Vera Bracha

Overview

The buy case for AdaptHealth (NASDAQ:AHCO) is based on the growth of the home medical equipment [HME] industry, which is projected to reach $62.1 billion by 2030. This growth is driven by factors such as an aging population and the increasing prevalence of chronic diseases, which highlight the need for providers like AHCO to deliver high-quality medical tools directly to patients’ homes.

Business description

AHCO is a major supplier of medical supplies, home healthcare equipment, and other associated services in the United States. AHCO provides its services to skilled nursing facilities, sleep labs, ambulatory care centers, and hospitals.

The home medical equipment industry is growing

The HME sector deals in providing essential medical products and ongoing supply services to patients in the comfort of their own homes, with the goal of enhancing their quality of life. Patients with multiple, long-term health issues can regain some of the independence they had to give up when they entered institutional care thanks to the HME sector. While the healthcare sector has historically focused on outpatient care and less severe conditions, advancements in technology have made the inpatient care of more serious conditions more accessible and affordable. Because of this, the focus of the sector has shifted to advanced acute illnesses.

The HME market is predicted to reach $62.1 billion by 2030, based on research conducted by industry experts. Expenditures on in-house long-term services and supports seem likely to be a major factor in this. This expansion is being driven by a few different factors.

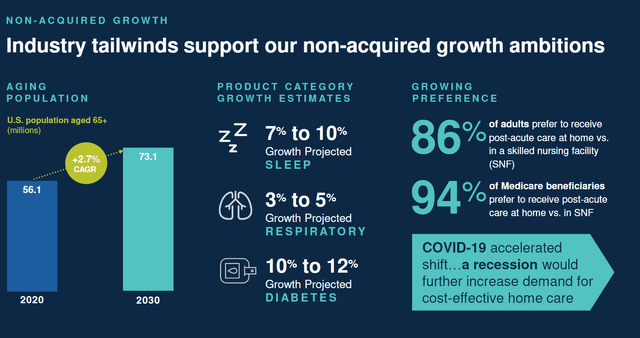

An aging population is the primary factor. In the United States, the number of people aged 65 and up is projected to keep rising. In 2030, the US census predicts, people aged 65 and older will make up 21% of the population, up from 15% today. This expansion highlights the need for providers like AHCO to deliver high-quality medical tools directly to patients’ homes, where they can be used to speed recovery and reduce hospital stays. The prevalence of chronic diseases also rises as the population ages. HME is crucial in assisting with the treatment of serious health problems affecting millions of Americans. I anticipate a rise in supplier demand within the HME sector as the prevalence of these conditions continues to rise.

Jan’23 presentation

AHCO offers a unique platform

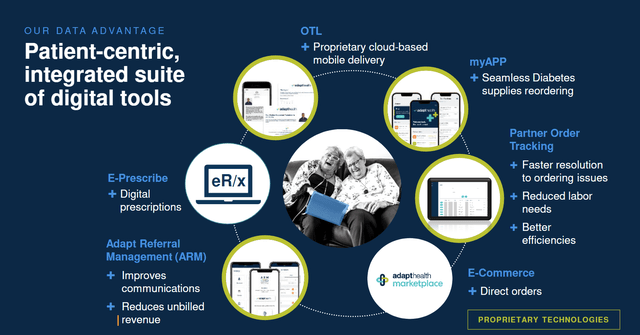

In my opinion, AHCO has a leg up on the competition in the HME market thanks to the integrated technology system it has developed over the past few years. The AHCO integrated platform stands out from the competition by automating processes that are traditionally manual, error-prone, and inefficient. Physicians and insurance companies are interested in the platform because of its user-friendliness, enhanced compliance, and automated, comprehensive workflow for providing care. In addition, I believe that electronic prescribing solutions will increase openness, while decreasing both clinical errors and delays. All of this has a real-world impact because it means that patients can expect quicker service from their healthcare providers after placing an order. The model’s scalability also means it can back up AHCO’s planned organic growth and facilitate the timely integration of any acquisitions.

To sum up, I think AHCO’s ability to invest in a cutting-edge technology platform sets them apart from rivals who are stuck using antiquated, manual processes because they lack the funds to upgrade their infrastructure.

Jan’23 presentation

National coverage

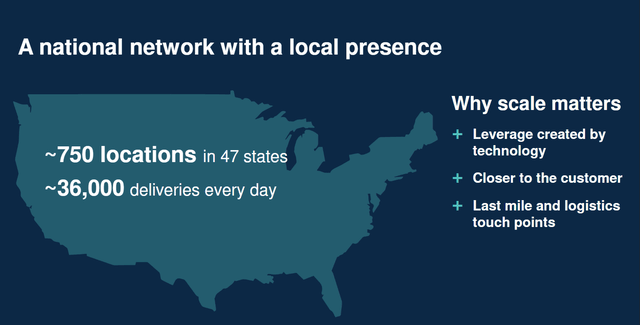

Through its relationships with large distribution players, AHCO is able to offer drop shipping of HME products directly to patient’s home within a short notice period. AHCO’s nationwide reach and ability to serve patients should make it appealing to payers, in my opinion. Thus far, AHCO has successfully established relationships with multiple payors, including major national insurers. Unlike many of its rivals, the AHCO can offer better rates to the vast majority of potential patients thanks to its extensive payor network. As a result, more patients, providers, and facilities would be able to take advantage of AHCO’s offerings, strengthening the company as a whole.

Furthermore, AHCO has a large distribution network, with 750 locations that can make 36,000 deliveries every day. The key here is that AHCO has placed a number of smaller depots across the country in optimal positions to support its delivery fleet, taking into account equipment volume and drive times.

Jan’23 presentation

M&A strategy

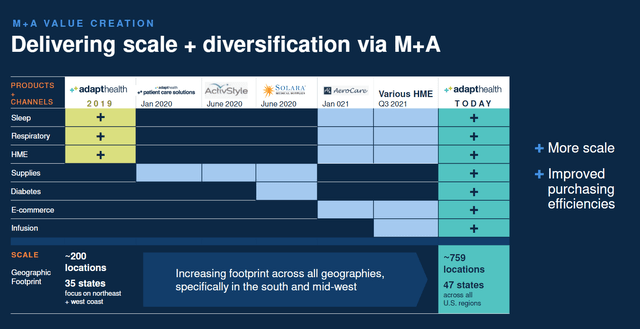

In addition to its organic expansion, AHCO’s platform also features modular and unified front- and back-office processes that aid in the smooth integration of acquisitions and the realization of cost synergies. If we look at AHCO’s past, we can see that it has shown it can put its money where its mouth is in terms of acquisitions, having spent hundreds of millions on more than five-dozen deals since its inception. As AHCO expands, I anticipate that it will continue to invest in expansion by acquiring and integrating larger targets.

The company has stated an annual revenue growth goal of at least $100 million from M&A (2Q22 earnings), and the number of deals conducted since 2020 clearly illustrates AHCO ability to hit these growth targets.

Jan’23 presentation

AHCO deep pool of customers is an advantage

An underappreciated aspect of AHCO’s story is the fact that they have helped close to 4 million patients so far. My opinion is that AHCO has a sizable platform from which to increase their TAM and seize opportunities for supplemental revenue by capitalizing on their access to patients. That’s especially true as management continues to implement its 2.0 plan, which involves moving care away from hospitals and into people’s homes. The most notable areas where I see room for improvement and potential synergies with AHCO’s current business offerings are in home infusion and patient acquisitions.

Pre-released guidance looked good

Management has reiterated their Q4 and FY23 pre-released guidance, which calls for organic net revenue growth of 8-10%. Management expect Sleep and Diabetes supplies to grow by 11-12%, while Respiratory, HME, and other supplies will grow by 3-6%. 4Q revenue is expected to be around $2.98B, with adjusted EBITDA forecast to be in the low end of the previously established range of $620M to $650M. The higher labor costs and some of FY23’s expenses pulled forward are the main factors influencing management’s EBITDA outlook for the fourth quarter. In my opinion, AHCO’s management has taken a cautious approach to guidance this year, taking into account the negative effects of 2022 in their projections for FY23.

Forecast

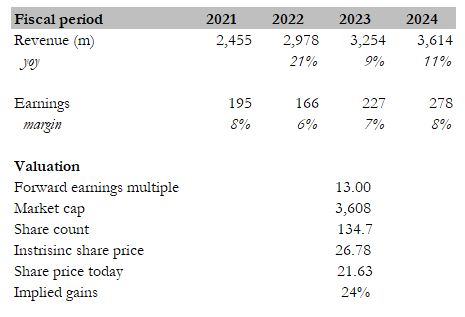

AHCO has a 24% upside, in my opinion. According to my model, it is worth $26.78 in FY23. The underlying secular trend for the AHCO industry is as certain as it can be. In my opinion, it is only a matter of execution whether AHCO can continue to execute and gain more market share to grow. This strategy is applicable to both organic and inorganic opportunities. Also, management reaffirming guidance and outlining and meeting organic growth targets is beneficial to the stock.

According to consensus estimates, AHCO should earn around $278 million in FY24. If we assume that AHCO will trade at the same forward PE multiple in FY23, the stock will be worth $26.78, or 24% more.

Author’s estimates

Key risk

Consolidation in the healthcare industry

A growing trend in the insurance industry over the past few years has been the consolidation of health care providers and insurance companies. As the health insurance sector consolidates, insurers may gain advantages in negotiations and the marketplace, such as easier access to data on claims, costs, and other metrics. It is possible that the AHCO’s ability to bargain for better rates and terms with health insurance providers in some markets will suffer as a result of this merger. Furthermore, if larger insurers find value-based payment models to be financially beneficial, this shift could be hastened.

Conclusion

The HME market is expected to reach $62.1 billion by 2030, which is the foundation for the investment case for AHCO. The aging population and the rise in chronic diseases are driving this expansion, and they show just how important it is for companies like AHCO to bring medical equipment right to patients’ doors. When compared to its rivals, who still rely on time-consuming and error-prone manual procedures, AHCO stands head and shoulders above the pack thanks to its innovative platform, which automates processes and improves compliance. Drop shipping certain HME products directly to patients’ homes is also possible thanks to the company’s national coverage and partnerships with national healthcare distribution companies. More patients, providers, and facilities are able to take advantage of AHCO’s services because the organization has established positive relationships with multiple payors, including major national insurers. In addition to being able to serve a larger number of customers, the company’s 750 distribution centers’ capacity to process 36,000 daily deliveries will allow them to broaden their offerings and improve access for more people in need.