How one can reconcile elevated inexperienced public funding wants with fiscal consolidation

Editors’ observe: This column is a lead commentary within the VoxEU debate on euro space reform.

Growing inexperienced public funding whereas consolidating price range deficits will likely be a central problem of this decade. The EU has set the bold objective of a 55% greenhouse gasoline emissions discount by 2030 in comparison with 1990 and nil web emissions by 2050. This can require a serious enhance in inexperienced investments, of which is a sizeable half needs to be public funding. On the similar time, main fiscal consolidations are wanted after the extraordinary fiscal help throughout the Covid-19 disaster. The consolidations will likely be framed by European fiscal guidelines. Previous consolidation episodes resulted in main public funding cuts. How can the EU be sure that public funding will enhance when fiscal consolidation is applied?1

The fiscal guidelines debate

A buoyant tutorial and coverage evaluation literature has assessed the EU fiscal guidelines. We see a broad consensus on the truth that the present guidelines face technical issues (measurement of potential output and structural balances) and usually are not effectively applied, however not on different questions, together with on the function of judgement, country-specificity, and the diploma of centralisation in fiscal surveillance (e.g. Martin et al. 2021).

A complete and broad-based reform will therefore take time and is unlikely to be accomplished by the reinstatement of fiscal guidelines in 2023, however the necessity to enhance inexperienced public funding is imminent. On this column, we assess the scope for adapting the foundations to make room for elevated public inexperienced funding.

Inexperienced funding wants to fulfill EU targets

European Fee situations recommend a direct enlargement of annual funding in clear and environment friendly vitality use and transport by about 2% of GDP as a way to attain the EU’s local weather targets (European Fee 2020). This estimate is consistent with these of D’Aprile et al. (2020) for the EU and the Worldwide Power Company (2020) for the world, amongst others. It doesn’t embrace the price of flanking social insurance policies which can’t be considered inexperienced funding.

The share of the private and non-private sectors in inexperienced funding wants

A lot of the new funding must be non-public, however the public share will likely be important. For total climate-related investments in vitality and transport, the 2019 Nationwide Power and Local weather Plans foresaw a median 28% public funding share within the EU (European Funding Financial institution 2020).2 If one assumes that the brand new further inexperienced investments have been consistent with this 28% public share, an annual further public funding of about 0.6% of EU GDP would end result. It is a main fiscal effort that may have to be financed.

The share of public funding might be lowered by applicable authorities regulation, taxation coverage and, particularly, a better carbon value. Nonetheless, a drastic carbon value enhance won’t be socially sustainable and the European trade won’t deal with that both. Furthermore, some inexperienced investments can’t be executed by the non-public sector due to market failures.

Additionally it is essential to take away distortions within the taxation and subsidisation of the vitality system to incentivise extra non-public funding. However the up to date estimates3 of Coady et al. (2019) present that they amounted to a mere 0.15% of GDP within the EU in 2020. Eliminating specific subsidies might cowl about one-fourth of the brand new public funding want.

Classes from the previous

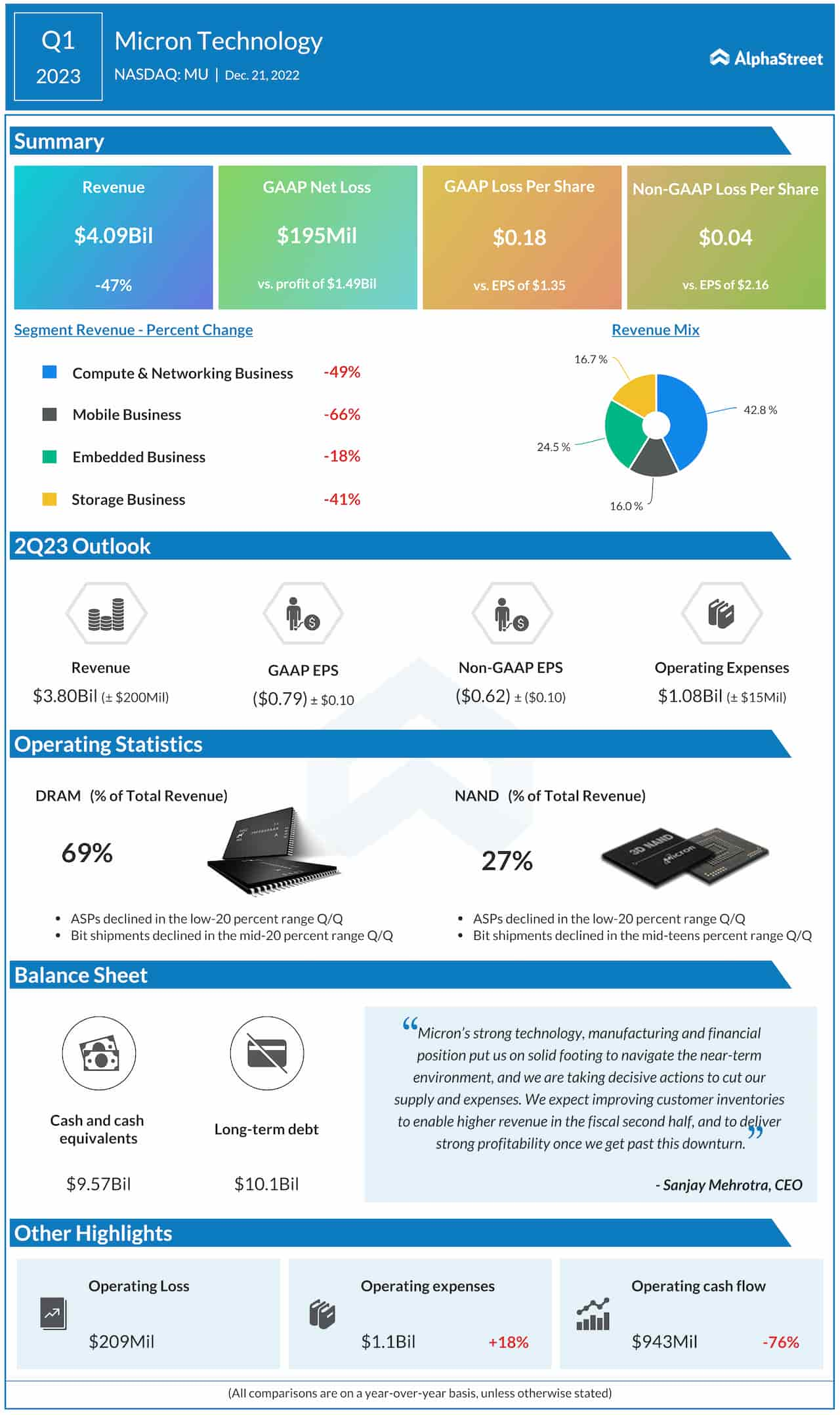

Public funding was a sufferer of fiscal consolidation in earlier episodes (Determine 1). Gross public funding fell by 0.8 proportion factors of GDP from 2009 to 2013 within the EU, and fell even additional by 2016. Even within the group of long-standing EU members that didn’t face market stress, the actual worth of public funding was barely decrease in 2013 than in 2009, whereas total major expenditures elevated by about 5% on this interval. There have been just a few international locations the place public funding as a share of GDP remained unchanged or elevated (Belgium, Denmark, Finland, Hungary, Sweden). In international locations below market stress, funding reduce was extra dramatic. Different extra future-oriented spending gadgets, resembling analysis and growth and training spending, have been additionally reduce.

Determine 1 Gross public funding, 2009 and 2013 (% GDP)

Supply: November 2021 AMECO dataset.

There are the reason why politicians choose slicing funding over present spending. First, in ageing societies, the pursuits of future generations have much less electoral help. Vote-maximising politicians are more likely to determine towards the longer term, as seen in earlier fiscal consolidation episodes. Second, fiscal guidelines drawback investments by treating them totally as present bills, though the advantages of investments accrue over lengthy durations. This biases the political economic system additional towards funding. Fundamental accounting logic would enable web investments to be funded by deficits as they enhance the inventory of property (Blanchard and Giavazzi 2004).

Choices for coping with the trade-off between fiscal consolidation and elevated inexperienced public funding

Fiscal consolidation should begin when EU fiscal guidelines are reinstated from 2023. Based on our simulations (Darvas and Wolff 2021), the velocity of consolidation might be reasonable – half a % per 12 months – below a versatile interpretation of present EU fiscal guidelines. This versatile interpretation would neglect the 1/twentieth debt discount rule (a rule that de facto has not been applied on account of different related components such because the implementation of structural reforms).

Nonetheless, to extend local weather spending by 0.6% of GDP, governments would wish to chop different spending by 1.1 proportion factors, in order that the 0.5% total consolidation is achieved. Such deep cuts to non-climate spending merely won’t occur given our political programs.

Thus, policymakers will face a tough selection between scaling again local weather ambitions, amending fiscal guidelines to make public local weather funding potential, or designing a brand new redistributive EU local weather fund to bypass fiscal guidelines. In our view, local weather targets should prevail, for 2 most important causes. First, European backtracking on emission discount targets may be adopted by comparable backtracking in non-EU international locations, which might danger irreversible deterioration of the surroundings. Second, for many EU international locations, there may be negligible danger of fiscal unsustainability. For these international locations, financing public local weather funding by debt is wise.

This leaves the EU with three choices for fostering inexperienced public funding. One could be a basic rest of EU fiscal guidelines. Nonetheless, this may not present incentives to extend public funding, and extra fiscal sources might effectively be used for recurrent consumptive spending given the political economic system actuality.

A second choice could be to centrally fund all EU local weather expenditure, probably through EU borrowing. In our simulations (Darvas and Wolff 2021), we present that that is already the street undertaken for various southern and jap EU international locations through the Restoration and Resilience Facility (RFF) till 2024. A bonus of constant with this strategy and widening it to all EU international locations could be the approval of nationwide inexperienced funding plans by the Fee and the Council. This might assist guarantee consistency with EU objectives and stop greenwashing. Nonetheless, such a fund would wish to have a a lot bigger capability than NextGenerationEU (NGEU) and would have to be in place for many years.

The therapy of the RRF in EU fiscal indicators and monetary guidelines offers classes on how a brand new EU local weather fund could be handled. According to the European System of Accounts and a Council authorized choice, in September 2021, Eurostat4 concluded that nationwide spending financed by RRF grants won’t be included in nationwide deficit and debt indicators, however spending financed by RRF loans will likely be (Darvas 2022).

The justification for excluding RRF grants is that EU borrowing to finance these grants shouldn’t be counted as member-state debt as a result of “there is no such thing as a match between the grants obtained from the RRF by the person Member States and the quantities that doubtlessly should be repaid by every particular person Member State, as the 2 components are calculated on the idea of various standards” and “there may be nice uncertainty on what quantity every Member State will likely be chargeable for” (para. 38 of the Eurostat steerage). Thus, EU debt used to finance the grants constitutes solely “a contingent legal responsibility for the Union budgetary planning”, however not a nationwide debt (para. 42). RRF grants don’t matter for deficits both. RRF grants are thus exempt from EU fiscal guidelines.

It’s totally different for spending financed by RRF loans. A rustic that borrowed from the EU is liable to repay the complete quantity of the mortgage (together with its curiosity) to the EU. Thus, spending financed by RRF loans isn’t exempt from fiscal guidelines.

An EU local weather fund could be recorded the identical means because the RRF. If it entailed main cross-country redistribution, its political feasibility appears to be like troublesome. But, with none re-distributive components, spending by this fund wouldn’t alleviate the constraint coming from fiscal consolidation necessities.

The third choice, which we favour, could be a inexperienced golden rule: permitting inexperienced funding to be funded by deficits that might not rely within the fiscal guidelines. This would supply incentives to undertake them, as a result of such funding could be excluded from the consolidation necessities. The crucial challenge is the definition of inexperienced funding. A defining criterion of local weather funding needs to be a direct discount of dangerous emissions. Nationwide fiscal councils and audit places of work, the European Fee, the European Court docket of Auditors, and the Council ought to play a job in assessing compliance with the inexperienced golden rule.

An additional benefit of a inexperienced golden rule is that it might be utilised by all EU international locations. In distinction, a non-redistributive EU local weather fund providing solely loans won’t incur important demand, partly as a result of some EU international locations can borrow at a less expensive fee than the EU, and partly as a result of demand for RRF loans was additionally reasonable, suggesting that borrowing from the EU isn’t a preferred motion.

Opposite to public funding, the place the constructive development results are effectively established within the literature (e.g. Tenhofen et al. 2010), the affect of inexperienced funding on development is unsure as many inexperienced investments would solely change functioning ‘brown’ infrastructure. A inexperienced golden rule can due to this fact be problematic in international locations with debt sustainability issues. Such international locations ought to, initially, rely solely on NGEU for his or her inexperienced funding as they can not ignore dangers to price range constraints. Solely after NGEU expires after 2026 will the query of a inexperienced golden rule change into related for these international locations.

Authorized choices

Finally, sure components of the 2011 Six-Pack laws5 and the 2012 Treaty on Stability, Coordination and Governance (TSCG)6 needs to be revised to incorporate a inexperienced golden rule within the EU fiscal framework. This may take years. However till that’s achieved, there are pragmatic choices for fostering such a rule within the preventive arm of the SGP, although not within the corrective arm. This requires a revision of:

- the present ‘funding clause’ to change the adjustment path within the subsequent years, and

- the medium-term goal (MTO) to alter the long-run anchor for the structural steadiness.

A Council choice could be adequate for these modifications.

The present funding clause permits for momentary deviations from the MTO (or from the adjustment path in the direction of it), amounting to at most 0.5% of GDP below slightly strict circumstances, such {that a} damaging GDP development or a degree of GDP greater than 1.5% under its potential. When all circumstances are met, solely nationwide co-financing of initiatives co-funded by the EU below sure EU funds might be thought of. The momentary deviation should be corrected by the fourth 12 months. These circumstances usually are not laid out in any EU laws, however are based mostly on a Council choice, knowledgeable by a Fee proposal,7 a Council authorized service choice and an EFC compromise settlement.8

Attainable revisions of the funding clause might embrace the elimination of the GDP situation, extending the scope to new inexperienced public funding, rising the 0.5% most deviation, and permitting an extended time to appropriate the momentary deviation.

The willpower of the MTO is codified in Article 2a of Regulation 1466/97,9 and public funding is explicitly talked about as a consideration for the MTO. We suggest {that a} first calculation of the MTOs follows the process described within the newest (2017) model of the Code of Conduct of the Stability and Progress Pact,10 after which in a second step, these MTOs are lowered by the rise within the web inexperienced funding the nation goals to implement. Fiscal surveillance ought to be sure that the additional fiscal house offered by a lowered MTO is solely used for web inexperienced funding. A limitation of the proposed MTO correction is that the ground of the MTO is minus 1% for euro-area and ERM2 members with public debt under 60%, and minus 0.5% when debt is over 60% of GDP.

Conclusions

Growing inexperienced investments in durations of price range consolidation will show politically near inconceivable if these investments are undertaken by slicing present expenditures or elevating taxes. Additionally it is not advisable that long-term capital investments be funded from present revenues. As a substitute, financial and accounting logic means that web capital investments be funded by deficits, reflecting the lengthy lifetime of inexperienced infrastructure. A inexperienced golden rule would supply the proper incentives for this. A serious and justified fear is ‘greenwashing’, or the will of governments to declare present spending as inexperienced capital investments. This must be addressed by a slim definition of inexperienced investments and powerful institutional scrutiny. A second fear is that inexperienced investments have unsure development results. In international locations with debt sustainability considerations, such investments ought to due to this fact not be funded with nationwide deficits. And certainly, till 2026, it’s the EU restoration fund that may present for that funding. Till a inexperienced golden rule is agreed on and legally applied, there may be scope to permit for a few of such funding to happen by utilizing the present flexibilities.

References

Blanchard, O and F Giavazzi (2004) “Enhancing the SGP by a correct accounting of public funding”, CEPR Dialogue Paper No. 4220.

Coady, D, I Parry, N P Le and B Shang (2019), “International Fossil Gasoline Subsidies Stay Giant: An Replace Primarily based on Nation-Degree Estimates”, IMF Working Paper 19/89.

Darvas, Z (2022), “A European local weather fund or a inexperienced golden rule: not as totally different as they appear”, Bruegel Weblog, 3 February.

Darvas Z and G Wolff (2021), “A Inexperienced Fiscal Pact: local weather funding in occasions of price range consolidation” Bruegel Coverage Contribution 18/2021.

D’Aprile, P, H Engel, G van Gendt et al .(2020), Web-zero Europe: Decarbonisation pathways and socioeconomic implications, McKinsey & Firm.

European Fee (2020), Influence evaluation accompanying the doc ‘Stepping up Europe’s 2030 local weather ambition. Investing in a climate-neutral future for the good thing about our individuals’, SWD/2020/176 last.

Worldwide Power Company (2021), Web Zero by 2050. A Roadmap for the International Power Sector.

Martin, P, J Pisani-Ferry and X Ragot (2021), “A brand new template for the European fiscal framework”, VoxEU.org, 26 Could

Tenhofen, J, G Wolff and Okay H Heppke-Falk (2010), “The Macroeconomic Results of Exogenous Fiscal Coverage Shocks in Germany: A Disaggregated SVAR Evaluation”, Jahrbücher für Nationalökonomie und Statistik 230(3): 328-355.

Endnotes

1 This column was written earlier than the outbreak of the conflict in Ukraine.

2 The EIB (2021) reported a forty five% unweighted common public share within the EU. We calculate the weighted common at 28%. IRENA’s (2021) 1.5°C situation estimated a 22% public share on the international degree in 2019, which might decline to 17% past 2030.

3 https://www.imf.org/en/Matters/climate-change/energy-subsidies

4 https://ec.europa.eu/eurostat/paperwork/10186/10693286/GFS-guidance-note-statistical-recording-recovery-resilience-facility.pdf

5 https://ec.europa.eu/data/business-economy-euro/economic-and-fiscal-policy-coordination/eu-economic-governance-monitoring-prevention-correction/stability-and-growth-pact/legal-basis-stability-and-growth-pact_en

6 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=celex:42012A0302(01)

7 https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52015DC0012&from=EN

8 http://knowledge.consilium.europa.eu/doc/doc/ST-14345-2015-INIT/en/pdf

9 https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX:01997R1466-20111213

10 http://knowledge.consilium.europa.eu/doc/doc/ST-9344-2017-INIT/en/pdf