Published by Nate Parsh on November 2nd, 2022

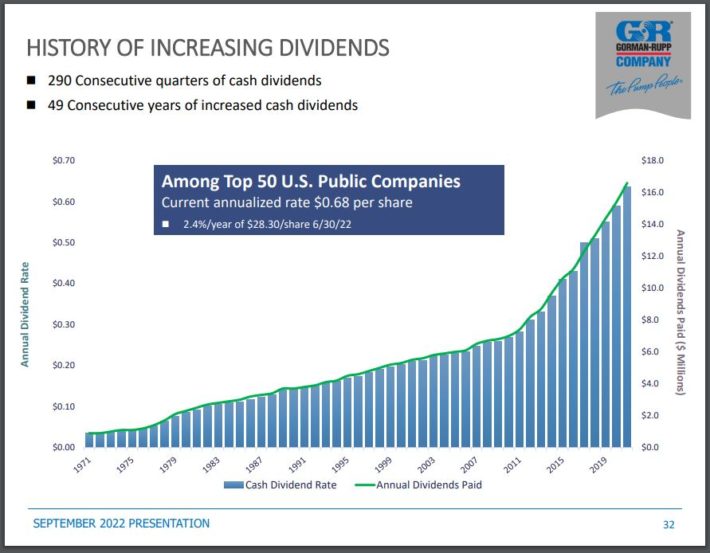

On November 14th, 2022, The Gorman-Rupp Company (GRC) announced that it was increasing its quarterly dividend by 2.9% to $0.175 for the December 9th, 2022 payment date.

While the size of the raise wasn’t necessarily impressive, this increase extended Gorman-Rupp’s dividend growth streak to 50 consecutive years. As a result, Gorman-Rupp is the newest entrant into the Dividend Kings.

The Dividend Kings are a group of just 48 stocks that have raised their dividends for a minimum of 50 straight years.

This group is among our favorites for investors to consider as we believe their high-quality business models that have enabled dividend growth for decades are likely to continue to do so in the future.

With this in mind, we created a full list of all 48 Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

This article will examine Gorman-Rupp’s business overview, growth prospects, competitive advantages, and expected returns for the next five years.

Business Overview

Gorman-Rupp has been in business since 1933. The company began as a manufacturer of pumps and pumping systems and has grown over time to become a leading supplier of critical systems that industrial clients count on to run their businesses. The company generates revenue of more than $500 million annually and has a market capitalization of $716 million.

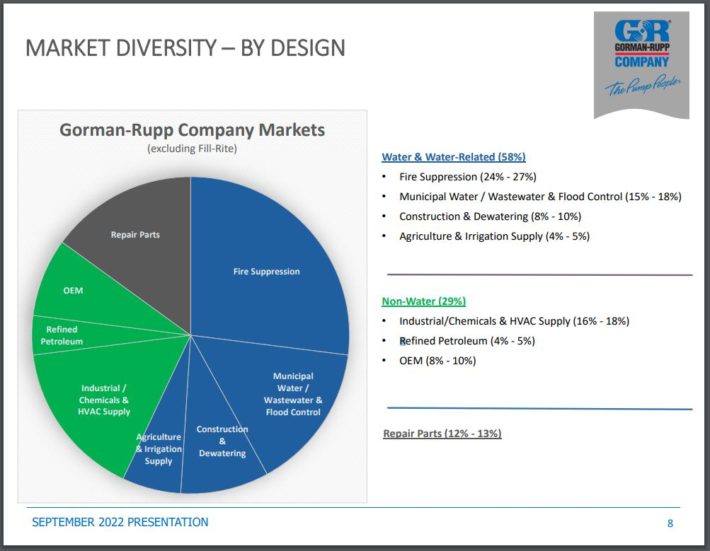

Despite its size, Gorman-Rupp is a key cog for many industrial customers. The company’s products are used in a wide variety of end markets, including agriculture, air conditioning, construction, fire protection, heating, industrial, liquid handling, military, original equipment, petroleum, ventilation, water, and wastewater. The company’s water-related businesses account for ~58% of annual revenue, non-water contributes 29%, and repair parts account for the remainder.

Gorman-Rupp reported third-quarter earnings results on October 28th, 2022. Revenue grew 52.1% to $153.8 million, which was nearly $12 million more than analysts had predicted. Adjusted earnings-per-share of $0.25 compared unfavorably to the $0.35 the company earned in the prior year and was $0.11 below estimates.

U.S. sales grew 48% while international was higher by 14%. Much of the domestic growth was due to the company’s acquisition of Fill-Rite, the leading pump designer, in June of this year (https://gormanrupp-20499357.hs-sites.com/news/gorman-rupp-completes-acquisition-of-fill-rite).

Even without this addition, Gorman-Rupp’s water business improved by 12.2%, and non-water improved by 9%.

Growth Prospects

Gorman-Rupp’s role in its industry is very important as the company’s products are necessary for these end markets to perform their basic functions. This makes this rather small company a rather vital piece of the industrial picture.

That said, the company’s earnings growth over the long term is often correlated to the health of the economy. Earnings volatility has been an issue as revenue can swing wildly from year to year.

The company has been very good at managing costs, which has allowed for stable margins over the last decade, but there are periods of weakness. This is evident in 2019 and especially 2020, where the COVID-19 pandemic greatly impacted results.

One factor working in Gorman-Rupp’s favor is the aging infrastructure that plagues its main market of the U.S. The America Society of Civil Engineers rates the country’s infrastructure as poor. Overall, the aging infrastructure system receives a C- from the organization, with particularly poor grades for drinking water, wastewater, and stormwater systems.

It is estimated that $2.6 trillion will be required to be spent to fix and improve water, wastewater, and flood control systems over the next decade to meet the need for infrastructure improvements. This should have Gorman-Rupp well-positioned for years to come.

Another way that Gorman-Rupp attempts to augment its organic growth is through the use of strategic acquisitions.

A good example of this was the previously discussed Fill-Rite purchase. Using cash on hand and new debt, Gorman-Rupp paid $525 million for Fill-Rite, which was formerly a division of Tuthill Corporation.

Source: Investor Presentation

Fill-Rite’s portfolio includes high-performance liquid transfer pumps, mechanical and digital meters, precision weights, hoses, nozzles, and accessories.

The addition of Fill-Rite was made possible because Gorman-Rupp’s balance sheet is in remarkably good shape even after issuing new debt to fund the purchase. Before this acquisition, the company had zero long-term debt on its balance sheet. That has now increased to $415 million, but this is a manageable sum given how meaningful Fill-Rite has already been to results.

Competitive Advantages and Recession Performance

Gorman-Rupp has become an industry leader due in large part to its ability to offer a variety of end markets the products that it needs. The company’s diversified portfolio helps to protect against declines in any one area of its business.

Source: Investor Presentation

Fire Suppression is the largest contributor to sales, but this is still just around a quarter of the total that Gorman-Rupp’s generates each year. This diversification can help to alleviate declines in a certain area.

However, Gorman-Rupp isn’t immune to the impacts of a recession. Listed below are the company’s earnings-per-share totals before, during, and after the Great Recession:

- 2006 earnings-per-share: $1.14

- 2007 earnings-per-share: $1.37 (20% increase)

- 2008 earnings-per-share: $1.04 (24% decrease)

- 2009 earnings-per-share: $0.70 (33% decrease)

- 2010 earnings-per-share: $0.93 (33% increase)

- 2011 earnings-per-share: $1.10 (18% increase)

Gorman-Rupp suffered significant declines during the Great Recession. The company saw a rebound shortly after this period as the economy began recovering and demand improved. The company established a new high for earnings-per-share shortly after the downturn.

At the same time, the company continued to increase its dividend, just as it had for decades.

Source: Investor Presentation

While business results will likely suffer during the next economic downturn, we believe that the tailwinds to the company’s business model will allow for continued dividend growth.

Valuation and Expected Returns

Shares of Gorman-Rupp are trading at 20.8 times our expected earnings-per-share of $1.30 for 2022. We believe fair value lies closer to 23 times earnings, which is less than the price-to-earnings ratio of 25 that the stock has averaged since 2012. Multiple expansion could add 2.1% to annual returns.

Between organic growth and the ability to add key businesses to its portfolio, we forecast that Gorman-Rupp can achieve earnings-per-share growth of 6% annually through 2027.

The dividend will also add to the results. Presently, Gorman-Rupp is yielding 2.6%, which not only tops the average yield of the S&P 500 but is also one of the stock’s highest yields in more than a decade.

Therefore, Gorman-Rupp is projected to return 10.3% annually through 2027, stemming from an expected earnings growth rate of 6%, a starting dividend yield of 2.6%, and a low single-digit contribution from multiple expansion.

Final Thoughts

The Dividend Kings are an exclusive list of companies that have established extremely long histories of dividend growth. This feat is so rare that there are less than 50 such names meeting the lone requirement of at least five decades of dividend growth.

Gorman-Rupp is the newest to be added to this list. The company’s impressive business model, ability to make strategic acquisitions and industry tailwinds should position the company to continue to grow its dividend. The stock is also reasonably priced and has double-digit total return potential over the next five years, earning Gorman-Rupp a buy recommendation.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].