Why did the inventory market bounce this summer time?

Everybody has their clarification: The Fed would possibly pivot! Inflation readings have now peaked! Oil costs are down 25%! China is ending the lockdowns! The labor market is staying robust! Earnings are nonetheless coming in higher than anticipated!

All true.

However there’s a fair higher motive that doesn’t invalidate any of those I’ve posted above. It permits all of them to get the oxygen they want, individually, to enchantment to the individual clinging to them as their “motive” for what’s occurring. All of us want our causes and explanations, in any case.

So right here’s my clarification, and, when you fancy your self an mental otherwise you’ve spent years at a flowery college, you’ll positively hate it: The cash has to go someplace.

The inventory and bond markets, together, type an equilibrium, absent extreme adjustments within the cash provide or the overarching wants of the investing public. There may be stasis.

The Federal Reserve is speaking about shrinking its steadiness sheet and bringing down the cash provide. They’ve raised rates of interest and are within the strategy of letting their $9 trillion portfolio of Treasury and mortgage bonds mature with out changing them with new bonds. They name this “the roll-off.” Nice.

Additionally they wish to shrink the cash provide to ease the demand for issues and stuff within the economic system and tighten monetary circumstances. There’s no proof that any of this has truly occurred but within the information, however we’ll assume it’s most likely underway.

Central banks all over the world are all engaged in the identical form of adjustment to each present rates of interest and market expectations for future rates of interest. In Argentina, they’ve 64% inflation, which implies you higher purchase the loaf of bread you may want on the dinner desk while you get up that morning. And don’t even take into consideration handing a restaurant proprietor your bank card for settling a invoice. Simply throw a fistful of pesos on the desk and run like hell lest the worth of your entree ought to rise throughout dessert. That is an excessive model of what economies everywhere in the globe are experiencing and reacting to.

Because of the sudden inflation battle breaking out this previous winter, the equilibrium of shares and bonds has been disturbed. Patrons and sellers have needed to alter. They’ve spent the previous couple of months adjusting. Not simply with their holdings, however with their emotions, ideas, feelings and expectations. And a brand new equilibrium is being reached. It received’t be remaining. This course of isn’t completed. It’s an oscillation.

Oscillation is a backward and forward, normally between two factors, over a time frame. Up and down for instance. Or left and proper. Oscillations are made up of cycles. Pluck a guitar string and the result’s a sound wave. The vibration is what produces the sound wave however it’s not self-perpetuating. It ends because the oscillation peters out. The sound fades. You’d should pluck it once more for a brand new sound wave. That is what’s known as a damped oscillation. “Most free oscillations finally die out because of the ever-present damping forces in our surrounding. The oscillation that decreases with time is known as damped oscillation. As a result of exterior elements corresponding to friction or air resistance that ends in damping, the amplitude of oscillation reduces with time, and this can end in power loss from the system. An instance could be the decaying oscillations of a pendulum.”

Volatility within the funding markets is a form of damped oscillation by which the drive that triggered the volatility can’t be sustained indefinitely. The “damping” drive that in the end comes alongside and quiets the oscillation is funding demand. The cash has to go someplace. Patrons step in as a result of they’re in want of returns above what the risk-free charge of return can present – finally. They can not keep on the sideline perpetually. Negatively-yielding sovereign bonds can’t be hidden out in indefinitely, no matter prevailing attitudes or funding coverage mandate and even authorities statute. Danger finds a manner. The intermediaries who handle massive pensions and portfolios – the individuals answerable for taking threat and producing return for others – will finally discover new issues to do and new locations to place the capital. Or the capital can be taken away and, with it, the potential charges. And no person desires that.

So! That is why the stock-bond portfolio can pattern in a single course or one other for various lengths of time and to completely different magnitudes of acquire and loss, however will finally oscillate its manner again to some equilibrium. Even when that equilibrium proves fleeting, a way-station somewhat than a vacation spot.

There are damping forces in every single place in society preserving the oscillation of inventory and bond volatility inside an ever narrowing band, regardless of periodic headline-catching outbursts once in a while. These damping forces embrace demography (we’re dwelling longer and in want of upper financial savings and returns on these financial savings), regulation (the arc of the universe bends towards elevated security and safety), innovation (the last word dampener on prices, inconvenience and the unavailability of products and companies), the professionalizing and institutionalization of the investing career (100 years in the past everybody in shares was a degenerate gambler with a margin mortgage, now simply half of us are) and the arrival of large retirement programs (100 and fifty years in the past you died plowing a cornfield or bought shot on the street over an insult – that was your retirement plan). Every of those damping forces performs its half to scale back the size and breadth of the periodic vibrations produced by a given volatility-engendering occasion (a Fed speech, an earnings miss for a vital inventory, an errant North Korean missile, a disappointing election, and so forth). This reduces the general oscillation we expertise in our inventory and bond portfolios total.

So there’s a massive directional transfer just like the one which jarred us all within the first half of 2022. After which we’re due. What was performed is undone. Reversion. The pong to the earlier ping. The zig to the zag. The yin to the yang. The cycle. The total oscillation. Trillions of {dollars} in quest of a house. Tons of of hundreds of thousands of buyers at work, performing in keeping with a trillion completely different time-horizon-and-goal mixtures. The method proceeds regardless. And on this equilibrium-seeking course of, we discover a new area for that basic stock-bond mixture of threat and safety, upside and earnings, to breathe in.

And the way do I do know that is so? I’ve greater than 200 years of proof on my facet. The cash has to go someplace. It all the time has had to go someplace. And we finally discover this equilibrium between the very last thing that occurred and the subsequent factor that’s about to. It’s onerous to maintain surprising us all with the identical information. Higher present up with one thing new. In the intervening time, we’ll get busy getting used to no matter you simply mentioned. The oscillation will be dampened by boredom, too.

However 2022’s volatility has been extremely distinctive for this period – we haven’t seen a plus 20% or minus 10% yr for the 60/40 stock-bond portfolio since 1975 up till now. That’s two years earlier than I used to be born. Extra on this in a second.

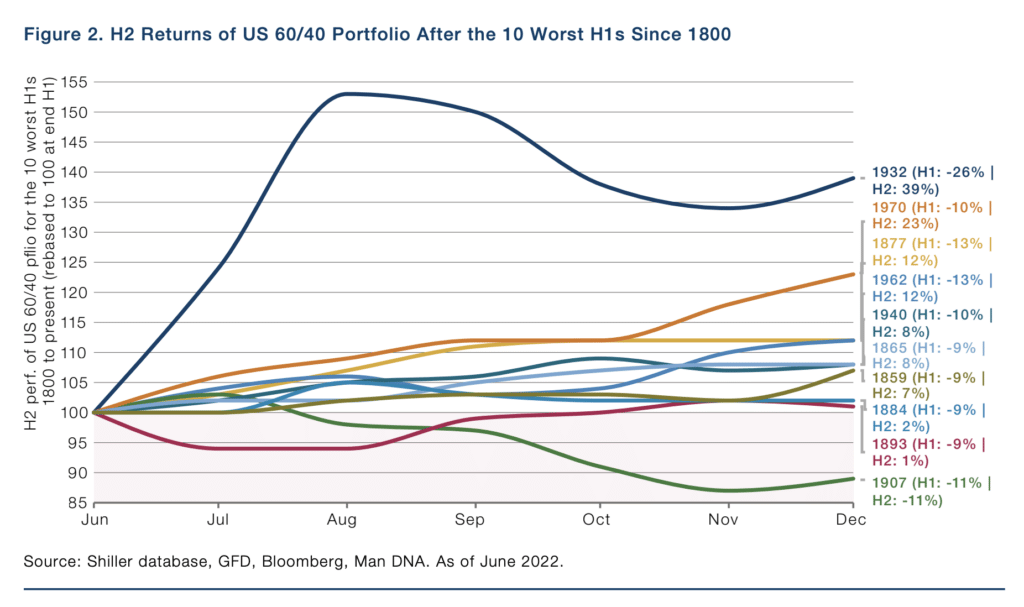

I’d like to point out you one thing you might not have seen earlier than. It involves us through the Man Group (thanks Meb). Within the first chart, we see that 2022’s first half was the second-worst for a 60/40 portfolio of shares and bonds in over two centuries. Centuries. I’ll let that sink in for a second. The researchers be aware that In 79% of years going again to 1800, a 60/40 portfolio was constructive via to June. This yr’s first half featured the worst 60/40 efficiency since 1932 and there have been only a few different years which have ever even come shut.

This represents a extreme disturbance of the pre-existing equilibrium. However once more, threat finds a manner.

So right here’s what has traditionally occurred subsequent…

Bounce.

The 60/40 has traditionally come roaring again within the second half of all of those years save for 1907, a yr we normally affiliate with “the Panic of” after we’re referring to it.

Man Group says “Within the ten worst H1s (excluding 2022), common efficiency was -12%. For the corresponding H2s the common was 10%, and the constructive hit charge was 90%.”

It’s not that the second half needs to be higher than the primary half, it’s simply that it nearly all the time is. You possibly can return and browse newspaper headlines to attempt to piece collectively the explanations for the bounce. Search and ye shall discover. There’ll all the time be one thing to pin the market motion on retroactively.

Or you’ll be able to settle for my clarification for the legendary sturdiness of the 60/40 inventory bond portfolio over years, a long time, eras and whole centuries: It has to go someplace.

The oscillation will proceed no matter whether or not or not you wish to settle for its existence.