Through Worldwide Man

The US authorities reaps an unfathomable quantity of energy from its racket of printing pretend cash out of skinny air and forcing it on the world.

The petrodollar system is an enormous cause it has gotten away with this rip-off for thus lengthy.

In brief, right here’s the way it works…

Oil is by far the biggest and most strategic commodity market. For the final 50 years, nearly anybody who needed to import oil wanted US {dollars} to pay for it.

Each nation wants oil. And if international nations want US {dollars} to purchase oil, they’ve a compelling cause to carry massive greenback reserves.

This creates an enormous synthetic marketplace for US {dollars} and forces foreigners to absorb most of the new forex items the Fed creates. Naturally, this offers an incredible increase to the worth of the greenback.

The system has helped create a deeper, extra liquid marketplace for the greenback and US Treasuries. It additionally permits the US authorities to maintain rates of interest artificially low, thereby financing huge deficits it in any other case can be unable to.

In brief, the petrodollar system is the bedrock of the US monetary system.

That’s why the US authorities protects it so fiercely. It wants the system to outlive.

World leaders who’ve challenged the petrodollar have ended up lifeless…

Take Saddam Hussein and Muammar Gaddafi, for instance. Every led a big oil-producing nation—Iraq, and Libya, respectively. And each tried to promote their oil for one thing apart from US {dollars} earlier than US navy interventions led to their deaths.

After all, there have been different causes the US toppled Saddam and Gaddafi. However defending the petrodollar was a severe consideration, on the very least.

When nations like Iraq and Libya problem the petrodollar system, it’s one factor. The US navy can dispatch them with ease.

Nevertheless, it’s a complete different dynamic when Russia and China undermine the petrodollar system… which is occurring in an enormous manner proper now.

Russia and China are the one nations with subtle sufficient nuclear arsenals to go toe-to-toe with the US as much as the highest of the navy escalation ladder.

In different phrases, the US navy can’t assault Russia and China with impunity as a result of they’ll match every transfer as much as all-out nuclear warfare—the very high of the navy escalation ladder.

For that reason, the US is deterred from getting into right into a direct navy battle with Russia and China—despite the fact that they’re about to strike a deadly blow to the petrodollar system.

The highest Russian vitality official not too long ago made it express. He mentioned Russia would settle for gold or Bitcoin in return for its oil.

“In the event that they wish to purchase, allow them to pay both in onerous forex—and that is gold for us… you too can commerce Bitcoins.”

Right here’s the underside line.

The petrodollar system’s demise seems to be imminent. It has huge geopolitical and monetary penalties that almost all traders don’t perceive.

The Actual Cause for China and Russia’s Large Gold Stash

It’s no secret that China and Russia have been stashing away as a lot gold as they’ll for a few years.

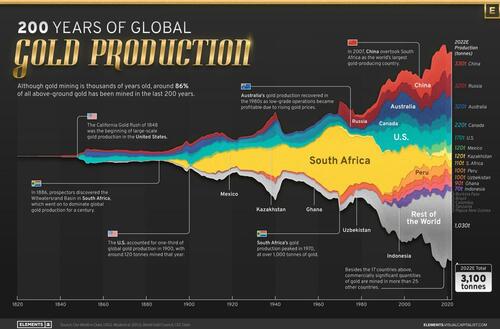

China is the world’s largest producer and purchaser of gold. Russia is quantity two.

As we speak it’s clear why China and Russia have had an insatiable demand for gold.

They’ve been ready for the suitable second to drag the rug from beneath the petrodollar system. And now’s that second…

After it invaded Ukraine, the US authorities kicked Russia out of the greenback system and seized tons of of billions in greenback reserves of the Russian central financial institution.

Washington has threatened to do the identical to China for years. These threats helped make sure that China cracked down on North Korea, didn’t invade Taiwan, and did different issues the US needed.

These threats towards China could also be a bluff, but when the US authorities carried them out—because it not too long ago did towards Russia—it could be like dropping a monetary nuclear bomb on Beijing. With out entry to {dollars}, China would wrestle to import oil and have interaction in worldwide commerce. Because of this, its financial system would come to a grinding halt, an insupportable risk to the Chinese language authorities.

China would reasonably not rely upon an adversary like this. This is likely one of the important causes it created an alternative choice to the petrodollar system.

This technique will permit anybody on the planet to commerce oil for gold. It’s going to bypass the US greenback, monetary system, and sanctions.

Right here’s the way it works…

After years of preparation, the Shanghai Worldwide Power Alternate (INE) launched a crude oil futures contract denominated in Chinese language yuan in 2017. Since then, any oil producer can promote its oil for one thing moreover US {dollars}… on this case, the Chinese language yuan.

There’s one massive subject, although. Most oil producers don’t wish to accumulate a big reserve of yuan, and China is aware of this.

That’s why China has explicitly linked the crude futures contract with the power to transform yuan into bodily gold—with out touching China’s official reserves—by gold exchanges in Shanghai (the world’s largest bodily gold market) and Hong Kong.

PetroChina and Sinopec, two Chinese language oil firms, present liquidity to the yuan crude futures by being massive consumers. So, if any oil producer desires to promote their oil in yuan (and gold not directly), there’ll at all times be a bid.

After years of progress and understanding the kinks, the INE yuan oil future contract is now prepared for prime time.

It comes on the good second.

Russia is the world’s largest vitality producer.

China is the world’s largest vitality importer, and Russia is Beijing’s largest oil provider.

And now that the US has banned Russia from the greenback system, there may be an pressing want for a reputable system able to dealing with tons of of billions price of oil gross sales exterior of the US greenback and monetary system.

The Shanghai Worldwide Power Alternate is that system.

Different nations on Washington’s naughty checklist are enthusiastically signing up. For instance, Iran—one other main oil producer—accepts yuan as cost. So do Venezuela, Nigeria, and others.

Even Saudi Arabia—the linchpin of the petrodollar system—is flirting within the open with China about promoting its oil in yuan. A technique or one other—and doubtless quickly—the Chinese language will discover a strategy to compel the Saudis to just accept the yuan.

China is already the world’s largest oil importer. Furthermore, the quantity of oil it imports continues to develop because it fuels an financial system of over 1.4 billion folks (greater than 4x bigger than the US).

The sheer measurement of the Chinese language market makes it inconceivable for Saudi Arabia—and different oil exporters—to disregard China’s calls for to pay in yuan indefinitely. The Shanghai Worldwide Power Alternate additional sweetens the deal for oil exporters.

Give it some thought…

An oil-producing nation has two decisions:

Possibility #1 – The Petrodollar

The dismal monetary state of affairs of the US ensures the greenback will lose important buying energy.

Plus, there’s huge political danger. Oil producers are uncovered to the whims of the US authorities, which might confiscate their cash at any time when it desires, because it not too long ago did to Russia.

Possibility #2 – Shanghai Worldwide Power Alternate

Right here, an oil producer can take part on the planet’s largest market and attempt to seize extra market share.

It will possibly additionally simply convert and repatriate its proceeds into bodily gold, a global type of cash with no political danger.

From the angle of an oil producer, the selection is a no brainer.

Despite the fact that most individuals haven’t realized it but, it marks the tip of the petrodollar system and a brand new financial period.

Numerous oil cash—tons of of billions of {dollars} and maybe trillions—that will sometimes move by banks in New York in US {dollars} into US Treasuries will as an alternative move by Shanghai into yuan and gold.

We may additionally see nations utilizing Bitcoin to pay for oil, as the highest Russian vitality official not too long ago urged.

What Occurs Subsequent

Ron Paul is aware of extra in regards to the worldwide financial system than virtually anybody alive.

He as soon as gave a speech known as “The Finish of Greenback Hegemony,” the place he identified the one factor that will precipitate the US greenback’s collapse.

Right here is the related half:

“The financial legislation that trustworthy trade calls for solely issues of actual worth as forex can’t be repealed.

The chaos that at some point will ensue from our experiment with worldwide fiat cash would require a return to cash of actual worth.

We’ll know that day is approaching when oil-producing nations demand gold, or its equal, for his or her oil reasonably than {dollars} or euros.

The earlier the higher.”

Right here’s the underside line.

China, Russia, and different nations will ditch the greenback and use yuan, gold, and doubtlessly Bitcoin to commerce oil. It is going to be the tip of the petrodollar system, and it’s imminent.

For over 50 years, the petrodollar system has allowed the US authorities and many People to dwell manner past their means.

The US takes this distinctive place without any consideration. However it would quickly disappear.

There can be lots of further {dollars} floating round instantly in search of a house now that they aren’t wanted to buy oil.

Because of this, I anticipate inflation to skyrocket and a monetary earthquake of historic proportions…

Assist Assist Unbiased Media, Please Donate or Subscribe:

335 views