Revealed on July twenty fourth, 2022 by Felix Martinez

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value greater than $360 billion as of the top of the 2022 first quarter.

Berkshire Hathaway’s portfolio is full of high quality shares. You may ‘cheat’ from Warren Buffett shares to search out picks for your portfolio. That’s as a result of Buffett (and different institutional traders) are required to periodically present their holdings in a 13F Submitting.

You may see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

Observe: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned simply over 136 million Occidental Petroleum Corp (OXY) shares for a complete market worth exceeding $8.3 billion. Occidental Petroleums at the moment represent over 2.6% of Berkshire Hathaway’s funding portfolio.

This text will totally look at Occidental Petroleum’s prospects as an funding at this time.

Enterprise Overview

Occidental Petroleum is a global oil and gasoline exploration and manufacturing firm with operations within the U.S., the Center East, and Latin America. It has a market capitalization of $57.2 billion. Whereas the corporate additionally has a midstream and a chemical section, it’s way more delicate to the worth of oil than the built-in oil majors.

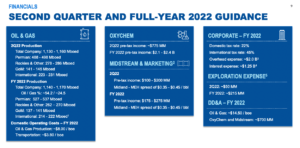

On Could 10, 2022, the corporate reported first-quarter outcomes for 2022. income beats estimates by $470 million for the quarter. In comparison with the primary quarter of 2021, the corporate income was up 57% year-over-year (YoY). Earnings additionally beat expectations by $0.09 per share. The corporate reported earnings of $2.12 per share, which is a rise of 43.2% versus the $1.48 per share that the corporate earned within the first quarter of 2021.

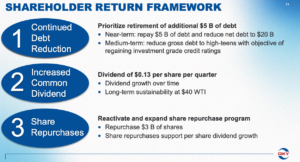

The corporate additionally repaid $3.3 billion of debt, representing 12% of the whole excellent principal. Reported money movement from persevering with operations of $3.2 billion and money movement from persevering with operations earlier than working capital of $4.2 billion. This was vital as the corporate recorded quarterly free money movement earlier than working capital of over $3.3 billion.

The OxyChem enterprise delivered its third consecutive report quarterly earnings as the corporate continues to satisfy the demand for the fundamental chemical compounds.

Supply: Investor Presentation

Progress Prospects

The pandemic has subsided, and therefore Occidental has first rate development prospects forward. It doubled its output within the Permian in 2017-2019 and expects to double it once more over the subsequent 5 years, from 300,000 to 600,000 barrels per day. Nonetheless, we be aware the excessive debt load of the corporate and its resultant sensitivity to costs. So long as the oil value stays excessive, Occidental will hold thriving.

The corporate’s earnings have been erratic all through the years. That is because of the risky nature of the worth of Oil. For instance, from 2015 to 2017, the corporate had destructive earnings breast the worth of Oil was under $40 per barrel. The $40 value per barrel is the corporate’s breakeven value. Thus, if oil costs keep on the present stage, then Occidental Petroleum will thrive.

One other development driver for the corporate will come from acquisition. For instance, On August eighth, 2019, Occidental acquired Anadarko. Occidental pursued this acquisition because of the promising asset base of Anadarko within the Permian, which has enhanced the already robust presence of Occidental within the space, and the $3.5 billion annual synergies it expects to realize.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Occidental may be very delicate to the gyrations of oil costs. The corporate’s reliance on oil costs was displayed within the Nice Recession, when its earnings-per-share fell by 58%, from $8.98 in 2008 to $3.79 in 2009. We reiterate that the corporate is way more delicate to grease costs than its “supermajor” friends like Exxon Mobil (XOM), partly resulting from its excessive debt load.

As a consequence of its leveraged steadiness sheet, Occidental has basically change into a leveraged guess for top oil costs sooner or later. Subsequently, solely traders with robust confidence in a sustained surroundings of excessive oil costs ought to take into account this inventory.

Through the COVID-19 pandemic, oil costs fell under $0 per barrel. This triggered the inventory value to fall over 99%. Additionally, earnings took an enormous hit as the corporate reported earnings for 2020 of $0.82, which decreased 341%.

Thus, the corporate doesn’t fare properly throughout a recession. As talked about above, an funding into OXY is as a result of the traders assume the oil value will proceed to remain excessive or go larger.

Valuation & Anticipated Returns

Occidental is buying and selling 8.6 occasions its anticipated earnings-per-share of $10.79 for 2022. This earnings a number of is decrease than the 10-year common price-to-earnings ratio of 17.1 of the inventory. Nonetheless, this low valuation is because of oil being over $100 per barrel.

We don’t assume it is going to keep at this stage. We predict that the mid-cycle earnings-per-share of $3.00 is extra life like. Thus, if the inventory reverts to its common valuation stage over the subsequent 5 years, it is going to incur a -6.5% annualized drag because of the contraction of its valuation stage.

Thus, we predict that the corporate is overvalued on the present inventory value stage, and we count on a complete five-year return of destructive 5% yearly.

Supply: Investor Presentation

Remaining Ideas

As a consequence of its upstream nature and its takeover of Anadarko, which quadrupled the corporate curiosity value, Occidental is awfully delicate to the worth of oil. Because of the rally of oil and gasoline bills to thirteen-year highs, which resulted from the invasion of Russia in Ukraine, Occidental has emerged as terribly worthwhile and is trying to minimize its debt load rapidly.

Nonetheless, we count on poor returns over the subsequent 5 years. If commodity costs stay excessive, the inventory may preserve its constructive short-term momentum and provide poor long-term returns. We fee the corporate as a promote on the present value.

Different Dividend Lists

Worth investing is a invaluable course of to mix with dividend investing. The next lists comprise many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].