Published on January 11th, 2023 by Nikolaos Sismanis

Few companies in the specialty chemicals industry have a history of paying consistent dividends over a long period of time.

Kronos Worldwide is one of the most loyal dividend payers in the specialty chemicals industry, even though this is a tricky industry to navigate.

The company is currently trading with a tremendous 8.0% yield attached, meaning it is one of the high-yield stocks in our database.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Kronos Worldwide.

Business Overview

Kronos Worldwide is a company that specializes in the production of titanium dioxide pigments, which are primarily used to enhance the color and brightness of products like paint, cosmetics, and plastics.

It’s quite important to outline the company’s ownership structure:

- Kronos Worldwide went public in 2003 and is a subsidiary of Valhi Inc. (NYSE: VHI), which owns 50% of the company’s outstanding stock.

- Further, a subsidiary of NL Industries, Inc. (NYSE: NL) holds about 30% of the stock.

- Then, Valhi holds about 83% of NL’s outstanding common stock, and a wholly-owned subsidiary of Contran Corporation holds approximately 92% of Valhi’s outstanding common stock.

- Finally, a majority of Contran’s outstanding voting stock is controlled directly by Lisa K. Simmons and various family trusts that exist for the benefit of Ms. Simmons.

Thus, shares have a limited trading volume, while the benefits of common shareholders may not be prioritized, which is something that prospective investors should be cautious about.

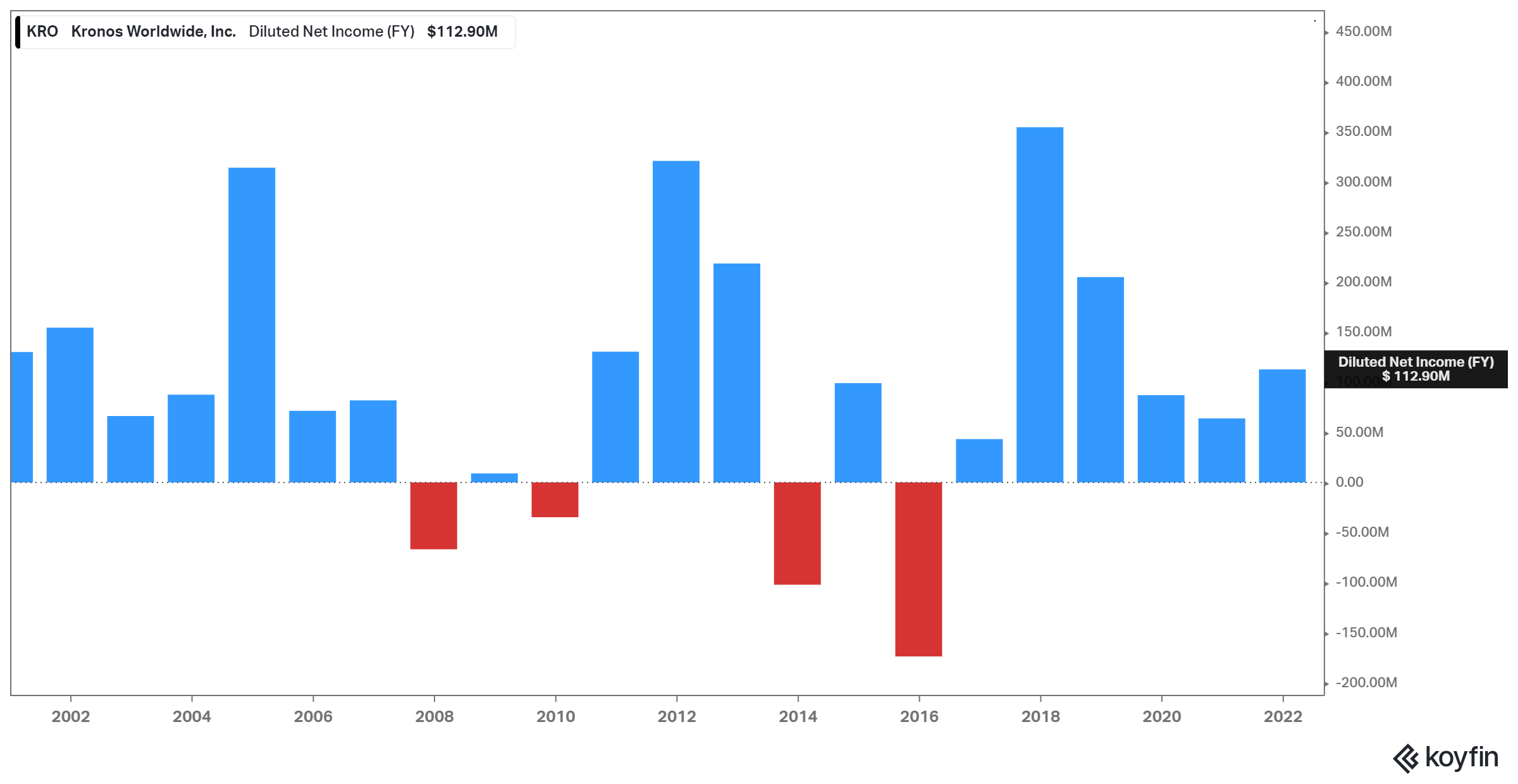

Overall, Kronos’ results have been volatile but generally favorable. While this is a pure commodity business, Kronos historically has been a strong operator with disciplined cost controls.

Still, the company’s cyclical business model can easily lead to unfavorable trading periods, as was the case in its most recent Q3 results.

Kronos recorded net revenues of $460 million, down 8% from the same period in 2021.

The company’s earnings-per-share also fell to 18 cents, down significantly from 31 cents during the prior-year period.

Management raised prices to reflect inflationary pressures, but these price increases were more than offset by a 20% decline in TiO2 sales volumes.

Volatile electricity prices and a weak global economic outlook have cast a long shadow over industrial operations in Kronos’s market. Thus, investors should anticipate a rough 2023 for the company before it potentially gets back on track.

Growth Prospects

Kronos operates in a very cyclical industry, with its results being highly susceptible to the underlying movement of titanium dioxide prices.

Thus, Kronos has had a fluctuating performance in terms of its earnings-per-share over the years. It has posted periods of earning as much as $2 per share but also experienced losses.

The company has not made any significant investments or acquisitions that would change its long-term earnings potential.

It also has not done any major repurchases of shares either, which has prevented the potential for growth in earnings-per-share through that strategy.

Overall, we expect Kronos, on average, to post similar earning results as in previous years moving forward.

Competitive Advantages

Kronos estimates it is the largest producer of TiO2 in Europe, with about 46% of sales volumes attributable to markets in Europe.

This means that the company has a significant advantage over smaller competitors when it comes to managing its TiO2 supply and being more efficient.

The company also has minimal net debt, which stands close to $70 million. Thus, the ongoing rise in interest rates should not be a big threat to the company.

Dividend Analysis

Kronos has a multi-layered ownership structure, where it is owned by other subsidiary companies, and its main purpose is to distribute profits to the higher levels of ownership, with the ultimate beneficiary being a trust controlled by Ms. Simmons.

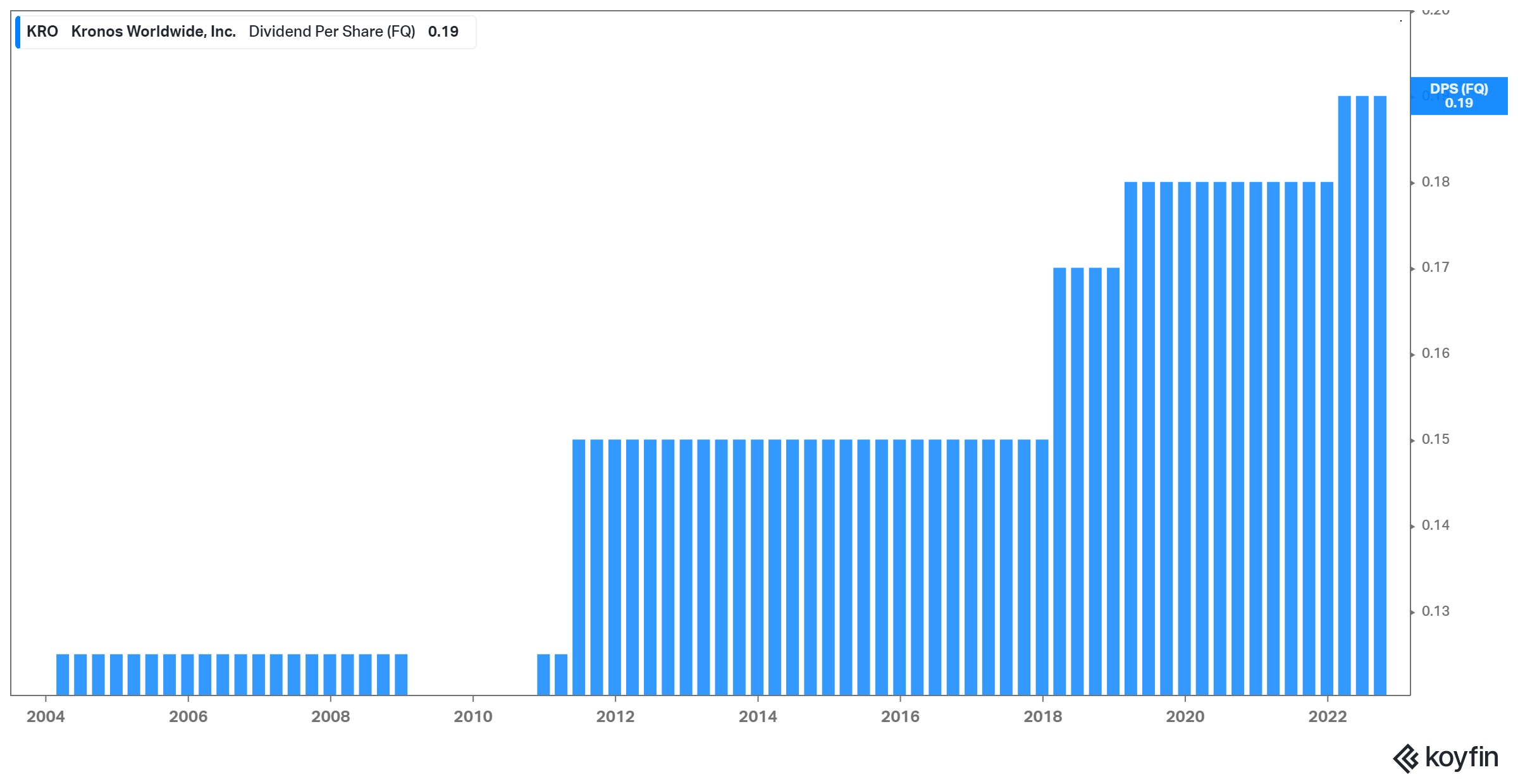

This gives increased confidence that the dividend will remain a priority of the Board of Directors, as has been the case during the company’s history.

Kronos did suspend the dividend during the Great Financial Crisis, but it was quickly reinstated in 2010. By 2011, the dividend had already greatly exceeded its pre-2007 levels, while it has either been maintained or increased since.

Due to its clean balance sheet and relatively strong performance throughout the industry’s cycle, we believe that Kronos’ dividend will be sustained moving forward and could even grow slowly over time.

Nevertheless, as hinted at via its 8% dividend yield, the dividend is not immune to a potential recession or a rough industry cycle, which could lead to temporary suspension or a cut.

Final Thoughts

Kronos is a rather interesting company. Due to its multi-layered ownership structure, the company is designed to distribute the majority of its earnings, which has resulted in a consistent stream of hefty payouts over the years.

Despite the cyclical nature of its business model, Kronos has been prudently managed, has little debt on its balance sheet, and has achieved overall decent results even during downturns in its industry.

While a temporary dividend cut is not unlikely if its niche market remains underwater for too long, it’s quite likely that Kronos will continue to provide shareholders with sizable dividends moving forward.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].