Oaktree Specialty Lending Corporation (NASDAQ:OCSL) Q1 2023 Earnings Conference Call February 7, 2023 11:00 AM ET

Company Participants

Michael Mosticchio – Head of Investor Relations

Matt Pendo – President

Armen Panossian – Chief Executive Officer & Chief Investment Officer

Chris McKown – Chief Financial Officer & Treasurer

Matt Stewart – Chief Operating Officer

Conference Call Participants

Melissa Wedel – JPMorgan

Bryce Rowe – B. Riley

Kevin Fultz – JMP Securities

Kyle Joseph – Jefferies

Erik Zwick – Hovde Group

Ryan Lynch – KBW

Operator

Welcome, and thank you for joining Oaktree Specialty Lending Corporation’s First Fiscal Quarter 2023 Conference Call. Today’s conference call is being recorded. At this time, all participants are in a listen-only mode, but will be prompted for a question-and-answer session following the prepared remarks.

Now, I would like to introduce Michael Mosticchio, Head of Investor Relations, who will host today’s conference call. Mr. Mosticchio, please go ahead..

Michael Mosticchio

Thank you, operator, and welcome to Oaktree Specialty Lending Corporation’s first fiscal quarter conference call. Our earnings release, which we issued this morning, and the accompanying slide presentation can be accessed on the Investors section of our website at oaktreespecialtylending.com.

Our speakers today are Armen Panossian, Chief Executive Officer and Chief Investment Officer; Matt Pendo, President; and Chris McKown, Chief Financial Officer and Treasurer. Also joining us on the call for the question-and-answer session is Matt Stewart, our Chief Operating Officer.

Before we begin, I want to remind you that comments on today’s call include forward-looking statements reflecting our current views with respect to, among other things, the expected synergies and savings associated with the merger with Oaktree Strategic Income II, Inc., the ability to realize the anticipated benefits of the merger and our future operating results and financial performance.

Our actual results could differ materially from those implied or expressed in the forward-looking statements. Please refer to our SEC filings for a discussion of these factors in further detail. We undertake no duty to update or revise any forward-looking statements. I’d also like to remind you that nothing on this call constitutes an offer to sell or a solicitation of an offer to purchase any interest in any Oaktree fund.

Investors and others should note that Oaktree Specialty Lending uses the Investors section of its corporate website to announce material information. The company encourages investors, the media and others to review the information that it shares on its website.

With that, I would now like to turn the call over to Matt.

Matt Pendo

Thanks, Mike, and welcome, everyone. Thank you to all on the call for your interest in and support of OCSL. Prior to my remarks, I would like to note that all per share amounts that we reference on this call have been adjusted for the one for three reverse stock split that we implemented on January 23, 2023.

Now turning to the results. We generated strong results in the fiscal first quarter as we identified compelling investment across sponsor and non-sponsor deals. This robust origination activity enabled us to further capitalize on higher base rates and spreads driving profitability. First quarter adjusted NII was $0.61 per share, a 10% increase from the $0.55 earned in the prior quarter. The increase was driven primarily by higher total investment income that more than offset increased interest expense.

Even as we grew, we remained highly selective maintaining our defensively positioned portfolio and strong credit quality. We again had no investments on non-accrual. We are mindful that in a rising rate environment, overall consumer spending and business investment tend to slow, creating the potential for a recession. As a result, we are proactively managing risks that may arise in our portfolio should the volatility persist.

Given the strength of our earnings, our Board increased our quarterly dividend by 2% to $0.55 per share, this marked the 11th consecutive quarterly increase and our dividend is up more than 90% from its pre-pandemic level at the close of fiscal 2019.

Looking more closely at our first quarter results, we reported NAV per share of $19.63, down from $20.38 for the prior quarter. This decrease primarily reflected the $0.42 special distribution paid by OCSL during the quarter as well as unrealized depreciation related to price declines on certain public debt investments. In January, our portfolio experienced recovery in the prices of our core investments and our NAV as of January 31 was estimated to be up approximately 1% to $19.83 per share.

Turning to the portfolio. We originated $250 million of new investment commitments in the first quarter more than double the level of the previous quarter. Of these 85% were first lien loans. The weighted average yield on new debt investments was 13.1%, which compares favorably to the 9.9% yield on new originations in the September quarter, as we were able to identify and capitalize on investment opportunities with wider spreads in the December quarter.

We received $104 million from paydowns, sales and exits in the first quarter, as we continue to selectively reinvest proceeds into better risk-adjusted opportunities. Importantly, the pipeline is very robust in the current quarter. We are drawing upon the breadth of the Oaktree platform to source attractive deals with strong downside protections.

Looking ahead, we expect substantial benefits from our merger with Oaktree Strategic Income II, Inc., or OSI2, which we closed in January. Our combined company has more than $3.3 billion of assets on a pro forma basis resulting in an increase in first lien investment to 74%, creating greater scale and financial flexibility, while maintaining our value-driven investment strategy.

We expect the merger to be accretive over the near and long term through cost savings, which we expect will total approximately $1.6 million of cost and operational synergies annually. We also will benefit from reduced management fees for the next two years as Oaktree, our manager has agreed to waive $9 million of base management fees in total, $6 million in the first year and $3 million in the second.

Since the closing of the merger, our trading liquidity has improved, and we have been making enhancements to our capital structure. Together, we are in excellent financial shape with strong liquidity and capital levels, and we are well positioned to continue delivering attractive returns to our shareholders.

With that, I would like to turn the call over to Armen to provide more color on our portfolio activity and the market environment.

Armen Panossian

Thanks, Matt, and hello, everyone. I’ll begin with comments on the market environment. The US job market finished calendar 2022 in relatively strong shape with steady job growth. The economy also grew at an annual rate of 2.9% in the calendar fourth quarter. However, both measures marked slowdown from earlier months, likely reflecting the Federal Reserve’s aggressive rate actions. While futures markets anticipate additional rate increases at the next two Fed meetings, they are also betting that they will pause by late spring and before the end of the calendar year, begin to once again lower rates.

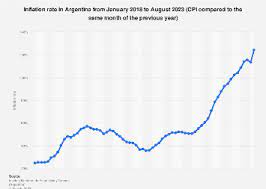

The case for this dovish pivot appears driven by the expectation that US inflation will continue to decline at a fairly rapid rate. However, while inflation in the US has slowed, China, the world’s second largest economy has fully reopened, which will likely boost global economic growth and may simultaneously exert upward pressure on global inflation this year, impacting prices in the US.

Further, the US labor market continues to be historically tight with strong job growth and the lowest unemployment rate in more than 50 years. Still, recent figures show a mixed picture of US economic health, wage growth is leveling off and consumer spending is starting to ease, signaling that the US economy is slowing and could slide into recession.

All of that noted, the uncertain economic backlog creates new opportunities for Oaktree. We have experienced across all market cycles and with a strong capital base and a long-term perspective, we have the conviction needed to withstand short-term volatility and continue to invest and generate strong returns for our shareholders.

While we will remain cautious moving forward, we are also confident in our team’s long history of identifying new investment opportunities, while maintaining solid credit quality. As you have heard me emphasize on previous calls, we focused on relative value in areas of the market where we can find the best risk-adjusted returns.

We draw upon Oaktree’s scale and resources to invest across multiple areas, including the sponsor and non-sponsor backed markets, leveraging the firm’s ability to negotiate and structure customized deals that provide downside risk protection. Altogether, we are deploying capital on favorable terms to further build our portfolio and generate strong returns for our shareholders.

Now turning to the overall portfolio. At the close of the first quarter, our portfolio was well diversified with $2.6 billion at fair value across 156 companies, up from 140 a year earlier. 86% of the portfolio was invested in senior secured loans, with first lien loans representing 72%, underscoring our emphasis on being at the top of the capital structure.

We continue to emphasize larger, more diversified businesses that present lower risk, because they’re better equipped to navigate downturns. Overall, our borrowers have been navigating the current inflationary environment very well and have continued to experience steady performance despite the challenging market conditions.

Median portfolio company EBITDA as of December 31 was approximately $128 million, generally in line with the prior quarter. Leverage in our portfolio of companies was relatively steady at 5.1 times, well below overall middle market leverage levels.

The portfolio’s weighted average interest coverage declined slightly to 2.5 times as of December 31 from 2.7 times in the prior quarter due to rising base rates. We leverage the Oaktree platform to originate $250 million of new investment commitments, of which $235 million was committed to new portfolio companies in the quarter.

Let me share a few representative examples of our new investment activity. First, we originated a non-sponsored loan to Superior Industries, a public company that is a leading designer and manufacturer of aluminum wheels. It sells to original automobile and light truck equipment manufacturers, as well as aftermarket distributors in North America and Europe. The company holds a strong market share, maintains a low leverage profile and generates high free cash flow, supporting healthy margins.

The deal consisted of a $400 million sole Oaktree commitment in a senior secured term loan that was used to refinance existing debt. OCSL was allocated $40 million and the loan was attractively priced at SOFR plus 800.

LATAM Airlines Group is another good example from our first quarter. It is a leading provider of passenger and cargo air transportation services throughout Latin America and it also applies to major destinations in North America and Europe.

As you may recall, OCSL previously had an investment in LATAM as part of its restructuring in late 2020. The company came back to the market to refinance existing debt and raise additional working capital. A deal involved an Oaktree led $1.1 billion syndicated loan, of which Oaktree funded $750 million, priced at SOFR plus 9.5% with call protection and an 8.5% original issue discount. OCSL was allocated $26 million of the total loan. Notably, we are also continuing to find opportunities in discounted CLO debt and ABS. Our CLO and ABS purchases totaled $20.7 million in the quarter with an average price of 87% of par. We see significant potential for upside should these return to par over time.

In summary, our strong liquidity position, experienced across both periods of growth and contraction as well as the sourcing power of the Oaktree platform continue to put OCSL in excellent position for 2023.

Now, I will turn the call over to Chris to discuss our financial results in more detail.

Chris McKown

Thank you, Armen. OCSL delivered another quarter of strong financial performance beginning fiscal year 2023 with good momentum. For the first quarter, we reported adjusted net investment income of $37.1 million or $0.61 per share, up 10% from $33.7 million or $0.55 per share in the fourth quarter of fiscal year 2022. The increase was primarily driven by higher interest income resulting from rising base rates, partially offset by higher interest expense.

Net expenses for the quarter totaled $40.3 million, up $6 million sequentially. The increase was mainly due to $5 million of higher interest expense as a result of the impact of rising interest rates on the company’s floating rate liabilities and modestly higher base management fees and Part I incentive fees due to the larger portfolio and its strong performance for the quarter. Professional fees were up slightly due to seasonality.

Turning to our credit quality, which continues to be excellent. As Matt mentioned, we had no investments on non-accrual at quarter end. With respect to interest rate sensitivity, OCSL still remains well situated to continue to benefit from a rising rate environment.

As of December 31st, 87% of our debt portfolio at fair value was in floating rate investments. Our strong earnings in the first quarter were again due to the higher base rates, which in turn drove our interest income higher.

We expect the most recent rate hikes will continue to have a positive impact on earnings. If base rates as of December 31st were in effect for the entire quarter, we estimate that our adjusted net investment income per share would have been about $0.03 higher resulting in adjusted NII of $0.64 per share.

Now, moving to the balance sheet. OCSL’s net leverage ratio at quarter end increased from the September quarter to 1.24 times based on our robust and opportunistic originations in the quarter, lower repayment activity, and a modest decline in NAV.

Leverage is now towards the higher end of our target range of 0.9 times to 1.25 times debt to equity. However, leverage will come down slightly on a pro forma basis with the OSI 2 merger to approximately 1.16 times.

As of December 31st, total debt outstanding was $1.5 billion and had a weighted average interest rate of 5.6%, up from 4.4% at September 30th due to higher base rates. Unsecured debt represented 43% of the total debt at quarter end, down modestly from the prior quarter.

At quarter end, we had ample liquidity to meet our funding needs with total dry powder of approximately $357 million, including $17 million of cash and $340 million of undrawn capacity on our attractively priced credit facilities.

Unfunded commitments — excluding unfunded commitments to the joint ventures, were $172 million with approximately $130 million of this amount eligible to be drawn immediately as the remaining amount is subject to certain milestones that must be met by portfolio companies.

Shifting to our two joint ventures. At quarter end, the Kemper JV had $409 million of assets invested in senior secured loans to 59 companies, up from $385 million last quarter, primarily driven by $25 million of additional contributions from the company and our JV partner, as well as new originations and partially offset by declines in the portfolio due to market credit spread widening.

The JV generated $2.6 million of cash interest income for OCSL in the quarter, up from $2.2 million in the fourth quarter as a result of the portfolio’s continued strong performance and the impact of rising interest rates on floating rate investments. We also received a $1.1 million dividend, up from $875,000 in the prior quarter. Leverage at the JV was 1.4 times at quarter end, unchanged from the prior quarter.

The Glick JV had $137 million of assets as of December 31, down from $147 million at September 30. These consisted of senior secured loans to 40 companies. Leverage at the JV was 1.3 times at quarter end, and we received $1.9 million of principal and interest repayment on OCSL’s subordinated note in the Glick JV during the quarter.

In summary, we are very pleased with our financial results for the quarter. We continue to believe that our solid portfolio and strong balance sheet position us well for the remainder of the fiscal year.

Now I will turn the call back to Matt.

Matt Pendo

Thank you, Chris. Our strong financial results for the quarter enabled us to generate an annualized return on adjusted net investment income of 11.9%, up from 10.7% in the prior quarter. While we are very pleased with the growth in our earnings over the past several years, including our solid first quarter results, we believe OCSL remains well positioned to maintain and even build upon our strong ROE going forward.

First, we believe OCSL continues to be positioned well for this rising rate environment, with 87% of our investment portfolio in floating rate assets, we expect to further benefit from the remaining interest rate increases that are expected to occur in the next few months. And as we have discussed on prior calls, we continued to benefit from higher ROEs being generated at our joint ventures.

During the first quarter, both joint ventures delivered ROEs of over 14%, as they are also benefiting from the rising rate environment and our ongoing portfolio rotation efforts. As I noted earlier, we expect that the cost savings and management fee reductions resulting from the OSI II merger will also support our returns.

In conclusion, we are very pleased with our strong start to the fiscal year. Our portfolio is healthy, and we are well positioned to continue to capitalize on this increasingly attractive investment environment with our ample dry powder. Thank you for joining us on today’s call and for your continued interest in OCSL.

With that, we’re happy to take your questions. Operator, please open the lines?

Question-and-Answer Session

Operator

We will know begin the question-and-answer session. [Operator Instructions] Thank you. And our first question is coming from Melissa Wedel from JPMorgan. Melissa, please go ahead.

Melissa Wedel

Good morning. Thanks for taking my questions today. First, I just wanted to say thanks for the information that you provided sort of pro forma for the combined portfolio. I think it was slide 18 in the deck. Unless, I missed it, I was wondering, if you could help us think about what that combined pro forma portfolio yield looks like. With OSI 2 a little bit lower yielding than OCSL?

Matt Stewart

Hi. It’s Matt Stewart. The pro forma yield is going to be pretty much unchanged post merger. The overlap from OSI 2 into OCSL was around 97%. So, significant overlap, and so there’s no material move in the portfolio yield.

Matt Pendo

I think, Melissa, it’s Matt, as you think about kind of the merger, I think the question – and you build the pieces, to Matt’s answer the portfolios are pretty much identical. We’ve got tailwind from rising rates that Chris talked about. We’ve got the cost synergies, $1.4 million operational synergies, plus $200,000 to $300,000 of interest expense plus the fee waiver and you kind of add all those together to kind of build your – if you look, kind of your March quarter.

Melissa Wedel

Got it. That’s very helpful. Thanks. And I assume the floating rate exposure would be similar as well given the high degree of portfolio overlap.

Matt Pendo

Yes.

Melissa Wedel

Got it. Okay. That’s my two questions. I’ll hop back in the queue. Thanks.

Operator

Our next question is coming from Bryce Rowe from B. Riley. Bryce, please go ahead.

Bryce Rowe

Thanks. Good morning. Wanted to maybe start on just the origination activity for the quarter, a nice strong quarter from a commitment and funding perspective, wanted to get a sense for you all if this quarter’s activity was more kind of seasonal strength, or would you say the opportunity set was just more attractive here in the December quarter?

Armen Panossian

Thanks for the question, Bryce. It’s Armen. So I think that, in the first half of 2022, pricing on the sponsor side of the market was generally not that attractive. We were very cautious about what we were doing on the sponsor side for most of the year. But beginning in August and September, it seemed like there was an air pocket in the market, especially on the sponsor side, pricing widened legal terms improved. And we’re able to originate some very attractive sponsor and non-sponsored transactions.

I think, it’s hard for me to say that, it was a seasonal thing. But our activity was faster than what it had been because of the quality of the deal flow, the pricing of it, the lower loan to values, the better legal terms. So I wouldn’t characterize it necessarily as seasonal, but it certainly was opportunistic, and I would say that in January, it’s been a little bit slower, but we have been building up a decent pipeline for the rest of the first quarter and into second quarter.

So I think there was a little bit of a rush to get deals done in November and December that is now resulting in sort of pulling forward of deals that would have otherwise occurred in January. I don’t know if you would call that seasonal, but it’s — these are kind of situations that have different time line. So I think that just in light of the fact that we saw some good deals, we really pushed heavy in the fourth calendar quarter to get that — to get those deals done.

Bryce Rowe

That’s helpful, Armen. And then just around pricing of the new commitments, you highlighted a 13% plus weighted average yield, are you still seeing that level? And I think you mentioned at least you called out to specific investments. It sounded like both of those carry pricing that was around that level that you highlighted as far as the weighted average yield for the new commitments for the quarter. So I’m just trying to get a feel for whether that’s an anomaly, or you’re still seeing that level of pricing on actionable opportunities in the current environment?

Armen Panossian

Yeah. I would say the frequency of our deal flow, if you were to line up the pipeline that we have, there is a little bit of a difference between sponsor-led deal pricing versus non-sponsor. The non-sponsored is certainly in that 13, 14, sometimes higher ZIP code. The sponsor deals that we’re doing these days are pretty much always first lien. The pricing is pretty much in the SOFR plus $650 million to $700 million range and with SOFR 4% and with OIDs on origination of two or three points, they’re solving to about 12% — 11.5% to 12% for sponsor-led deals.

So it is, I would say that most of the deals we’re seeing are a little bit shy of 13%, but not a lot. Not — I wouldn’t say several hundred basis points lower, it’s maybe 100 or 150 basis points lower. I do think that as long as base rates stay where they’re at and as long as the market technical stay in this type of dynamic where there’s a more balanced interaction between lenders and private equity sponsors. That this type of pricing in the, call it, 11% to 14% range is possible.

Bryce Rowe

Okay, okay. All right. Maybe last one for me. In terms of the joint venture, you saw a bit of an uptick in the dividend coming into OCSL from the — from at least one of the joint ventures. Just curious if that’s more a function of the higher ROEs that the joint ventures are generating, or is it a function of the, I guess, the increased investment you made in the JV here in the December quarter? Thanks.

Matt Stewart

Hi, it’s Matt Stewart. It’s a little bit of both. During the quarter, we drew down about $25 million of additional capital into the JV that we deployed into the market. But we did get the benefit of base rates that we saw in the portfolio, in OCSL as well. But it’s a little bit of both, and we were able to deploy a decent amount of capital during the December quarter.

Bryce Rowe

Okay, great. Thank you guys.

Operator

And our next question is coming from Kevin Fultz from JMP Securities. Kevin, please go ahead.

Kevin Fultz

I want to follow-up on Bryce’s question on the investment landscape. Clearly, it was a very active quarter of investment activity. And I’m just curious, how you would compare the attractiveness of the current vintage of deals that you’re doing relative to historical periods? And then if you can maybe parse out sponsor versus non-sponsor opportunities?

Armen Panossian

Sure. Thanks, Kevin. So I would say, let’s talk about non-sponsored first. Those deals are always bespoke. It’s hard to say what the “market pricing” is for a non-sponsor deal, because every one of the transactions are so different. The competitive dynamic is very different between non-sponsored and sponsored, while it feels like non-sponsored pricing is wider, it doesn’t feel several 100 basis points wider. It’s maybe 100 to 200 basis points wide of where it was a year or two ago. But more importantly, the legal terms and protections around non-sponsored transactions have always been tight, but I feel like they’re a little bit tighter these days versus a year or two ago. And the loan-to-values are a little bit lower these days than there were a year or two ago.

Now with that said, loan-to-values and non-sponsored transactions are always lower than sponsored deals, at least the deals that we do are always lower loan-to-value. So this is kind of incrementally tighter loan-to-values versus non-sponsor historically versus non-sponsor today. So it is certainly more attractive. But non-sponsor deals are certainly very difficult to find. And they’ve always been that way, and they continue to be that way.

On the sponsored side, a typical first lien transaction for a new deal, I would say, has changed in two very important dimensions. One is pricing. A typical first lien sponsor deal with 4.5 to 5 turns of leverage was usually done at a roughly 55% or 60% loan-to-value and pricing of SOFR plus 500 to 550. That’s what it was — what the market was in for 2019 and 2021 and for the first half of 2022 that range kind of held true.

But pricing these days, especially since August or September of 2022, for that same deal loan-to-value has declined. So that’s the first dimension of change that’s important. It’s loan-to-values are now 40% to 50% rather than 55% to 60% and pricing has widened. And I would say, typically, pricing is SOFR plus 650, 675. And for — if leverage is a little bit higher, it could get as high as soups 700 for a sponsor transaction.

These are for businesses that are not tech or software LBOs, tech and software LBOs are at least 50 basis points wide. They’re usually SOFR plus 725 to 800 in that range for a tech LBO deal. So again, pricing was wider by, call it, 150 basis points, 125 to 150 basis points and loan-to-values are lower by 10 to 20 percentage points in sponsor land.

I think in — on the third dimension that we would like to see more change is actually in the case of covenants. The middle market sponsor deals have always had a covenant, a maintenance covenant or two. They continue to have maintenance covenants.

On the large cap end, it ebbs and flows, we saw a return of covenants in the fourth calendar quarter for large-cap deals, sponsor deals. So, companies with $100 million of EBITDA or more. We did see a return of covenants there, because the banks have stepped back with a broadly syndicated loan market, and we’re no longer an alternative for that borrower base. But that technical shifts pretty rapidly. We saw a deal that we were engaged on with a very large private equity sponsor a few weeks ago, very large equity check, something like 65% of the total capital structure, 35% loan-to-value on that deal. And effectively, that sponsor was able to syndicate it out to a group of direct lenders, probably 10 to 20 direct lenders for a roughly $800 million transaction. And we’re — and in so doing, that competitive dynamic was able — they were able to remove the maintenance covenant and essentially execute a covenant-light deal.

And we passed on that transaction when we saw that the covenant was falling away, because we thought that the company actually had cyclicality to it, and we’re not inclined to do a covenant-light deal for that.

But — so that dimension in terms of maintenance covenants is an important one to us. And I think that in the fourth quarter — fourth calendar quarter, it looked really good, but it could — that could change kind of quickly depending on competitive dynamics in the sponsor space.

Kevin Fultz

Helpful color there. And I’ll leave it there. Congratulations on really nice quarter and for completing the merger.

Armen Panossian

Thanks, Kevin.

Operator

The next questioner is Kyle Joseph from Jefferies. Kyle, go ahead.

Kyle Joseph

Hey, good morning, guys. Thanks for taking my questions. Curious to get your take on expectations for credit this year. Obviously, it seems like rate increases haven’t yet impacted company credit performance broadly, including your portfolio.

But is that kind of a timing thing? Like, how long can companies continue to perform under this higher rate environment? And how do you expect credit performance for the industry this year? And do you see any opportunities resulting from that?

Armen Panossian

Thanks, Kyle. This is Armen, again. So credit quality, I think, you’ve got to parse out the two pieces that influence credit. First is unlevered performance of companies and the second is the elevated cost of borrowing.

In terms of the unlevered performance of companies, I would say that, generally speaking, if the company has not been a beneficiary of inflation. So, for example, an energy-related company or a commodity company that benefits from inflation, assuming the way — assuming that is not the case, the typical borrower in the US, generally speaking, has raised prices, and therefore, revenues are generally up and were up in 2022 year-over-year.

However, the pace that — of inflation in the cost structure has outpaced the revenue increases generally for companies. So I would say that, while revenues are up, dollars of gross profit or dollars of EBITDA have not materially changed, and, in some cases, might have even declined.

So the EBITDA margin or gross margin of these businesses, I would say, by and large, is flat to down, even though revenues are up. And that — it’s very generic statement. Obviously, there are exceptions to that type of generic statement.

But I would say that the unlevered performance in an inflationary environment is troubling because, with the increase in prices that companies have passed through to their customers, we are approaching the point where, in some industries, there’s demand destruction and you’re seeing a slowdown in the growth rate of quantities sold.

So that’s something we’re watching closely. I would say, there isn’t a very rosy picture, an upside picture for unlevered performance of companies. I don’t think any business is just crushing it and doing a great job, inflation notwithstanding.

Now in the case of leverage free cash flow, which is, obviously, cash flow after the cost of — the elevated cost of borrowing, that is a problem, especially as base rates become consistent through the quarter. I mean, they’ve — base rates have been increasing for the last 9 months, 12 months. And every quarter, you sort of — you have a lagged impact of base rates as the SOFR or LIBOR contracts reset, base rates continue to rise in the fourth calendar quarter. And in fact, our dividend or our ROE on our portfolio would have been higher at base rates at the end of the quarter were the same at the beginning of the quarter. So, there is certainly some catching up of — in company performance because there is a lagged effect on the cost of borrowing rising through quarters. So that doesn’t bode well for borrowers. It’s great for the yield on portfolio for investment managers like us, but for borrowers, obviously, it has become a material change in their performance on a levered basis.

A lot of these businesses ignoring our portfolio, but let’s just look at the market overall, direct lending was pricing at LIBOR plus 500 to 550 generically for the last three or four or five years. When LIBOR was at 25 basis points, these companies at a 1% LIBOR floor, so those — that cost of debt at the time of issuance was 6% to 7%. Now, you have a 300 basis point increase in SOFR above that LIBOR floor, which is a 50% increase in the cost of borrowing for the unhedged borrower. That’s pretty material in light of the fact that on an unlevered basis, the corporate performance of these companies is challenged, as I mentioned earlier in my answer.

So, I do expect for there to be elevated risk in portfolio generally elevated defaults, especially in broadly syndicated loans. In direct lending, it’s hard to say if the risk will translate into default because of the bilateral nature of lenders and borrowers in the direct lending landscape. So, I think defaults will probably be muted, but the reality is that there will be stress in portfolios that will need to be handled by direct lenders, especially those lenders that have been that have been supporting highly levered LBOs over the last few years at pricing of LIBOR plus 500 because they will have borrowers that are the most stretched in terms of debt to EBITDA and the most stretched in terms of interest coverage ratio. So, it’s something to watch. And I think the default rates on broadly syndicated loans will rise and that should be a proxy for what’s happening in terms of stress in direct lending portfolios.

Kyle Joseph

Got it. And then one quick follow-up for me. Just in terms of your prepayment or repayment pipeline, it doesn’t sound like the merger should have really any material impact on that given the overlap, but kind of the outlook for repayments broadly in 2023, given all the moving parts macro-wise?

Armen Panossian

Yes, it’s a good question. It’s hard to predict. But I would say that our non-sponsored deal flow, the characteristics that those borrowers have are that they took on leverage from us to achieve a strategic goal, not to financially engineer equity results.

So, when those strategic goals are accomplished, we get repaid. We got repaid on several transactions that met this definition in 2022. We have some expected repayments over the next several months, again, in the non-sponsored area where we lend to businesses that were experiencing some growth and they had to make some capital expenditures to sustain that growth.

So, we — and that cost of debt, as I mentioned, on non-sponsored lending is generally higher than sponsor lending, which means that we are going to look very expensive when these businesses to achieve their goals. And so we expect to get paid off, refinanced in some of those non-sponsored transactions this year.

On the sponsored side, it’s hard to see that happen. Sponsor LBO transaction volume seems to be declining because of the elevated cost of borrowing on new deals, which means that a lot of sponsored businesses that are in our portfolio or in the markets overall, they’re unlikely to transact from one sponsor to the next or from a sponsor to an IPO, which means that those particular loans on the sponsor side probably don’t see material repayments in 2023. So that’s our expectation.

Now with that said, we also do have a publicly traded book. January has been a very strong month. In the publicly traded book we view that over time as a source of cash as well. And therefore, you might see some “repayments” because of trading activity that we take on. And we will turn that cash around and deploy it into private debt, hopefully, higher yielding, more sort of structured private debt than what you typically see in the market?

Matt Pendo

And just picking up on that, we’ve covered this a bit earlier. It’s Matt, Kyle. The OSI II portfolio has the same liquid makeup as OCSL. So it’s just more of that asset we can rotate out of.

Kyle Joseph

Yes. Got it. Thanks a lot for answering my questions.

Armen Panossian

Thanks, Kyle.

Operator

We will now take a question from Erik Zwick from the Hovde Group. Erik, please go ahead.

Erik Zwick

Good morning. Thank you. Just wanted to first start with a question on portfolio leverage. You indicated that you’re at the top of the range now and with pro forma for OSI II closing down to about 1.16. But given the fact that over the past 12 months, you were able to go from kind of call it the bottom of your range to the top of your range and it seems like investment opportunities are still plentiful today. How do you think about managing that leverage and continuing to grow out the portfolio here in the near-term?

Armen Panossian

Yes. Thanks, Eric. So a couple of things. One is, we have seen some of the best opportunities in direct lending over the last several months than what we — better than what we’ve seen over the last several years. And that’s why we felt the conviction to increase our leverage and take advantage of those opportunities.

We did also buy publicly traded debt as that market went through some very deep choppiness in 2022. And I would say that public book is a source of cash to fund new private deals without increasing leverage. We don’t intend to increase leverage from the current levels.

We’re always looking at potential market activities, where we can increase the size of our portfolio as well. So we’re — I think that – I think that we can grow, but we’re not going to want to grow through leverage at this point. We’re just going to kind of work within the portfolio and do whatever we can on the capital market side, when appropriate. So that’s all I could say about that.

Chris McKown

Yes. I think one of the things that as you look at the December quarter, that balance sheet was pre-merger, but we were working on the merger, announced the merger. We had the vote for January. So we are anticipating and expecting kind of managing the portfolio, assuming the merger would be completed. So that’s why like the 1.16 number is really more operative than the 1.24 times

Erik Zwick

That’s helpful. And just a bit of a follow-up on the secondary market. Opportunities you mentioned, certainly a little bit slower in the last two quarters, but the pricing that you saw in the most recent quarter, according to Slide 6 was the most attractive you’ve seen. So just curious if that was a, a one-off opportunity, or would you expect to continue to see similar opportunities maybe in the next quarter or two at attractive pricing like that?

Armen Panossian

Yeah. I think the pricing is relatively consistent in terms of the opportunities we’re evaluating now. Again, sponsor-led private credit is SOFR plus 650, 675 for the typical deal non-software transaction, software’s at SOFR plus call it 750 or thereabouts. That’s pretty consistent today versus the last quarter or the quarter before.

And on the non-sponsored side, its north of that, generally, what’s hard to predict at this point is the pace of the deal flow. It’s – on the non-sponsor side, especially, there are periods of time, where we do a lot in one quarter. It just happens to be the case. But because it’s pretty opportunistic and bespoke, we really have a tough time predicting the pace at which we originate on the non-sponsored side. But pricing-wise, it’s I would say, holding in there, at least for now year-to-date versus last year – versus the back half of last year.

Erik Zwick

Got it. And one last one, if I can squeeze it in. Just looking at the press release that there was 42 equity investments currently today, 30 of which you also hold a debt investment. So for those 12 where you don’t currently have a debt investment, are these opportunities whether the debt has repaid and you still have equity investments, or are there times or you take solely make an equity investment in companies?

Armen Panossian

Yeah. We generally don’t take equity investments solely. It would be in a small handful of instances, the legacy portfolio that we acquired from Fifth Street that had restructured and we own equity in those small handful, or it’s an equity position that is left over from a debt position that did repay. But we don’t buy just straight equity without – without a debt component attached to it as a matter of policy.

Erik Zwick

That’s what I figured. Thanks for confirming. That’s all for me today. Thank you.

Operator

A question comes now from Ryan Lynch from KBW. Ryan, please go ahead.

Ryan Lynch

Hey, good morning. First question I had was just when I look at your liability structure post merger with OSI 2. It looks like your guys’ total unsecured borrowings drops to about 36% from 43%. Are you guys comfortable operating at that range where you’d be post-merger, or are you guys – would we expect you guys to look at the capital markets to increase that number to a level closer where you guys have kind of operated historically?

Matt Pendo

Yeah. Ryan, it’s Matt. Good questions. So specifically answers, are we comfortable at this level? I’d say, the answer is we are comfortable. The liability structure in OSI 2 with the liability structure we created, we knew the assets. That was one of the advantages of the transaction. So that just kind of moves over and we’re able to actually re-price some of it more attractively. That being said, we’re always looking at the unsecured market. We’ve had very good success, the two unsecured deals. I think, we’re priced well, traded well. I think we have a very happy base of fixed income investors. So we’ll continue to look at that as that market performs, or kind of reopened.

So we look at both, but we’re comfortable where we are, but we obviously like to have a very balanced liability structure and capital structure in general.

Ryan Lynch

Okay, understood. And Armen, you gave, I would say, fairly downbeat commentary on the outlook for credit quality, at least in the private credit markets broadly, given that fundamentally, it sounds like unlevered business performance is performing not great, given tightening EBITDA margins and then obviously there’s pressure on levered cash flow given higher rates. Do you expect now that inflation is showing some signs of easing, it’s still pretty high, would you expect there to be any reversal in 2023 of any of those trends from a margin pressure, or is inflation just still too high?

And then kind of a separate question on that, because you mentioned pressure on EBIT or on levered cash flow. You all provided the estimated range of interest coverage of 2.5 times, which is slightly declined from the prior quarter, which provides some, I think, some value, but really in this marketplace, it’s really going to be the tail end risk of those borrowers that are going to be — is really the tail risk from higher rates on certain borrowers that are running closer to that lower leverage point.

So have you guys done any analysis that looked at your current portfolio where either rates are currently or where the forward LIBOR curve is, what percentage of your current portfolio would fall below that one times interest coverage?

Armen Panossian

Yeah. Good question. So we are always looking at our portfolio in terms of assessing risk profile levered on a fundamental basis or on a levered free cash flow basis. I don’t have what percentage of our portfolio would be less than one times fixed charges, but it wouldn’t be much or any of the portfolio.

And you’re right that the tail risk is the part of the market to look at — or the part of the portfolio to look at versus the average. But generally speaking, our portfolio is pretty lightly levered. And we do look at it on what our fixed charge ratio is and leverage profile is for sponsored versus non-sponsored versus publicly traded.

And we’ve done a good job of managing leverage profile and fixed charge coverage to a point where we really don’t have meaningful watch-list names, and that’s evidenced by the fact that we don’t have anything on accrual.

So we’re watching it closely, but I wouldn’t — I don’t have anything to report to you to say like X-percent of our portfolio would fall below one times coverage if base rates stayed here for 12 months. We don’t have something like that to report at this time.

But in the first part of your question, do I think that if inflation moderates, that some of this will reverse? It’s a great question. So I think, generally speaking, companies have increased prices, but at a slower clip than the increase in the cost of goods sold.

Now for a reversal to occur, that means prices would need to decline in terms of the cost of goods sold, but the revenue side of the price equation would need to stay flat. Now there will be a period of time where that’s possible, where price increases are happening on a delayed basis, but cost of goods sold are stabilizing. Generally speaking though, you don’t see a material reduction in cost of goods sold after an inflationary period. Inflation slows, but it doesn’t go negative, generally.

In some industries, it could, sometimes building products like timber prices, steel prices, concrete prices may for a period of time decline, if demand declines. But I wouldn’t say, by and large, that that’s something that we would expect to see that a meaningful price decline in cost of goods sold that create an outsized profit earning opportunity.

Now it’s hard to predict what happens in 2023 with inflation and rates. I do think that the pace of inflation is showing signs of slowing, that’s a good thing. It does point to a pivot at some point. However, the market seems to believe a pivot is going to happen in 2023. I think that’s probably a little bit too rosy. I think the downside surprise here with the Fed is that they leave rates high for a little bit longer than what people expect to make sure that the inflationary picture is under control.

So I wouldn’t bet on this outsized profit earning opportunity in 2023, but it could happen. I think stability is possible in late 2023 or more likely in 2024 with a more stable kind of supply-demand balance and cost of borrowing stability for most companies. So it’s coming, but I just don’t think it’s this year.

Ryan Lynch

Okay. That’s helpful. That’s all for me today. Appreciate the time.

Armen Panossian

Thank you.

Operator

And this concludes our question-and-answer session. I would like to turn the conference back over to Mr. Mosticchio. Please go ahead.

Michael Mosticchio

Thank you, Marliese, and thank you all for joining us on today’s earnings conference call. A replay of this call will be available for 30 days on OCSL’s website in the Investors section or by dialing 877-344-7529 for US callers or 1-412-317-0088 for non-US callers with the replay access code 6846351 beginning approximately one hour after this broadcast.

Operator

Thank you for attending today’s presentation. You may now disconnect.

![[Watch] Fans chant “Kohli, Kohli” near LSG’s dugout after SRH denied a no-ball in IPL 2023 [Watch] Fans chant “Kohli, Kohli” near LSG’s dugout after SRH denied a no-ball in IPL 2023](https://staticc.sportskeeda.com/editor/2023/05/32991-16839809789920-1920.jpg)