Published on January 10th, 2023 by Nikolaos Sismanis

Shares of Enviva have declined significantly over the past year over fears of a potential dividend cut.

Still, Enviva has continued to grow its dividend despite the fact that it’s essentially funded by further debt and equity proceeds.

With shares declining and the dividend growing in the meantime, the stock’s yield has now been pushed to a hefty 6.8%.

Hence, Enviva is among the high-yield stocks in our database.

We have created a spreadsheet of stocks (closely related REITs and MLPs, etc.) with 5% or more dividend yields.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

This article will analyze Enviva (EVA).

Business Overview

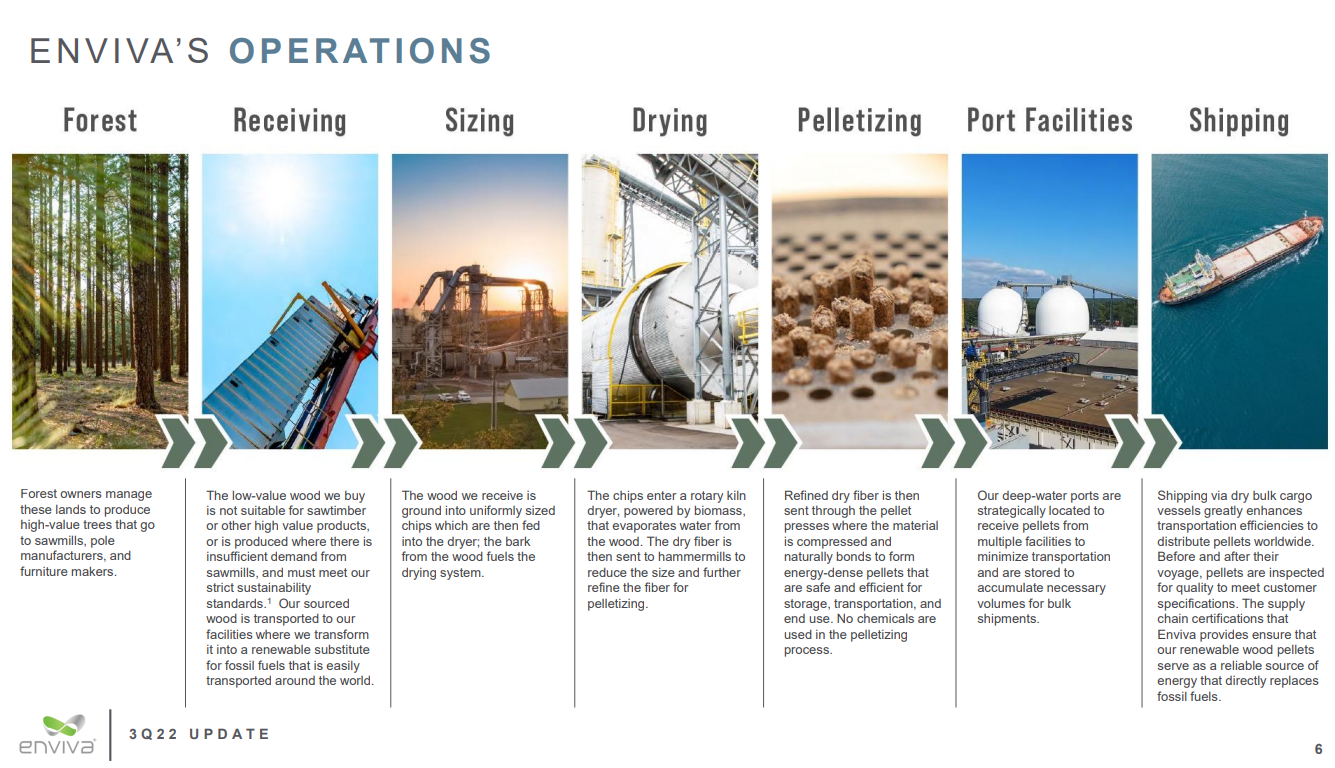

Enviva specializes in sourcing wood fiber and turning it into transportable wood pellets. It is, in fact, the largest producer of wood pellets for utilities in the world, with the majority of their wood pellets being sold through long-term contracts with clients all over the world.

Their ten U.S.-based facilities have a total capacity of roughly 6.2 million metric tons per year, while the company exports its wood pellets through its own marine terminals and third-party marine terminals in various other states.

Source: Investor Presentation

In October 2021, EVA acquired 100% of the ownership interest in Enviva Holdings, simplifying the company’s structure by converting from an MLP into a traditional corporation beginning in 2022.

Enviva’s recent performance has been somewhat soft, with adjusted EBITDA coming in at $60.6 million in its Q3 results, down from $62.9 million last year non-recast (i.e., prior to the business simplification)

Distributable cash flow came in at $36.3 million, an also underwhelming result from last year’s $49.5 million, prior to the transformation of the company.

The company estimates a distributable cash flow of roughly $180 million for fiscal 2022, which hardly covers the dividend despite management’s commitment to raising it.

Growth Prospects

Enviva plans to increase its distributable cash flow by expanding production capacity and completing accretive acquisitions. They recently acquired the Lucedale plant, for instance, which began operations in the last quarter of 2021, and should have reached full capacity by the end of 2022 (Q4 results yet to be out).

The company has also announced plans to accelerate its expansion through organic growth. Specifically, the company expects to double its production capacity over the next five years from 6.2 million metric tons per year to around 13 million metric tons per year.

This growth will be achieved by constructing and starting operations on two plants simultaneously.

That said, inflationary pressures (higher commodity, transportation, and wage costs) are likely to pressure the company’s profitability during the current environment.

Competitive Advantages

Being the largest player in the transportable wood pellets space, Enviva has the edge over its smaller competitors, who cannot scale as efficiently.

Thanks to its diverse supplier base and facility locations, the company is able to enjoy more consistent and cheaper deliveries than other companies in the region or industry.

Its Chesapeake terminal, for instance, provides a competitive advantage of 3-4 days shorter shipping time to Europe compared to other ports located in the south or along the Gulf Coast.

Dividend Analysis

Even prior to becoming a c-corp, Enviva had been appreciated by dividend growth investors due to its hefty payouts and consistent increases. Payouts have now grown for six consecutive years, while the stock trades with a yield close to 6.8%.

That said, Mr. Market has been coming close to the realization that Enviva’s dividend growth strategy is not sustainable. Payouts have barely been covered since Enviva initiated the dividend in 2016, while the company has lately resorted to raising additional capital to find enough cash to cover it.

In the first half of 2022, Enviva recorded a negative operating cash flow of $68.9 million. In Q3, things got a little better, but overall the company still recorded a negative operating cash flow of $51.6 million for the first nine months of the year.

Despite the negative operating cash flows, Enviva continued to pay and even increase its dividend, whose payments totaled $158.3 million during the same period.

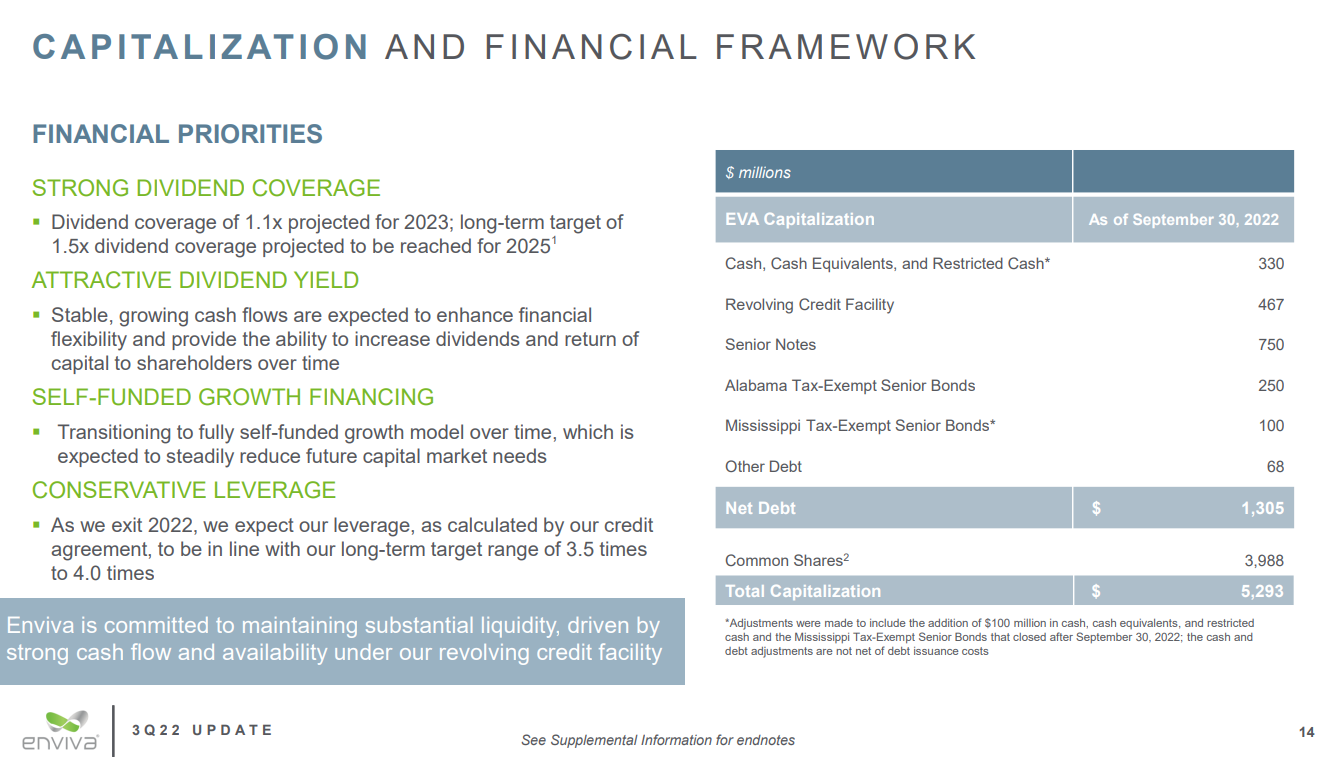

Negative operating cash flow cannot possibly fund their dividend payments, let alone the $162.4 million in CAPEX the company also recorded. So how did they fund this hole? By issuing $250.4 million of debt, net, and $333 million of equity.

Moving forward, this move to temporary sustain payouts will be expensive for shareholders, as the debt will demand additional interest expenses and the equity additional dividend payouts.

The company expects dividend coverage to expand to 1.5X by 2025, but whether such an ambitious target is possible remains to be seen.

Source: Investor Presentation

Unless the company resumes dividend coverage within 2023, the probability of a dividend cut should only increase over time.

Final Thoughts

Enviva has managed to reward shareholders with growing dividends since its debut in the public markets.

Its transformation to a c-corp should simplify operations and unlock some more flexible growth avenues.

Nevertheless, the viability of Enviva’s dividend is currently being contested.

Therefore, we urge that investors should not rely heavily on Enviva’s payouts.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them regularly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].