sb-borg/iStock through Getty Photographs

DraftKings Earnings Date: Could sixth

Analysts on the lookout for – ($1.23) EPS 4Q and – ($3.92) for 2021.

Income: On the lookout for ~$1.99b +53% y/y for 2021.

What analysts and observers on reverse sides of a sector name do is usually the identical as authorized eagles litigating a case. There are two abstract approaches to show/disprove a bull or bear situation from the arguments summoned:

The bulls level with confidence, the bears view with alarm.

Someplace in between the strains, a fact endures: the case is both made or not, and from it, you push the button to purchase, promote, or maintain. It is time for all buyers in DKNG to placed on their massive boy or massive lady pants and stare the DKNG future squarely within the face as we head towards their newest earnings name.

DraftKings Inc. (NASDAQ:DKNG), a sterling instance of a inventory made for the “courtroom of funding appeals,” we now current.

The choice earlier than the “jury” because it had been is that this: Okay, there may be a lot accrued conjecture in regards to the sports activities betting sector and the businesses that inhabit it, each bullish and bearish, that it is come time to marshal the important thing arguments in a single place and current the proof to the jury. You’re the jury. Previous to the earnings launch do you purchase, promote or maintain?

All rise. Right here comes the choose.

The bull case: Offered by DKNG administration and the likes of Cathie Wooden & her followers who see sunshine forward

Sports activities betting, now totally authorized/operative in 27 states, has generated a cumulative win because the SCOTUS determination (Could 2018) of $8.2b in win divided amongst 13 firms with a maintain of seven.1% off of $116b whole wagered.

The sustaining win share in opposition to deal with (quantities guess) runs to round 7.1%. So, ought to the enterprise proceed its fast progress arc forward, this is what varied analysts have estimated to be the gross income aim of the US sector by 2025.

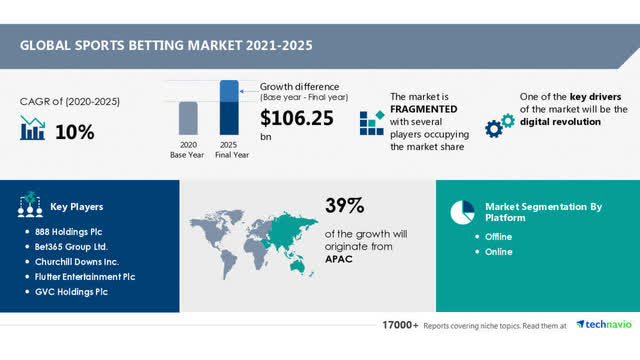

The worldwide estimate by Technavio forecasts income of USD$106b by 2025. That implies that the US section as famous within the forecasts under would produce anyplace between 15% to 35% of the worldwide whole enterprise by 2025.

Google

The win up to now off the $116b wagered implies that so as to attain the forecast $25b in win by 2025 at a 7% maintain, the deal with would want to come back in at round $350b. Satirically, that’s tiny in comparison with what a examine by the American Gaming Affiliation estimated was the quantity legally wagered within the U.S. previous to the SCOTUS determination. $1.7T, sure that is trillion.

When you imagine that authorized sports activities betting has fully put unlawful bookies out of enterprise, I’ve a bridge I might wish to promote you. However what it does inform us is that the authorized betting coming to life after the SCOTUS determination is coming from new bettors. These are usually extra tech-savvy, youthful individuals who love their smartphone apps. They’re prospects who discover the power to put down just a few shekels on their favourite groups only a few buttons away nice enjoyable and diverting – particularly throughout a siege of pandemic.

And that’s the reason DKNG and their opponents are nonetheless throwing billions in promotional offers their manner 4 years after SCOTUS. The place DKNG had and nonetheless has the sting is within the conversion of its superior each day fantasy sports activities prospects to sports activities bettors. So, to higher perceive why DKNG inventory skyrocketed in 2021 to $71.98 on March nineteenth of that 12 months, buyers want to understand the wonderful job DKNG has executed in that conversion.

So what lies forward and the way properly geared up is DKNG to emerge by 2025 as a sector chief?

A cross-section of US sports activities betting income forecasts by 2025

Ark Investments: $37b

G&M Information survey: $18.b

Macquarie: $30b.

Morgan Stanley: $25b

For functions of the bull case offered right here, we are going to cite the Morgan Stanley estimate as our base market income assumption at $25b because it falls someplace within the mid-point between the Ark excessive and the G&M low.

Market share: DKNG is among the many prime three

With out query, DKNG is among the many prime three platforms in US sports activities betting with a sustainable market share we imagine can vary round 15%, assuming it reaches 2025 nonetheless impartial, neither acquired nor merged with one other main platform. That may convey its annual income base to ~$3.7b, or close to double the place analysts count on it reached on the shut of the 2021 gaming 12 months.

For the reason that firm continues to provide working margins deep in destructive territory, we are able to solely take what’s broadly accepted amongst many buyers as an affordable case for an working margin in a very good public firm, which is 15%. Now, this may occasionally look like tight, given the usually extra capacious margins on which digital firms function.

However whereas we count on appreciable consolidation through mergers or acquisitions within the area earlier than 2025, we will not realistically undertaking the prices of aggressive play. That interprets to an unknown advertising spend which is the endgame that can decide gross and internet margins and, by extensions, projected EPS. We assume that three years from now, consolidation added to a diminishing variety of new, massive addressable inhabitants states will convey stability to DKNG advertising spend at a far decrease price per buyer acquisition than right this moment. The corporate is already nudging in that course as we see losses per share narrowing every quarter.

DraftKings has the dimensions to remain among the many prime platforms

DKNG at writing is operative in 18 states of 27 completely authorized. There are three extra states presently in late-stage legislative motion that would produce full legalization earlier than the 12 months’s finish. They’re: Ohio, Maryland, and Nebraska. The inhabitants mixed is 19m, with Ohio alone representing 11m of that whole. What this exhibits is that the features in addressable inhabitants from right here ahead will start to decrease as a lot of the massive states are already within the ballgame.

California, the most important kahuna of all of them (39.5m), is edging closer-but there’s a caveat. If it does go, it’s possible that the enterprise can be handed over to the tribal casinos, none of that are public firms. No person but is aware of if the tribes will function the enterprise themselves utilizing tech stack suppliers, or companion with current platforms.

However at 15%, worse case, DKNG will generate $585m in gross revenue by 2025, a determined leap from its anticipated billion-dollar-plus losses per 12 months it’s now piling up. Texas, with 39m in inhabitants, has had a invoice lingering in its legislature since 2019 with no obvious ahead momentum but.

The slowing tempo of latest legalizations in states with low populations could also be extra bullish for DKNG than what might initially be obvious. The corporate’s Q on Q triple, now double-digit income features have been wrested out of latest state betting. However with fewer new state bettors to pursue, and higher margins extracted from current brand-loyal prospects in mature states, DKNG is well-positioned to maintain lowering its advertising spend and velocity the tempo towards profitability downstream.

DKNG has its share of sponsorships, partnerships and co-marketing offers with leagues and groups that place its model as among the many sector leaders. The worth of those offers lies principally within the visibility they convey to the model to on a regular basis sports activities followers. It additionally has stay sports activities books in casinos.

The case for DKNG will get down to those fundamentals

It has arrived at and can preserve its shut second share of market standing to Fan Duel. Because the sector features in its income base and addressable audiences, it has the dimensions to maintain itself amongst sector leaders. Its model id is powerful, its geographic unfold vast.

Its Day by day Fantasy Sports activities enterprise is stable and properly marketed.

Its current monetary state stays good:

Money readily available (mrq) $2.15b

Money per share (mrq): $5.27

Whole debt: (mrq) $1.32b

Present ratio (mrq): 2.96. This can be a bit on the excessive aspect however properly inside a protected vary in our view at this time limit.

Detrimental money movement: – ($419m) Ought to start to slim.

Leveraged FCF: – ($102m) Ought to start to slim.

So in abstract this is the case for DKNG: you might have a sector chief with a well-established model identify energetic in 17 of the 27 now-legal U.S. sports activities betting markets. You’ve each expectation that within the three states presently nearing legalization famous above that DKNG could have an early entry in every. The corporate has confirmed itself adept at having its ear to the bottom day in and day trip with information of latest legalization statuses and is properly ready to maneuver shortly.

Responding to the massive destructive: When and if will DKNG become profitable by curbing its advertising spend?

The abstract case for DKNG provided by bulls is that this: Sooner or later throughout the subsequent three years, DKNG could have adopted different sector leaders by reining in advertising spend and start to show worthwhile. And when it does, it would produce dramatic earnings features and big gross margins widespread to tech shares that produce massive earnings features quarter on quarter.

Within the interim, it would proceed to burn money at a excessive charge. But it has a pleasant money place on its steadiness sheet now and its capability to borrow, if want be, stays. Its present debt load is comparatively modest, which tells us it will possibly deal with its money burn within the intermediate-term with out piling up large quantities of latest debt. Whereas new state legalizations might are usually fewer and in much less densely populated areas, DKNG can be well-positioned to swoop in and get their share of market among the many leaders.

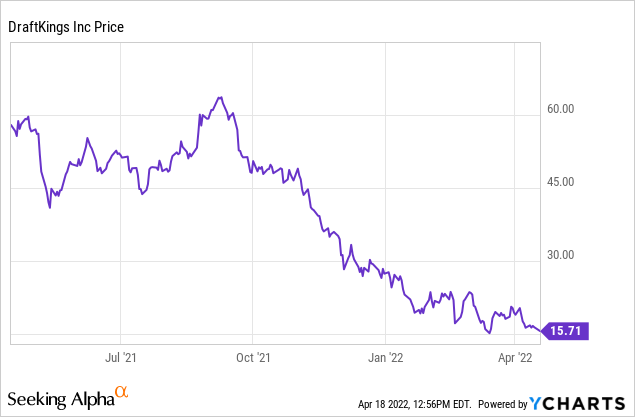

The inventory: DKNG inventory continues to take a beating for a similar causes your complete sector has misplaced a few of its 2021 gloss. The price of buyer acquisition dampens revenue prospects. In a way, DKNG shares have been victimized by its personal success, having traded in an upside frenzy that was not justified by any measure. The inventory is now promoting at its lowest price-to-sales ratio because it turned a public firm.

Sector developments will work to DKNG’s favor. First, key competitor, Caesars Sports activities Ebook, has introduced a dramatic curtailment of its advertising spend to the top of this 12 months, citing the aim of getting worthwhile quicker. WynnBET, the late entry of Wynn Resorts, Ltd. (WYNN), has put the for-sale join on its sports activities betting entry for $500m. Its thesis: The price of advertising in opposition to a slim margin enterprise is a non-starter.

This identical pondering was echoed by Churchill Downs Integrated (CHDN), which introduced it was leaving the sports activities betting enterprise fully as a result of it noticed no gentle on the finish of the revenue tunnel for its personal expanded sports activities e-book enterprise.

With probably sturdy opponents leaving the sector and others reducing down their advertising spend to convey a brand new rationality to the sector, DKNG stays a steadfast chief among the many prime 4 operators within the area.

So, the bull situation, if you happen to purchase it, is saleable: DKNG has the monetary heft to maintain shopping for market share regardless of the losses they produce, maintain on to its ~2m common month-to-month customers, and be among the many leaders in each new state legalized going ahead.

At $16.49 a share in opposition to a consensus PT of $33, it’s clear that a lot of the luster constructed into the inventory throughout its high-flying days was an unjustified frenzy. However at its present worth, with the corporate seeing double-digit income progress in sequential quarters and slowly diminishing EPS losses as advertising spend begins to come back beneath management, we’re a price purchase.

The bear case: DKNG might by no means be worthwhile

At writing, DKNG’s quick curiosity inventory place is 9.55% of the excellent. This tells us that there are a ton of buyers who see an extra fall coming when the corporate releases its earnings just a few weeks from now. That isn’t an unreasonable assumption.

On the identical time, Cathie Wooden’s Ark Investments is telling the world: we’re believers in DKNG. She not too long ago added to her place, shopping for 279,441 shares and thereby boosting her stake to 1.4% or $424m-making her the second-largest holder of the inventory. The pure query is: clearly she’s been worth averaging since a lot of her holdings have been acquired at a lot larger costs. So, what magic does she see in DKNG that appears to evade Mr. Market’s eyes?

We’ve no flies on the wall in her workplace, but it surely appears moderately apparent to us that, given her longstanding bullish outlook on DKNG, she has purchased into the fundamental premise that the corporate is able to persevering with to eat losses, construct its buyer base as the general market expands, and in some unspecified time in the future, it would start to slowly drain the trough of giveaway offers.

At that time, when incremental income features are acquired at an economical foundation, and DKNG instructions its top-tier share of the market within the sector, there isn’t any place for the inventory to go from the place it now trades however again to double or extra.

It is that straightforward. You possibly can undergo exhausting workouts of metrics, technical evaluation, historic buying and selling research, deep dives into the world of sports activities playing, and so on., and nonetheless come up puzzled about DKNG. Just one enduring actuality ought to rely and that’s this: the revenue margin in sports activities betting is so skinny to start with, that the prospect of a pure-play operator within the area ever making important income on the enterprise is problematical.

Most not too long ago, the privately held sports activities merchandise ecommerce big, Fanatics, closed a $100m cope with Amelco, a provider of sports activities betting tech stacks to ship an entire bundle – bettor prepared – to the merchandiser for its long-expected entry into energetic sports activities wagering. Fanatics says it has 80m prospects, and CEO Rubin is telling the world he expects it to be among the many leaders within the betting sector. He could also be in for a impolite awakening, or not. However the level right here is that anybody else coming into the sector, particularly with so huge an current buyer base and valuation, has to provide heartburn to DKNG administration going ahead.

There may be clearly hubris happening right here. Whereas some old-line playing operators depart the area, we have now Rubin lining up his artillery aiming on the crowded area. Is it any surprise the inventory sloshes round with no sure course?

This isn’t to say that at its present worth DKNG may not properly be price a toe-dip previous to what may very well be excellent news on Could sixth. And, after all, if there may be unhealthy information, you possibly can say, how a lot decrease may DKNG go? Properly, the quick cash is betting rather a lot decrease.

Verdict

Our conclusion after our personal newest appraisal of the inventory stays about the place it was the final time we reported. We expect there may be one actually good cause to personal DKNG now: the likelihood, if not the likelihood, that it is going to be purchased by a really deep-pocketed acquirer at a pleasant premium above its present worth. That may very well be price a shot right here with not loads of draw back threat.

Place your bets.