Revealed on March 28, 2022, by Felix Martinez

Unum Group (UNM) is an undervalued excessive yield dividend development inventory. The corporate has been paying a score dividend for 13 consecutive years. The corporate now sports activities a excessive dividend yield of three.8%, larger than its five-year dividend yield common. For those who as a dividend development investor, this can be a firm that it is best to have in your watchlist.

We additionally cowl a number of different completely different high-yield shares in our database.

We now have created a spreadsheet of shares (and carefully associated REITs and MLPs, and so forth.) with dividend yields of 5% or extra…

You’ll be able to obtain your free full checklist of all securities with 5%+ yields (together with vital monetary metrics comparable to dividend yield and payout ratio) by clicking on the hyperlink under:

Thus, we’ll evaluation Unum Group (UNM) for the next high-yield shares on this collection, with a present dividend yield of three.8%.

Enterprise Overview

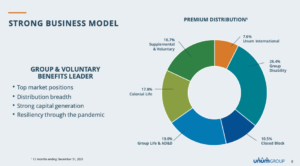

Unum Group is an insurance coverage holding firm offering a broad portfolio of monetary safety advantages and providers. The corporate operates by its Unum U.S., Unum U.Okay., Unum Poland, and Colonial Life companies, offering incapacity, life, accident, essential sickness, dental, and imaginative and prescient advantages to tens of millions of shoppers.

Unum has about 182,000 companies within the U.S. and U.Okay that supply advantages to its workers which might be supplied by Unum. The corporate is quantity 266 on the fortune 500 checklist, and 1 in 3 firms on the Fortune 500 checklist orders Unum advantages to their workers.

Supply: Investor Presentation

On February 1, 2022, the corporate reported fourth-quarter and full-year outcomes for Fiscal 12 months (F.Y.)2021. Income for the fourth quarter was down 30.3% in comparison with the fourth quarter of 2020. This lower was primarily from internet funding acquire. In 4Q2020, the web funding acquire was $1,304 million in comparison with a lack of $8.7 million final quarter. Nonetheless, premium revenue, the corporate’s fundamental income section, grew 2.4% yr over yr.

The reported internet revenue for the fourth quarter was $159.7 million or $0.78 per diluted frequent share for the fourth quarter of 2021. After-tax adjusted working revenue was $182.0 million or $0.89 per diluted frequent share. This compares extra worthwhile to 4Q2020, the place the corporate made a revenue of $135.4 million or $0.66 per diluted frequent share.

Unum’s U.S. section reported an adjusted working revenue of $81.4 million final quarter, a lower of 43.3% from $143.5 million in 4Q2020. Premium revenue for the section elevated 3.0% to $1,529.3 million for the quarter, in comparison with premium revenue of $1,485.1 million within the fourth quarter of 2020. Internet funding revenue for the section elevated 5.2% to $182.1 million within the quarter in comparison with $173.1 million in the identical interval of 2020.

For the yr, income was down 8.7% in comparison with FY2020. Once more, this was due to the web funding acquire section, which noticed a considerable lower year-over-year. Nonetheless, Premium revenue for the yr was up 1.1% in comparison with your entire yr of 2020. Internet revenue for the yr was up 3.9%, from $793.0 million in FY2020 to $824.2 million final yr.

Adjusted earnings-per-share equaled $4.35 in comparison with $4.93 in 2020. This was a lower of 11.8% year-over-year. We count on the corporate will earn $4.80 per share for FY2022. This will likely be a acquire of 10.3% in comparison with your entire yr of 2021.

Progress Prospects

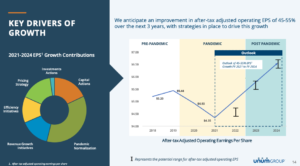

As an insurance coverage holding firm, there are a couple of alternative ways an organization can proceed to develop. As you see within the picture under, the corporate has a couple of plans to drive development. For instance, a pricing technique will likely be one solution to develop the corporate. Administration plans to have core competence in pricing and renewals. This may enable the corporate to align gross sales, underwriting, and actuarial.

The corporate additionally has effectivity initiatives plans, which is able to decrease bills. The corporate has plans for a digital-first, end-to-end go away expertise. There’s a vital enhance within the adoption of digital channels for enrollment, administration, and claims. In addition they plan to cut back their actual property footprint.

Supply: Investor Presentation

One other development driver of earnings will likely be how the corporate allocates its capital. The corporate expects to take care of $200 million of buybacks per yr over its outlook horizon and anticipated Fairwind LTC contributions between $550-650 million. Because the inventory value remains to be undervalued, these steps ought to absolutely assist future earnings development.

Aggressive Benefits & Recession Efficiency

The corporate is within the insurance coverage trade with commodity-like merchandise in nature. Nonetheless, the corporate’s aggressive benefit is its measurement and historical past. This enables the corporate to compete with higher pricing. The corporate works with 1 in 3 firms on the fortune 500 checklist that orders Unum advantages to their workers. This may be difficult for opponents to step into this area.

The corporate carried out very properly in the course of the nice recession; nonetheless, the corporate inventory value didn’t. The inventory value noticed a lower of over 47% from 2007 to the low in 2009. Nonetheless, earnings grew in that very same interval.

UNM’s earnings-per-share all through the Nice Recession:

- 2007 earnings-per-share of $2.04

- 2008 earnings-per-share of $2.51 (23% enhance)

- 2009 earnings-per-share of $2.63 (5% enhance)

- 2010 earnings-per-share of $2.66 (1% enhance)

As you see, the corporate did very properly in the course of the 2008-2009 Nice Recession. Each the earnings and dividend grew in these years. Thus, this led us to consider that the corporate will carry out properly in one other recession, however the inventory value will decline with the broader market.

Dividend Evaluation

The corporate has been paying a rising dividend for 13 straight years. The dividend development fee has been 11.5% prior to now ten years. Nonetheless, the corporate’s dividend development fee has been slowing down lately. For instance, prior to now 5 years, the dividend development fee has been 8.7%. For the previous three years, it has been 6.1%. The latest dividend enhance was 5.3% on Could 27, 2021. Thus, we count on one other dividend enhance on the finish of subsequent month.

We consider that the corporate will develop earnings at a 2% fee over the following 5 years. Despite the fact that the dividend payout ratio is low, we predict that the dividend development fee will even be close to this degree. Most probably within the low-to-mid single-digit.

The dividend payout ratio has been meager for the corporate based mostly on prior years. For instance, the very best dividend payout ratio was 23% during the last ten years. This was achieved in 2020 when earnings had been down due to the COVID-19 pandemic. As talked about above, we count on the corporate to earn $4.80 per share for FY2022. At the moment, the corporate pays a dividend of $1.20. This may give us a dividend payout ratio of 25% based mostly on FY2022 earnings. This makes the dividend terribly secure.

Additionally, administration plans to allocate funds in direction of buybacks with any additional money. Because the firm is undervalued to its guide worth, administration is elevating its share buybacks with $250 million introduced by the top of 2022, which is sort of 5% of the market cap. This quantities to a notable return of capital for traders.

The corporate additionally has an impressive steadiness sheet. The corporate has a 0.3 debt-to-equity ratio, which is superb. Additionally, PRU has an S&P Credit score Score of “A.” The “A” credit standing is an investment-grade score.

Thus, the steadiness sheet is superb and will assist the corporate face up to a recession and not using a dividend lower. Due to this fact, we predict the dividend could be very secure.

Closing Ideas

The corporate is a really secure and boring enterprise. That is the kind of enterprise that dividend development traders like to personal. The corporate continues to generate money movement. This enhance in money movement is getting used for repurchasing sizable quantities of shares, paying out a major dividend, and strengthening its investment-grade steadiness sheet.

Total, this can be a strong firm with the flexibility to proceed to pay and enhance its excessive dividend yield for years to return.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].