sutlafk/iStock by way of Getty Pictures

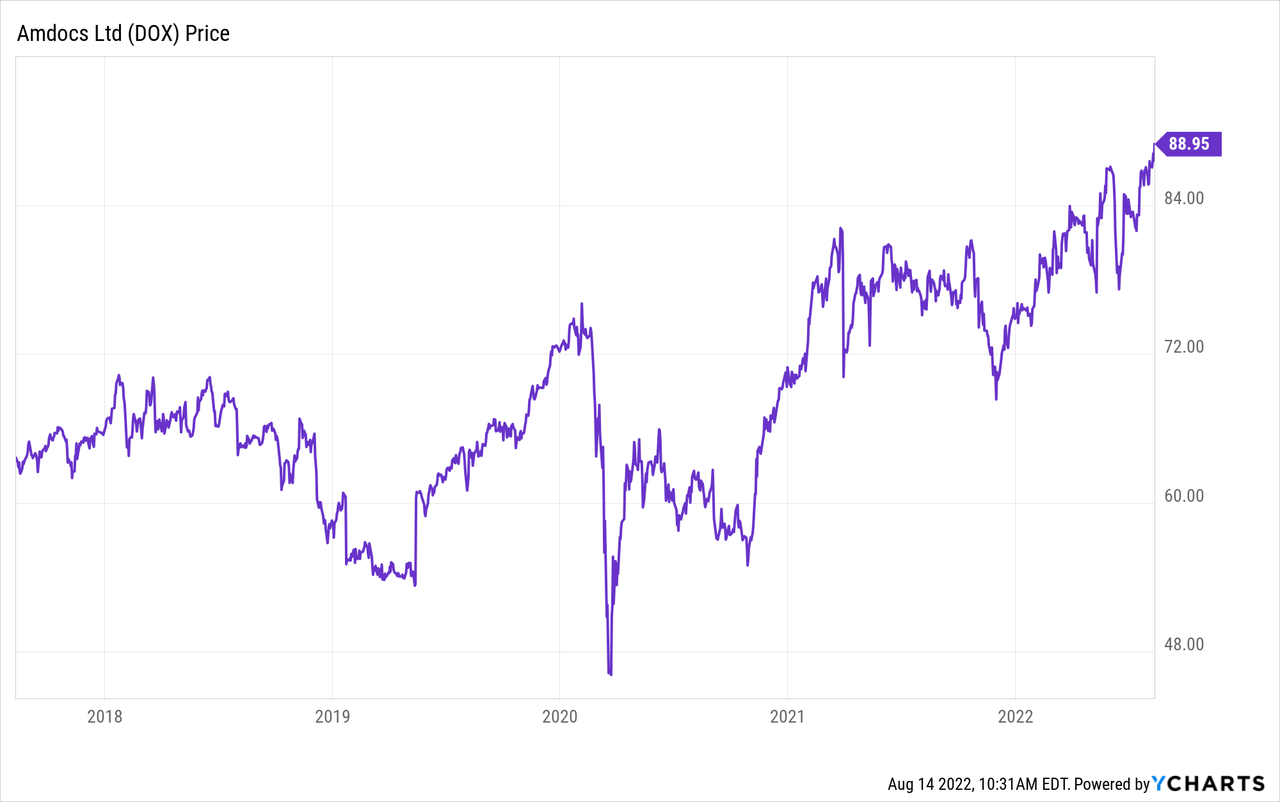

St. Louis, Missouri-based mostly Amdocs (NASDAQ:DOX), an IT supplier of 5G and cloud-based networking, buyer care, engagement, assurance and billing providers, is outperforming the broad market this 12 months (+18.5% YTD) and has a complete return of 59% since my preliminary BUY score protection began on In search of Alpha again in September of 2020 (see Amdocs: Time To Play Catchup). The corporate is producing sturdy free-cash-flow and has a significant share buyback program that’s considerably decreasing the excellent share-count. The Q3 earnings report launched a few weeks in the past was bullish: document income, a powerful backlog, and barely higher ahead steerage. DOX has a powerful steadiness sheet, and its secure and sticky enterprise mannequin allows it to bolster natural progress with opportunistic and strategic M&A. The corporate ought to be capable of continue to grow income at ~10% yearly, with earnings rising a bit sooner than that as a consequence of share-count discount. I reiterate my BUY score on DOX based mostly on its somewhat defensive nature, sturdy profitability & free-cash-flow profile, steady-as-she-goes progress, and rational valuation.

Funding Thesis

5G networking and cloud-based IT providers firm Amdocs supplies buyer care, engagement, and billing help which might be the sort of sticky providers that its clients (firms like AT&T, T-Cellular, Comcast, and so on.) are very hesitant to change as a result of potential for a messy migration, buyer disappointment, and elevated price. Because of this, DOX has secure income which generates important free-cash-flow. A robust steadiness sheet and its free-cash-flow profile allows the corporate to reward shareholders whereas utilizing M&A to complement natural progress.

Q3 Earnings

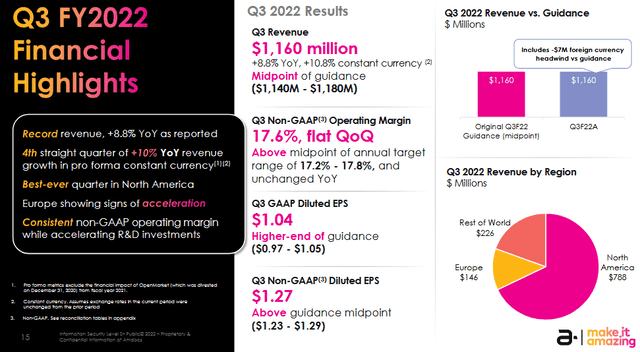

DOX launched its Q3 EPS report on August third, and it was a beat. I say a “beat” as a result of, regardless of a $7 million overseas trade headwind, income was a document (+8.8% yoy and an acceleration of the three.9% within the prior 12 months) and EPS got here in towards the high-end of steerage:

Amdocs

Be aware that, in fixed forex phrases, it was DOX’s fourth straight quarter of 10% yoy income progress as a consequence of document North America outcomes ($788 million or 68% of complete income). Normalized free-cash-flow throughout the quarter was $144 million – which equates to $1.17/share based mostly on the 123.153 million fully-diluted shares excellent at quarter’s finish. Margin was flat sequentially however met the mid-point of steerage regardless of the FX headwind.

On the Q3 convention name, Amdocs CEO Shuky Sheffer reported on current enterprise developments:

Q3 was additionally one other quarter of sturdy gross sales momentum. We strengthen relationship with giant and long-standing clients like T-Cellular and AT&T’s Cricket Wi-fi, we’re pleased to say that we expanded our managed providers engagement for an extra 5 years, as Tamar will contact on later. Moreover, we additional grew our footprint with different main operators together with Vodafone Germany, which has chosen Amdocs for follow-on digital transformation tasks.

Sheffer additionally stated DOX built-in greater than 27 million clients for Excel in Indonesia as a part of a multi-year managed digital transformation challenge. The challenge will allow Excel to launch modern digital providers and improve their buyer experiences. Amdocs can also be reaching tens of millions of Brazilian subscribers in all cities serviced by Telefonica Vivo.

Share Buybacks

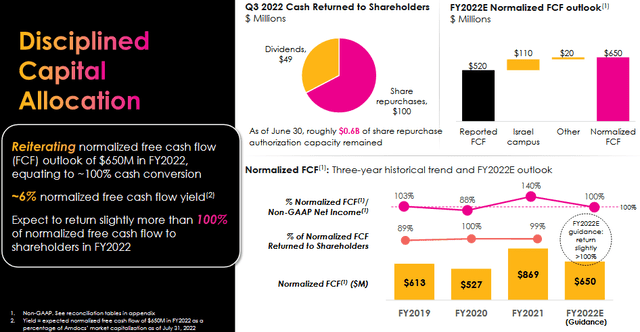

Throughout the quarter, DOX repurchased $100 million price of shares whereas paying out dividends of $49 million:

Amdocs

Now, sometimes I do not wish to see such an over-emphasis on share buybacks. Nonetheless, as an instance my level that Amdocs truly has a “significant” share buyback program that outpaces worker inventory compensation (considerably uncommon today …), be aware that the excellent share-count in my first article on DOX in September of 2020 (Q3 FY2020) was 133,593,000. On the finish of the current Q3 report (two years later), the excellent fully-diluted share-count was 123,153,000, or down 10,440,00 shares, or -7.8%. That may be a significant discount in shares that has – together with strategic M&A and natural progress – labored to extend EPS from $0.90/share in Q3 FY2020 to (non-GAAP) $1.27/share in Q3 FY2022.

Going Ahead

DOX reported a 12-month backlog that was a document $3.95 billion – that is +10% yoy, +$60 million qoq, and provides buyers comparatively excessive visibility into the longer term.

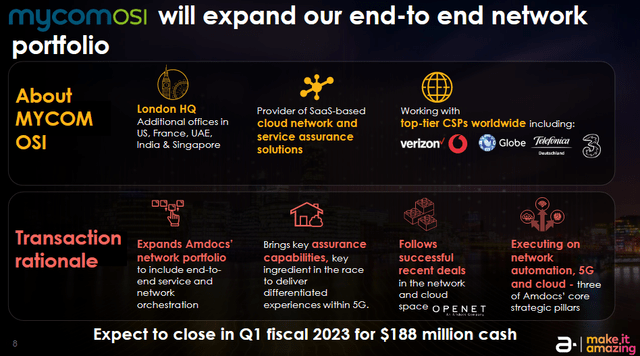

The acquisition of MYCOM OSI was introduced in Could for $188 million in money and is predicted to shut throughout Q1 FY2023. MYCOM OSI is a privately-owned enterprise headquartered in London but additionally has workplaces within the US, France, the UAE, India, and Singapore. MYCOM OSI was the primary service assurance vendor to supply its functions by way of a SaaS-based subscription mannequin over the general public cloud. Though the acquisition just isn’t anticipated to have a fabric impact on earnings over the following couple of 12 months, DOX seems to be taking part in the long-game right here by increasing its end-to-end community and assurance options whereas opening the door to new clients for which it could possibly then supply its different providers:

Amdocs

Dangers

Amdocs just isn’t proof against the macro-risks presently going through the worldwide financial system: excessive inflation, a rising rate of interest atmosphere, COVID-19 associated shut-downs and supply-chain challenges, in addition to the damaging impacts of Putin’s horrific war-of-choice in Ukraine that has, successfully, damaged the worldwide power & meals chains.

As of the top of Q3 (June thirtieth), Amdocs had $650 million in debt, $850 million in money, and a $500 million credit score facility. That being the case, and contemplating DOX generated $144 million in FCF throughout the newest quarter, the corporate can simply afford the $188 million MYCOM OSI acquisition. Nonetheless, I’m shocked the corporate made an acquisition for which the near-term advantages aren’t extra significant.

FX headwinds could persist within the coming quarters as a result of potential for continued power within the U.S. greenback given the Federal Reserve’s intention to maintain elevating rates of interest to combat inflation. That stated, and as famous beforehand, 68% of Q3 income got here from North America.

Abstract & Conclusion

Amdocs is what I think about to be a slow-n-steady progress firm that has a wonderful profitability and free-cash-flow profile, which it makes use of to purchase again shares and develop by way of M&A. The backlog is powerful and provides buyers excessive visibility into the longer term. For my part, this sort of strong – maybe even “defensive” – enterprise mannequin is what the market presently favors and is probably going the explanation why DOX is outperforming. And whereas I admit I do not utterly perceive the rationale of the deliberate MYCOM OSI acquisition given the dearth of near-term payback, it’s a comparatively small deal which DOX can simply afford and there actually might be some strategic worth in increasing DOX’s first service assurance choices in addition to further buyer acquisition which is able to open the door to DOX’s different choices. Meantime, important share discount ought to allow DOX to develop EPS and FCF/share sooner than top-line progress. DOX is a BUY and will simply earn $5.25 in FY22 and $5.70 in FY23. The inventory may simply hit $100 (or extra) over the following 12-months, merely given a market-multiple of 20x.

I will finish with a 5-year value chart of DOX inventory: