By Graham Summers, MBA

Stocks are now in very serious trouble.

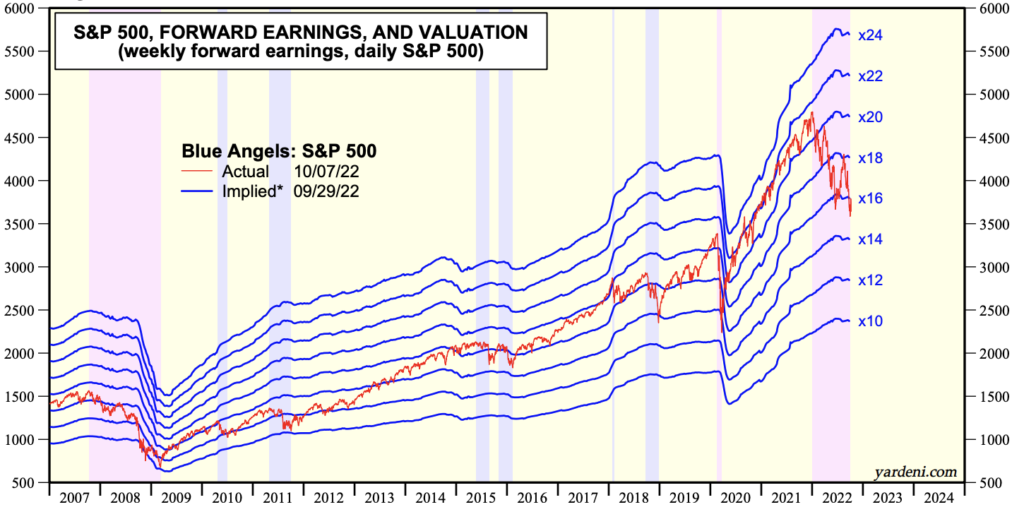

The ENTIRE collapse thus far in this bear market for stocks has been due to bond yields rising. When Treasuries were yielding 0.25%, investors were willing to pay 20-22 times forward earnings for stocks. However, once Treasury yields rose to 3%+, stocks were repriced down to 16-18 times forward earnings.

The below chart from Ed Yardeni does a great job of illustrating this.

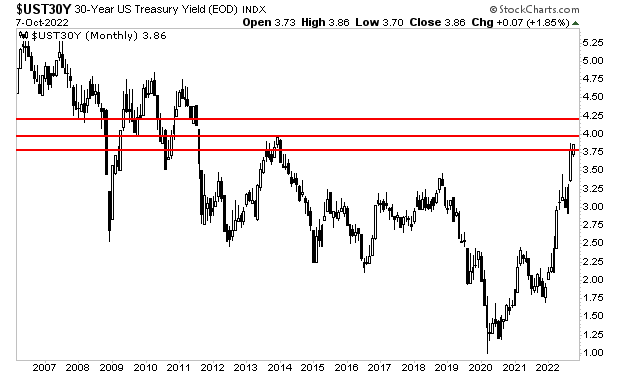

I bring this up because Treasury yields are showing NO SIGNS of stopping.

The yield on the 30-Year Treasury erupted higher last week, breaking above critical resistance at 3.75%. The door is now open to 4% if not 4.25%.

This means that stocks are about to be repriced even lower, possibly to 14 times forward earnings, or ~3,400 on the S&P 500. And if Treasury yields don’t stop soon, we might even go to 12 times forward earnings which is sub-3000 on the S&P 500.

This all ties in with what I’ve been saying for months…

Inflation blew up the Everything Bubble. And smart investors are using this to see incredible returns!