The members of Tiger 21 – a peer community of ultra-high web price entrepreneurs and buyers – are placing most of their cash to work within the inventory marketplace for the primary time.

Tiger 21 consists of 1,200 members with a cumulative $140 billion in belongings, and people will need to have a minimum of $20 million in liquid belongings to qualify for membership.

Its founder and chairman, Michael Sonnenfeldt, informed CNBC on Thursday that though actual property had traditionally been the most well-liked vacation spot for members’ cash, they have been now seeing some “actual bargains” within the inventory markets.

This has, partly, pushed public equities to the No. 1 spot for Tiger 21 for the primary time because the community’s inception.

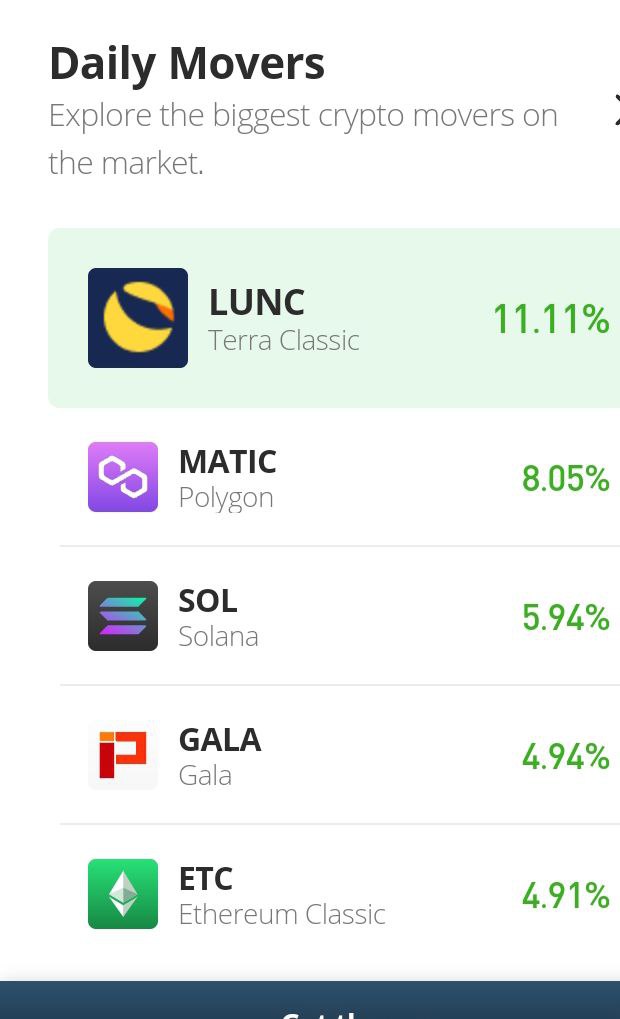

Sonnenfeldt stated members aren’t targeted on inventory choosing for probably the most half, a lot of the fairness funding is channeled into ETFs (exchange-traded funds) and index trackers, whereas know-how has been among the many hottest sectors. Public equities now represent 27% of the membership’s general asset allocation.

“You may have plenty of the FAANGs which have are available from a lot greater costs — they’re pondering there’s plenty of profit there, and clearly one of many large areas is vitality, not solely on the oil and gasoline facet, however a lot greater rising curiosity in renewables and easy methods to play the photo voltaic alternatives, the wind alternatives,” Sonnenfeldt informed CNBC’s “Road Indicators Europe.”

“They know that is the largest funding theme maybe in human historical past, and it’s getting plenty of their consideration.”

After a dismal first half of the 12 months on the again of hovering inflation, tightening financial coverage and recession fears, inventory markets have staged a aid rally in current weeks, and acquired an additional enhance Wednesday after U.S. inflation was proven to have cooled in July on the again of a fall in oil costs.

Many buyers have elevated their money holdings to climate a possible recession. Sonnenfeldt stated the money allocation of Tiger 21 members has traditionally held strong at an unusually excessive 12%.

It is because they’re primarily “wealth preservers” who’ve offered companies and dwell on roughly 2% of their web price, and due to this fact use money reserves to shore up round 5 years of residing bills, he stated.

Within the brief time period, Tiger 21 famous that members are utilizing their ample money to search for offers and inflation hedges.

“However additionally they need assets to pounce on a possibility and so they have been seeing them in rising numbers, so their money really simply ticked down from 12% to 11%. It could sound like a small quantity, however it in all probability means that members are fairly bullish over the long run,” Sonnenfeldt stated.

“They’ve recession fears — a majority of our members assume that we’re going into recession — and nonetheless between actual property, public fairness and personal fairness, it’s a 76% allocation, so that’s fairly assured in the long run.”