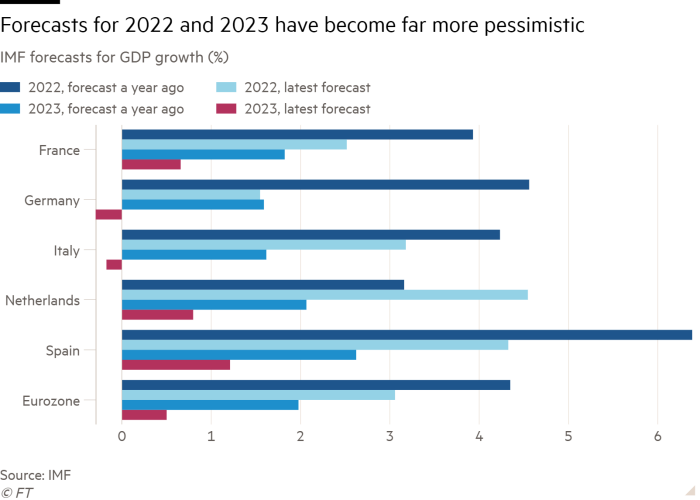

The economic challenges facing the eurozone are not the same as those facing the US. On balance, however, they are even more difficult.

The eurozone economy is not suffering from overheating of domestic demand to the same extent as the US. This should make the task of monetary policy easier for the European Central Bank than for the Federal Reserve. But the supply shock buffeting the eurozone is far bigger, with a huge rise in the price of energy, especially gas, after Russia’s invasion of Ukraine. That shock is both inflationary and contractionary: inflationary, in that it has raised the price level sharply; and contractionary, in that it has lowered real incomes for households and the terms of trade for countries.

Crucially, the eurozone is more fragile than the US. Its national economies are diverse and cross-border insurance mechanisms relatively undeveloped. Above all, politics remain national. As a result, fragmentation is always a risk. Nevertheless, the eurozone does have advantages in handling the Covid and energy shocks compared with the financial crises of a decade ago. Recent shocks have affected members in quite similar ways, while the global financial crisis split the eurozone between domineering creditors and humiliated debtors. This time is indeed different.

So, what might the future hold? And what, above all, needs to be done?

Start with monetary policy. In the year to August 2022, headline consumer price inflation was 9.1 per cent in the eurozone and 8.3 per cent in the US. But core inflation (without energy and food prices) was only 4.3 per cent in the eurozone against 6.3 per cent in the US. Thus, 4.8 percentage points of eurozone inflation were due to increases in energy and food prices, against 2 percentage points in the US. Data on labour market data similarly indicate substantially less overheating than in the US.

This explains why the ECB has tightened later and less than the Fed — a 1.25 percentage point rise in the intervention rate, from minus 0.5 per cent, in the former, against a 3 percentage point rise, from 0.25 per cent in the latter. Nevertheless, the ECB was right to start normalising monetary policy, too, partly because policy had been so aggressive and partly because it needed to prevent the price effects of the shocks from being embedded in expectations. Its actions were also not premature: the IMF’s Global Financial Stability Report reveals that the inflation expectations of many market participants have already shifted upwards to about 4 per cent.

Nevertheless, the ECB needs to be cautious about how quickly and how far it moves. One reason for this is that the energy shock is going to impart a powerful recessionary impulse to the economy. Indeed, recessions are highly probable in the eurozone. Another reason for caution is the complexity of the transmission mechanisms, as laid out in a recent speech by Philip Lane, ECB chief economist. A particular worry is the uncertainty about the lags. It is quite possible that headline inflation will be falling fast quite soon, because gas prices have been falling. If so, the main impact of today’s monetary tightening may occur long after inflation expectations have already adjusted downwards. Indeed, it is possible that “normal” monetary policy for the eurozone remains very loose, as it was pre-Covid.

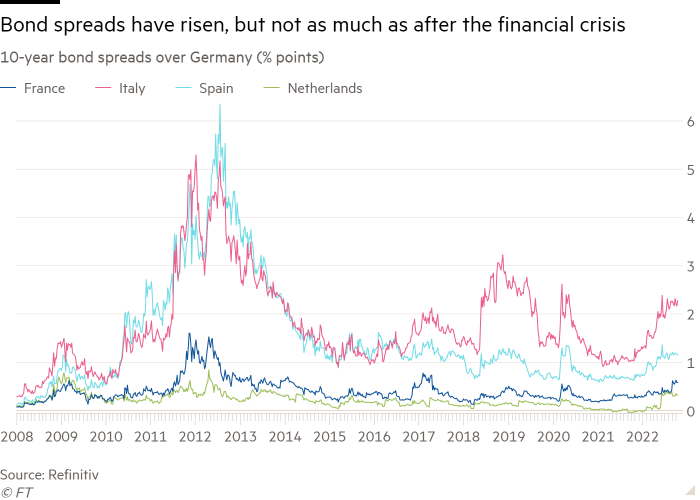

A particular concern is the rising spreads on government bonds, which would then be transmitted to borrowers in the most vulnerable economies. So far, these spreads are far smaller than during the eurozone crisis. Moreover, the ECB has several tools — on its own or in co-operation with other institutions, notably the European Stability Mechanism — to deal with fragmentation. These include asset reinvestment, a new “transmission protection instrument” and, if all else fails, the “outright monetary transactions” developed in 2012, after Mario Draghi’s “whatever it takes” speech. Implementing these programmes will, however, create conceptual, practical and political difficulties, especially over the distinction between illiquidity and insolvency. Ultimately, though, it is simple: throughout these crises, the eurozone has to treat all members as if they were in much the same shape even though they are not.

Will this work? The best answer is that it has to. The survival of the EU and so the eurozone, its economic core, is in the overriding national and collective interest of its members. They confront a brutal enemy of their most fundamental principles in the east and an unpredictable US in the west. The EU must not only survive, but thrive, if Europe itself is to do so. As has been shown repeatedly since Covid hit, the member countries understand this, especially the most important ones. However ramshackle and incomplete the structures of the EU and eurozone may be, members must keep everybody together through thick and thin. Right now it is going to be the latter.

This means far more than ensuring that the monetary regime works for everybody. It also means shaping a common energy policy, notably one that accelerates the shift to renewables; helping member states cushion their citizens against the worst of the energy shock, agreeing a common policy towards Vladimir Putin’s Russia in conjunction with Nato, shaping a trade and economic policy that manages relations with China, and even moving towards more stable relations with the UK.

The compromises needed to address the energy shock and Ukraine war will be painful. But they must be made. Without the EU, the member countries would be lost. They know this and will, I am sure, act upon that knowledge. Out of these crises must emerge a stronger EU, because there is no alternative.

Follow Martin Wolf with myFT and on Twitter