Perytskyy/iStock via Getty Images

In mid-2021 I noted that it would take a sharp drop in valuations to justify a long position. Since then, we have seen the EWY decline by 30%, while sales and profits have continued to rise. This has seen the PE ratio on the iShares MSCI South Korea ETF (NYSEARCA:EWY) fall below 10x. While the index is cheap based on earnings, its falling free cash flows are a red flag, preventing me taking a long position.

The EWY ETF

The EWY tracks a market-cap-weighted index of large- and midcap Korean companies. To ensure diversification, the index applies certain investment limits with no single issuer exceeding 25% of the underlying index weight, and all issuers with a weight above 5% not cumulatively exceeding 50%. However, the top 10 companies still account for 52% of the index, with Samsung Electronics (OTCPK:SSNLF) alone boasting a 22% weighting. The fund’s expense ratio is relatively high at 0.59%, which takes a large chunk out of the 1.1% dividend yield.

EWY Top 10 Fund Holdings (Bloomberg)

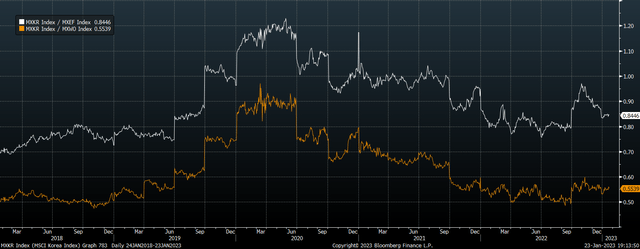

The Korea Discount Has Widened

Korean stocks have underperformed over the past 18 months relative to both emerging and developed markets. As a result, the EWY’s discount to its peers has widened further. On a price/earnings basis the MSCI Korea trades at just 9.7x, compared with 11.5x for the MSCI Emerging Markets index and 17.5x for the MSCI World.

Trailing PE Ratios. Ratio Of MSCI Korea Over MSCI EM and MSCI World (Bloomberg)

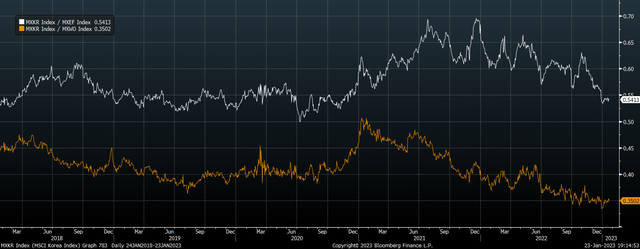

This discount is particularly noteworthy when considering the low profit margin on Korean stocks, which sits at just 6.7%, compared to 10.8% for the MSCI EM and 10.9% for the MSCI World. If we compare the trailing price/sales ratios, Korea’s discount is extreme, particularly relative to the MSCI World.

Trailing PS Ratios: MSCI Korea Vs MSCI EM and MSCI World (Bloomberg)

Korea’s macroeconomic fundamentals are also far superior to most developed market countries. Persistent current account surpluses have seen Korea amass a large external surplus, while its government debt is less than 50% of GDP. The country also has a high savings rate, equivalent to 37% of GDP, which is 10 percentage points above the global average. These factors suggest that an argument could be made for Korean stocks to trade at a premium to global averages.

Free Cash Flows Not Keeping Up With Earnings

As corporate profits are a function of national savings, we should expect to see high corporate profit margins for Korean companies, but this is certainly not the case. As shown above, profit margins are extremely low in Korea, and they may even mask the true profitability of Korean stocks as operating and free cash flows paint a much more negative picture. Free cash flows have been fully 90% below reported earnings for the past 12 months, having failed to rise in line with the surge in earnings. As a result, the free cash flow yield is just 1.0%. In the case of Samsung, while the price/earnings ratio is just 9.1x, its price to free cash flow ratio is 17.5x.

This is a red flag when it comes to investing in Korea and explains why the dividend yield on the EWY remains low despite the low price/earnings ratio. Indeed, the dividend yield on the MSCI Korea, at 1.7%, is just over half of the MSCI EM and has dropped back below that of the MSCI World. Over the long term, this low dividend yield has seen the EWY underperform its peers despite its cheaper valuations.

Summary

Weakness in the EWY over the past 18 months has seen Korea’s valuation discount relative to developed and emerging markets widen further. On a price/sales basis, the EWY is incredibly cheap, and the country’s high savings rate should theoretically help support profit margins, which have risen over recent years. However, Korean companies seem unable to translate rising earnings into free cash flows, which explains the still-low dividend yield on the EWY. I would need to see signs of earnings being converted into free cash flows in order to turn bullish on this ETF.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.