DNY59/E+ by way of Getty Photographs

The Legend

The Nephilim had been on the earth in these days, and in addition afterward, when the sons of God got here in to the daughters of males, they usually bore kids to them. These had been the mighty males who had been of outdated, males of renown.

Genesis 6:4

The Huge Cash In Leveraged 3x ETFs was revealed in Could, 2020. Most of my growth work since then has been feeble makes an attempt to design efficient methods of analyzing these devices.

One tentative conclusion I’ve come to is 3x Bulls on Main Inventory Indexes provide the only and finest sensible likelihood for a person to rapidly amass nice wealth. The long-term numbers are so sturdy, that they need to arguably be a regular element in bigger portfolios.

My analytical methodology is pushed by ideas of utilized info idea which I picked up within the college of onerous knocks. New Ideas in Computational Finance describes a few of the main design issues, noting that they’re fairly just like facets of the work of Stephen Wolfram.

This technique gives higher market insights than a mathematical statistically oriented strategy. The most recent time period to explain my methods is Utilized Info Concept.

Nephilim Logic

ETFs on main indexes had been a significant step ahead in many various methods. For instance, they permit longer analytical lookbacks with out survivor bias, at some price in granularity. 3x Bulls present related analytical advantages due to the artificially elevated volatility.

Nephilim are created by holding a 3x Bull through the CO (Near Open) finite state and holding a non-leveraged ETF throughout OC (Open to Shut). The mixed return streams create a brand new safety.

Nephilim appears an applicable time period for the idea. On the similar time, it isn’t straightforward to discover a memorable time period to explain non-leveraged ETFs, so right here I exploit Daughters of Males to take care of the symbolism.

Creation Course of

I modified my information construct process not too long ago to enhance processing velocity, and facilitate Nephilim logic. The efficiency a part of the mission went on for a number of months and bought a bit intense. In all the joy, I briefly forgot in regards to the Nephilim half.

The creation course of is easy to elucidate:

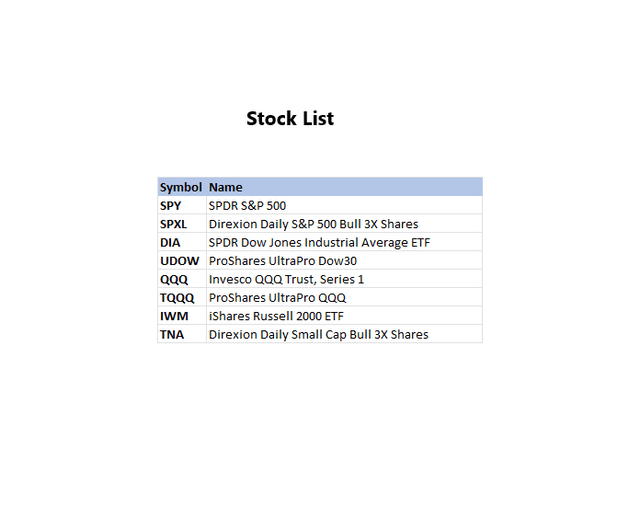

The Inventory Listing

Inventory Listing (JIFriedman.com)

The record is a worksheet that tells the algorithm what shares to load for evaluation, and the sequence they need to seem in.

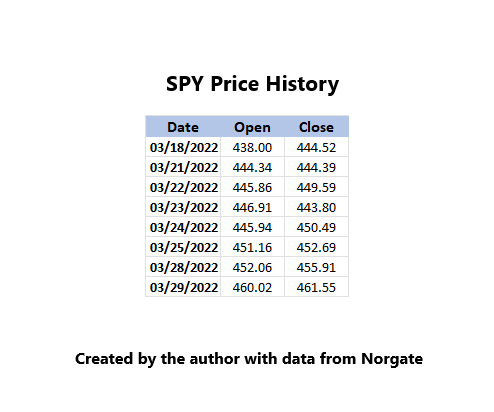

Inventory Worth Historical past

SPY Worth Historical past (JIFriedman.com)

For every inventory on the inventory record, there’s a txt file in a listing with value historical past for that inventory that will get up to date shortly after the market closes. The costs are adjusted for dividends and splits, and so on. Norgate solves the technical problems with getting clear value historical past information.

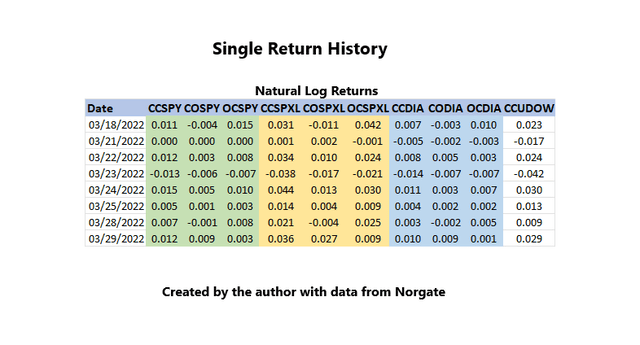

The Construct

Theoretically, one can go from the inventory record and value historical past instantly to provide any of my research with out creating any intermediate spreadsheets. That could be a gradual course of after all. As a sensible matter, the open and shut costs will not be vital after calculating day by day pure log returns for the 2 finite states:

- CO – Near Open

- OC – Open to Shut

CC (Near Shut, or purchase and maintain) can also be calculated, however that could be a step that’s not strictly vital as a result of with pure logs:

CC = CO + OC

It’s helpful to pre-calculate the pure logs for every image and retailer the leads to a single worksheet to get entry to info with out doing a number of txt file opens and closes downstream that are sluggish.

Single Return Historical past Sheet (JIFriedman.com)

The Single Return Historical past spreadsheet is laid out to permit very environment friendly and quick research constructing algorithms. The research constructing algorithms instantly convert the one return historical past spreadsheet right into a two dimensional array (row, column). Deal with decision between the return historical past enter and research output is the technical problem. Like I’ve mentioned earlier than, it takes somewhat follow.

With 16K most columns, Excel can deal with over 5,000 particular person shares’ value historical past (3 columns per inventory). Excel has processing constraints as a result of want to satisfy regular buyer necessities and sooner or later it might probably grow to be an unsuitable platform. The problems bought bizarre sufficient to switch my search patterns on YouTube and a Wolfram video popped up sooner or later.

10 Yr Efficiency

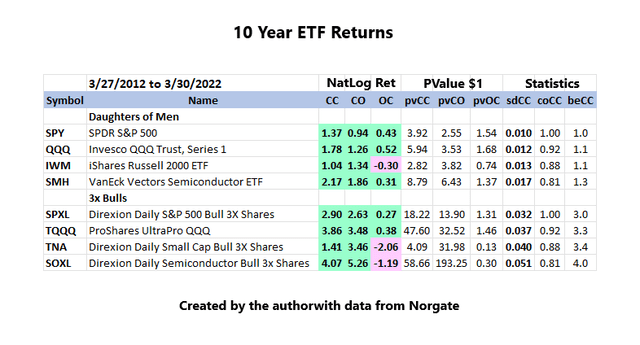

ETF 10 Yr Efficiency (JIFriedman.com)

Purchase and Maintain efficiency for the interval is in CC NatLog Ret, and proven in a extra human-friendly method in pvCC or current worth of $1 invested on the interval begin.

The numbers are clearly overwhelmingly favorable for the 3x Bulls.

An investor is comfortable if a 3x Bull outperforms a non-leveraged instrument by an element of three or extra based mostly on the current worth of $1 invested in each at first of an analytical interval. That could be a par quantity.

Roughly precisely the other will occur in a down market. In a down market, or intermediate downtrend, the investor will likely be fortunate to not lose greater than 3 instances the non-leveraged instrument’s loss.

Statistics for the interval embrace:

- sdCC – Normal deviation of the day by day pure log return

- coCC – Correlation of the inventory with SPY over the interval.

- beCC – Beta of the inventory versus SPY over the interval.

The additional danger for the 3x Bulls is hinted at in the usual deviation. Most individuals cannot take care of the danger of…

Nephilim Pairs and Efficiency

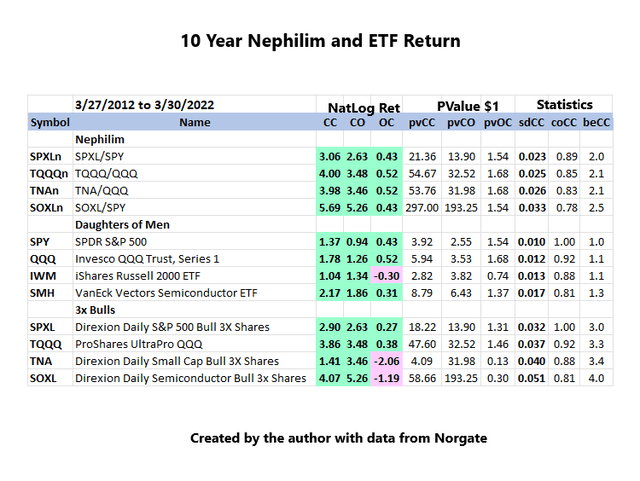

- SPXLn = SPXL and SPY

- TQQQn = TQQQ and QQQ

- TNAn = TNA and QQQ

- SOXLn = SOXL and SPY

Nephilim and ETF 10 Yr Efficiency (JIFriedman.com)

The Nephilim are given the CO mojo of the 3x Bulls and the relative OC serenity of the daughters of males. This makes Nephilim CC efficiency much more spectacular than the 3x Bulls. On the similar time, volatility (or danger) is considerably decreased. SOXLn, for instance, has nearly the identical commonplace deviation as SPXL, however efficiency high quality can also be vastly improved as a result of it now has a decrease beta and correlation than SOXL has with SPY.

SOXLn versus SOXL Efficiency By way of Time

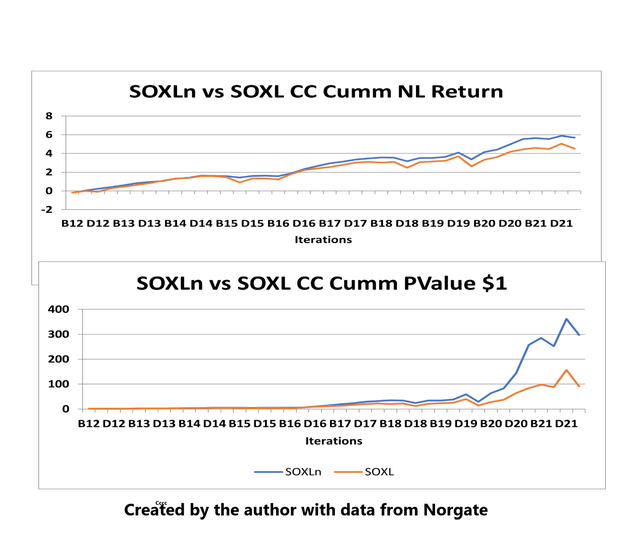

The ten-year interval might be damaged into 40 durations (or iterations) of 63 days (or 3 months). Since there are 4 such durations in a 12 months, every quarter is recognized by an alpha code together with the 12 months, so B12 corresponds to the second quarter of 2012.

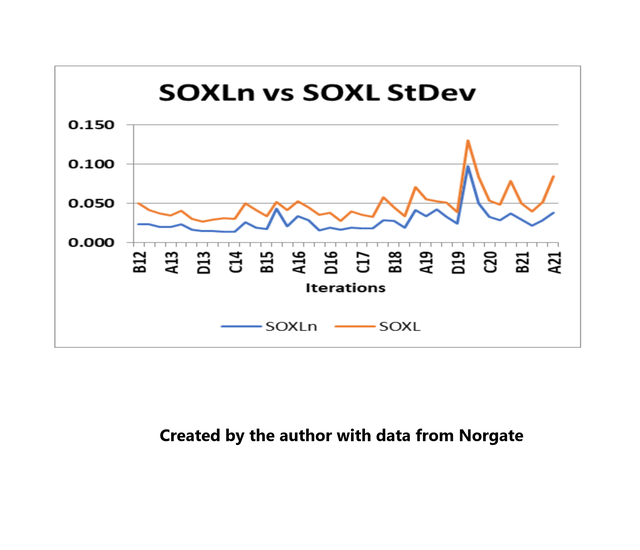

SOXLn/SOXL Historic Efficiency (JIFriedman.com) SOXLn vs SOXL Volatility (JIFriedman.com)

The StDev research exhibits that SOXLn is considerably much less dangerous than SOXL, whereas the returns for SOXLn are much better.

It’s potential to see the usual deviation of SOXL steadily growing during the last 10 years. That’s per main indexes. It in all probability is not value freaking out over.

Funding Methodology

It is very important perceive how purchase and maintain works earlier than an investor will get into buying and selling techniques. Present motion has proven the market to be in an intermediate downtrend that’s near ending as a result of the present bounce seems to be stronger than minor.

If an investor missed the beginning of the collapse in early January, it was higher to experience issues out. An excessive amount of delta can flip somewhat turbulence into a private disaster.