Updated on February 2nd, 2023 by Nathan Parsh

PPG Industries (PPG) is one of the largest paint companies in the world. It is also one of the most reliable dividend stocks in the market–PPG has paid dividends every quarter since 1899.

Moreover, the company has increased its dividend each year for the last 51 years, which qualifies it to be a member of the exclusive Dividend Aristocrats list.

This is a group of 68 stocks in the S&P 500 Index with at least 25 consecutive years of dividend growth.

We consider the Dividend Aristocrats to be among the elite dividend-paying companies. With this in mind, we created a full list of all 68Dividend Aristocrats.

You can download the entire Dividend Aristocrats list, with important financial metrics like dividend yields and P/E ratios, by clicking on the link below:

The stock is also on the exclusive list of Dividend Kings.

PPG’s remarkable dividend consistency gives it broad appeal to the more conservative members of the dividend growth investing community.

Indeed, the company has a very safe dividend payment with room for steady dividend increases each year, thanks to its strong business model. This is still very much the case today.

This article will analyze PPG’s investment prospects in detail and determine whether the company merits a buy recommendation at current prices.

Business Overview

PPG Industries was originally founded in 1883 as a manufacturer and distributor of glass. PPG stands for Pittsburgh Plate Glass, which is a reference to the company’s original operations.

Over time, PPG has made remarkable strides in becoming an industry leader in the paints and coatings industry.

With annual revenues of about $18 billion, PPG’s only competitors of similar size are fellow Dividend Aristocrat Sherwin-Williams (SHW), as well as Dutch paint company Akzo Nobel (AKZOY).

PPG Industries has grown to such an impressive size thanks to its worldwide operating presence and focus on technology and innovation.

Its research and development focus is a key differentiator between PPG and other paint & coatings companies. Because of its heavy R&D investments, PPG has grown to be a market leader today.

In addition, PPG has a long history of accretive acquisitions that have helped it grow over time. PPG has been very busy in just the past couple of years, securing acquisitions that will add nearly $2 billion in revenue to its top line, and will also bolster its international presence. It has a very long history of successful acquisitions, meaning it can grow not only organically, but also through acquiring scale and market share.

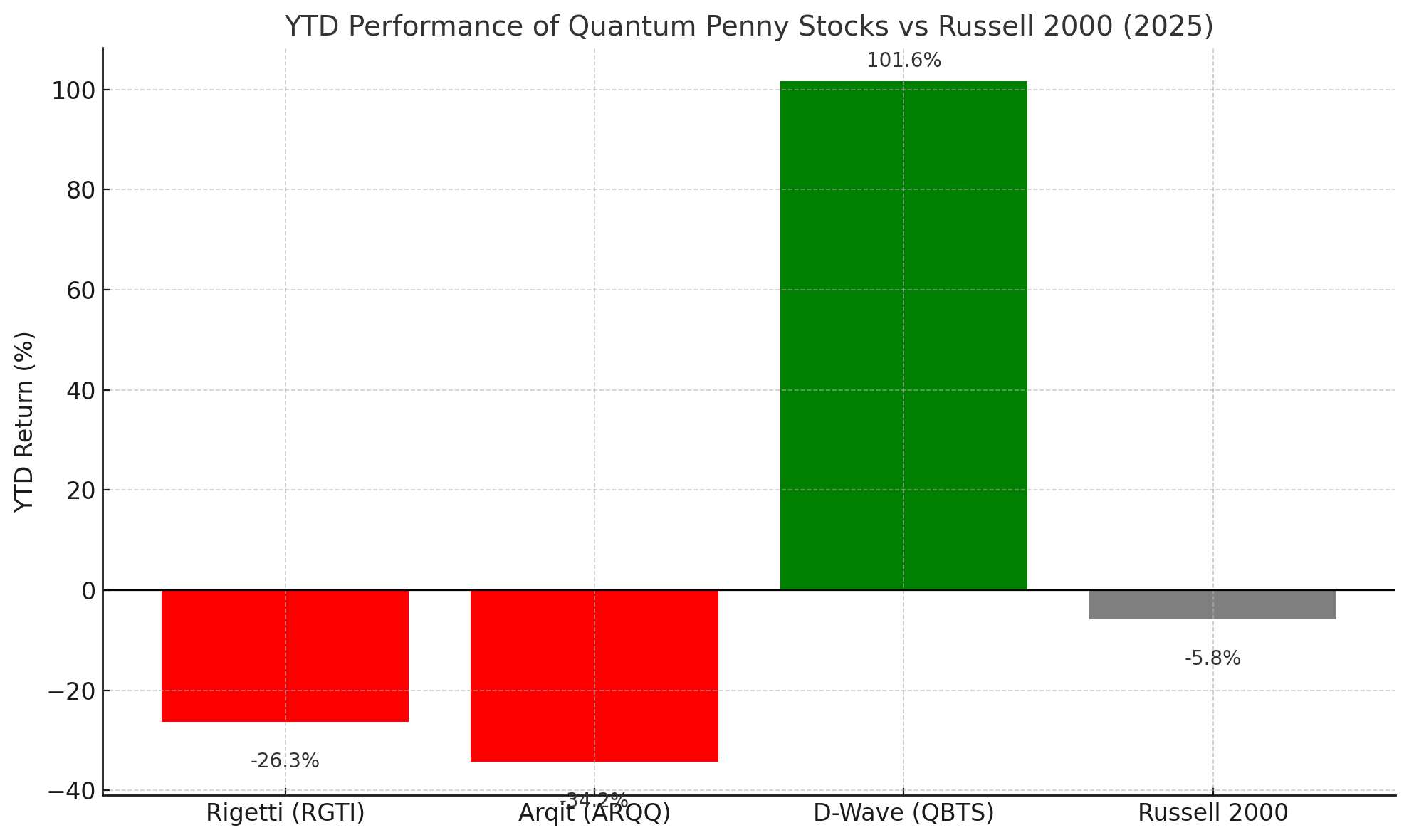

PPG reported fourth-quarter and full year results on January 19th, 2023.

Source: Investor presentation, page 4

Revenue was flat for the quarter, but up 5.4% to $17.7 billion for 2022. Adjusted earnings-per-share fell to $1.22 from $1.26 for the quarter. Full year earnings-per-share of $6.05 compared unfavorably to $6.77 in 2021.

PPG has developed incredible brand loyalty over the years, which has helped it to endure the rising input cost facing the company in recent years. PPG has largely offset these costs by raising prices on its products without seeing a significant drawdown in volume. As you can see, pricing added 11% to quarterly results with volume down a mid-single-digit figure.

Our initial estimate for 2023 is $6.99 in earnings-per-share.

Growth Prospects

By and large, a company’s ability to increase revenues and profits is a function of its capital allocation.

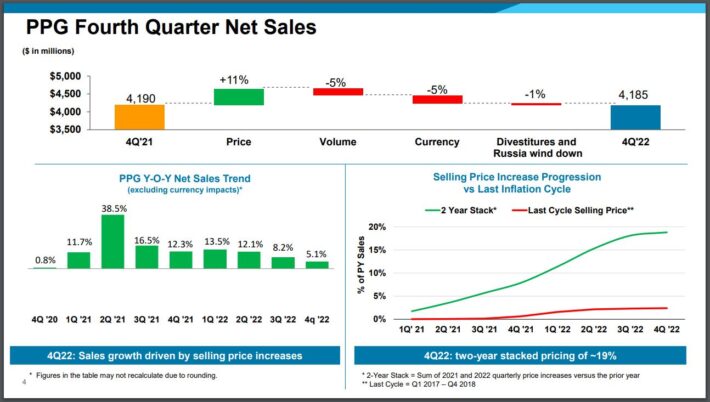

PPG has spent billions of dollars in recent years buying its next generation of growth. It tries to maintain a somewhat balanced capital allocation strategy, but it is also not afraid to spend big on acquisitions when opportunities present themselves.

PPG has spent much more of its deployed cash on share repurchases than its competitors, which has been a major source of earnings-per-share growth over time.

It is also likely that mergers and acquisitions will be a continued focus for PPG moving forward, as the company moves back towards its core competency of portfolio optimization.

Acquisitions have been a key growth driver for PPG for many years. That growth has come at a cost, namely an increase in the company’s debt.

Source: Investor Presentation, page 8

PPG is now virtually exclusively a coatings business. The transformation in recent years away from legacy businesses like glass and chemicals has left the company with an impressive portfolio of coatings products that collectively generate nearly $18 billion in annual revenue.

PPG recognized years ago that its future growth would be in coatings, and has positioned itself accordingly.

Its track record suggests that its underlying business is likely to continue growing at a satisfactory rate for the foreseeable future. In the past decade, the company has grown its earnings-per-share at an average rate of just under 6%.

PPG has been an elite growth stock for a long time. This growth has not been linear, as there have been ups and downs from year to year, but over time, PPG has delivered impressive growth.

Given its very strong fundamentals and its focus on coatings, we believe investors can reasonably expect 8% adjusted earnings-per-share growth from PPG Industries through full economic cycles.

However, PPG’s performance is likely to suffer during periods of economic recession. The good news is that we would likely see such an event as a buying opportunity for this high-quality business.

Competitive Advantages & Recession Performance

PPG enjoys a number of competitive advantages. It operates in the paints & coatings industry, which is economically attractive for several reasons. First, these products have high-profit margins for manufacturers.

They also have low capital investment, which results in significant cash flow. PPG has put this significant cash flow to use over time, as discussed above.

Given all this, it makes sense that there are just two coatings companies (Sherwin-Williams and PPG Industries) on the Dividend Aristocrats list.

With that said, the paint and coatings industry is not very recession-resistant because it depends on healthy housing and construction markets. This impact can be seen in PPG’s performance during the 2007-2009 financial crisis:

- 2007 adjusted earnings-per-share: $2.52

- 2008 adjusted earnings-per-share: $1.63 (35% decline)

- 2009 adjusted earnings-per-share: $1.02 (37% decline)

- 2010 adjusted earnings-per-share: $2.32 (127% increase)

PPG’s adjusted earnings-per-share fell by more than 50% during the last major recession and took two years to recover.

As PPG’s 2020 results showed, the decline in new construction is the dominant factor for PPG during a recession. The 2020 recession was no different, as PPG faced factory shutdowns and severely reduced demand from consumers, although that proved to be transitory.

While the long-term prospects of this Dividend Aristocrat remain bright, investors should be willing to accept volatility in a recession.

If anything, a recession and corresponding decline in PPG’s share price would allow investors to purchase more shares of this stock at a much more attractive price.

Valuation & Expected Total Returns

We are forecasting earnings-per-share of $6.99 for the fiscal year of 2023, putting the price-to-earnings ratio at 19.2. This is just above our fair value estimate of 19 times earnings, meaning PPG is slightly overvalued today.

As such, we expect a modest 0.2% headwind to total returns from valuation in the coming years.

In total, we project that PPG will return 9.5% annually through 2028, stemming from 8% earnings growth and the starting yield of 1.9%, partially offset by a 0.2% headwind from multiple contraction. Given this, we continue to rate PPG a hold, though we would find the name more attractive on a slight pullback.

Final Thoughts

PPG Industries has many of the characteristics of a very high-quality business. It has a proven business model and has generated strong growth over the past several years.

It also has a significant international presence and multiple catalysts for future growth. Lastly, it has increased its dividend for 51 years.

However, the stock is slightly overvalued.

PPG’s dividend outlook is exemplary and we see many more years of dividend increases on the horizon. That said, we suggest waiting for a pullback before buying.

If you are interested in finding high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].