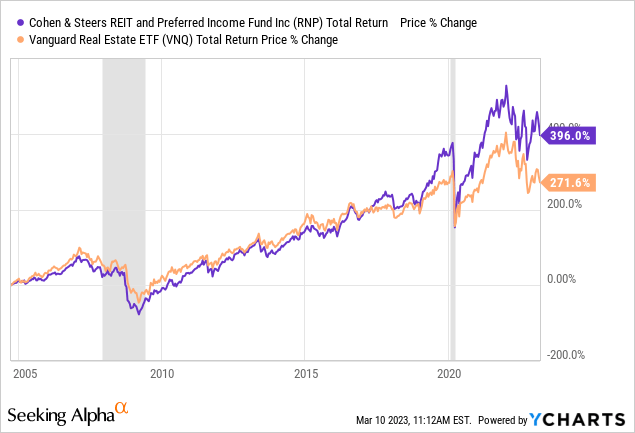

These factors, I believe, have been sufficient to cause RNP to outperform VNQ not only during the current period of rising interest rates but also throughout its entire lifespan as a public CEF:

It is true that during market crashes, RNP underperforms VNQ, but in the long run, RNP has consistently outperformed VNQ. Of course, this long-term outperformance may have come mostly from low interest rates allowing the CEF to use low-cost debt to increase the yield on equity. As rates have surged higher, RNP’s debt is becoming a liability rather than an asset.

But just as I argued in my pitch for the Reaves Utility Income Fund (UTG) in this article, if you believe interest rates will not stay this high for the long term, RNP is a strong buy.

As I’ll show below, the CEF can survive another year or so of elevated interest rates, and when rates eventually come down, the fund is in a fantastic position to continue its long-term streak of outperformance.

Overview of RNP

The CEF has assets under management of about $1.5 billion, with its 289 holdings split almost evenly between REITs and fixed-income securities like preferred stocks.

Since the fund does some fancy things like active portfolio management and leverage, the expense ratio is naturally higher than for passive ETFs at 1.33% of managed assets. While far higher than VNQ’s expense ratio of 0.12%, the idea is that RNP’s managers will more than earn their keep via higher returns over the long run.

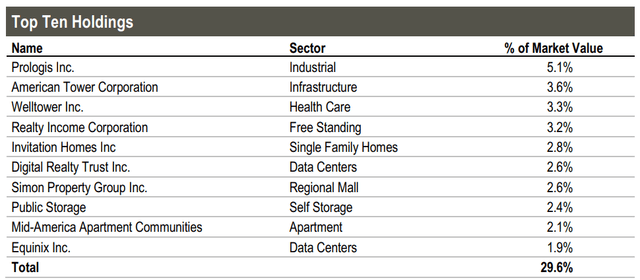

The top ten holdings, about which management clearly feel the greatest conviction based on the ~30% weight, are all larger capitalization REITs.

Cohen & Steers

Of course, a fund like this probably would never have a smaller REIT in the top ten for liquidity reasons. Even so, the top constituents could have been slightly different than they are.

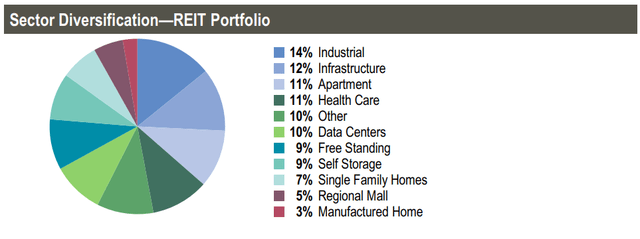

As far as REIT sectors are concerned, it is interesting to note that RNP heavily emphasizes some of the most inflation-protected sectors like industrial, infrastructure, and apartments. Overall, though, the REIT portfolio does appear to be nicely diversified.

Cohen & Steers

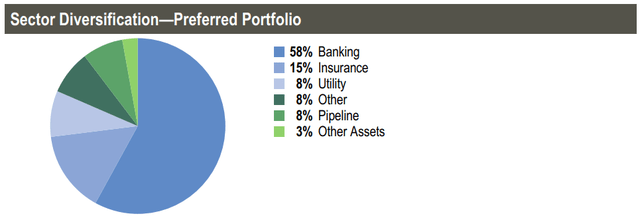

As for the slightly over 50% of the fund (currently) in preferred stocks and other fixed-income securities, this portion of the fund comes almost uniformly from non-real estate issuers like banks and insurance companies.

Cohen & Steers

With yields of 5-8%, these fixed-income securities are a nice buffer against rising interest rates, because the effective interest rate on RNP’s debt can rise substantially without reaching the preferreds’ yields on cost. This maintains a spread between RNP’s debt and asset yields.

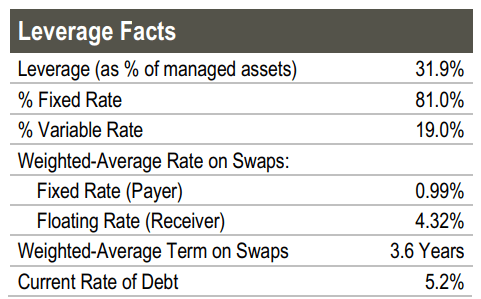

Speaking of debt, RNP utilized leverage just shy of 30% (29.73%) of assets at the end of January, which was down slightly from the 31.9% leverage at the end of December.

Cohen & Steers

At the end of December, over 80% of debt featured fixed interest rates, which puts a ceiling on the increase in interest expenses this year. Since half of the fund is in fixed-income securities, having ~80% of debt at fixed interest rates strikes me as being a conservative way to use leverage.

Also comforting is the fact that the remaining term on interest rate swaps, which keep interest costs fixed for a period of time, is over three years.

Comparison To Peers

Two of RNP’s closest peers that are not managed by Cohen & Steers would be:

- Nuveen Real Estate Income Fund (JRS)

- Neuberger Berman Real Estate Securities Income Fund (NRO)

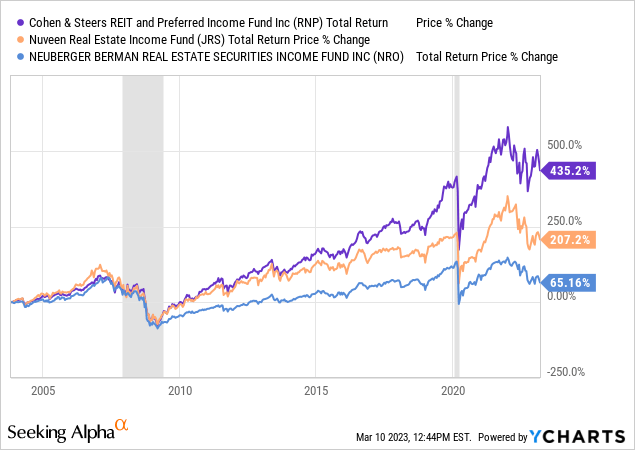

Compared to these two, RNP has produced stunningly superior total return performance over its lifetime:

RNP also enjoys the lowest expense ratio of the three CEFs while also sporting the highest leverage.

| Expense Ratio | Leverage | |

| RNP | 1.33% | 29.7% |

| JRS | 1.75% | 27.9% |

| NRO | 2.06% | 26.9% |

Interestingly, RNP also has the highest exposure to preferreds at 50%, compared to JRS and NRO at about 35%.

Bottom Line

When it comes to publicly traded real estate, Cohen & Steers are generally the best and most reliable managers out there. Rather than being jacks of all trades, they specialize in real estate. It makes sense, then, that one of their actively managed CEFs would outperform other real estate funds and ETFs over the long term.

For income investors and total return investors alike, RNP looks like a great buy right now.