This article/post contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services

Mining companies extract, process, and sell metals, minerals, and materials. These materials include precious metals, industrial metals, construction materials, energy materials, and fertilizers.

Mining stocks can be an attractive option for investors due to the increased demand for and decreased availability of natural materials. These stocks can also pay dividends, adding cash flow to your portfolio.

Mining stocks sometimes suffer during an economic downturn, when the demand for metals and mined materials may dip. However, as gold is a popular hedge against inflation and certain mined materials have high demand and value, mining stocks may still hold steady compared to other industries. Here’s a look at some of the best mining stocks today.

Please note that all the stock prices below are current as of market close on October 25th, 2022.

5 Mining Stocks Worth Considering in 2022

Here are some of the best mining companies to invest in today.

| Mining Company | Ticker | TL;DR (Too Long; Didn’t Read) |

|---|---|---|

| Alpha Metallurgical Resources Inc. | AMR | Alpha Metallurgical Resources Inc. is a mining company that extracts, processes and markets coal, with mines in Virginia and West Virginia. |

| Barrick Gold Corp. | GOLD | Barrick Gold Corp. is the world’s second-largest gold miner by production. |

| Rio Tinto Group | RIO | Rio Tinto Group is the world’s second-largest mining company. It produces aluminum, copper, and iron ore, as well as other metals and minerals like boron, salt, diamonds, and titanium. |

| BHP Group Limited (BHP) | BHP | BHP Group Limited produces copper, nickel, iron ore, potash, and metallurgical coal. BHP Group has operations in more than 90 locations. |

| Teck Resources Ltd | TECK | Teck Resources Ltd is a mining company based in Canada that produces coal, zinc, and copper. It also works in the energy sector. |

1. Alpha Metallurgical Resources Inc. (AMR)

- Current Price: $165.99

- 12-Month High: $180.80

- 12-Month Low: $44.89

- 1-Year Target: $207.00

- Market Capitalization: $2.79B

Alpha Metallurgical Resources Inc. is a mining company that extracts, processes, and markets coal to steel producers, electric utilities, and industrial clients. The Tennessee-based company operates underground and surface mines in Virginia and West Virginia.

While the coal industry is on most people’s naughty list for environmental reasons, the product is still critical for thermal energy and many industrial processes. While we may see demand for coal decline over time, Alpha Metallurgical Resources still has a very willing market to buy its products.

Alpha’s stock is up more than 100% year to date, from $62.99 at the beginning of the year to $180.80 on October 25th. The revenue has more than tripled year-over-year. Alpha’s forward dividend is $1.57, and its one-year target is $207.00.

2. Barrick Gold Corp. (GOLD)

- Current Price: $15.23

- 12-Month High: $25.58

- 12-Month Low: $14.53

- 1-Year Target: $28.41

- Market Capitalization: $26.964B

Barrick Gold Corp. is the world’s second-largest gold miner by production. The Toronto-based company operates mines in 16 locations across 13 countries. In 2021, the company produced 4.4 million ounces of gold. It also operates a small group of copper-producing mines, offering diversification if gold prices fall.

Gold is a popular place for investors to stash their resources during times of economic uncertainty, which could drive up the price of gold. Higher gold prices could help Barrick, although it faces strong economic headwinds with rising labor and fuel costs.

Although it is trading at $14.23 as of October 25th (which is very close to its 12-month low of $14.53), gold typically falls when interest rates rise, which is not surprising. Barrick Gold could be a value stock to consider holding. Barrick’s one-year target estimate is $28.41.

3. Rio Tinto Group (RIO)

- Current Price: $55.05

- 12-Month High: $84.00

- 12-Month Low: $51.22

- 1-Year Target: $70.77

- Market Capitalization: $89.214B

Rio Tinto Group is the world’s second-largest mining company. Rio Tinto Group produces aluminum, copper, and iron ore, metals essential to the energy transition from fossil fuels to renewables. The company also produces metals and minerals like boron, salt, diamonds, and titanium. Rio Tinto used to mine coal but recently exited the coal mining business due to the forecasted economic issues for coal amid climate change concerns.

Because it is so diversified, Rio Tinto is better positioned to withstand a price drop in any specific marketplace. For example, the company was willing to divest itself from coal mining as the long-term outlook isn’t as strong as other areas in the Rio Tinto portfolio.

It is worth noting, however, that stocks are trading at $55.05 as of October 25th, close to its 12-month low of $51.22. That could indicate investor worries, but it could signal an opportunity if you believe the stock is poised for a turnaround. Rio Tinto’s one-year average target estimate is $70.77.

4. BHP Group Limited (BHP)

- Current Price: $49.67

- 12-Month High: $70.74

- 12-Month Low: $46.65

- 1-Year Target: $69.33

- Market Capitalization: $169.323B

BHP Group Limited produces copper, nickel, iron ore, potash, and metallurgical coal. BHP Group has operations in more than 90 locations worldwide. Potash is a potassium-rich salt used in agriculture and is a key ingredient in many fertilizers and industrial chemicals. Glass manufacturing, mining, recycling, water softening, and fireworks are among the industrial buyers of potash.

The coal producer provides coal of varying grades specifically for use in other industrial processes. While this still significantly impacts the planet, it’s better than the thermal coal used for electricity production.

The stock has been pretty stable over the past year, with a low of $46.65 and a high of $70.74. The 12-month target price estimate averages $68.67.

5. Teck Resources Limited (TECK)

- Current Price: $34.44

- 12-Month High: $45.74

- 12-Month Low: $26.21

- 1-Year Target: $41.37

- Market Capitalization: $18.315B

Teck Resources Limited is a mining company based in Canada. It produces coal, zinc, copper, and energy resources. It is the second-largest producer of steelmaking coal worldwide. Operations are primarily in Canada, Peru, Chile, and the United States.

On September 16th, 2002, Teck announced an agreement with Agnico Eagle. The deal will make Teck and Agnico Eagle 50/50 joint venture partners in a copper-zinc mining project in Mexico. The transaction is valued at $580 million.

The current stock price is midway between the 12-month high and low and not too far below the one-year analyst target. But when you consider the dividend and steady demand for its products, you may find it a wise long-term investment.

Other Ways To Invest In Mining Companies

Mining is a very diverse industry that does much more than pull gold and coal out of the ground. Precious metals (gold, silver, platinum), industrial metals (iron, copper, nickel, aluminum), construction materials (stone, limestone, sand), energy materials (oil, coal, uranium), and fertilizers (phosphate, boron, potash) all have to come from somewhere. Mining companies play an essential role in the supply chain.

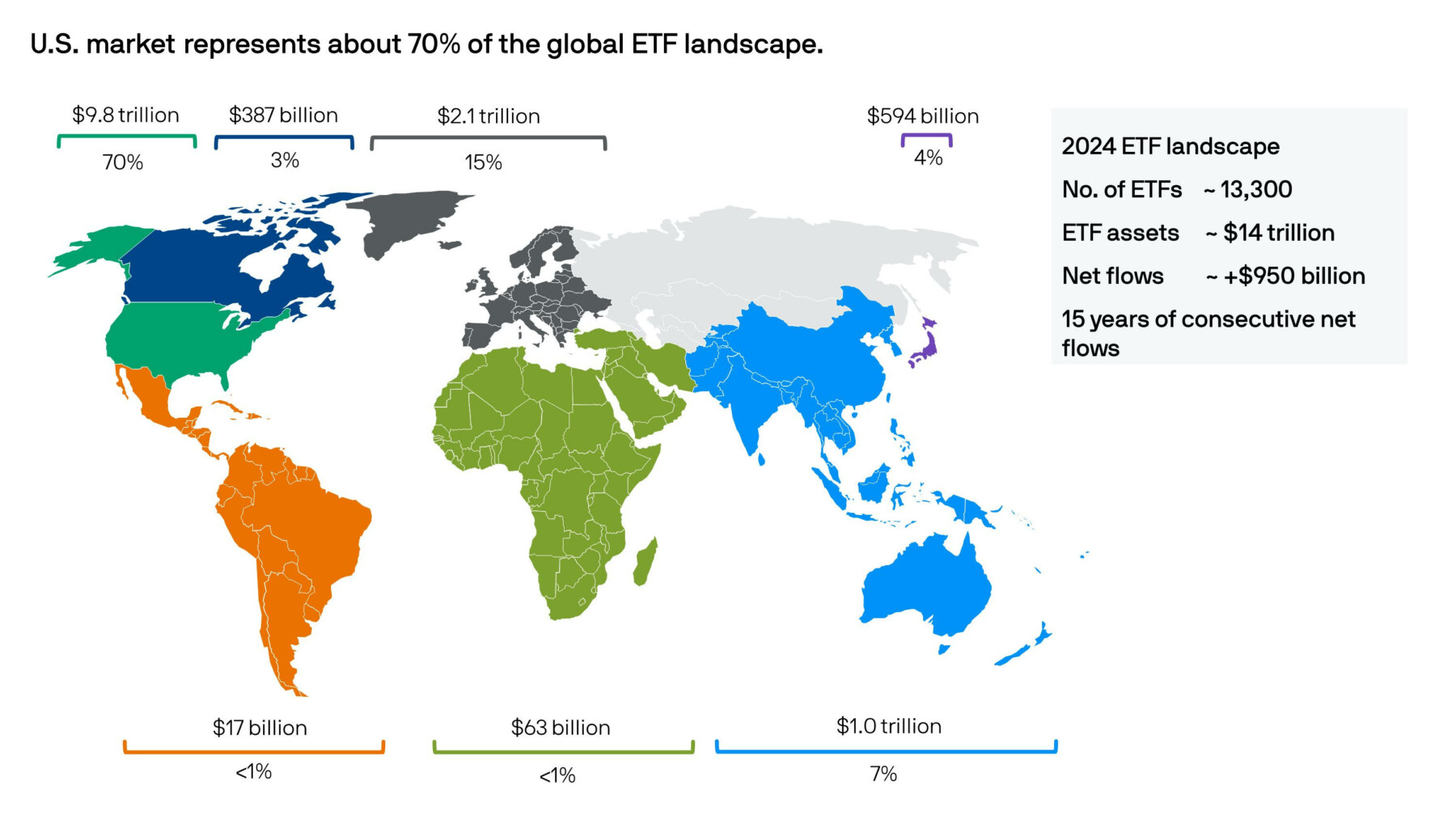

If you want to invest in mining companies but aren’t currently looking to invest in a single stock, you could invest indirectly through ETFs, mutual funds, and robo-advisor portfolios. Some funds focus on mining stocks, while others give you exposure to the underlying commodities. However you decide to invest, it’s important to do plenty of research to know what you’re buying and the risks.

Should You Invest In Mining Companies?

Mining companies typically have more money to invest in new mines and growth during periods of economic expansion. However, mining expansion projects can take a long time to complete and are extremely expensive. This can cause problems with timing if the project is completed after the economy has changed, which can affect projected returns.

If you’re considering investing in mining, you should pay attention to the amount of debt the mining company has. Mining companies with a lot of debt can struggle during economic downturns. On the other hand, mining companies that have low production costs and efficient operations can see significant profits during any economic period.

Due to these risks, focusing on the top mining companies can be safer. Companies that have been around for years are more likely to have proven their ability to generate profits during the ups and downs of the economic cycle.

The Bottom Line on Mining Stocks

The mining industry can be volatile, but that can work to your advantage if you time the stocks right. Mining stocks have also historically increased over time, so with the right timing and longevity, mining stocks could pay off.

More stocks to consider: