Ilya S. Savenok/Getty Images Entertainment

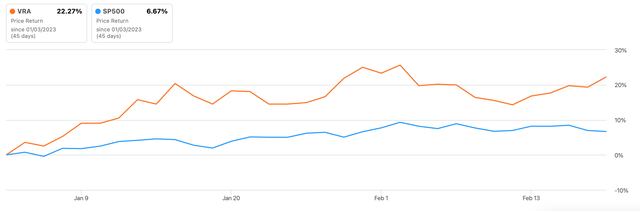

Bag maker Vera Bradley (NASDAQ:VRA) with the joyful sounding tagline “Be Colourful” has indeed had a happy start to 2023. Its share price is up by 22.3% year-to-date [YTD]. While this has likely to do with the current investor interest in consumer discretionary stocks, it stands out since it has outperformed the S&P 500 Consumer Discretionary Index, which has gained 16.3% YTD as I write.

Share price trend (Source: Seeking Alpha)

When I last wrote about it in November 2022, it had already started running up fast, around the time that the company’s new CEO, Jackie Ardrey took over. The company’s third-quarter results created even more optimism around the stock, which has sustained into this year. Here I take a closer look at its numbers to see what has changed since November and if there is any reason to change my Sell rating on it, despite its significant price rise since.

Weak growth figures

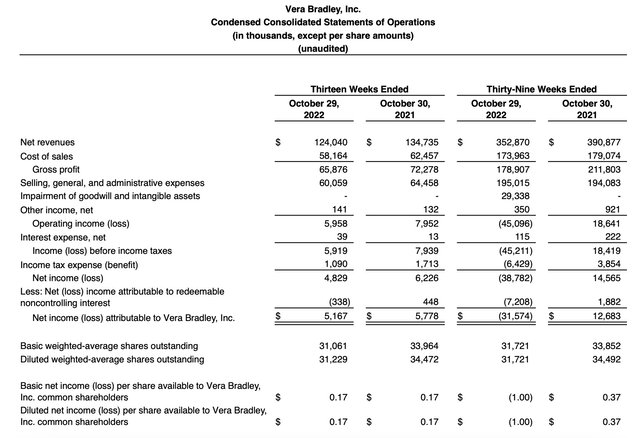

To start with, the company’s sales continued to drop for the third consecutive quarter in the third quarter of the year (Q3, ending October 29, 2022). The decline was 7.9% year-on-year (YoY), while for the first nine months of the current financial year, it’s at 9.7%. I would be willing to chalk this up as a cyclical phenomenon, to which companies like Vera Bradley are particularly susceptible, but a look at its long-term revenue trend reveals otherwise. It has grown in only three of the last 10 years and its compounded annual growth rate [CAGR] is at less than 0.1%.

Source: Vera Bradley

Strong gross margin, but operating profits are wanting

Next, let’s consider its profits. The company has been consistently profit making and its gross profit margin is quite strong at 53.1%. But this obscures the fact that the company’s gross profit growth has been inconsistent, in fact for the year ending January 2022, it was less than it was 10 years ago.

On the operating profits front, the good news is that it reported an operating income for the first time this year in Q3. But its operating margin is pretty low at 6%. Here too, operating profits have weakened over the years. For the last year, they were at just 27% of their levels 10 years ago, and at 64% of the operating profit five years ago.

Outlook and market multiples

Its outlook isn’t exactly optimistic either. It expects both revenues and operating profits to decline from this year. Revenues are seen falling by at least 8.5% and operating income could decline by at least 61.5%. Its diluted EPS is forecast to be between USD 0.22 and USD 0.26. This is less than half the levels of 0.57 it saw last year.

With a run-up in share price and lower EPS guidance, it has a forward non-GAAP price-to-earnings (P/E) ratio of 24.25x at present. This is significantly higher than the 14.9x for the consumer discretionary sector. Its GAAP P/E doesn’t come into consideration because it has reported a loss on a trailing twelve months basis. Going by its non-GAAP P/E alone indicates that its price can see an over 30% drop from the current levels if it were to trade closer to the P/E for the sector.

The company’s price-to-sales (P/S) ratio is at 0.37x, lower than that for the consumer discretionary sector at 0.96x. In any other situation, I would have taken it into consideration when assessing where the price can go next. However, given that Vera Bradley’s revenues have been declining, I don’t think this is the ideal metric to consider.

Some advantages exist

It’s not as if the company doesn’t have its advantages. Its balance sheet in particular looks good, with little debt. This is a particular edge at a time of rising interest rates and even better considering that the company’s operating income looks weak. Its liquidity also looks fine, with a healthy current ratio, though it’s worth pointing out that this is largely because of a high level of inventories.

It’s also on a cost-cutting drive, which could bode well for its income in the coming quarters. In fact, it’s interesting to note that the company has already reported a decline in both cost of revenues and total operating expenses. This is a rarity at this time when most companies are still experiencing relatively elevated costs as inflation persists, even as it has started coming off.

Its new CEO could also bring in fresh changes to Vera Bradley. Audrey, who comes with 25 years of experience in retail, has said she plans to “develop and execute solid growth plans… and deliver consistent, sustainable growth and value to our stakeholders over the long term.” She’s already shaking things up, having eliminated some key positions in the company.

What next?

It would ideal if the value creation were to spill over to share prices as well since the company’s long-term share price trend is weak. An investor who had bought it 10 years ago, would be sitting on a 77% loss on investment right now. And for one who bought it five years ago, the loss would be 41.5%. This isn’t surprising given the company’s inconsistent revenue growth and declining operating income over the years.

It also seems to suggest that if Vera Bradley’s performance continues to sag, so will its share price, irrespective of the recent run-up. At present, it doesn’t seem likely that its performance will pick up soon. At the same time, analysts are positive about its performance for the next financial year. Keeping this in mind, I think its next results are worth looking out for, considering that they will have guidance for 2023.

If it’s positive, the company’s stock could well make gains over the rest of the year. However, for now, I think its price has already run up quite a bit higher than what the fundamentals indicate. This is a good indication to sell it at a high. If the performance truly does improve, it can be bought at a later date again. For now, I maintain my Sell rating on it.