When can we actually say goodbye to this bear market? Whereas Financial institution of America’s international fund managers are now not “apocalyptically bearish,” some on Wall Avenue stay cautious.

Add our name of the day to that final batch. It comes from True Contrarian weblog and e-newsletter’s chief government, Steven Jon Kaplan, who sees buyers mired in what might be the longest bear market in historical past, and “approaching the subsequent and possibly the largest proportion drop of this bear market thus far.”

MarketWatch final spoke to Kaplan in mid-November 2021, when he warned of a looming selloff for shares, notably massive highfliers. Simply days later, the Invesco QQQ

QQQ

exchange-traded fund (ETF) that tracks the Nasdaq-100 Index, and plenty of different tech funds topped out. The S&P 500

SPX

peak adopted on Jan. 4.

Kaplan based mostly that November warning partly on one in all his favourite indicators — firm insider promoting and shopping for, which he tracks through J3 Info Providers Group.

In an interview with MarketWatch on Wednesday, he rattled off an inventory of worrying indicators, corresponding to aggressive promoting by that group once more, particular person buyers piling into the market, declarations that the bear market is over and the Cboe Volatility Index, or VIX

VIX,

skirting beneath 20 in latest days.

Historical past additionally performs a giant half in his worries about markets proper now.

True Contrarian/Carl Swenlin, StockCharts.com

“It’s fascinating to see how carefully the 1929-1932 and 2000-2002 bear markets paralleled one another, with virtually precisely the identical sorts of pullbacks and rebounds. I anticipate related habits for 2022-2025,” he stated. (See hyperlink to authentic chart)

QQQ pullback from 2000 by means of 2002

True Contrarian/Buying and selling View

Kaplan famous that it took eight years for the 1929 bear market to reach, almost 10 years for March 2000s and even longer for the bear market he sees as ongoing, given the bull market started in March 2009.

“So what all of them have in widespread is that these very lengthy bull markets preceded the bear markets for therefore lengthy, that individuals tended to overlook how you can put money into bear markets and what they’re about,” he stated.

The acquainted bear market sample by means of historical past has been a small drop to begin that doesn’t unfold panic, then a soothing bounce, then an even bigger drop and an even bigger rebound, which once more relaxes buyers. However he stated based mostly on 1929, 1973 or 2000, the subsequent stage of promoting might convey dramatic losses, corresponding to 40% for a fund like QQQ.

Kaplan is frightened concerning the newest Constancy quarterly retirement survey, which revealed buyers clinging to hopes that the market will return to highs in the event that they wait lengthy sufficient. Difficult that, Kaplan pointed to a different examine displaying that people who invested out there in September 1929 have been nonetheless 38% down by August 1982 in actual phrases, adjusted for inflation.

“It type of explodes the parable that it’s important to come out forward if you happen to simply type of dangle in there when issues are robust,” he stated.

Learn: Most retirement savers are ‘staying the course’ — even when they’re completely pressured

So how to deal with one other massive drop. Repeating November recommendation, he recommends I-Bond or Sequence I financial savings bonds that may be purchased straight from the federal government and are at the moment providing a return of simply over 9%. U.S. Treasurys are additionally paying 3% to three.5% proper now, one other approach to go for the approaching years, he stated.

Learn: This rule with an ideal file says the market hasn’t bottomed, says Financial institution of America’s star analyst

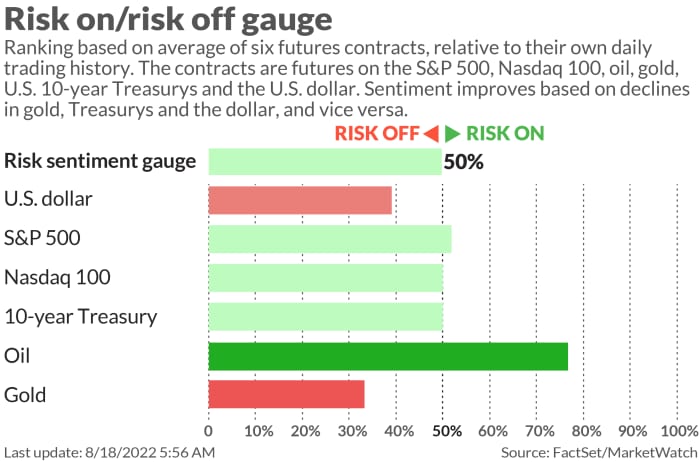

The markets

Inventory futures

ES00

YM00

NQ00

are inching up, following Wednesday’s Fed-inspired losses. Bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are easing, whereas the greenback

DXY

is flat. Oil costs

CL

BRN00

are climbing, and bitcoin

BTCUSD

is hovering beneath $24,000.

Learn: Why one economist fears the Japanese yen might be headed for a destabilizing downward spiral

The excitement

Shares of Mattress Bathtub & Past

BBBY,

which has been on a loopy meme experience these days, are slumping after GameStop

GME

Chairman Ryan Cohen disclosed plans to unload his hefty stake within the retailer months after shopping for it. The corporate stated Thursday it has been ‘working expeditiously’ for weeks to strengthen its steadiness sheet

In the meantime, this 20-year-old made an enormous revenue on the inventory, based on Securities and Change Fee filings.

Retailer Kohl’s

KSS

is tumbling after a revenue miss and slashed outlook amid plans to chop stock bulk

Cisco

CSCO

inventory is climbing after the tech big’s surprisingly upbeat earnings and income forecast.

Apple

AAPL

plans to unveil its newest iPhone 14 and smartwatches on Sept. 7, based on a brand new report.

“Finish of an period.” Stellantis

STLA

unit Dodge to discontinue two widespread ‘muscle automobiles’ because it tilts towards electrical automobiles.

Jobless claims slipped 2,000 to 250,00 within the newest week, whereas the Philly Fed index rose to six.2 from a predicted adverse 5.0. Present dwelling gross sales and main financial indicators are nonetheless to come back, together with appearances by Kansas Metropolis Fed President Esther George, who will communicate at 1:20 p.m. Japanese and Minneapolis Fed President Neel Kashkari, at 1:45 p.m.

Better of the online

Massive Oil is simply too optimistic a sluggish transition away from carbon will probably be sufficient to halt international warming

Two years after Covid infections, dangers of psychotic issues and dementia linger

Kremlin reportedly ousts head of its Black Sea Fleet following Crimea assaults

High tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m. Japanese Time:

Random reads

Vacationers behaving badly: Two arrested in Venice for cruising its waterways on motorized surfboards.

An extinct large shark was quicker, greater and hungrier than scientists initially thought

Cambodia finds its misplaced historic artifacts — on the Met

Have to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Japanese.