Optimum coverage for acquisitions of potential rivals underneath monetary constraints

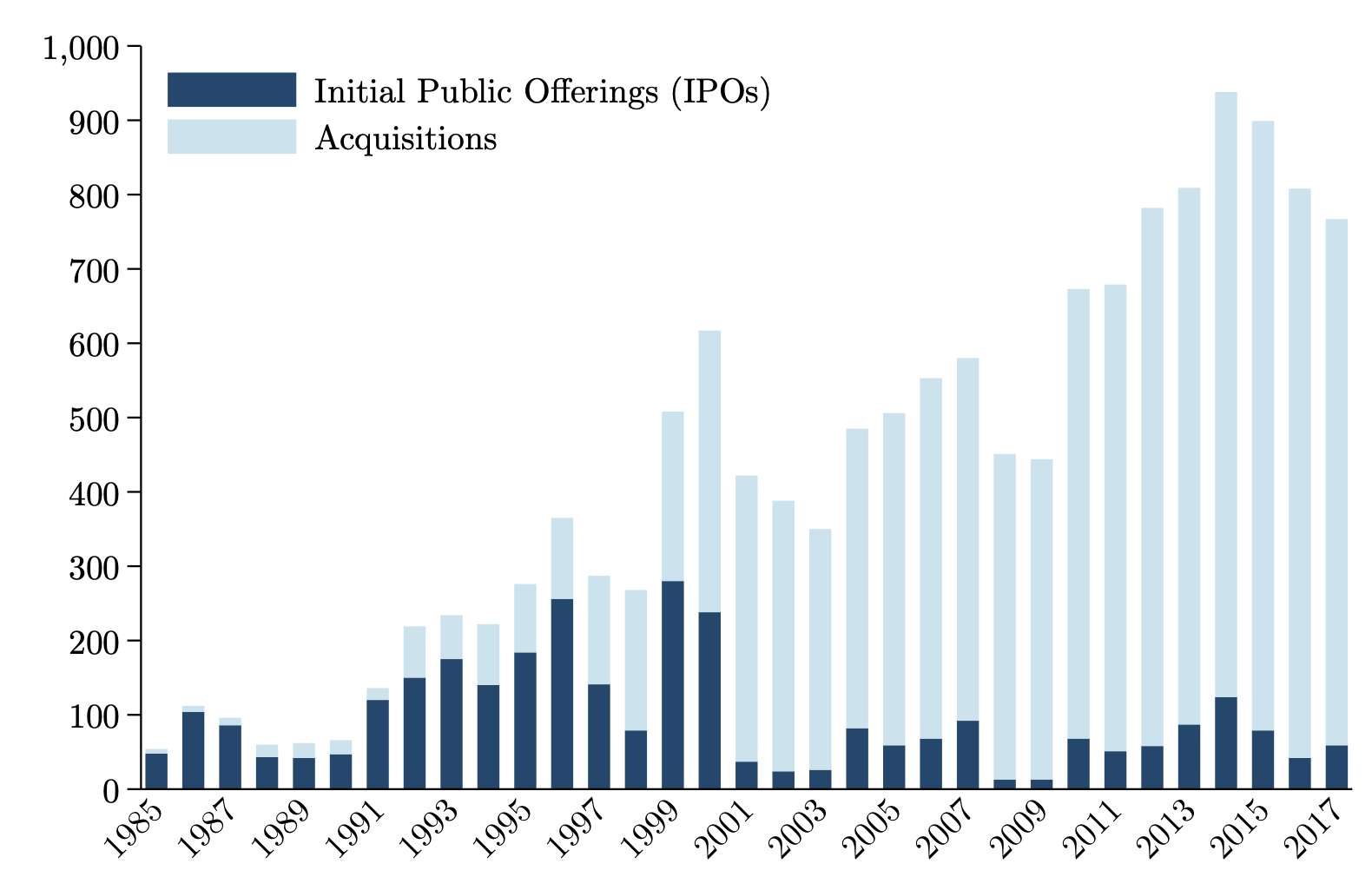

Potential rivals are corporations that at present don’t exert aggressive stress however may achieve this sooner or later. The acquisition of those corporations is a widespread phenomenon. As Determine 1 reveals, for the reason that mid-Nineties there was a dramatic shift within the exit technique of start-ups backed by enterprise capital, from IPOs in direction of acquisitions (clearly, not all of the targets of such acquisitions are potential rivals). Within the digital financial system alone, lots of of start-ups have been purchased in the previous couple of years by incumbents reminiscent of Alphabet (Google), Amazon, Apple, Meta (Fb) and Microsoft, however this phenomenon extends past the digital industries. Related patterns prevail in different industries reminiscent of, amongst others, the healthcare and pharmaceutical industries, as documented by Eliason et al. (2020) and Cunningham et al. (2021), respectively.

Determine 1

Supply: Pellegrino (2021).

Observe: The determine plots the variety of profitable exits of start-ups backed by enterprise capital within the US by yr and sort (Preliminary Public Choices vs. Acquisitions).

Typically, such acquisitions didn’t set off necessary pre-merger notification necessities, resulting in stealth consolidation (Wollmann 2019). When antitrust companies did open an investigation, the acquisitions have been authorised (apart from the latest Fb/Giphy choice by the UK’s Competitors and Markets Authority, the primary time a merger by one of many Huge Tech corporations has ever been blocked). Consequently, many have requested for stricter antitrust motion, alarmed by the doable anti-competitive penalties arising from the elimination of future competitors (Cremer et al. 2019, Furman et al. 2019, Scott Morton et al. 2019, Lemley and McCreary 2020, Motta and Peitz 2021).

A lot of the emphasis on this debate has been on such acquisitions having anti-competitive results once they take the type of so-called ‘killer acquisitions’, as documented by Cunningham et al. (2021) within the pharma trade: incumbents purchase a start-up to then shelve the start-up’s undertaking, to keep away from cannibalisation of current earnings. Nonetheless, one should recognise that such acquisitions might enable for the event of tasks that will in any other case by no means attain the market. This will likely occur as a result of the incumbent has an availability of sources that the goal agency lacks. In a latest paper (Fumagalli et al. 2020), we deal with monetary sources as the important thing asset that start-ups could also be in need of and acquirers can complement, based mostly on proof displaying monetary constraints are an essential obstacle to the start-ups’ development.

On this context the place each anti- and pro-competitive results might in precept come up, the target of our paper is to determine optimum coverage in direction of acquisitions of potential rivals. Maybe surprisingly, regardless of the potential upside of such acquisitions, we discover that antitrust companies ought to implement merger management in a ‘strict’ means, as we clarify under.

In our mannequin, a start-up owns a undertaking with optimistic web current worth that, if developed, will enable it to compete with an incumbent agency. To cowl the price of growth, the start-up wants to lift exterior funds. It could be both ready to take action, and therefore would succeed as an impartial firm available in the market, or it might be financially constrained, and it will be unable to change into an precise competitor. Neither the incumbent nor the antitrust company is aware of the kind (i.e. financially constrained or not) of the start-up. The worth of the takeover is decided in a non-cooperative bargaining sport with uneven info. If the incumbent and the start-up finalise an acquisition, the antitrust company authorises or blocks the deal based mostly on pre-committed requirements of assessment.

We present that the takeover sport can function two sorts of equilibrium presents: both a excessive takeover worth, such that any start-up would promote at that worth, no matter its kind; or a low takeover worth, at which solely financially constrained start-ups could be keen to promote.

Which worth arises on the equilibrium relies on the choice of the antitrust company on the proposed deal and on the chance for the incumbent to pay a excessive worth. Extra exactly, if a low worth is accepted, the antitrust company infers that the start-up is financially constrained and can authorise the deal. That is the case during which the acquisition is (weakly) helpful: if the incumbent develops, a brand new product will attain the market; if it cabinets, nothing modifications for the reason that start-up wouldn’t have been in a position to succeed independently. A excessive worth, as a substitute, doesn’t reveal extra info on the kind of start-up to the incumbent and the antitrust company. By paying a excessive worth, the incumbent is for certain to acceptable the undertaking and keep away from product market competitors, however it might find yourself overpaying for a constrained start-up. This can be a threat price taking solely when the prior chance that the start-up is unconstrained is excessive sufficient. Nonetheless, the antitrust company must authorise the deal for the high-price takeover to happen. It’ll achieve this if the prior chance that the start-up is unconstrained is low sufficient. In that case, the state of affairs during which the early takeover is welfare detrimental, due to the suppression of product market competitors and, when the incumbent cabinets, additionally of undertaking growth, is sufficiently unlikely.

There are conditions, subsequently, during which a high-price provide is worthwhile for the incumbent, however the anticipation that the deal will likely be blocked leaves no different possibility than providing a low worth. On this case, the merger coverage exerts a ‘choice impact’: it pushes in direction of acquisitions that focus on solely constrained start-ups and are thus preferable by way of welfare. Furthermore, the extra stringent the requirements of assessment, the stronger the choice impact and the extra possible {that a} low-price takeover replaces a high-price takeover on the equilibrium.

For that reason, the optimum merger coverage commits to requirements of assessment which might be sufficiently strict to ban high-price takeovers. Certainly, it’s optimum to take action even when the high-price takeovers may enhance anticipated welfare. By forcing the swap to a low-price takeover, such a merger coverage makes anticipated welfare even increased. The optimum merger coverage, although, wouldn’t block all acquisitions of potential rivals: low-price transactions contain solely start-ups which might not have entry to credit score, and therefore wouldn’t have the ability to change into impartial rivals. Such takeovers could be authorised.

That is the primary message of our paper: regardless of the doable pro-competitive impact, the optimum merger coverage shouldn’t be lenient in direction of acquisitions of potential rivals.

From a coverage perspective, our evaluation questions the present laissez-faire strategy in direction of acquisitions of potential rivals and helps the proposals in direction of stricter enforcement of those mergers. Legislative initiatives in addition to modifications in enforcement requirements are being thought-about in a number of jurisdictions. As an example, the US companies have introduced the assessment of the Horizontal Merger Tips1 and that they could problem acquisitions of potential rivals – a departure from earlier coverage.2 Within the UK, the Competitors and Markets Authority issued revised merger pointers in July 2021,3 asserting a stricter merger enforcement throughout sectors.4

Furthermore, our evaluation means that antitrust companies ought to use the data conveyed by the takeover worth when reviewing acquisitions of potential rivals. In our setting, a excessive takeover worth indicators that the takeover might not be indispensable for the success of the start-up and that, subsequently, is more likely to increase anti-competitive considerations. This perception could be utilized extra broadly: in our mannequin one can interpret as synergies the truth that incumbent’s belongings, by complementing the belongings of the start-up, might allow growth, however acquisitions may produce synergies of various nature, for example as a result of the start-up is in need of managerial expertise or market alternatives. Additionally in these circumstances, a excessive transaction worth might mirror that the start-up doesn’t want these synergies to develop and have success available in the market, and that the takeover might hurt competitors.

This perception helps the usage of a transaction worth threshold as an extra check to determine mergers which might be probably anti-competitive and that deserve a more in-depth look.5 This echoes the proposals made by numerous antitrust companies to revise their strategy in direction of mergers in digital markets (Competitors and Markets Authority 2021). Nonetheless, the validity of this strategy may also be utilized to display screen any merger involving a possible competitor.

Our outcomes additionally counsel that the data conveyed by a excessive transaction worth ought to be used not just for the preliminary screening but additionally for the evaluation of the counterfactual to the mergers which might be investigated and of their results on competitors.

References

Argentesi, E, P Buccirossi, E Calvano and T Duso (2020), “Tech-over: Mergers and merger coverage in digital markets”, VoxEU.org, 4 March.

Bryan, Ok A and E Hovenkamp (2020), “Antitrust Limits on Startup Acquisitions”, Assessment of Industrial Group 56: 615-636.

Caffarra, C and F Scott Morton (2021), “The European Fee Digital Markets Act: A translation”, VoxEU.org, 5 January.

Competitors and Markets Authority (2021), “A brand new pro-competition regime for digital markets”, offered to Parliament by the Secretary of State for Digital, Tradition, Media & Sport and the Secretary of State for Enterprise, Vitality and Industrial Technique.

Cremer, J, Y de Montjoye and H Schweitzer (2019), Competitors coverage for the digital period, Report ready for the European Fee.

Cunningham, C, F Ederer and S Ma (2021),“Killer Acquisitions”, Journal of Political Economic system 129(3): 649-702.

Eliason, P J, B Heebsh, R C McDevitt and J W Roberts (2020), “How Acquisitions Have an effect on Agency Conduct and Efficiency: Proof from the Dialysis Business”, Quarterly Journal of Economics 135(1): 221-267.

Fumagalli, C, M Motta and E Tarantino (2020), “Shelving or growing? The acquisition of potential rivals underneath monetary constraints”, Economics Working Papers 1735, Division of Economics and Enterprise, Universitat Pompeu Fabra.

Furman, J, D Coyle, A Fletcher, P Marsden and D McAuley (2019), Unlocking digital competitors. Report of the Digital Competitors Knowledgeable Panel.

Lemley, A M, and A McCreary (2020), “Exit Technique”, Stanford Legislation and Economics Olin Working Paper 542.

Motta, M and M Peitz (2021), “Huge Tech Mergers”, Info Economics and Coverage 54.

Pellegrino, B (2021), “Product Differentiation and Oligopoly: A Community Strategy”, College of Maryland, Mimeo.

Prat, A and T Valletti (2018), “Merger Coverage within the Age of Fb”, VoxEU.org, 26 July.

Scott Morton, F, P Bouvier, A Ezrachi, B Jullien, R Katz, G Kimmelman, A D Melamed and J Morgenstern (2019), Market Construction and Antitrust Subcommittee Report, George J. Stigler Middle for the Research of the Economic system and the State, The College of Chicago Sales space Faculty of Enterprise, Committee for the Research of Digital Platforms.

The Economist (2018), “American tech giants are making life robust for startups”, 2 June.

The New York Occasions (2020), “Huge Tech’s Takeovers Lastly Get Scrutiny”, 14 February.

The Wall Avenue Journal (2019), “How ‘Stealth’ Consolidation Is Undermining Competitors”, 19 June.

Wollmann, T G (2019), “Stealth Consolidation: Proof from an Modification to the Hart-Scott-Rodino Act”, American Financial Assessment: Insights 1(1): 77-94.

Endnotes

1 See, for instance, https://www.ftc.gov/news-events/press-releases/2022/01/ftc-and-justice-department-seek-to-strengthen-enforcement-against-illegal-mergers.

2 See, for instance, the speech delivered by AAG Vanita Gupta at Georgetown Legislation’s fifteenth Annual World Antitrust Enforcement Symposium Washington, DC, September 14, 2021.

3 Competitors and Markets Authority, “Merger Evaluation Tips”, 18 March 2021.

4 See Prat and Valletti (2018), Argentesi et al. (2020) and Caffarra and Scott Morton (2021), for discussions on merger coverage in digital markets.

5 The present notification thresholds are principally based mostly on each merger events having a sufficiently excessive turnover and stop antitrust companies from investigating the overwhelming majority of mergers involving potential rivals.