Igor Kutyaev/iStock through Getty Pictures

The week ending March 18 was one of the best week thus far in 2022 for industrial shares (market cap of over $2B) because the high 5 gainers every amassed extra +36% whereas the highest 10 all grew by +20%. Shares ended the March 16 session with notable features, surviving a noon swoon following the Federal Reserve’s first rate of interest hike since 2018.

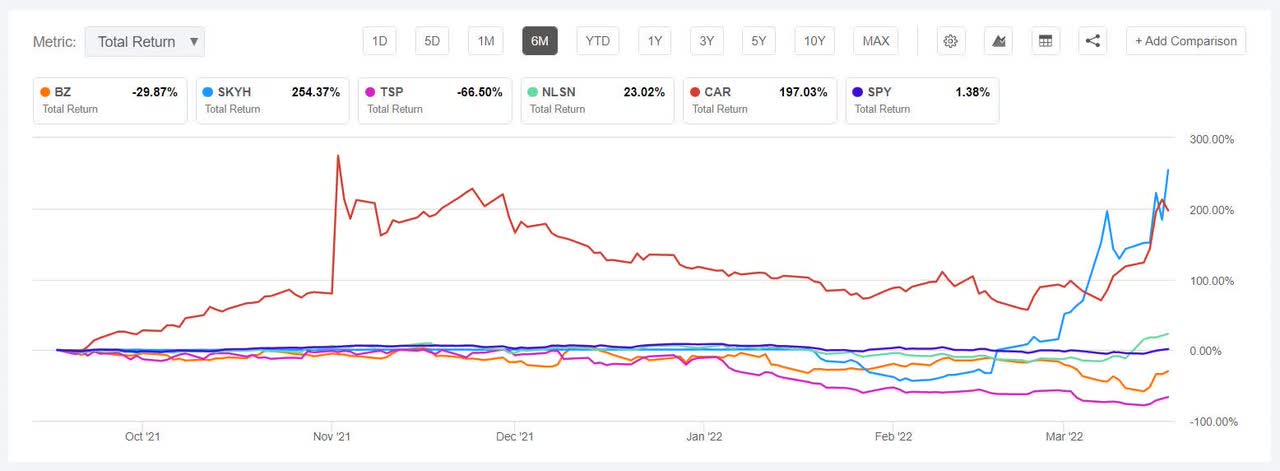

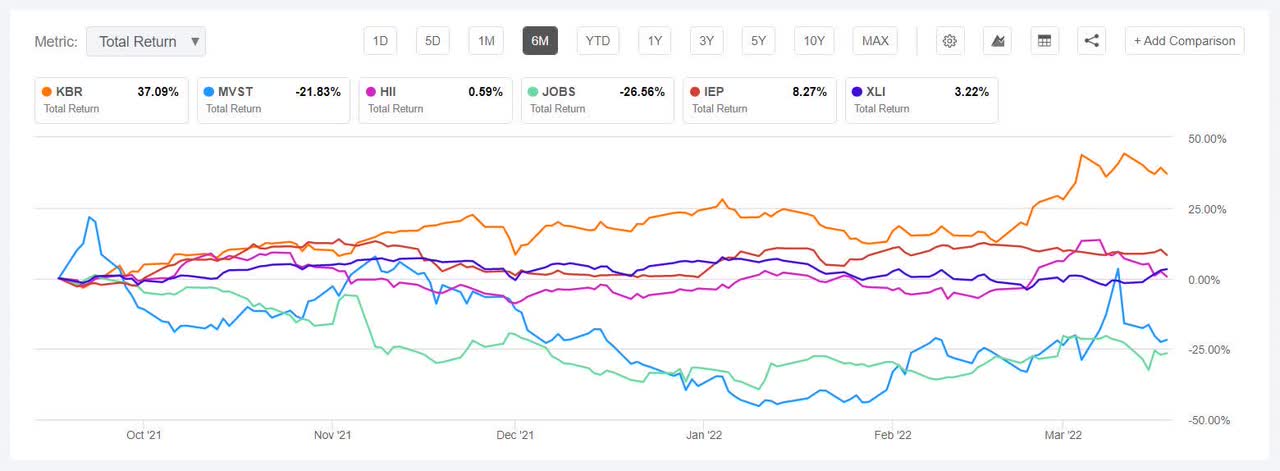

The SPDR S&P 500 Belief ETF (SPY) +5.80% was within the inexperienced after seeing crimson for 2 consecutive weeks. YTD the ETF is -6.41%. The Industrial Choose Sector SPDR (XLI) +5.00% was additionally again within the inexperienced. YTD -2.81%.

The highest 5 gainers within the industrial sector (shares with a market cap of over $2B) all gained greater than +36% however March 16 appeared to be the fortunate day for many.

Kanzhun (NASDAQ:BZ) +51.77%. The Chinese language on-line recruitment platform went from being the highest decliner per week in the past to take the #1 gainer tag. The corporate gained essentially the most on March 16 (+37.80%). The Wall Avenue Analysts’ Ranking is Purchase with an Common Value Goal of $40.02.

Sky Harbour (SKYH) +45.97. The plane hangar developer made its debut within the high 5 gainers for the primary time. The corporate, which went public in January through a enterprise mixture with Yellowstone Acquisition, too gained essentially the most on March 16 (+27.76%).

The chart beneath exhibits 6-month complete return efficiency of the highest gainers and SPY:

TuSimple (TSP) +40.60%. From being the worst performer two weeks in the past to leapfrogging within the gainers checklist, the inventory noticed fairly a turnaround this week. The autonomous trucking firm gained (March 16 +22.37%) on report that it’s seeking to promote its China unit for as a lot as $1B. Nevertheless, YTD the inventory is down -62.23%. For Cathie Wooden’s ARK Innovation ETF worst-performing inventory on the yr is TuSimple.

Nielsen (NLSN) +39.58% gained at the beginning of the week on report {that a} private-equity consortium together with Elliott Administration was in superior talks to purchase the TV/Web rankings big. Nielsen continued to realize a day in a while a report that Brookfield Asset Administration is a part of the consortium. WindAcre Partnership, which reported a 9.61% stake in NLSN, stated that the inventory is “deeply undervalued”.

Avis Price range (CAR) +36.12% held on to the #5 gainer spot for the second week in a row. The automobile and truck rental firm, which was the highest industrial inventory of 2021, too gained essentially the most on March 16 (+21.53%). Previously one yr, the inventory has gained +319.89%.

The week’s high 5 decliners amongst industrial shares (market cap of over $2B) misplaced greater than -4% every.

Microvast (NASDAQ:MVST) -7.01%. The battery system maker’s inventory has been seeing sharp swings between gainers and losers since final yr. Simply over a month in the past it was the #1 gainer.

Huntington Ingalls Industries (HII) -6.01%. The inventory noticed a mixture of features and losses this week. Early within the week, the corporate stated it delivered the latest Virginia-class fast-attack submarine to the U.S. Navy. on March 11.

The chart beneath exhibits 6-month complete return efficiency of the worst 5 decliners and XLI:

KBR (KBR) -5.16%. The engineering options supplier was within the decliners’ checklist after being among the many high gainers about two weeks in the past. KBR secured a $70M contract from the U.S. Military, earlier within the week.

51job (JOBS) -4.76%. The Chinese language staffing firm had made features in January and early March on information of privatization bid. On March 1, it was reported that an investor group backed by DCP Capital and Ocean Hyperlink Companions agreed to accumulate the corporate for $4.3B. YTD, inventory has risen +7.50%.

Icahn Enterprises (IEP) -4.08%. Firstly of the week, the corporate elevated its tender provide for Southwest Gasoline to $82.50/share, a ten% premium over the earlier $75 provide value.