Up to date on July twenty second, 2022 by Bob Ciura

Water is without doubt one of the primary requirements of human life. Life as we all know it can’t exist with out water. For this easy cause, water will be the most respected commodity on Earth.

It’s only pure for traders to think about buying water shares. There are a lot of totally different corporations that can provide traders publicity to the water enterprise, equivalent to water utilities. Another corporations are engaged in water purification.

In all, we now have compiled an inventory of over 50 shares which are within the enterprise of water. The listing was derived from 5 of the highest water trade exchange-traded funds:

- Invesco Water Sources ETF (PHO)

- Invesco S&P World Water ETF (CGW)

- Invesco World Water ETF (PIO)

- First Belief ISE Water Index Fund (FIW)

- Ecofin World Water ESG Fund (EBLU)

You’ll be able to obtain a spreadsheet with all 56 water shares (together with metrics that matter like price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

Along with the Excel spreadsheet above, this text covers our prime 7 water shares in the present day, that we cowl within the Certain Evaluation Analysis Database.

This text will focus on the highest 7 water shares in keeping with their anticipated returns over the subsequent 5 years, ranked so as of lowest to highest.

Desk of Contents

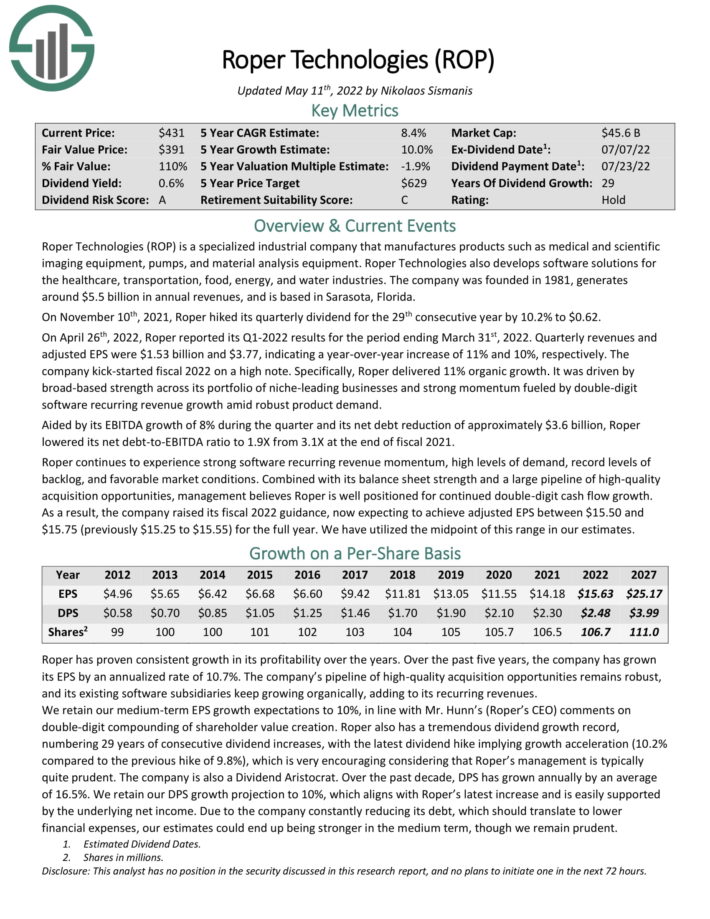

Water Inventory #7: Roper Applied sciences (ROP)

- 5-year anticipated annual returns: 9.4%

Roper Applied sciences is a specialised industrial firm that manufactures merchandise equivalent to medical and scientific

imaging tools, pumps, and materials evaluation tools. Roper Applied sciences additionally develops software program options for the healthcare, transportation, meals, vitality, and water industries. The corporate was based in 1981, generates

round $5.5 billion in annual revenues, and relies in Sarasota, Florida.

On April twenty sixth, 2022, Roper reported its Q1-2022 outcomes for the interval ending March thirty first, 2022. Quarterly revenues and adjusted EPS had been $1.53 billion and $3.77, indicating a year-over-year enhance of 11% and 10%, respectively. The corporate kick-started fiscal 2022 on a excessive word.

Particularly, Roper delivered 11% natural development. It was pushed by broad-based energy throughout its portfolio of niche-leading companies and powerful momentum fueled by double-digit software program recurring income development amid strong product demand.

Aided by its EBITDA development of 8% throughout the quarter and its web debt discount of roughly $3.6 billion, Roper lowered its web debt-to-EBITDA ratio to 1.9X from 3.1X on the finish of fiscal 2021.

Supply: Investor Presentation

Roper continues to expertise robust software program recurring income momentum, excessive ranges of demand, report ranges of backlog, and favorable market situations. Mixed with its stability sheet energy and a big pipeline of high-quality acquisition alternatives, administration believes Roper is properly positioned for continued double-digit money move development.

Consequently, the corporate raised its fiscal 2022 steering, now anticipating to attain adjusted EPS between $15.50 and $15.75 (beforehand $15.25 to $15.55) for the total 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on ROP (preview of web page 1 of three proven under):

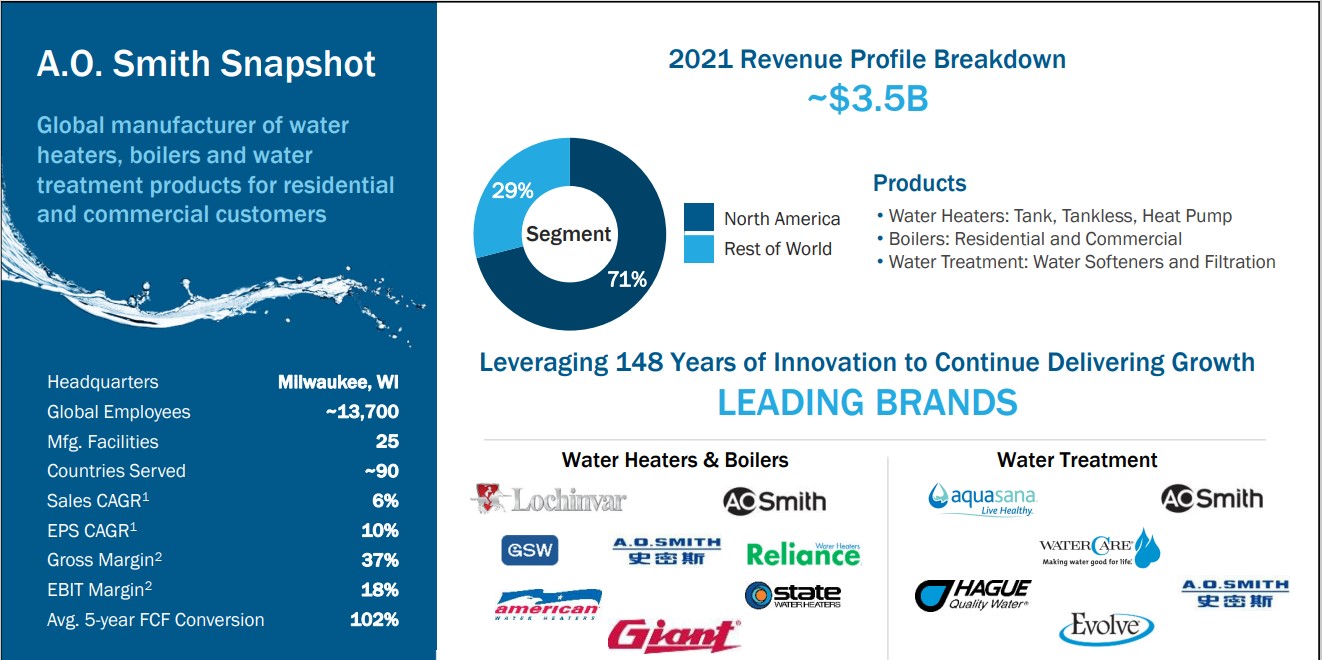

Water Inventory #6: A.O. Smith (AOS)

- 5-year anticipated annual returns: 10.1%

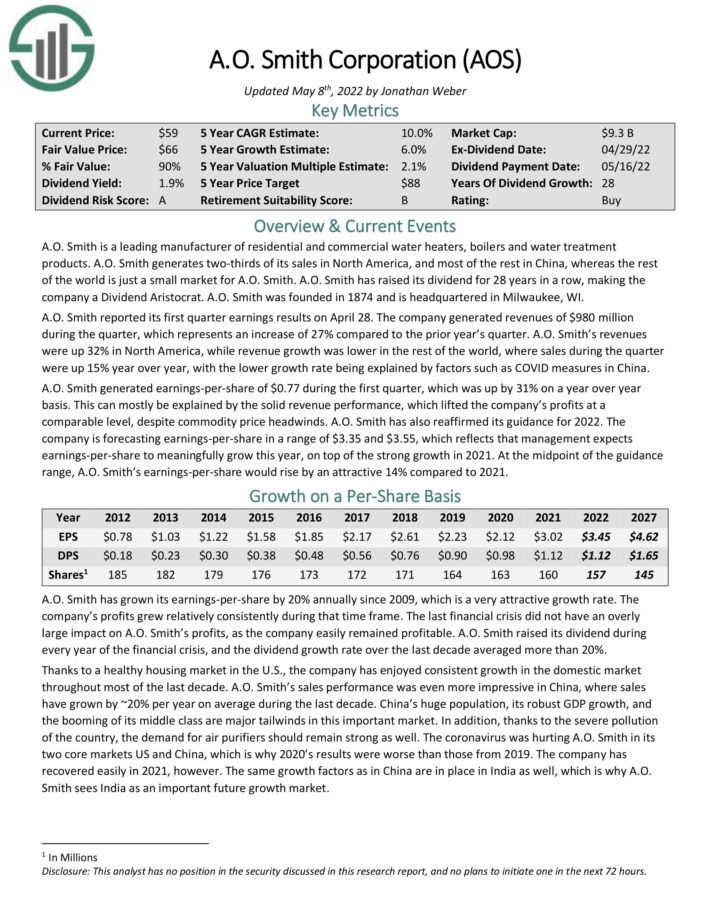

A.O. Smith is a number one producer of residential and industrial water heaters, boilers and water therapy merchandise. A.O. Smith generates the vast majority of its gross sales in North America, with the rest from the remainder of the world. It has category-leading manufacturers throughout its varied geographic markets.

Supply: Investor Presentation

A.O. Smith reported its first quarter earnings outcomes on April 28. The corporate generated revenues of $980 million throughout the quarter, which represents a rise of 27% in comparison with the prior 12 months’s quarter. A.O. Smith’s revenues had been up 32% in North America, whereas income development was decrease in the remainder of the world, the place gross sales throughout the quarter had been up 15% 12 months over 12 months, with the decrease development fee being defined by elements equivalent to COVID measures in China.

A.O. Smith generated earnings-per-share of $0.77 throughout the first quarter, which was up by 31% on a 12 months over 12 months foundation. This could principally be defined by the strong income efficiency, which lifted the corporate’s income at a comparable degree, regardless of commodity value headwinds.

A.O. Smith has additionally reaffirmed its steering for 2022. The corporate is forecasting earnings-per-share in a variety of $3.35 and $3.55, which displays that administration expects earnings-per-share to meaningfully develop this 12 months, on prime of the robust development in 2021. On the midpoint of the steering vary, A.O. Smith’s earnings-per-share would rise by a sexy 14% in comparison with 2021.

Click on right here to obtain our most up-to-date Certain Evaluation report on A.O. Smith (preview of web page 1 of three proven under):

Water Inventory #5: Gorman-Rupp Co. (GRC)

- 5-year anticipated annual returns: 10.2%

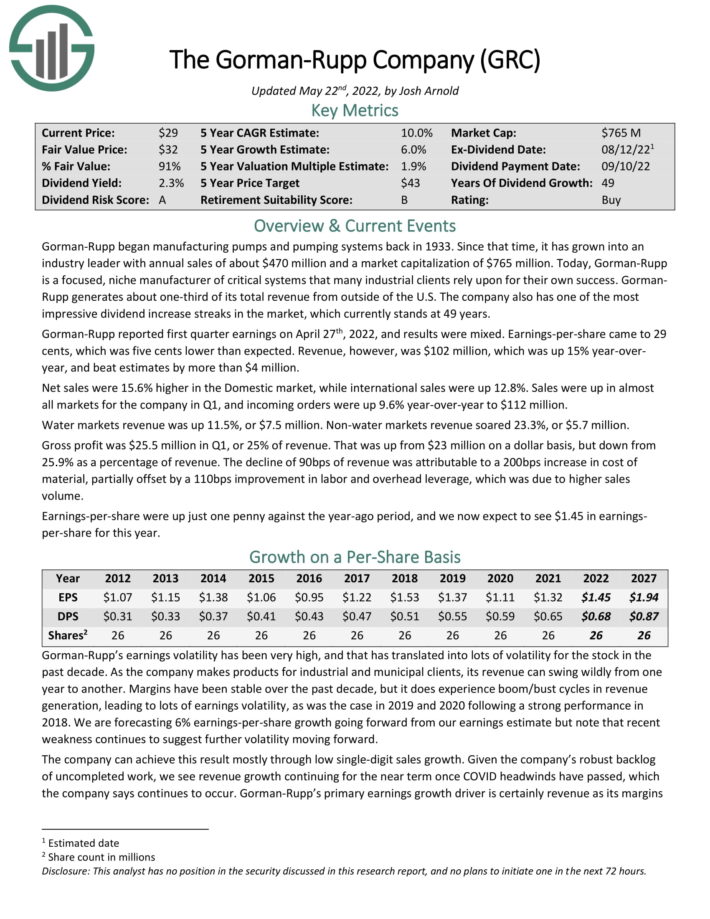

Gorman-Rupp started manufacturing pumps and pumping programs again in 1933. Since that point, it has grown into an

trade chief with annual gross sales of about $405 million. In the present day, Gorman-Rupp is a centered, area of interest producer of crucial programs that many industrial shoppers depend on for their very own success.

GormanRupp generates about one-third of its complete income from exterior of the U.S. The corporate additionally has one of the crucial spectacular dividend enhance streaks available in the market, which at present stands at 49 years.

Gorman-Rupp reported first quarter earnings on April twenty seventh, 2022, and outcomes had been blended. Earnings-per-share got here to 29 cents, which was 5 cents decrease than anticipated. Income, nonetheless, was $102 million, which was up 15% year-over-year, and beat estimates by greater than $4 million.

Web gross sales had been 15.6% greater within the Home market, whereas worldwide gross sales had been up 12.8%. Gross sales had been up in virtually all markets for the corporate in Q1, and incoming orders had been up 9.6% year-over-year to $112 million. Water markets income was up 11.5%, or $7.5 million. Non-water markets income soared 23.3%, or $5.7 million.

Gross revenue was $25.5 million in Q1, or 25% of income. That was up from $23 million on a greenback foundation, however down from 25.9% as a share of income. The decline of 90bps of income was attributable to a 200bps enhance in price of fabric, partially offset by a 110bps enchancment in labor and overhead leverage, which was as a result of greater gross sales quantity.

Click on right here to obtain our most up-to-date Certain Evaluation report on GRC (preview of web page 1 of three proven under):

Water Inventory #4: Stantec Inc. (STN)

- 5-year anticipated annual returns: 10.6%

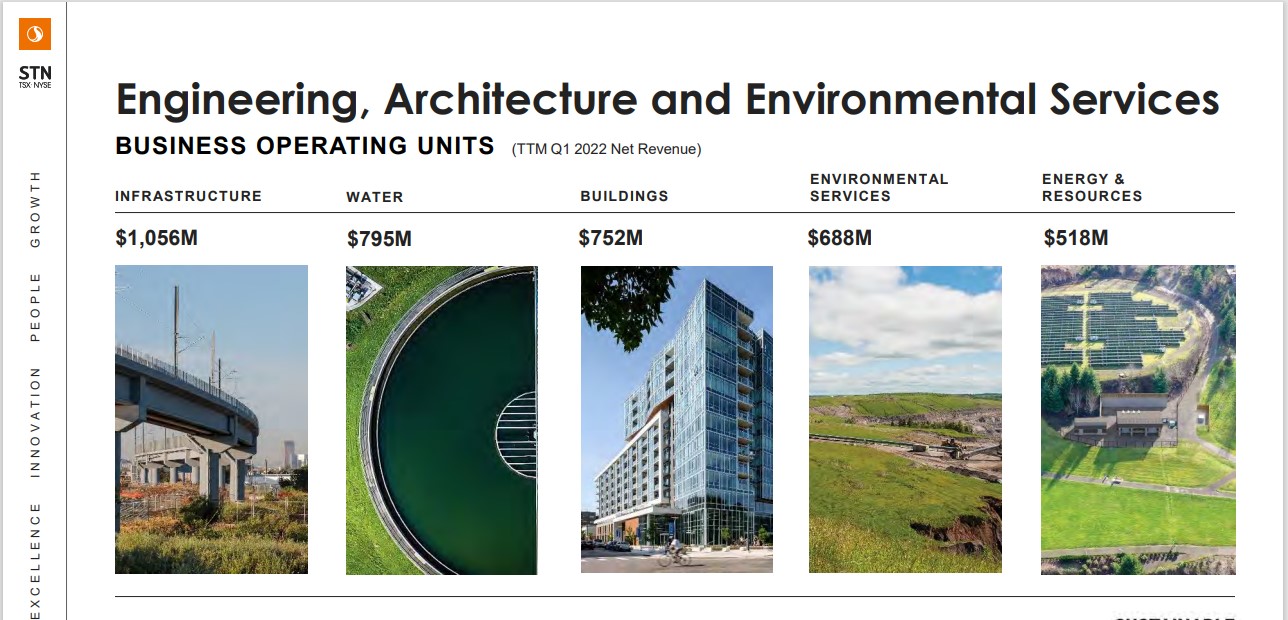

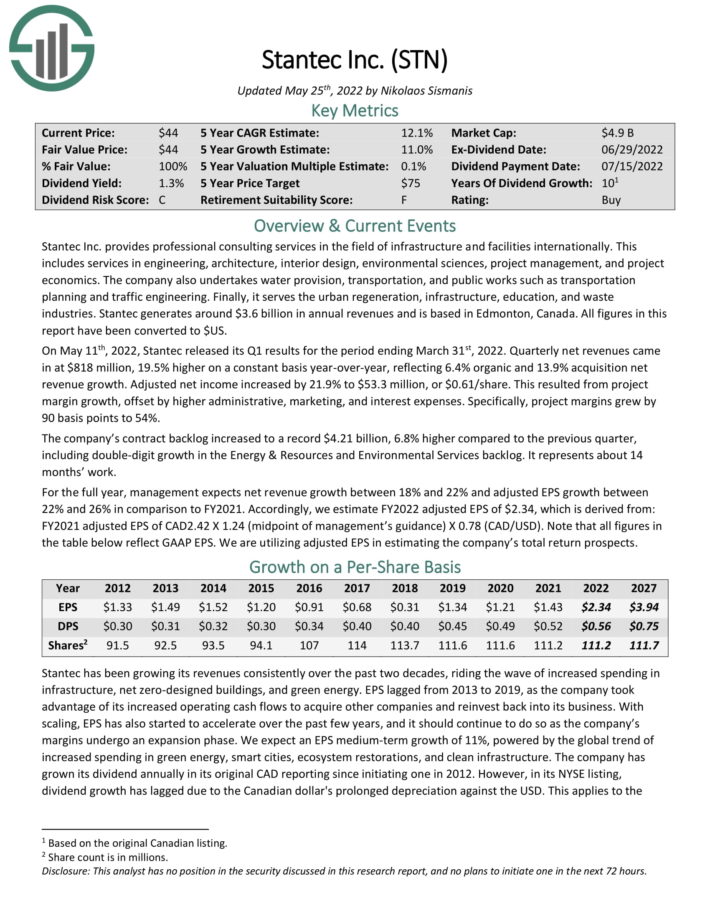

Stantec Inc. supplies skilled consulting providers within the area of infrastructure and amenities internationally. This consists of providers in engineering, structure, inside design, environmental sciences, mission administration, and mission economics.

The corporate additionally undertakes water provision, transportation, and public works equivalent to transportation planning and visitors engineering.

Supply: Investor Presentation

Lastly, it serves the city regeneration, infrastructure, schooling, and waste industries. Stantec generates round $3.6 billion in annual revenues and relies in Edmonton, Canada.

On Could eleventh, 2022, Stantec launched its Q1 outcomes for the interval ending March thirty first, 2022. Quarterly web revenues got here in at $818 million, 19.5% greater on a continuing foundation year-over-year, reflecting 6.4% natural and 13.9% acquisition web income development. Adjusted web earnings elevated by 21.9% to $53.3 million, or $0.61/share. This resulted from mission margin development, offset by greater administrative, advertising, and curiosity bills. Particularly, mission margins grew by 90 foundation factors to 54%.

The corporate’s contract backlog elevated to a report $4.21 billion, 6.8% greater in comparison with the earlier quarter, together with double-digit development within the Vitality & Sources and Environmental Companies backlog. It represents about 14 months’ work.

For the total 12 months, administration expects web income development between 18% and 22% and adjusted EPS development between 22% and 26% compared to FY2021. Accordingly, we estimate FY2022 adjusted EPS of $2.34, which is derived from: FY2021 adjusted EPS of CAD2.42 X 1.24 (midpoint of administration’s steering) X 0.78 (CAD/USD). Notice that each one figures within the desk under replicate GAAP EPS. We’re using adjusted EPS in estimating the corporate’s complete return prospects.

Click on right here to obtain our most up-to-date Certain Evaluation report on STN (preview of web page 1 of three proven under):

Water Inventory #3: Algonquin Energy & Utilities Corp. (AQN)

- 5-year anticipated annual returns: 11.9%

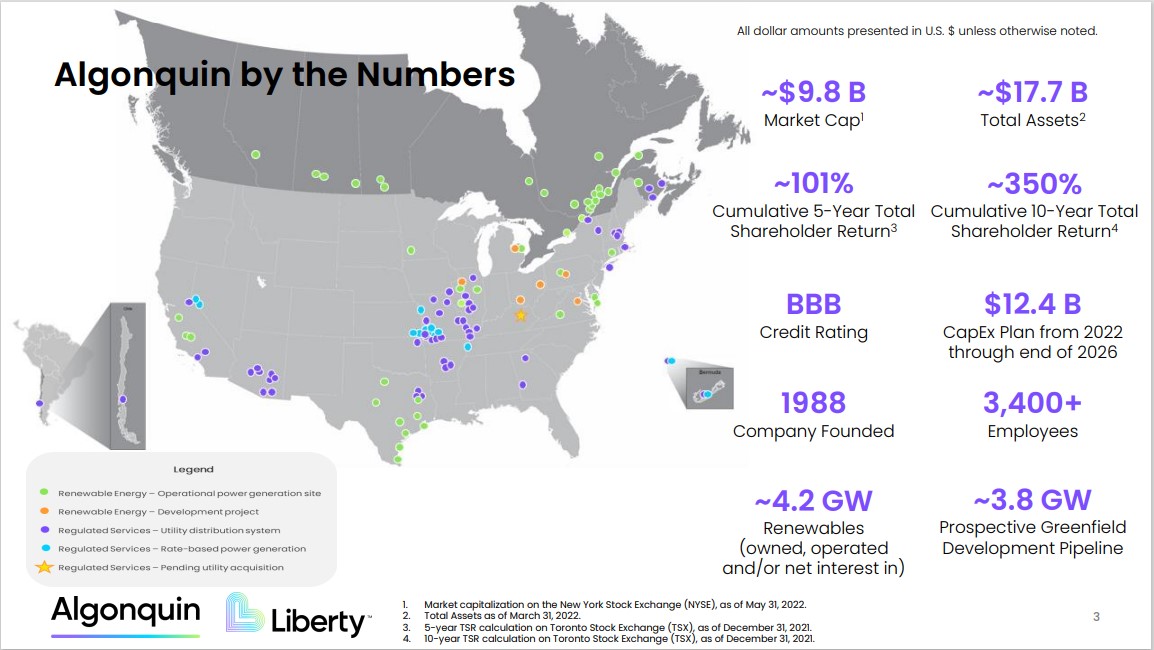

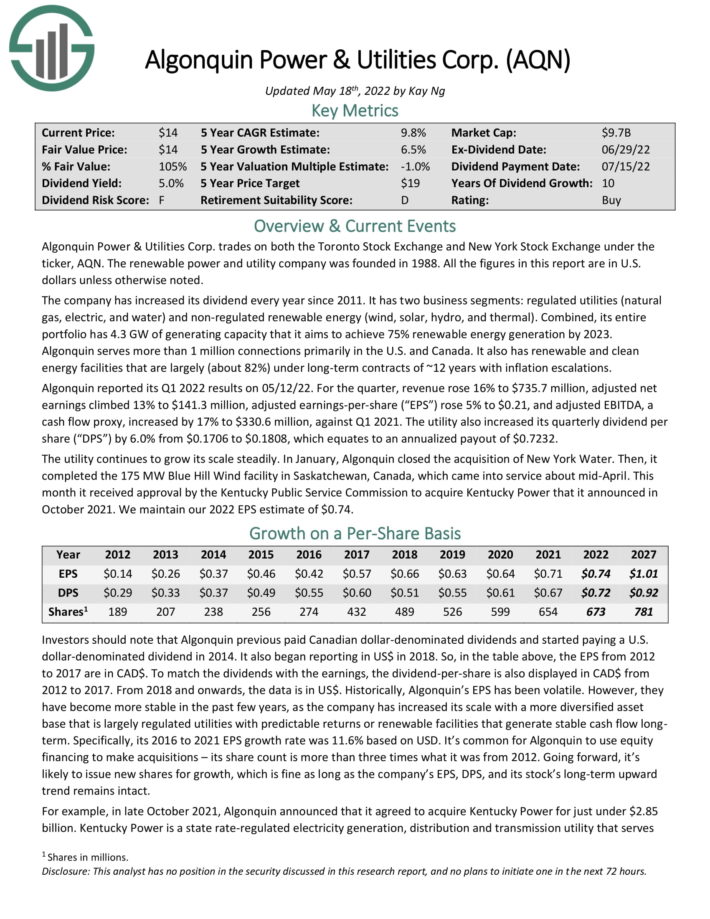

Algonquin Energy & Utilities Corp. trades on each the Toronto Inventory Change and New York Inventory Change underneath the ticker, AQN. The renewable energy and utility firm was based in 1988. The corporate has elevated its dividend yearly since 2011.

It has two enterprise segments: regulated utilities (pure fuel, electrical, and water) and non-regulated renewable vitality (wind, photo voltaic, hydro, and thermal). Mixed, its total portfolio has 4.3 GW of producing capability that it goals to attain 75% renewable vitality technology by 2023.

Supply: Investor Presentation

Algonquin serves greater than 1 million connections primarily within the U.S. and Canada. It additionally has renewable and clear vitality amenities which are largely (about 82%) underneath long-term contracts of ~12 years with inflation escalations.

Algonquin reported its Q1 2022 outcomes on 05/12/22. For the quarter, income rose 16% to $735.7 million, adjusted web earnings climbed 13% to $141.3 million, adjusted earnings-per-share (“EPS”) rose 5% to $0.21, and adjusted EBITDA, a money move proxy, elevated by 17% to $330.6 million, towards Q1 2021. The utility additionally elevated its quarterly dividend per share (“DPS”) by 6.0% from $0.1706 to $0.1808, which equates to an annualized payout of $0.7232.

The utility continues to develop its scale steadily. In January, Algonquin closed the acquisition of New York Water. Then, it accomplished the 175 MW Blue Hill Wind facility in Saskatchewan, Canada, which got here into service about mid-April. This month it obtained approval by the Kentucky Public Service Fee to accumulate Kentucky Energy that it introduced in October 2021. We keep our 2022 EPS estimate of $0.74.

Click on right here to obtain our most up-to-date Certain Evaluation report on AQN (preview of web page 1 of three proven under):

Water Inventory #2: SABESP (SBS)

- 5-year anticipated annual returns: 13.0%

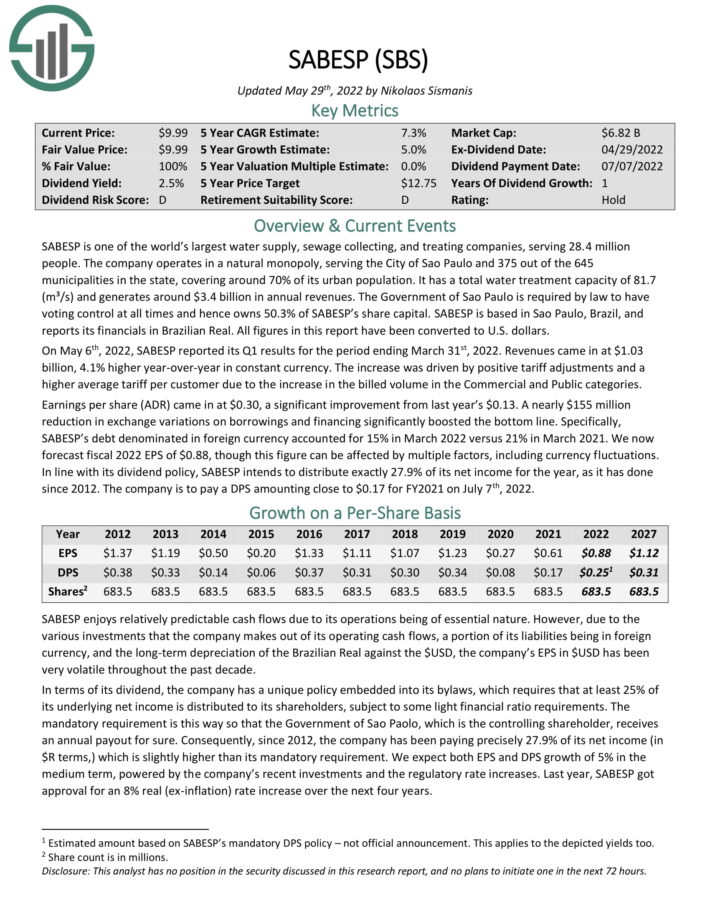

SABESP is without doubt one of the world’s largest water provide, sewage accumulating, and treating corporations, serving 28.4 million folks. The corporate operates in a pure monopoly, serving the Metropolis of Sao Paulo and 375 out of the 645 municipalities within the state, masking round 70% of its city inhabitants. It has a complete water therapy capability of 81.7 (m³/s) and generates round $3.4 billion in annual revenues. SABESP relies in Sao Paulo, Brazil.

On Could sixth, 2022, SABESP reported its Q1 outcomes for the interval ending March thirty first, 2022. Revenues got here in at $1.03 billion, 4.1% greater year-over-year in fixed forex. The rise was pushed by constructive tariff changes and a better common tariff per buyer as a result of enhance within the billed quantity within the Industrial and Public classes.

Earnings per share (ADR) got here in at $0.30, a big enchancment from final 12 months’s $0.13. An almost $155 million discount in change variations on borrowings and financing considerably boosted the underside line. Particularly, SABESP’s debt denominated in international forex accounted for 15% in March 2022 versus 21% in March 2021.

We now forecast fiscal 2022 EPS of $0.88, although this determine will be affected by a number of elements, together with forex fluctuations. In step with its dividend coverage, SABESP intends to distribute precisely 27.9% of its web earnings for the 12 months, because it has achieved since 2012. The corporate is to pay a DPS amounting near $0.17 for FY2021 on July seventh, 2022.

Click on right here to obtain our most up-to-date Certain Evaluation report on SBS (preview of web page 1 of three proven under):

Water Inventory #1: Pentair plc (PNR)

- 5-year anticipated annual returns: 13.9%

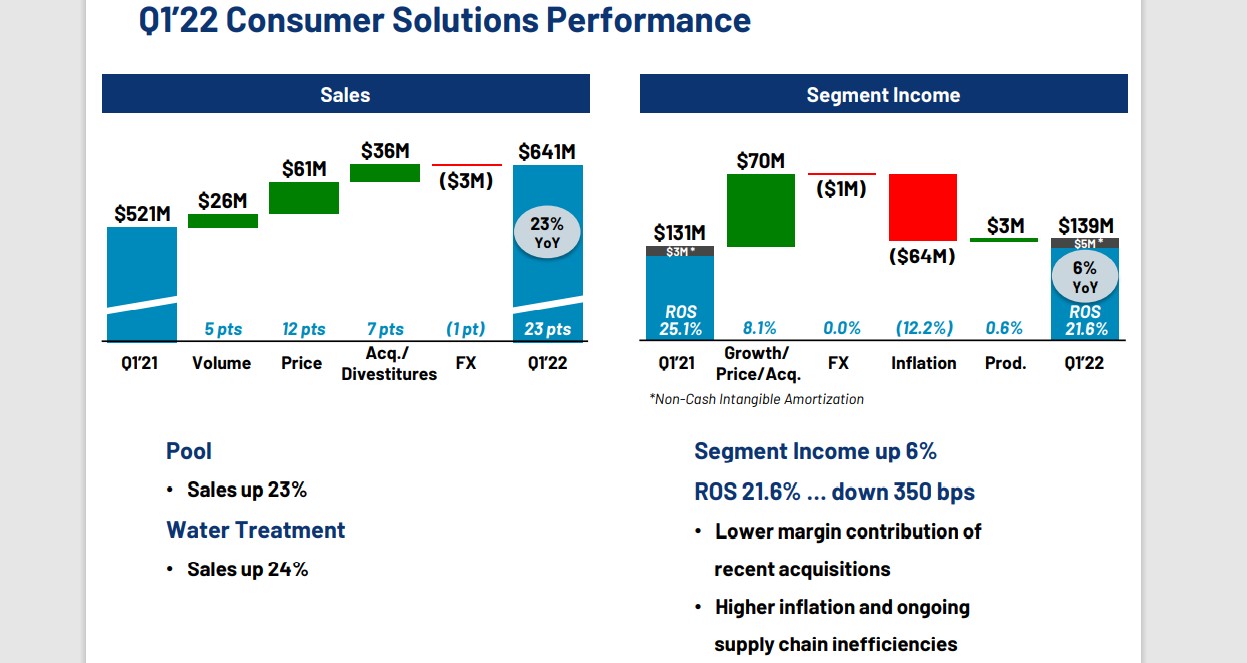

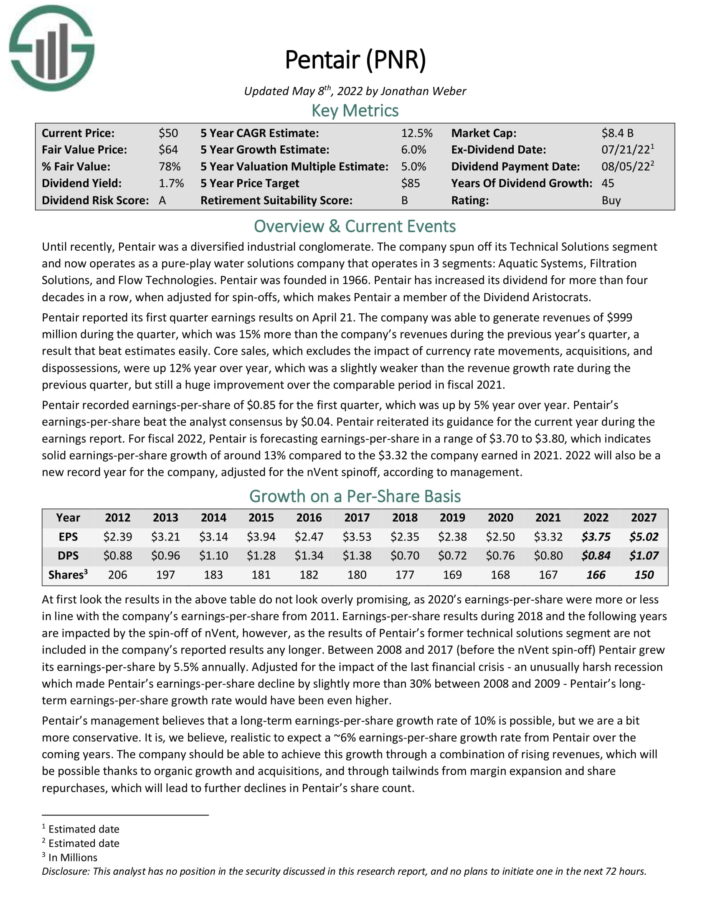

Pentair operates as a pure–play water options firm with 3 segments: Aquatic Techniques, Filtration Options, and Stream Applied sciences. Pentair was based in 1966. Pentair has elevated its dividend for greater than 4 many years in a row, when adjusted for spin–offs.

Pentair reported its first-quarter earnings outcomes on April 21. Revenues of $999 million rose 15% year-over-year, and beat estimates simply. Core gross sales, which excludes the influence of forex fee actions, acquisitions, and dispossessions, had been up 12% 12 months over 12 months.

Supply: Investor Presentation

Pentair recorded earnings-per-share of $0.85 for the primary quarter, which was up by 5% 12 months over 12 months. Pentair’s earnings-per-share beat the analyst consensus by $0.04.

Pentair reiterated its steering for the present 12 months throughout the earnings report. For fiscal 2022, Pentair is forecasting earnings-per-share in a variety of $3.70 to $3.80, which signifies strong earnings-per-share development of round 13% in comparison with the $3.32 the corporate earned in 2021. 2022 can even be a brand new report 12 months for the corporate, adjusted for the nVent spinoff, in keeping with administration.

Complete returns are anticipated to achieve 13.9% over the subsequent 5 years.

Click on right here to obtain our most up-to-date Certain Evaluation report on Pentair (preview of web page 1 of three proven under):

Ultimate Ideas

Water may very well be one of many largest investing themes over the subsequent a number of many years. An rising international inhabitants is just going to trigger demand for water to rise sooner or later.

And, given the truth that water is a necessity of human life, demand for water ought to maintain up extraordinarily properly, even throughout the worst recessions.

Subsequently, younger traders with an extended time horizon equivalent to Millennials ought to think about water shares.

These elements make water shares interesting for risk-averse traders in search of stability from their inventory investments.

Not all of the water shares on this listing obtain purchase suggestions presently, as some seem like overvalued in the present day. However all of the water shares on this listing pay dividends and are prone to enhance their dividends for a few years sooner or later.

Extra Sources

At Certain Dividend, we frequently advocate for investing in corporations with a excessive chance of accelerating their dividends every 12 months.

If that technique appeals to you, it might be helpful to flick through the next databases of dividend development shares:

The main home inventory market indices are one other strong useful resource for locating funding concepts. Certain Dividend compiles the next inventory market databases and updates them month-to-month:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].