Andy Andrews/DigitalVision via Getty Images

Maintaining Our Rating

We initiated a “Strong Buy” rating for Evercore (NYSE:EVR) on August 20th, citing the company’s strong history of good financial performance through economic cycles, shareholder friendly policies, and a cheap valuation. Since then, the company had a return of 2.39% compared to S&P 500’s return of -9.25%. In other words, the company has significantly outperformed the market in that time span, by nearly 11% since the publication. After Q3 results, we reiterate our rating, based on the company’s better than expected bottom line and top line performance, along with optimism that the economic cycle will recover.

Strong Q3 Performance

Evercore reported stronger than expected results, with a Q3 EPS of $2.20 (beating $1.32 consensus estimates) and a Q3 revenue of $583 million (beating $487 million consensus estimates). The better than expected performance during a quarter that saw 75 bps rate hike, higher bond yields, and various geopolitical events supports our thesis that Evercore will do well enough to steer through economic challenges. Management recognized the tough economic environment but remained upbeat on the future performance:

Evercore continues to perform well in the current, challenging environment. Our diverse capabilities allow us to advise and assist our clients throughout the cycle. We remain steadfast in our commitment to providing the highest level of client service.

– John S. Weinberg, Chairman and Chief Executive Officer

The company also noted some additional highlights, such as the company’s role as the bookrunner on the largest IPO to date for Corebridge Financial ($1.7 billion), and numerous awards for its Private Funds Group and Evercore ISI. Furthermore, Evercore also reported a quarterly dividend of $0.72 per share, maintaining its dividend levels despite the tough economic climate, which further supports our thesis that the company will be able to maintain its generous shareholder programs even through the troughs of this current economic cycle.

Valuation Remains Cheap

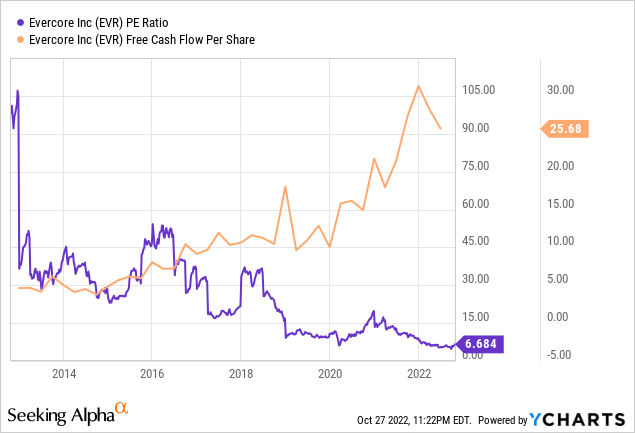

Even after Q3 earnings, the valuation still remains cheap, as the stock trades still at its lowest levels in years. As mentioned in our previous article, we believe 12.0x to 15.0x P/E multiple should be its long-run average P/E multiple, and therefore we still see substantial upside in the stock price. Furthermore, the Free Cash Flow Per Share still stands at around $25, which means that at current levels, 25% of the stock is backed by free cash flow. Overall, our valuation stance has not changed since our coverage in August, and we believe the stock remains cheap at this time.

Economic Risks

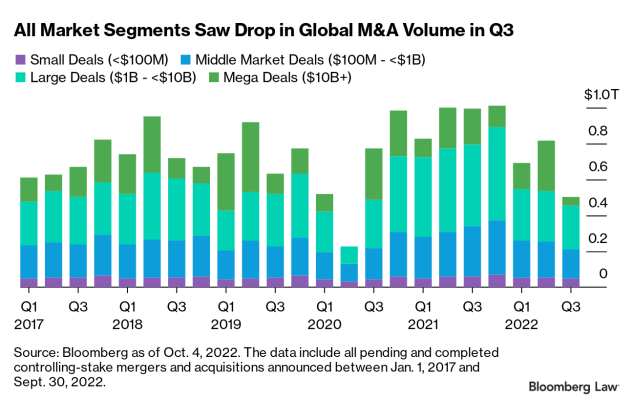

M&A has been slow in Q3, with Q3 M&A deal volume being the lowest quarterly deal volume since Q2 of 2020. Axios reports that the global M&A volume was 42% drop from the prior quarter, and some reasons for the significant drop in M&A volume has been uncertain macroeconomic conditions, price declines, rising costs of financing, inflation, and more. Evercore has also experienced significant revenue decline from the deterioration in the M&A market, as, according to Financial Times League Tables, Evercore saw a near 50% decline in its M&A related fees. However, many of the rate hikes have already been priced into the market, and there appears to be more discussion at the Federal Reserve on stopping interest rate hikes. At the very least, we believe that Evercore will be nimble and financially strong enough to sustain its profitability during a weak M&A environment, and Q3 2022 has showed us that. If and when rates start to go down or market activity thaws, we believe that Evercore will be poised to regain revenue and profit growth as M&A activity picks up.

Bloomberg Law

Final Takeaway

Overall, we believe Q3 earnings have worked to support our thesis, and demonstrated the company’s relatively strong performance given the lack of M&A and financing activity. The company continues to provide shareholder value through consistent dividend income, and we believe that the company will see a valuation expansion as soon as economic conditions improve for the better.